Investing Strategy: Buying the Dip

Buying the dip is a tactic that’s deeply ingrained in the investor community mindset. From institutional fund managers to self-directed investors, the dip in prices is a great opportunity to buy stocks at bargain prices.

Investors often overreact to negative news and trends, thus dumping their stock unwisely. Stock volatility is a common event, yet some drops like the one we experienced today with the Dow Jones, S&P and NASDAQ suffering huge losses.

It’s being touted frequently on social media today, Black Friday, to buy the dip. But is this a dip or a continuous slide? And when would the slide hit bottom? The Covid 19 new Omicron variant threat isn’t really understood, but it seems serious. So on Monday, we may see an additional drop. If we see a 10% drop, then yes smart buyers are able to come out of this buy the dip opportunity with smiles.

Bitcoin stocks, Bitcoin and Ethereum, oil stocks and oil prices took a big hit today, giving us a perfect example of buying the dip pay offs. Both the price of oil and Crypto currencies took a deep dive already and next week the bleeding should continue. We’re suddenly remined of the winter of 2018, when BTC dropped 65% over a month of declines. The cases of cryptocurrency and oil stocks is the most volatile, but potentially most profitable as well.

If you believe in the long term economic outlook and recovery, then this has to be considered a dip.

And it only needs to rocket for a short time for you to sell and make a fortune. That’s why buying the dip is an interesting topic.

Biotech and pharma stocks are really hot right now, but their chance of a big uptick is slim. Moderna was up briskly and it might still be a good buy. Those who bought Bitcoin and Moderna a couple of years ago are likely millionaires now.

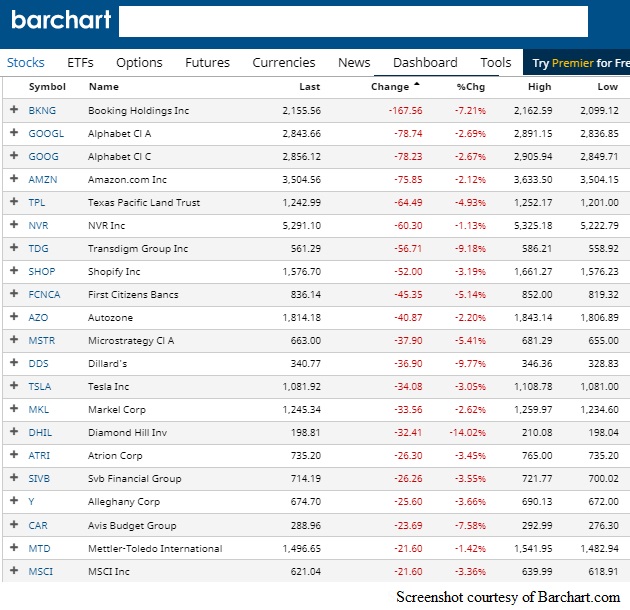

Which Stocks Took the Biggest Hit on Black Friday?

How to Buy Stocks on the Dip

Find the best stock picks by:

- review the stock chart timeline to review past behaviors and research what might have caused the last dip

- look for stocks that are riding really high and there are people who want them to tank (the current US President – oil stocks, Xi Jing Peng — cryptocurrency) and when they will strike them

- look for previous wild swings as they’re likely to be repeated at some

- view the stock price trends, macroeconomic trends, and determine how long the macrotrend might last

- review sector trends and performance to weigh vs what your intended stock is comparing

- do your research online and weigh in what other predictors and forecasters believe will happen

Buy Opportunity Examples

The best example of a buying the dip opportunity is with the recent drop of Zillow. It appears investors overreacted to Zillow’s plan to get out of the ibuyer real estate market, and sell properties they held. Yes, it appears Zillow shouldn’t have been in that business and now they’re paying the piper.

2 years ago Steve Reisman warned about Zillow’s venture and it’s taken 2 years for the drop to happen. As negative as this big loss might be (if it becomes a big loss) Zillow is an excellent online real estate company and home buyers shop on Zillow. To write this company off is a big mistake. It will bounce and is a good buy the dip opportunity.

Studying the dip is a science to many technically oriented traders. Sure they’re looking at what’s happening today, next week and the 3 month and 6 month forecasts, and what might happen in 2022 and the 5 year forecast. However, buy the dip stock picks might be short term or long term investment plays. You would be best to check out price changes over different time periods to observe changes.

Can the technical charts tell you much. Maybe, but they’re based on past performance and right now the markets are driven by political decisions and pandemic recovery factors. That includes bizarre adjustments and reactions to the post pandemic recovery. Picking buy the dip stocks won’t be easy. Crypto and oil stocks are no brainers, in my opinion. Absolutely, review the best pandemic recovery stocks.

Have these investors struck it rich via buy the dip strategies? Or is picking long term winners (Bitcoin, Tesla, Google, Apple, Facebook, Moderna) the way to real wealth?

And will buying the dip make us more sensitive to a predictable stock market crash and generate awareness of those stocks to sell before the crash?

Is The Market Going to be Up and Down till Spring 2022?

Recent market dips were an opportunity and some believe another one is coming soon. JP Morgan says these new dips will be temporary and that the market is on an uptrend. That’s good for you. It means overall, you can gamble and perhaps not get burned.

What if you took $20k and focused it solely on the buy the dip opportunities?

Of course you have to watch the forecasts, reports and predictions along with recent company news, and look for stocks that look like they’re headed for a tailspin. Of course, many stock market advisors/experts offer warnings about these stocks. And when stock owners overreact to those opinions and sell off in droves, it does create some buying opportunities for other smart investors.

Trader TV Looks at Buying the Dip

This chart shows plenty of dips happening throughout the last year. Consider if you had purchased at each bottoming you see in the line. In particular, the NASDAQ and the Russell 2000 have offered up plenty of dip buying opportunities. Of course, the pandemic crash in April 2020 was the ultimate dip to buy but look how late in the year it took before the market boomed.

And these temporary dips are even more attractive to day traders. If you’re investing, it’s maybe not a bad idea to study day trading and tune into a top day traders website/blog. They like to brag and talk about why stocks are moving. You wouldn’t take investment advice from them, but that info can give you another perspective to make you a better investor.

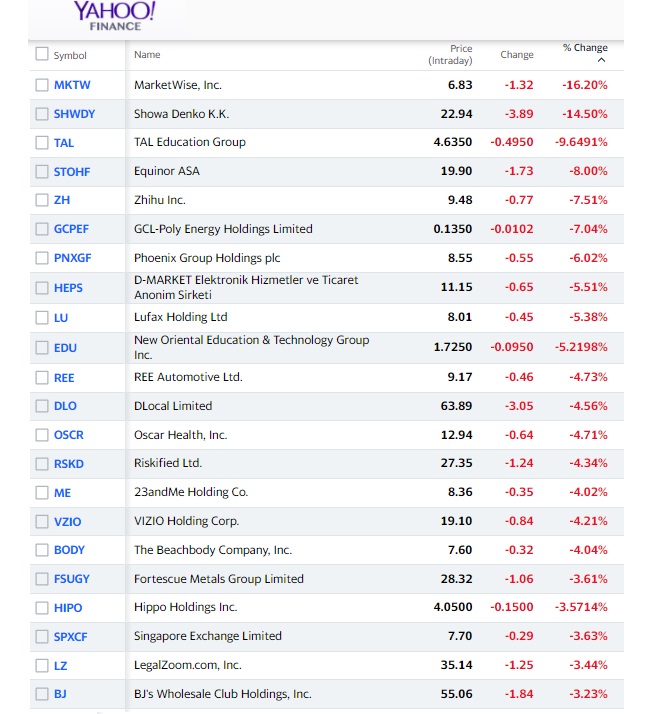

Zone in on the biggest losers as your collection of dip stocks to buy:

Marketwise Inc is a multi-brand subscription services platform providing premium financial research, software, education, and tools for investors. Of course, this summer was a weak time for investing. Perhaps the company has not kept competitive and are losing customers to Robinhood?

Marketwise stock was flying two months ago rising from $10 a share to $12.80 and dipped to $6.71. Investors are disappointed with earnings and are bailing out, but is it too much disappointment? Will this stock rebound?

There’s no doubt that corporate investors and even day traders act in a consistent, identifiable pattern, and that some are analyzing these behavioral trends to get an edge.

Are the dips in the Dow Jones, S&P, and NASDAQ all that relevant? They record a small set of large caps that might not tell you what you need to know. You can wait for Bitcoin, Tesla, and others to run their rollercoaster course, and it’s almost certain some investors have mad a fortune off of them. They’re keeping their eye on the long term Bitcoin forecast, and buying when it drops. Yet, now, the price is roaring back up, and few are certain of why.

Buying the dip is market timing and investors warn not to do that. Stock prediction is a tricky thing, and no one, even the best technical experts are knowledgeable enough to time the stock market.

When are the Dips?

Dips happen after Fed announcements (higher rates), tapering, or negative news. So you’ll want to set up alerts via your stock portfolio or financial investing account to be up on coming news events.

One common seasonal dip is after investors return from vacations in September and the market rises, then it tends to correct (what goes up comes back down/volatility) and you get an October dip opportunity.

And the market often sucks throughout the winter which is a big dip period.

Dips happen during the day, during the week, and month and even during cyclical changes. Traders make money off of those predictable changes. And with zero commission trading, small time investors can also buy the dips and improve their own portfolio values.

Warrior Trading has an article on buying the dips during the day. They point out that buying and selling is more complicated than you might believe. You’ll want to keep an eye on the top gainers and losers, and at about 11:00 am, the morning frenzy will be over the market might trend back downward.

Many position traders close their positions around 3-4 PM EST. During that time, volume in addition to volatility increase like at the onset of the trading day. At this period, there can be great opportunities, as well as big, speedy moves that can take place until 4 PM, which marks the end of a standard trading day. — Warrior Trading.

Watching the market futures might help give you an idea what’s ahead in the day, and yet sometimes stocks go the other way at the opening bell.

UK Spread Betting in the video below discusses buying the dip technicalities including a look at Tesla stock when it was at $378. It’s up much higher of course.

Buying The Dip Tips

Here’s a few dip buying tips to help you ease into a more thorough strategy for buying the dips in the stock market.

- review the CBOE volatility charts

- look for sectors that look like they’re going to get crushed in the year ahead

- look for seasonal price patterns for sectors

- monitor the top losers and cross reference with top gainers for the past few months

- look for volatile stocks that have dipped many times and have come back each time

- watch for steep, sudden climbs or falls

- use the Fibonacci tool https://fibonacci.com/ and connect the highest and lowest point

- tune into legitimate, authoritative stock market experts who say a correction is coming or who say a rise is coming soon

Use a regime detection methodology to amplify signals from momentum indicators (such as moving averaging crosses, etc) - study a company and industry sales vigorously before a company reports earnings

So that’s a brief intro into buying stocks on the dip. If you do become proficient at buying the dip over any length of time, it stands to reason you could win some big profits.

Good luck with your investment strategy in 2024.

Housing Market Real Estate Forecast | AI Stock Forecasts | ChatGPT Stock Forecasts 2024 | Tesla Stock Price 2024 | Stock Market Today | S&P Forecast 2024 | NASDAQ Forecast | Best Stock Picks | Tesla Stock | Dow Jones Forecast | Stock Trading Platforms | Stock Trading