Is This Year End Stock Market Rally Real?

This week’s strong momentum was surprising but some gamblers really had a hunch where this market is headed. Did information leak out or are they just all on the ball?

It was a sharp upturn. It does look real, but let’s have a look at what supports, what experts say and what might derail it before you hog wild on a buying spree. The next week coming will be an interesting one with still more big earnings reports scheduled for Nov 6 to 10th.

With some economists and analysts expecting a recession, a call for a year-end rally seems very odd. I forecasted that there would not be a recession, against what most doomsday people were calling for. Morgan Stanley’s Mike Wilson stills says a year-end rally isn’t likely.

The 2024 Outlook Seems a Whole Lot Brighter Now

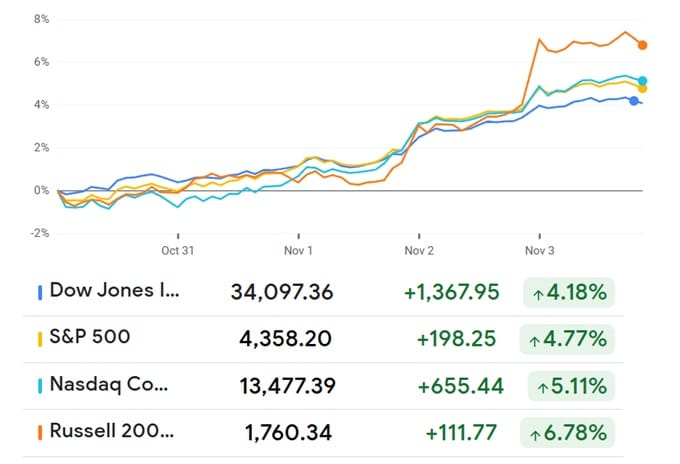

Yet, the calls for a 2023 year-end, extra-strong Santa Claus rally are growing. Fundstrat’s Tom Lee has been forecasting this for what seems like forever. And now, believers are seeing the light with last week’s news and big jump in prices. As you can see below, the NASDAQ, Dow, S&P, and Russell 2000 all jumped.

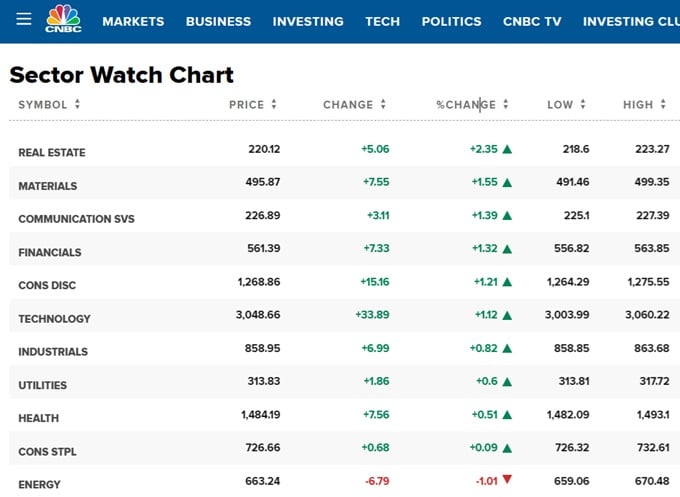

As the CNBC chart shows, real estate was the biggest gainer as rate expectations ease. Only energy was in the red.

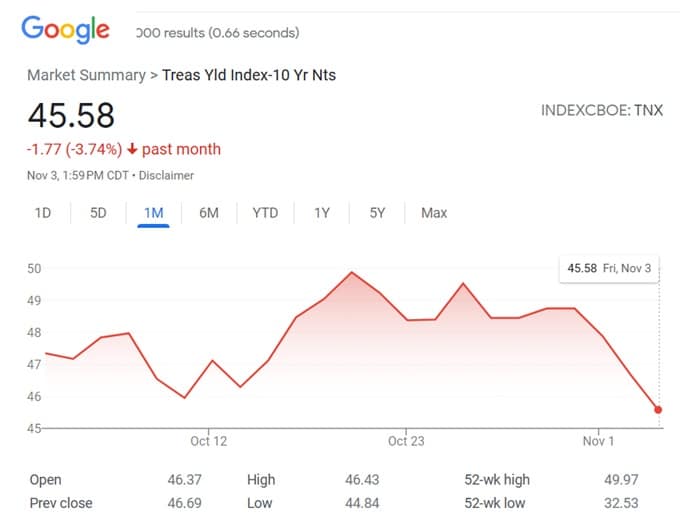

Originally, the year-end rally had improving earnings and the end of the FED rate hikes as its main catalysts. Friday’s poor jobs report is music to investors’ ears as it may be the key signal the market bulls were waiting for. And some too believe this is just the start of a full 2024 year stock market rally.

Raymond James said the 10% market correction since July should have led to closing much higher. Chief investment officer Larry Adam has set his year-end 2023 price target for 4,400 and 2024 S&P 500 price forecast of 4,650. That’s an upside of about 6% to 12% from where the index is currently.

Adam believes the year-end rally sits on:

- the end of the FED tightening cycle

- lower FED rates (and mortgage rates)

- improving mega-cap earnings

- positive year-end with November and December typically strong

- bearish to optimism mindset in investor

Energy markets are flat as well, and so far the Middle East war has not ignited. And the 10 year Treasury yield fell on Friday as well, telling us the yield curve is beginning to flatten. Of course, Jeffrey Gundlach points out frequently, the flattening of the yield curve is another pre-recession signal.

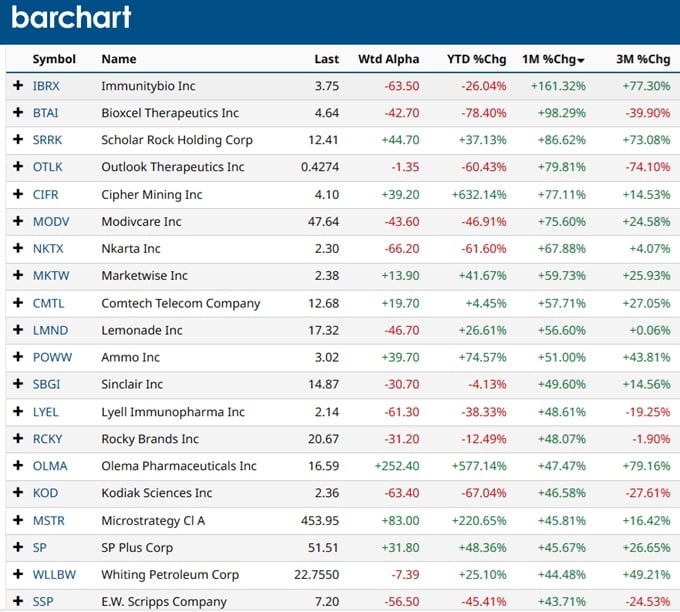

I’m very cautious, so am not suggesting you buy in 100% but you might want to move some money into the top movers you can view below. Recommendations from experts are below as well.

The point may be that the market still needs further catalyst power to evolve into the big rally investors want. And let’s not forget the big fight in congress over government spending, with the current President saying he won’t accept any cutbacks in spending. November 16th is the deadline for a potential government shutdown.

The GOP has put forward a rolling shutdown avoidance bill, but the Democrats have said they will stick to their agenda. Goldman Sachs whose stock rose 4.4% last week believes a shutdown won’t happen.

Of course, there are trillions of dollars waiting to move out of money markets/bonds to equities when investors get the big green light from top forecasters and analysts. It takes a while for optimism to take hold, so this jump could continue next month when job numbers will be lower.

Friday’s job report showed less hiring and more unemployment claims. The unemployment rate is up to 3.9%, hardly recessionary but companies are streamlining their workforce. Less waste means higher earnings.

Chief investment strategist Michael Hartnett broke from his usual bearish view to say technicals no longer stand in the way of a year-end rally for the S&P 500 Index. And Savita Subramanian, head of US equity and quantitative strategy and an optimist on stocks this year, said now was a better time to buy the US benchmark relative to its July peak — Bloomberg report yesterday.

After a subdued September and October performance, this rally could actually happen. Investors are just beginning to believe as this weeks big rise (in the Google Finance Chart here shows). They’ll be on the hunt for the best stocks to buy.

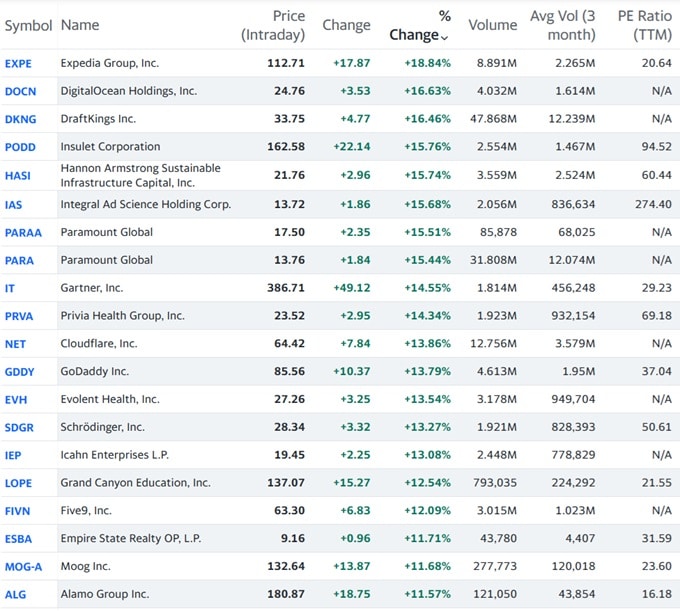

Top performing stocks included DR Horton, Expedia, DraftKings, Insulet, DigitalOcean, GoDaddy, Cloudflare, Paramount Global and Alamo. NVDA jumped 9.46% last week while DR Horton jumped an astonishing 16%. Other AI chipmakers rose strongly too bolstered by a strong US manufacturing reshoring mandate which gives further support to US stocks.

The Russell2000 enjoyed the biggest gains last week as the expectation of lower interest rates will be a big boost to small cap companies.

Top Performing Stocks Overall on Friday.

Top 10 Year End Rally Stocks

Check out the home builder stocks. I’m going to go with DR Horton as the best stock to own. It’s already on a roll, proving investors like it. They have a lot of inventory and are looking for reasons to continue building homes. Interest rates won’t fall much so homeowners are still locked into the mortgages for at least 2024.

If financially enabled homebuyers want to buy, they’ll be forced to buy new.

Lennar, PulteGroup, and Toll Brothers were all up on the week by 14% to 17%.

Expedia is another hot stock, which I don’t like. However, people are still traveling and if the economy rolls, they’ll likely be traveling in the winter, spring and summer.

Investors aren’t looking at the best sectors, P/E ratios, or dividends right now. They’re jumping on fast risers. Make sure you review them for signs of disaster (news) and when their next earnings reports are. Dumping the Faangs is wise because so many other depressed stocks are available. Investors parked their money in Apple, Goog, Netflix, Amazon, and Facebook this year as recession hedges.

But if the recession for small to mid-caps is over, then it stands to reason small and mid caps will deliver more impressive portfolio growth for 2024 and 2025. You’re in this for the long term right?

Stock Market Forecast 2024 | 5 Year Stock Market Forecast | 3 Month Predictions | 6 Months Predictions | 6 Month Economic Forecast | 10 Year Stock Market Outlook | NVDA Stock Price | Home Builder Stocks | Hot Stocks | Housing Market Forecast