Best Oil Stocks to Buy?

As the price of oil moves past $110 a barrel, investors realize where it might be headed, to above $150. The Putin war isn’t about to end and may persist for years.

Europe intends to cut off Russian oil, however India and China are scrambling to acquire that cheap energy supply regardless of the political and future trade sanctions. The news of China grabbing up cheap oil keeps sending prices downward however since they won’t need to buy Brent or Saudi oil.

The unknown: China and India don’t believe they’ll face sanctions and are amoral about the death of Ukraine’s people and destruction of that country. To some, this mindless disregard is something that can’t be tolerated. China is looking to invade Taiwan, and the outcome is obvious.

No one is sure how the communist regime will respond to US and European sanctions. Likely, given China is already struggling, and they will back down. This means Russia’s oil and gas will be locked in and the price of Brent and WTI will rise.

Check out the best oil stocks to buy below.

As mentioned in the stock market report, some fund investors are selling ishares energy stocks and avoiding oil profits. How long can that go on, when investors themselves need a good return? They won’t be getting a good return from big tech stocks, ETFs, and blue chips. The whole Democrat ESG scam, with TESLA knocked out of the S&P shows political forces are still at work in the markets, and why oil stock haven’t yet shot through the roof.

See some of the Canadian oil stocks with P/E ratios of 2 to 3. Astonishing potential as long as the economy doesn’t crash. And if a recession does occur, even oil prices will come down, yet oil stocks will remain the most profitable for some time.

At some point, the institutional money will flood back into the market. Who wants to lose money on losing stocks?

Prices are raging and this means the oil and energy problem must be solved, because it’s going to cripple the economy.

US Oil Companies Can Produce

With the oil price forecast above $150, it stands to reason investment will flood into oil stocks. You can still get a jump on this market by finding oil companies with production capacity and lots of reserves. Of course, that’s a research process for you. Head over to barchart.com or tradingview and see what oil investment analysts believe. Some of the best performing oil stocks to buy are listed below.

During the recent downturn, even energy stocks got hit, but if anything is investible right now, it would companies in the oil sector. Just recently some Gulf of Mexico oil auctions created quite an event. Everyone’s hungry for investible oil fields and the best oil stocks to buy. And Canadian oil stocks might be up a notch from most US and Global oil stocks. A rising tide raises all ships, but is there one that grow significantly? Find out below.

Which oil stocks to buy depends on your appetite for risk and your profit goals. Big oil companies offer less profit but are safer, while small caps and penny stock are risky, but may have huge upside potential. I’ll introduce you to a few.

Oil companies make their money 3 different ways:

- exploration, production, and oilfield services.

- transportation, processing, and storage of oil and related liquids

- refining and distribution of petroleum products.

Oil Pushing Towards $100 a Barrel

Oil price forecasts are pushing above $100 and we’re up above the $90 psychological barrier already. That persistent rise is a good sign. The key to further oil price rises is the shortage of oil, rising demand and the neglect of new supply. Supply hit will critical lows in 2022 and production won’t keep up.

Oil industry experts such as Eric Nuttal of Nine Point Partners especially has pointed out the oil crisis fundamentals and that supply is what will drive this epic opportunity in oil. In this video, he explains the dynamics that are causing this energy supercycle. He says this cycle is much more bullish than the last one and prices could hit $140.

It’s been pure politics that’s suppressed the industry, but reality is going to kick back hard this year.

Big money cautious investors are eyeballing the Exxon’s, Conoco Philips, BP, Marathon, and Chevrons. They get all the ink from commentators and investment gurus because they’re safer and dividends can be excellent. In fact, dividend payouts could be really strong in 2022 given how fast oil prices are rising.

It’s one of those very infrequent times when millionaires are going to be made. On the other side of the oil stocks opportunity are penny stocks and small caps. These hold huge potential for price gains.

Take TransOcean Inc. for instance. They may be the leading owner of drilling rigs, exploration equipment among other important assets to the oil industry. For the last few years, with the green regulations, they haven’t been doing well. The world was getting along for a short period without as much exploration, drilling and production.

Take TransOcean Inc. for instance. They may be the leading owner of drilling rigs, exploration equipment among other important assets to the oil industry. For the last few years, with the green regulations, they haven’t been doing well. The world was getting along for a short period without as much exploration, drilling and production.

So RIG has dropped in price to 21 cents at one point. It’s up to almost $4.00 now. In 2014, it reached over $150 a share. So you can see the opportunity with oil forecast to go higher and a huge demand for oil rigs coming in the next few years.

Yes, the Democrats are suppressing the industry, but Americans are tiring of the high prices. Instititutional green conscious investors took their money out of the sector too, which crushed this company’s value. It was implied RIG would die because no one would drill for oil anymore.

Well, drilling is up in 2022 and when the shortage get severed, the call will go out to companies to begin exploration and drilling again. The Democrats won’t okay the XL Keystone Pipeline so offshore oil will be in big demand in the US.

And globally, demand will grow. Someone has to explore, drill and pump which plays right into service companies such as TransOcean.

Unwise oil stock investment advisors actually forecast this company’s stock to go to zero in one year. They felt the era of carbon energy drilling was done forever. Total ignorant of reality and the growing need for energy across the world. Remember, this isn’t a US issue, it’s about energy for 7 Billion people.

There is nothing the Democrats can do to stop the demand for oil across the world and preventing ocean drilling or land drilling. With the Republicans likely to win the next midterm elections, political power will swing back to the energy producers.

With growing revenues, political might will grow and exploration, drilling and production will resume. When the big profits start rolling, the institutional investors will get jealous and begin plowing their money back into the oil stocks. That alone could push them to record prices.

You could weigh in dividend payments in your oil stock decisions, however the decision to pay them, and how much they pay, is set by the big oil companies. They may not pay anything. The smarter route is to listen to the top oil investment advisors and look at macro factors that are driving parts of the market.

For instance, the Canadian Oil market has been kicked around and underinvested, and has received less revenue than it should. Yet those conditions are about to change. Your very best investment opportunities might be in the Canadian oil sector. Disclosure: I own shares of Transocean, Athabasca Oil Sands, and Baytex Energy. They’re beginning to soar.

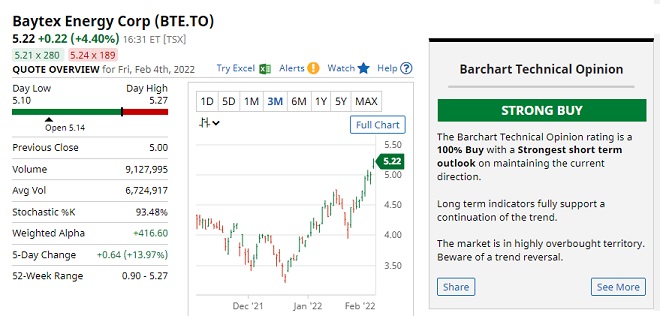

Of all the stocks, I believe BayTex Energy may have the best potential.

There may be better picks and you we do see some excellent growth in these oil stocks below.

Top Oil Stocks Right Now

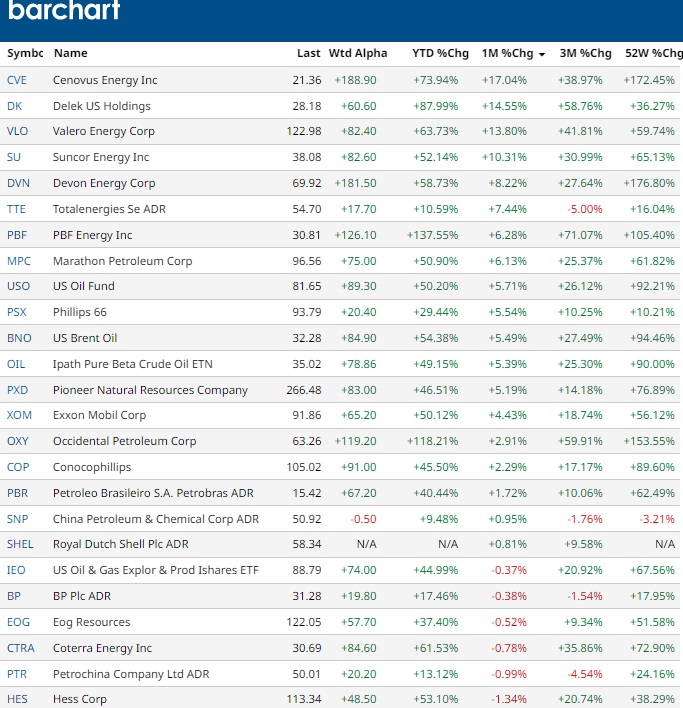

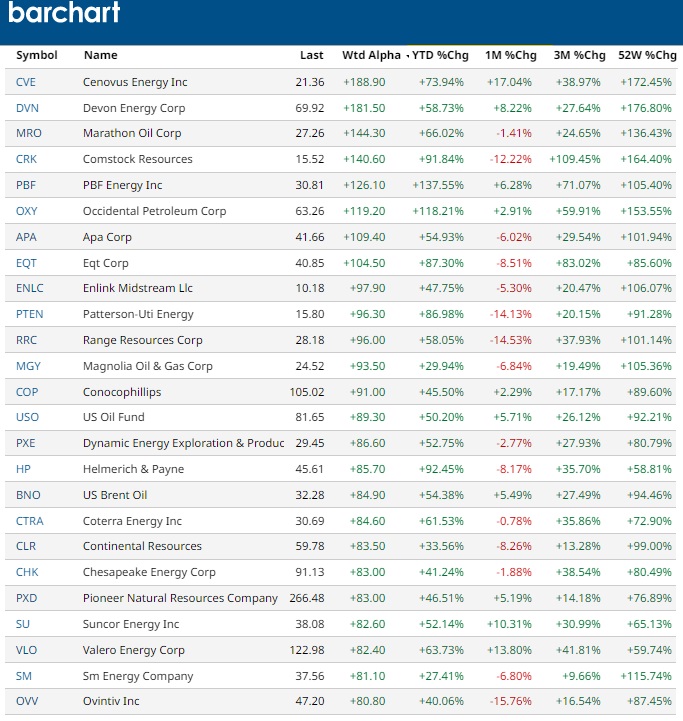

Take a look at Barchart’s best performing oil stocks of the last 5 days:

One signal that might play into your choices is which stocks are already hot. That’s proof that they may have assets and transportation opportunities that investors are liking. But the market hasn’t opened up fully so other oil companies hold excellent potential.

And these are Barchart’s weighted selection based on their criteria of strong and recent factors.

For risk aversive investors, Yahoo Finance noted these major oil stocks are of strong interest to hedge fund managers:

- Exxon Mobil Corporation (NYSE:XOM),

- Chevron Corporation (NYSE:CVX)

- ConocoPhillips (NYSE:COP)

- EQT Corporation (NYSE:EQT)

- Chesapeake Energy Corporation (NASDAQ:CHK)

- Pioneer Natural Resources Company (NYSE:PXD)

- Marathon Petroleum Corporation (NYSE:MPC)

- Cheniere Energy, Inc. (NYSE:LNG)

Investopedia Believes these penny oil stocks are worth a good look:

- Cardinal Energy Ltd. (CJ.TO)

- Baytex Energy Corp. (BTEGF)

- Crew Energy Inc. (CR.TO)

- Transportadora de Gas del Sur S.A. (TGS)

- Tamarack Valley Energy Ltd. (TNEYF)

- Canacol Energy Ltd. (CNE.TO)

- Athabasca Oil Corp. (ATHOF)

- Pipestone Energy Corp. (PIPE.TO)

- CGX Energy Inc. (CGXEF)

- Invesco S&P SmallCap Energy ETF (PSCE)

Best Canadian Oil Stocks 2022

Canadian Oil Companies have extra potential. First they sell primarily heavy crude oil which is used in a wide array of products that will grow in production due to the economic recovery. Canadian oil sells at a discount but that discount will decrease as global demand grows. Political changes in the US could result in the Keystone XL Pipeline being

Does the threat of a stock market crash and housing market crash affect the oil market? An economic collapse would certainly lower demand for oil and gasoline. Yet the outlook for the global economy is good right. Low interest rates takes the pressure of all businesses and experts are giving the global economy the thumbs up.

* The content and opinions contained in this post are those of the author and do not constitute investment advice. This information is for exploring opportunities and entertainment. Please refer to your stock investment advisor for guidance and opinions on investible oil stocks and when to buy.

Stock Market Forecast 2024 | XOM Stock Price Forecast | Oil Price Forecast 2024 | Best Oil Stocks | GOOG | Google Finance | Tesla Stock Predictions | 3 Month Forecast | 6 Month Outlook | 5 Year Outlook | 10 Year Stock Forecast | Crash Statistics