Friday’s Stock Market Action

The debt talks continue with President resisting negotiation as he leaves the US. Given these negotiations are critically important for the nation, travelling is sending some very bad signals about a successful negotiation

Nevertheless, futures are all up this morning with the NASDAQ leading the way with a .31% gain and the S&P up only .21%. This week’s GDP and jobs data bolstered a more positive outlook despite international issues.

BEA reports that Real gross domestic product (GDP) grew at an annual (revised) rate of 1.3% in Q1 2023 vs +2.6% for Q4 2022. Jobless claims came in at 229,000, less than the 245,000 that Reuter’s experts had predicted. Overall, that suggests the economy is very resilient — a good sign for the stock market.

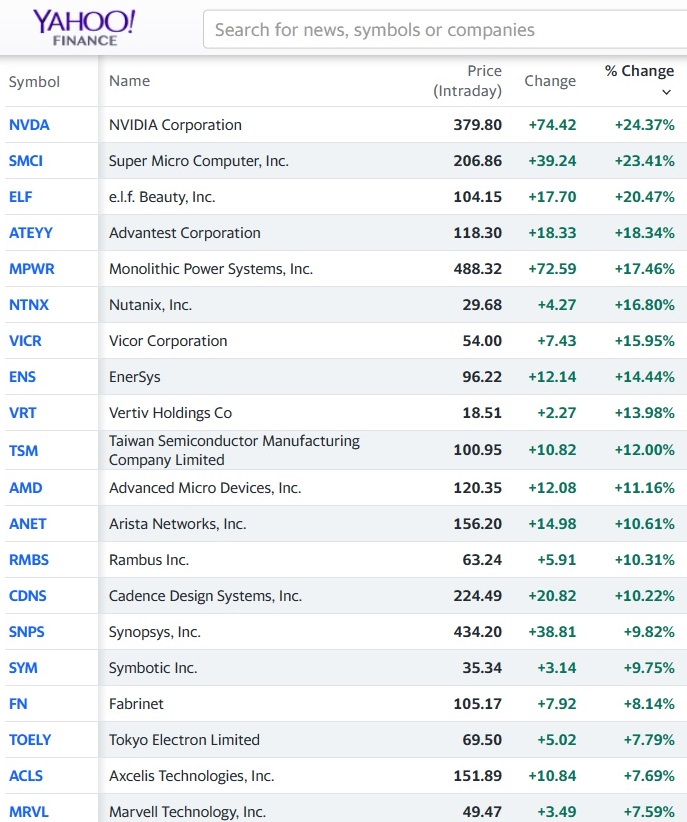

Here’s yesterday’s winning stocks. NVIDIA and AMD and the issue of microchips for AI use was a key topic yesterday. Super Micro Computer is in the news too with its server products and new investment.

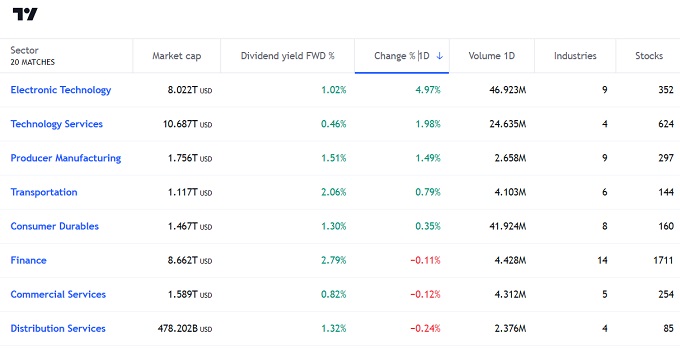

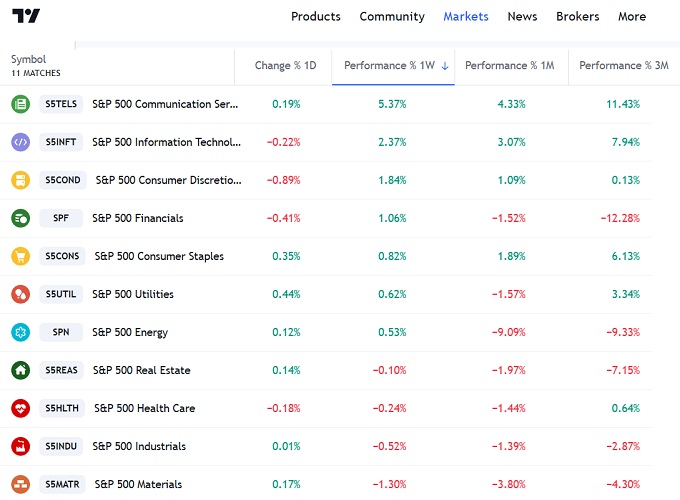

Trading View reveals the hot tech sectors that rose yesterday. Energy minerals, retail trade, and communications stocks took a dive.

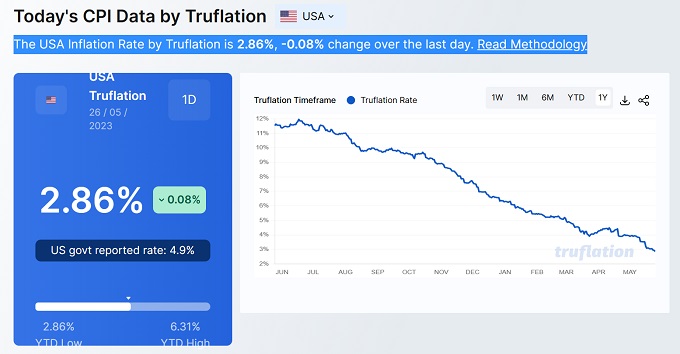

Inflation Easing Steadily?

Truflation’s Inflation index shows a progressive downward trend which should excite most investors, that it’s under control and the Fed should pivot on rates by the end of the year. That’s not far for stock market investors. That will buoy the 5 year and long term forecasts. See more on the weekly, 3 month and 6 months projections.

Russia/China/SaudiArabia Threat

Some worrying signals of recent involving the Saudi’s buying Russian oil products doesn’t see to phasing everyone just yet. But too many more images and stories of an OPEC-Russia-China (BRIC) economic collaboration could frighten investors. As many as 19 countries have expressed an interest in joining the BRICS group of nations as a counter to Western domination.

Given that the US has relinquished its energy independence, Investing hundreds of billions in a long term plan to adopt expensive alternative energy sources, it’s vulnerable to this international turbulence. The US looks vulnerable and all the AI optimism won’t tackle this threat.

President Biden reiterated his interest in continued dependence with China output at a time when political ties are weakening. Europe too is dependent on Saudi Oil and the suffering the embarrassment of seeing the Saudis buy cheap product from Russia (who continue to bomb and kill in the Ukraine) and sell them high priced product may become too much. That’s a political powder keg which could have a big impact on Europe’s economy.

The US and Canada will likely not be able to feed energy into Europe cost effectively for a long time. And shale oil producers in the US fear shale supply is running out. As energy prices rise this summer, it might be the last time Biden can go to the SPR reserves to keep prices down. It will be decades before the US infrastructure can rely on alternative energy, so China and Russia have the US right where they want them — weakened and vulnerable.

Biden is really digging in stubbornly to keep his objective of a $7 trillion dollar spending package which would plunge the US deeper into unaffordable debt.

The crisis hit the S&P and NASDAQ, yet the Dow Jones and Russell 2000 have reversed their losing ways yesterday. Today, stock futures are decidedly down with the Dow Jones Futures .41%, NASDAQ down .3% and the S&P downs .37%.

Also, oil prices have grown sharply this week and are already up $1.50 on the week. See more on the oil price forecast.

This pandemic era spending bill ($7 Trillion budget being asked for) would increase inflation, taxes and force the Fed to keep rates elevated. Which is why some pessimistic economists believe the economy will enter a protracted period of recession. And fears are that even a temporary default would wreck the US’s credit rating and send interest rates up. So there is a lot on the line.

The housing market and builder stocks may take a hit too, with rates pushing up another 1.5%, and further extended into 2024. That’s why some of the forecasts and predictions are moving into the 2023 to 2027 period now. If it gets more investors focused on the 5 year outlook, then that might be good for the markets. Less speculation and more enduring investment in US companies.

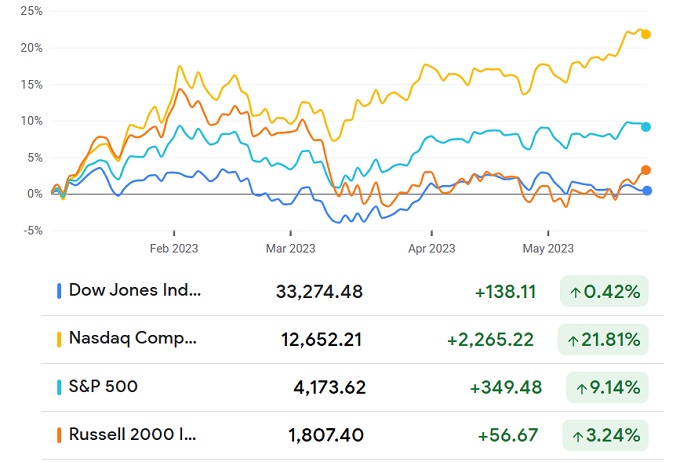

All Major Indexes Year To Date

The upward trend is obvious, but it will it come crashing down during this debt crisis?

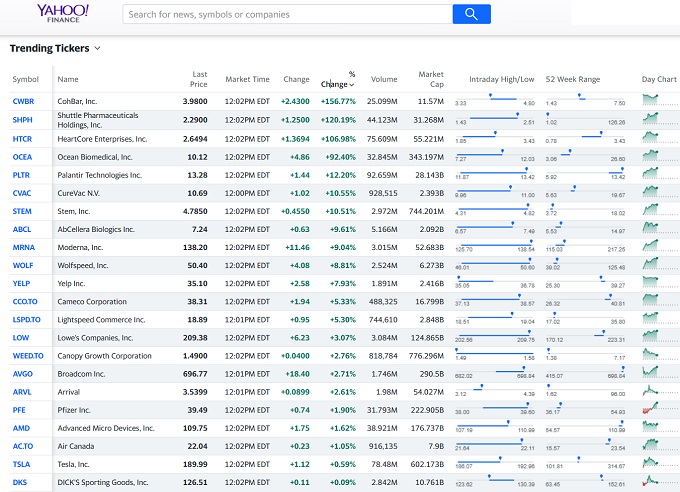

Here’s today’s hot trending stocks courtesy of Yahoo Finance. Tesla is making the news today with a drop after a 5 day run of $22 per share up to $191. Its ended it’s hot streak.

Shuttle Pharmaceuticals is another hot biomedical stocks which is developing first-in-class therapies to cure cancer and improve the outcomes of patients receiving radiation therapy. Investors are jumping on pharmaceuticals and biomedical stocks it seems with CohBar (CWBR) +157%, Ocean Biomedical (OCEA) +79%, Shuttle Pharmaceuticals (SHPH) +46%, Icosavax (ICVX) +31% and Recursion Pharmaceuticals (RXRX) +20%. Moderna, Inc (MRN) +8.8 rising today.

The current situation will pass one way or the other. If it’s resolved or Biden invokes the 14th to keep the spending spree going, the stock market should rise significantly. Investors are starved for good news about the summer outlook and for 2024.

MarketWatch reported that Hedge-fund titan Paul Tudor Jones said the FED has made its last interest-rate hike for the cycle, and this should keep U.S. stocks elevated heading into the end of 2023 and into 2024. That news was brightening the mood of those who heard however no one believed the Dems would hold to another pandemic level spend during an anti-inflation campaign. So blinders and gloves are off now. Democrat media are pressing hard on the “stubborn Republican ruining America” rhetoric so we’ll see what Americans are willing and wanting to believe.

And in another report, MarketWatch quoted Atlanta Fed President Raphael Bostic today as saying it would be appropriate for the central bank to pause interest-rate hikes at its June meeting. What has changed is investors and consumers seem to be holding back under uncertainty for the rest of 2023. The slowdown signals seem to be mounting.

Overseas, the Hang Seng and Nikkei indexes rose slightly showing nothing too negative is happening on the world stage. The hopes are the US government is willing to resolve the debt ceiling. Stay tuned for ongoing negotiation news.

Domestically, both Tesla and Google stock declined slightly. Old news doesn’t last long in today’s marketplace.

Last week’s action on the markets were highlighted by the Debt ceiling negotiations which aren’t going well and lower consumer confidence readings. US President appears to prefer invoking the 14th Amendment to push the debt ceiling up further, and kick the debt crisis can down the road.

His actions could signal how bad the debt situation is, and that the Democrats want to continue with excessive spending to fund their political objectives. The friction could deeply affect how the 2023 2024 2025 markets play out. See more on the 6 month forecast and this week’s market news.

Find price charts for major stocks below including Apple, Facebook, Google, Amazon, and NetFlix. After yet another volatile trading day, Dow Futures and Futures for the other three majors are up.

- The US markets traded flat after mixed sentiment and inflation data. The S&P 500 fell 0.25%, Dow 30 eased down 0.22%, and the Nasdaq fell 0.38% as of 12:20 PM ET on Friday.

- Some of the hot stocks today are Tesla, which rose 3.5% after Elon Musk said he found a new Twitter CEO and Disney, which fell 6.8% after missing subscriber estimates.

- Biotechs, pharma and consumer discretionary stocks are hot.

- International stock markets were mixed, with some Asian and European indexes closing higher and some lower. The Shanghai Composite gained 0.66%, FTSE 100 rose 0.36%, DAX rose 0.22%, the Nikkei 225 lost 0.81%, and the Hang Seng slid 0.14%.

hhh

Major Indexes Today:

See more on the DJIA, NASDAQ, S&P 500, TSX, Russell 2000 and oil stocks.

FAANG Stocks This Week

The FAANGs are key stocks by weighting in the various indexes, and are a prized investment by individual investors and institutional investors. In volatile, uncertain market with rumors of recession, these stocks can be a good choice.

With rumors of downturns, NFLX often comes back to life and it’s enjoyed a 3.6% lift.

Google Alphabet’s stock price rocketed today and is up +11.83 past 5 days. Shareholders were collectively $9 Billion richer after Google announced more AI intentions, including using AI more in the Google search tool. Investors have liked GOOG of late however there are concerns of the company falling behind OpenAI and ChatGPT which has gained a cult following.

TESLA Real Time

Google Stock Real Time

Amazon Stock Real Time

There’s a number of investing sites and data sources which help you get quotes on today’s prices and more on the current status of the S&P 500, Dow Jones, and NASDAQ. See more on Facebook stock, Google stock and Tesla stock.

Top Stocks Today

The markets saw some steep price gains today. First Solar Inc., Array Technologies, Icahn Enterprises, Nextracker, and News Corporation lead the way with big gains on Friday.

Top 3 Performance Mentions

- Goodyear Rubber Tire (GT). Elliott Investment Management, which holds about 10% of Goodyear’s stock released a critical report of Goodyear proposing management changes. Investors liked that a lot.

- Maxeon Solar Technologies (MAXN). The company’s stock was issued a Buy recommendation from Goldman Sachs today, with a $29.20 average price target.

- Klx Energy Services Holdings Inc (KLXE) reported $239.6 million revenue, beating estimates by $12.4 million. In Q1 of last year, the company lost $1.98 per share on revenue of $152.3 million.

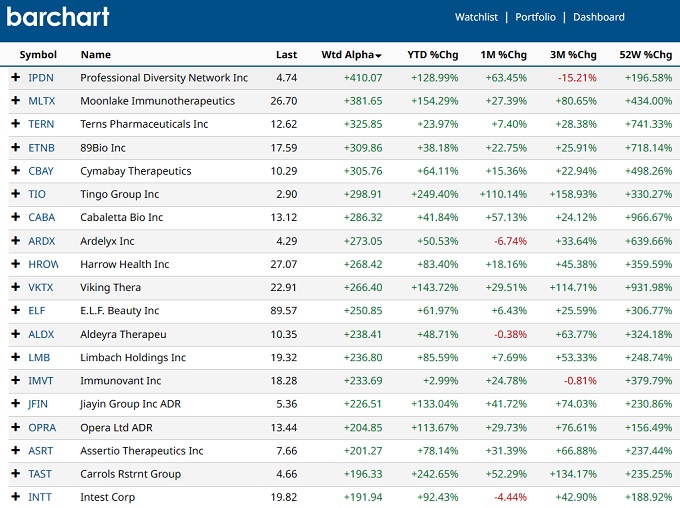

Top Stocks as of 2nd week of May

For the previous 5 days, these stocks have outperformed:

Like more insight into what’s going on in the stock market this week, be sure to check out the stock market predictions post. There you’ll find the key issues driving the market right now and what will influence it this week, 3 months from now and next year. Yahoo Finance has a broad array of stock market information including real time tickers and economic news.

For immediate stock market news, the news service Reuters might be your best source. CNBC has a daily morning report, and businessinsider has real time tickers to view your top choices. Barchart has all your stocks, ratings, and more.

Investors seem happy, and we might begin to see more cash flow back into stocks as rates fall late this summer. Investors may find some great stocks to buy.

S&P, NASDAQ are up strongly year to date, while the Russell 2000 and Dow Jones can’t the traction they need due to a slowing global economy and troubles with the US government and high interest rates.

The Majors Today:

Dow Jones: 33,391

S&P 500: 4071

NASDAQ: 11,461

Russell 2000: 1,892.84

S&P TSX: 20,485.66

Top Recommendations Today

Some of the most impressive stocks discovered via Barchart give promise that some worthy stocks are available. See more on the best stocks to buy. Pharmaceuticals and Therapeutics stocks are worth a look. See more on the 3 month outlook for stocks.

Top Rising S&P Sectors Today

From Red to Green, what a difference a few days makes! Consumer discretionaries, consumer staples, and IT took off today. This may tell us what a big rally might look like right after the coming elections, only much bigger. Given there are a lot of investors on the sidelines playing it cautious this rally is interesting. As the US dollar weakens and if rates do moderate, more cash will likely flow out of bonds and cash accounts into stocks [opinion].

Read more on the 3 month forecast, 6 month forecast and check out signals for an impending stock market crash. It’s not likely until 2023 and most indicators are solid. Check out the full stock market forecast and predictions.

Please do check out stocks to avoid, the best stocks to buy, best tech stocks, and the forecast for the next 6 months.

Hot Topic for 2024

Remember Transitory Inflation?

From last year: The Fed’s Jerome Powell predicted inflation this year might reach 3.4% but will fall back down near the 2% target the Fed is targeting. May’s CPI was 5% which is running too high for some, but if it is transitory, no statement of rising rates was needed. Powell spoke in a stuttered fashion throughout his speech, which suggests doubts and uncertainty, or that political pressure is being applied.

Aberdeen Standard Investments deputy chief economist James McCann commented that “This is not what the market expected. The Fed is now signaling that rates will need to rise sooner and faster, with their forecast suggesting two hikes in 2023.“

Forget 2023, we’re not even through 2022. The Fed Pivot is the key conversation now as the inflation/recession matter comes to a head.

More on the 2023 2024 2025 Forecasts:

Tesla Stock Forecast | Stock Price Quote | Best S&P Sectors |2023 2024 2025 | Market Rally | Stock Trading Platforms | Stock Trading | Low Mortgage Rates Today | Best Dow Jones Stocks | Best Stocks to Buy | Stock Market Next Week Quarter 6 Month | Stock Market Predictions | Stock Market News | S&P 500 Forecast | Dow Jones Forecast | Will Stock Market Crash?