Why a US Recession Won’t be in the Cards for 2024

The equity markets took a dive Wednesday on expectations of bad news. Yes, not on bad news, but the expectation of bad news. At least someone’s expectation.

The equity markets took a dive Wednesday on expectations of bad news. Yes, not on bad news, but the expectation of bad news. At least someone’s expectation.

So much for the technical analysis everyone’s publishing right now. There seems to be a little conspiracy to scare investors.

Even Market Bull Ring leader Tom Lee of Fundstat is shying away from his hot market outlook for 2023, warning us of a down first half of 2024. Roller coaster rides. Thanks for nothing Tom! Maybe get some new tarot cards.

Recession Calls Anyone?

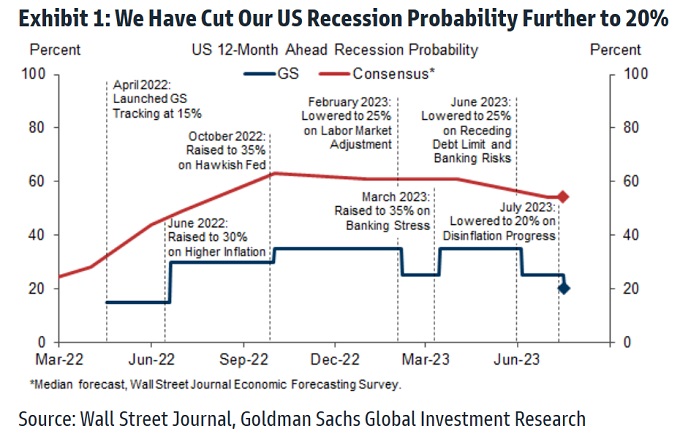

Not the Bank of America. They’re reversing their dour outlook and scrapped their recession call. Goldman Sachs too lowered their recession probability to <20%. Those are two strong voices in the market driving a lot of investment plans.

And Yardeni Research is forecasting good times for the S&P and investors.

Why is a Recession So Unlikely?

Analysts look at the usual suspects including consumer spending, interest rate threats, inverted bond yield curves, Q2 earnings reports, low unemployment, good jobs reports, and increased factory building in the US.

Analysts look at the usual suspects including consumer spending, interest rate threats, inverted bond yield curves, Q2 earnings reports, low unemployment, good jobs reports, and increased factory building in the US.

So where are they finding bad news? There’s not much which is why there’s such a big turnaround in stock market forecasts for 2024 and the next 5 years.

For the next 6 months’ forecast, we’ll have more turbulence. We could see a slight downturn in the markets for the next 3 months as credit tightening kills off lending including home loans.

- Government can’t erode their tax base. It’s only been lucky so far, but when tax revenue falls in a recession, the government finds itself in a nervous situation.

- Housing Market ready to rumble. The housing market, the whipping boy of the market bears, may be hurt for the next 3 months too. Yet when rates start to fall, homes will be listed and the sell off will begin and prices will drop. Consider that the housing crisis is already extreme and tempers will boil if things get worse. Construction of homes and multifamily units will surge again too. Even 5% rates may not hold back this power natural market power surge.

- Sure, oil prices are rising, but the US could Benefit. President Biden could tap into the SPR reserves and spill out tens of millions of barrels anytime, and he likely will. It will anger the Saudis and they’ll respond. It could get ugly as Russian oil is disappearing, and Europe is tiring of the war. Incidentally, fracking oil producers have new technology that will make old wells productive again, just as demand for oil and gas increases. The US may get back to 12 million barrels produced per day. This will all keep the price of oil from getting too high. Still you may want to check out oil stocks, particularly Canadian oil stocks as they’re looking solid.

- 2024 is the year of the Presidential Election. Election years are historically positive for the markets. Joe Biden and the Democrats can’t hold onto political power if a recession happens, since Americans would move on from their high rate/high debt spending, poverty/crime building recession misery. They’re already tired of it and the Republicans will surely promise to get rid of the recession.

- Vision of Republicans. Since a Republican win looks more likely next fall, that will appeal greatly to investors who like the idea of reduced taxes, lower interest rates, cheaper, easier credit again, less regulation, combined with the trillion-dollar infrastructure spending beginning in 2024. Once voters see the real picture, that Republicans will spite the Dems by unleashing the economy, they’ll vote accordingly.

- Cash-rich Corporations. Let’s not forget that corporations are holding a lot of cash and they’re reporting great earnings this year. So a recession would require quite a nasty catalyst to snuff out the growing fire. Everyone is saying the FED will be that nasty catalyst making hasty rate-rising decisions and cutting the money supply.

- Ai-Driven Economic Boost. Additionally, the AI investment boom is huge and people still believe in it. As this money is spent to build entirely new products and is built into the new factories being constructed, (see new AI chip factories in US) it’s going to give the US a big economic advantage. PWC says AI will give the US a 14% boost, but they mistakenly gave China the nod as being the biggest gainer. But international trade is changing, and China’s day has gone. The US is positioned to get a bigger chunk of the global AI productivity boom with the new US-focused economy including the US Chips Act.

US Can’t Afford a Recession

US Can’t Afford a Recession

Janet Yellen trashed Fitch for the credit downgrade of the US from AAA to AA+ as though the debt ceiling crisis didn’t happen.

She’s lost even more credibility as a financial regulator by being indignant when the US is saturated in debt while she and the FED warn they’re going to crush the economy. Doesn’t she watch her own news videos?

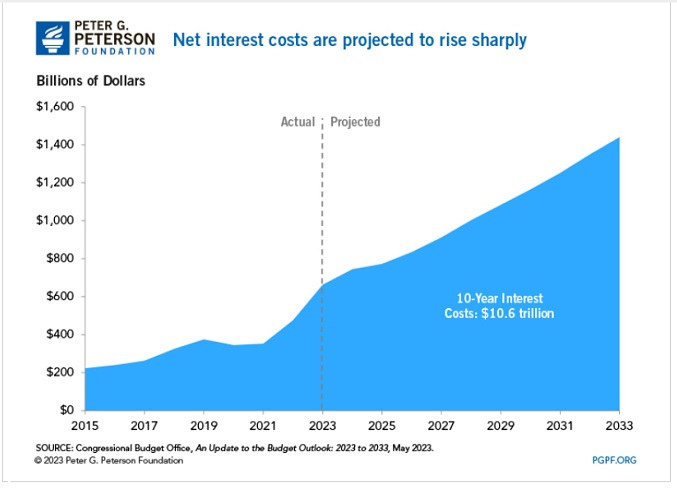

The U.S. debt payments are becoming a serious problem, limit or no debt limit. The FED will have to lower the interest rates so the US can borrow to pay them. Currently, the Treasury intends to sell $800 billion in Treasury Bills and wants to pay that back over an extended period. They’ll get buyers, because debt buyers feel the economy is being trashed, so 5% t-bills look good. And with Fitch cutting the US credit rating, they will have to pay even higher debt payments. And higher rates means higher loan rates for the Treasury Department.

In June, the Congressional Budget Office (CBO) projected that annual net interest costs would total $663 billion in 2023 and almost double over the upcoming decade, soaring from $745 billion in 2024 to $1.4 trillion in 2033 and summing to $10.6 trillion over that period. — from Peter G Peterson Foundation report.

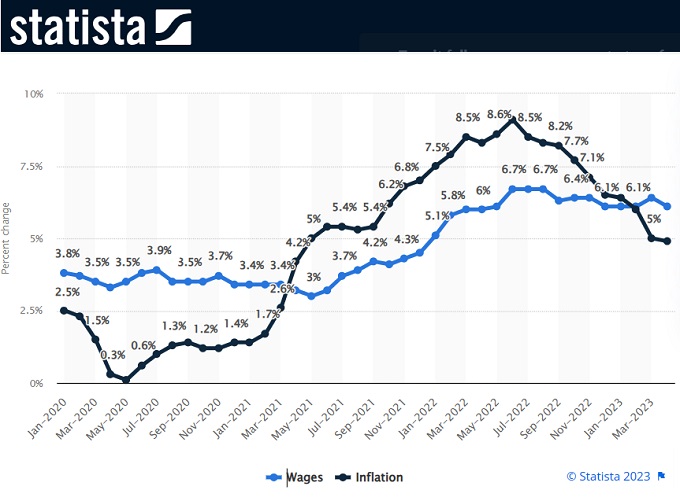

Inflation is definitely headed lower but may linger given the economy looks promising and the FED’s stubborn schoolbook insistence. Wages look steady.

That’s the case against Biden and the Fed’s attack on the economy and the stock market. The real solution is lower rates, increased competition, deregulation, and promoting trade (ex China). Take a closer look at the 2024 stock market forecast.

Header Image by rawpixel.com on Freepik.

More on the 2023 2024 2025 Forecasts:

Stock Market Predictons | Real Estate Housing Market | Stock Market 2024 | S&P Forecast 2024 | Stocks with Best P/E Ratios | Best S&P Sectors | NASDAQ Forecast 2024 | Dow Jones Forecast 2024 | Russell 2000 Forecast | Stock Trading Platforms | Best Dow Jones Stocks | Best Stocks to Buy | Stock Market Prediction Tips | Stock Prediction Software | Stock Market News Today | Google Finance | Travel Marketing Tips | Bleisure Travel Marketing | Travel Company Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel | SEO Expert Gord Collins