Stock Market Forecasts

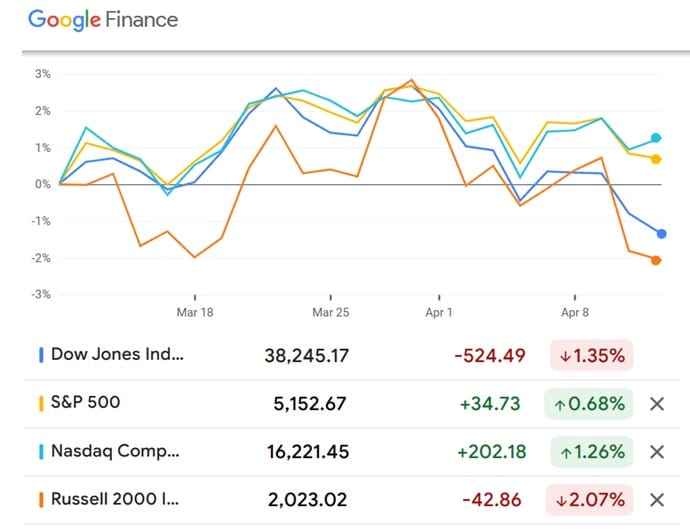

Dow, S&P, NASDAQ Turbulent

After yesterday’s higher-than-expected CPI report for March, confidence in the markets are a little shaken, and we wonder when this will impact the economy.

The FED is obsessed with the CPI rate, and the forecasted rates erode the economy, business investment and the stock market. And the longer the rate stays high, the more perilous the consequences as homeowners, banks and small businesses face debt refinancing they can’t afford.

Higher for longer rates are a small-minded path to mediocrity in a country that is striving to be released from its economic and cultural chains. Is the rate decision a political decision to protect the status quo for the Biden regime? Or is it because the FED can’t raise money for a failing government without high t-bill rates?

Slight Growth is the Likely Path

There is optimism, but not for a booming recovery. The US economy is predicted grow a little yet as each month passes, the bull forecasters feel more consternation about a glowing positive outlook. The Democrat’s spending is behind the inflation and it looks like that pandemic-era excess will continue. Which means companies and consumers will keep spending.

The FED’s unwise insistence on a textbook policy inflation rate of 2% is clearly impossible without a strong recession and major unemployment increases. So the FED and the Democrats have each other in a headlock, and 2024 could be just another wasted year due to a dysfunctional handling of the economy.

The wild card that everyone’s aware of is the Presidential Election in 6 months. President Trump looks to be the frontrunner but few are certain of his winning. He’s promised tax cuts, deregulation, and a pro-US economic policy. For most US businesses, the optimism of a change could be a strong catalyst for a stock market surge in December. The election saga continues.

Turbulence Will Continue

March’s turbulent charts show investors are overly skittish about the intent of the FED. But the FED official’s intent is clear, that economic growth is a threat to their 2% target and they are likely not to lower interest rates. Some say there will be no rate cuts this year, and perhaps a rate increase one year from now. That’s because overall the economy is forecast to perform well.

The summer season spending combined with the continuous repatriation of goods production back in the US are key drivers for the next 3 months and 6 month outlook. The National Association for Business Economics survey predicts a economic growth rate of 2.2% up from 1.3% last November.

However, JP Morgan believes economic growth is likely to decelerate in 2024 as the effects of monetary policy take a broader toll, unemployment could drift higher in 2024, and although inflation trends are cooling, but are likely to remain above the Fed’s 2% target through 2024.

But hold on JPMorgan, it seems they and everyone keep adjusting their sliding forecast as obvious factors play out. It seems they can’t comprehend the political part of the inflation/interest rate problem given it’s influence is visible.

As long as the Democrats keep spending ($1+ trillion more excess this year) the FED cannot lower rates. And the government has its financing issues too that lower rates might worsen. This conflict of interest is cited by the media, but it needs to be brought into broad daylight. Economists are starting to suggest the FED should give up on the 2% rate target, but we’re not the FED governors as a whole have the courage or esteem to let go of the errant goal.

This is an unusual, unprecedented period for the US, and Americans might have to get used to higher inflation. 3% is not an unacceptable inflation print for the times.

Hunting for Catalysts

The market is looking for catalysts and coming up empty. The AI push has fizzled and what everyone wants is for US industry to grow. Yet, commodity prices are rising amidst shortages caused by producer cutbacks in production due to an unpromising marketplace. Rent and auto insurance gave inflation a boost, and there are no saviors for the housing market.

Tom Lee of Fundstrat correctly predicted despite all the turbulence in 2023, that the S&P would reach 5200 and he nailed it right on. Tom and a few others have lifted their forecast, and they’re more conservative with 5400 being a common ceiling. I think the real story is in December after the election as the new President announces new policies. The optimism in December could create a strong rally as the drags on the economy are eliminated. I think the S&P could hit 6,000 by year end 2024.

The analysts and economists did forecast market pullback, and we’re on a downtrend with not much stop a further slide. Earnings are okay, but more companies will report disappointing earnings in the months ahead.

I think a pullback or correction could happen. The mood is low with commodities prices rising the FED balking at lowering rates. There might be volatility from news stories or missed earnings as nervous investors try to save their short-term profit tactics to shore up their investing confidence (and greed).

Spring 2024 is Here with Summer just Ahead

Summer brings families to spend on travel, food, home entertainment, and more giving the economy a lift. Oil prices are not forecast to rise much, and Biden is likely to use the SPR to deflate prices. We can’t forget that an ailing economy makes Biden’s re-election unlikely. The rising unemployment the FED needs would lead to a new President.

The question then is, what will Biden try to do to improve the matter beyond paying off billions in student loans. Without that debt, young people will have more to spend, which might only push up rent and clothing prices.

March, along with the 3-month, 6-month, full 2024 forecast, 5 year forecast and the long-term market forecast all look positive. FOMO retail investors are worried they’ll miss out on the ultimate price gain in 2024, but most will slowly adjust to the slower economic growth picture and begin picking long-term winners instead of trying to be slick day traders (picking ponies).

Market Indicators this Week

The conference board reported it economic index fell by .4% in January. They don’t see a recession. Instead, they see slow growth.

Let’s keep in mind that election years are typically strong for markets, with about 10% growth on average for the S&P. In 8 months, President Trump will begin lowering taxes and deleting destructive regulations that hamper US productivity. Everyone knows this, so it’s difficult to feel pessimistic about the 2025 market forecast.

As this chart from Google Finance reveals, the last 3 months have been phenomenal rewarding those of faith, that the US is the best place to invest going forward. Experts believe this rally will broaden out over 2024.

AI Animal Spirits Driving the Markets

Are you excited about the prospects for large caps and the AI-powered markets. Experts believe it’s real and not a 1999-style bubble. These massive companies such as Google, Nvidia, META, Amazon, Apple, AMD, and others are flush with billions in cash, so the FED rate means nothing to them. They fund their own business.

AI is going to deliver massive earnings growth as the AI-based market expands driving chip sales, new services, and bringing labor efficiencies. That all spells big profits for Nvidia and AMD.

It’s important to know that Trillions in US infrastructure spending is about to begin this year which will power up the economy and draw foreign investment to the US. Greater protection of US manufacturing with support from the US government means US stocks are the prize of global markets.

The economic break with China is certain and this bodes well for the US economy.

As the US dollar sinks in value (lower interest rate forecast trend) and the global economy returns, Bitcoin will be in big demand which could push its price well up in the next two years. The forecast for Bitcoin is exceptional and more funds will open to Bitcoin ETFs like grayscale and ishare Bitcoin shares.

As interest rates fall over 2024/2025, trillions in money markets will move to equities which drive a super spike in stock prices.

Stock Market Predictions for 2024

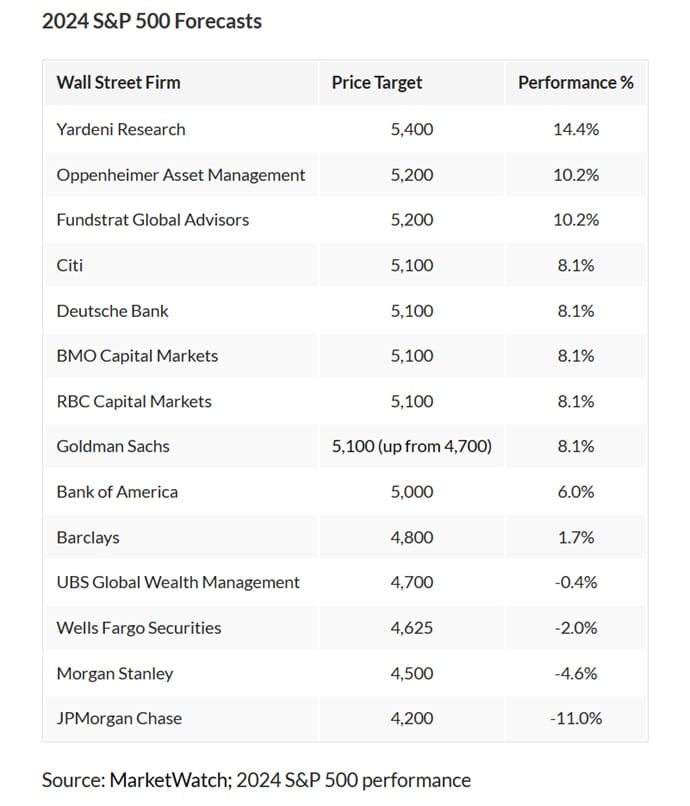

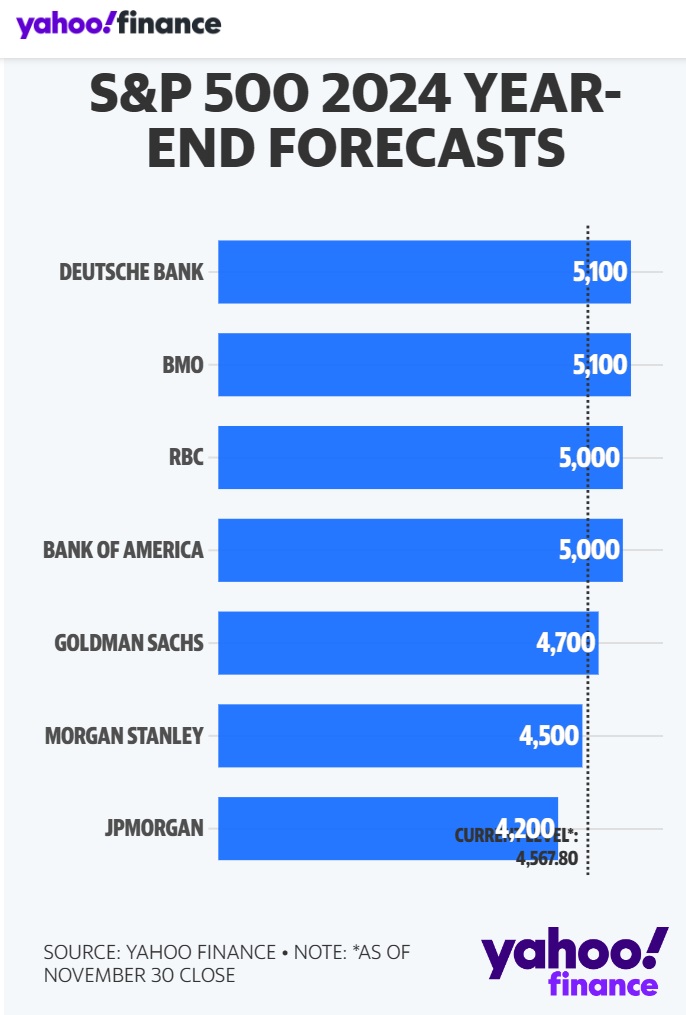

If you’re still not a believer that this rally will continue without a major pullback, then let’s review Wall Street Predictions provided by Investors.com and MarketWatch:

Goldman Sachs Research forecasted the S&P 500 index would end 2024 at 4700, for a 12-month price gain of 5% and a total return of 6% including dividends. We’re far beyond that, which means these companies have a far too fearful outlook that investors are beginning to disrespect.

As you can see, most investment companies are bullish about 2024 with a range of about 8% to 10% for the optimistic, most noted authorities. Of course, we’re well up already two months into the new year and it looks like these will be revised upward as increasing good economic news is reported.

The US economy is in excellent condition. Unemployment is 3.7%, inflation is only 2.8%, income is up 3.4%, consumer spending continues moderately, and US national income is up and forecast to rise continuously to 2029.

Let’s Review why the Stock Market Forecast is so Rosy

- inflation continues to lower

- FED rate cut expected in June/July and a full 1% lower by 2025

- US GDP slowing thus inflation may be past

- US dollar weakens strengthening exports

- $6 to 8 Trillion in money markets could move to equities as interest rates fall

- materials prices on a downward trend (natural gas, oil, lumber)

- innovation and investment in AI contributing to a rebuilding of the economy and a renewing of many products in use (laptops, smartphones, autos)

- investor doubt and insecurity have eased of late given the rally is so persistent, weathering all bad news

- normally sluggish 1st quarter downturn will end in a few months

- China dependence is decreasing with the re-onshoring of manufacturing to the US

- trillions in US infrastructure spending due to start this year

- unemployment is rising slightly which helps keep wage demands down

- Earnings are slated to increase by an unthreatening 1.3% YoY with topline sales expected to grow by 3.1%

- Presidential election 8 months away with the tax-cutting, deregulating Donald Trump in the lead

- A defeat of Joe Biden translates to pro-business policies which gives investors tremendous relief

- Goldman Sachs sees the S&P hitting 5100 this year

- Chips Act and infrastructure spending should bolster economic growth

After a strong 3 months, the Dow Jones, S&P, Russell 2000 and NASDAQ are gaining speed.

At this point, you’re wondering which sectors are going to boom this spring, and which individual stocks will rocket. Certainly, the Russell 2000 has some hot stocks rocketing right now. The overall trend for the Russell is heading upward yet there are still concerns about the economy.

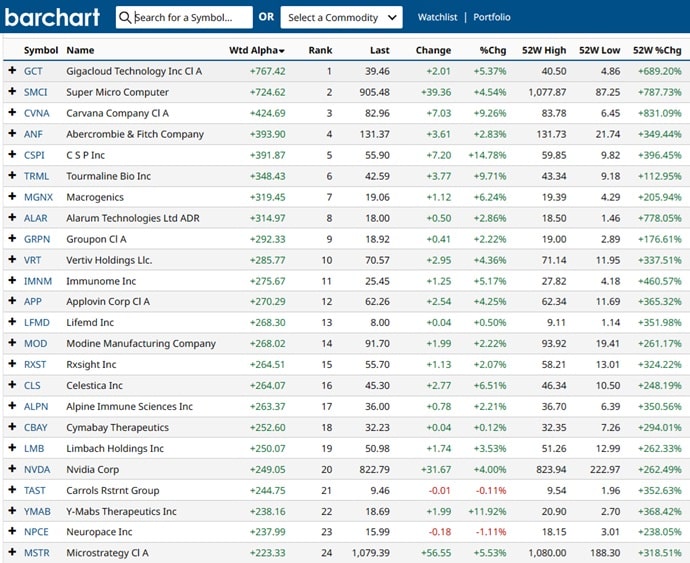

Hot Stocks by Weighted Alpha

Barchart shows us those stocks that are rising best in the last 12 months to show a solid trend upward, while weighting those with the strongest price growth of late. As usual, Super Micro Computer, and Gigacloud, are present, but we wonder where Nvidia, Google, Amazon, Apple, Tesla, Microsoft and the magnificent stocks are lately?

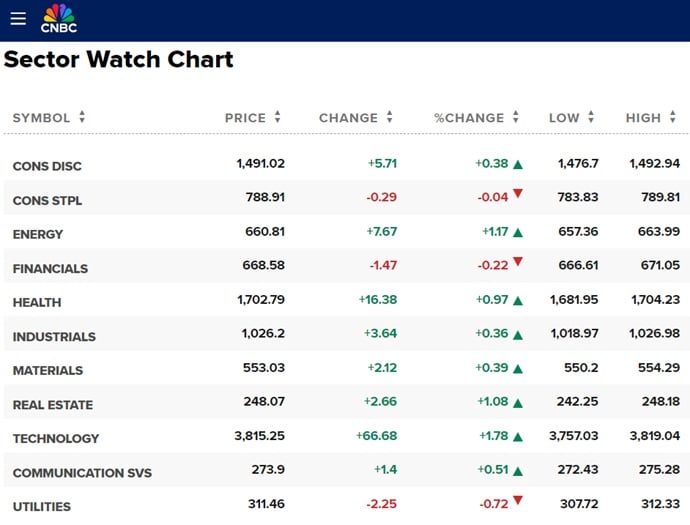

Hottest Sectors this Week

Perhaps not surprisingly, technology, consumer staples, and communications lead the way. Materials and energy leveled upward but are not expected to do well for the next few months. The Dow was lagging because of poor economic news.

Have a look at the 3-month and 6-month projections for the stock market and collectively you’ll see the bull market horizon is not far off. And view the 5-year forecast for better clarity for the road ahead. Getting a grip on the macro picture is important, and don’t forget that politics is the dictator of markets and they can still throw a monkey wrench into this (high rates, regulations, anti-stimulus spending bills).

Will Fear of Missing Out Also Boost the Stock Markets?

FOMO investors are afraid of losing out and if they start moving all that money from the money markets ($4 to $6 Trillion estimated) then stock prices could rocket. It’s definitely time to own something. You may find the best stocks to buy today, or next week are a basket of large caps, but for those who demand more, the Russell 2000 small caps are likely where you’ll get rich.

“This environment where rates are cooling, inflation is moderating and the Fed is on the sidelines, that is typically a good backdrop for risk assets. Typically when rates start to move lower, you get valuation expansion and the areas that we could see some more meaningful valuation expansion is outside of large-cap tech.” — Mona Mahajan, senior investment strategist at Edward Jones

Interesting stock picks:

Arm Holdings (ARM), United Rentals (URI), Toll Brothers (TOL), D.R. Horton (DHI), TopBuild (BLD), InterContinental Hotels (IHG), Marriott Worldwide (MAR) and Palantir Technologies (PLTR).

AI technology, homebuilders and travel companies are the best stocks to buy. I like DR Horton and Toll Brothers outlook for the next few years. The demand for housing is intense with resale properties unable to be sold with severe shortages (costs, interest rates, materials shortages, lack of government support). As mortgage rates fall, hungry, impatient buyers will jump on new homes available on the market.

Certainly, the 7 million new illegal immigrants will need everything from housing and furniture to cars and clothing.

The November 2024 election is only 11 months away. It’s hard to ignore this growing factor for the stock market outlook. If President Trump is re-elected, taxes and spending would drop and the FED rates forced downward. Business likes that kind of thing.

When Will all that Money Market Money move over to Equities?

Markets have suffered low volume and disinterest for sometime, yet $5 to 6 Trillion in money markets is one reason to hang in there with your best picks. Not all of that money will move, but a good chunk of it will by end of 2024. If Biden wins, then money will retreat to the money markets.

Year to date, NASDAQ and the S&P 500 have persevered well. As interest rates ease, the NASDAQ was positioned best for growth, which means US tech stocks might be the best bargains. Here are your top-performing tech stocks of late on the NASDAQ exchange. With the coming growth of AI, Nvidia has caught the eye of investors.

Morgan Stanley pointed out in their Stock Market Outlook 2023 report, the stock market does very well in non-election years (+71%), and not badly in Presidential election years (40)%).

6 Month Stock Outlook

By April of 2024, we might be through most of the bad news and economic crisis. The economist’s dour predictions of a 2024 crash/downturn will be done. By then, the Dems will have to capitulate on spending to reduce inflation, and that will drive a massive upward shift in the DOW, S&P, NASDAQ and Russell 2000. See more on the 6 month S&P forecast.

If the FED rate drops and mortgage rates fall, it could stimulate the housing market which fires up everything. There is a crisis in the multifamily sector for overleveraged builders, but those that get through it will see their sales improve by next spring of 2024.

The 5 Year Stock Outlook

For the period 2024 to 2029, we’re looking at impressive growth. This is mostly fueled by lowering interest rates, expanded oil and gas production, bringing manufacturing back to the US, and government spending more in line with reality instead of ideology. The US leadership in AI and microchip manufacturing is key since AI will increasingly influence manufacturing, services and the financial sector. Perhaps even the AI stock market software tools will be useful then. See more on the 5 year market outlook and even check out the 10 year forecast.

Key Market Signals to Watch

Government Debt Crisis and Shutdown: key driver of this current downdraft in stock prices. There will be damage as government credit rating and suppliers are affected after the shutdown. Lower spending means companies will review their risks and their decision to work with the US government going forward.

Lower Bond and Treasury Yields: Right now the FED is sticking it to the equities market due to their desperate search for cash to pay out on debt liabilities. That’s drawn money into the bond market for comparatively weak ROI for investors who want a lot more than a few percent growth. Only equities pay off big and create millionaires. Charles Schwab expects yields to fall in Q3 and into 2024 as inflation continues to cool.

Stock Markets Heading Down: The last 3 months have been strong, but overall support for a strong Q4 is weakening, and Q1 2024 is looking cloudier with rain in the forecast. Yet, after March, investors may the sun shine through.

Regional banks stocks: they’ve seen their stock prices fall strongly last week. The FED noted in its Loan Officer Survey that “Banks reported tighter standards and weaker demand for all commercial real estate loan categories.” Higher for longer interest rates combined with tighter lending standards threaten to slow the economy which relies on credit (real estate).

New Inflation Data: New inflation data released from the Bureau of Labor Statistics showed the (CPI) a 0.3% increase in December to 3.4%, following a 0.1% rise in November. Energy, producer prices and import inflation are consistently negative.

FED Pivot Timing: There is no consensus about the FED easing cycle for 2024. Some believe a .25% cut is due in March leading to a full 1% decline over 2024.

Rising Oil and Natural Gas Prices: OPEC looks weak as the US pumps a record 13 million barrels of oil per day, and a very warm winter has led to plummeting natural gas prices. Although middle east wars are causing oil supply fluctuations, it is likely supplies will flow even better in the year ahead, to help keep energy prices down at least for 2024.

Strengthening US Dollar: the US dollar had weakened great but is now on the rise once more (103 dollar index) and that will help foreign investors buy more in the US or invest in fast growing US companies. US exports should enjoy a short period of international trading advantage.

$6 to $8 Trillion Cash in Waiting When the Market Gives the Green Light

Investors still hoard a lot of cash, at record levels, and are still waiting for the stock market to really turnaround. During the past year, US investors holding cash were hit badly and few FX experts are calling for a resurgence in the greenback. A strong persistent bull run should draw them back setting up a strong upswing in all indexes.

Money market funds are still swelled at $5.3 Trillion with inflows infusing another $599 Billion into the sector, according to a Bank of American report. However, the last time we saw huge inflows like that was back in 2008 after the Lehman Brothers collapse.

Forecasts for the S&P

Let’s take a look at what conservative banks predicted how the S&P forecast would turn out in 2024. Are you investing with these companies?

Dow Jones DJI Projections

Currently, for year to date, the Dow Jones is underperforming and Dow Jones stocks are barely up for the year. The economic slowdown, with the rapid rise in credit costs, has stunted manufacturing.

This chart from Barchart (one of the best investing websites to subscribe to) shows few Dow Stocks were thriving despite today’s great rise. However, there will still be a great buy the dip opportunity. Investors should review oil stocks since the price of oil is suppressed. Commodities and energy industry experts believe oil prices will rise — either through OPEC cuts or the depletion of the Special Petroleum Reserve.

What Do the Economists Say about a Recession?

Ethan Harris, head of global economics research at Bank of America Corp. “We’re either going to have a weak economy or a recession.” — TBS News Report

Jamie Dimon of JP Morgan said there’s a 66% likelihood the U.S. is headed into a mild recession or something even worse.

“We put the odds that the economy will suffer a downturn beginning in the next 12 months at one in three with uncomfortable near-even odds of a recession in the next 24 months,” said Moody’s Analytics chief economist Mark Zandi said last May. — Washington Post.

Are Investors Not Realizing the Bear Market Has Left?

Lael Brainard, usually a more dovish policymaker, said she expected “a combination of rate increases and a rapid balance sheet runoff to bring U.S. monetary policy to a more neutral position later this year. Further tightening would follow as needed” — from CNBC report. So far, pretty accurate.

Forecasts 3 Months to 5 Years to 10 Years

Getting a clear view of the economy in the next 3 months to 10 year framework takes a little study. You can view more on the immediate market situation, the 3 month outlook, 6 month outlook, 5 year outlook and 10 year outlook. A smart investor will make themselves very aware of each forecast period. The current market view will disappear and like a slide show, move to the next period.

The five year to ten year outlook is steadier and it’s important to consider that politically, the intent is to bring industrial production back to the US. That single factor should help view the future more optimistically. Interest rates, mortgage rates and lending to small businesses should all improve.

Stock Market Crash Possibilities

There are very few credible market economists who are expecting a crash, although a few believe a downturn in the summer will occur as inflation creeps back up, and the FED responds with a hike. The FED may not hold rates where they are if inflation does pick up by June. It’s sufficient to keep the FED out of the markets and let laisses faire take hold, to the degree it’s currently allowed.

Here’s 7 Factors to Watch as Signals of a Downturn

- inflation persists or rises (wages, energy, consumer prices, rent)

- government insists on printing more money and spending more

- Interest rates rise (could go up further)

- disappointing earnings in Q4 (consumers pulling back spending fast)

- geopolitical conflict such as China/Russia strife (that will intensify)

- regional bank crashes (believed to be done, but some concerns remain)

- oil price shocks (yes, oil prices are rising fast with supply down and oil sanctions enforced)

What’s the Long-Term Investment Outlook?

The 10 year stock market outlook is less certain of course, but consider that Millennials and Gen Z’s will slowly form more families and this is a massive number of people and a high spending phase of their lives. Additionally, millions of illegal immigrants flooding into the country in their 20’s to 40’s represent additional market demand. Demand drives prices and economic growth which fuels growth for many of the stocks above.

As interest rates and mortgage rates fall, the business community can enjoy a return to profitability while banks resume normal lending for credit, business and buying homes. The 2024 outlook for the stock market is wonderful!

Check out this list of Stock Trading Websites where you can launch your stock-buying campaigns.

Stock Market Today | Nvidia Stock Price | Best AI Stocks | Toll Brothers | Chip Stocks | Tesla Stock Price | Stock Quotes | Stock Market Now | Best S&P Sectors | Stock Market 2024 | GOOG Stock Price | 3 Month Predictions | 5 Year Stock Forecast | 6 Month Outlook | Dow Jones Forecast | NASDAQ Forecast | S&P Predictions | Stock Quotes | Stock Market Crash | Stocks Next Week | Stock Market Investing Tips | Stock Trading Platforms | Google Finance | Author Gord Collins