3 Month Stock Market Outlook

A trade war with China, excessive interest rates, consumer switch to experiences rather than goods, and the continuation of the AI-driven US economy will likely permeate the investment scene going forward.

xChina may be a bigger story now as the block on talk on China dumping picks up steam. And China is playing trade blocks with the US with US AI chips getting blocked. (AMD is taking a beating). The news today is a factor since the Dow, S&P, NASDAQ and Russell 2000 all took a dive.

But of course, the FEDs obsession of 2% com hell or high water, suggests some of the lifeboats are being prepped. Hopefully this won’t lead to a stock market correction or crash.

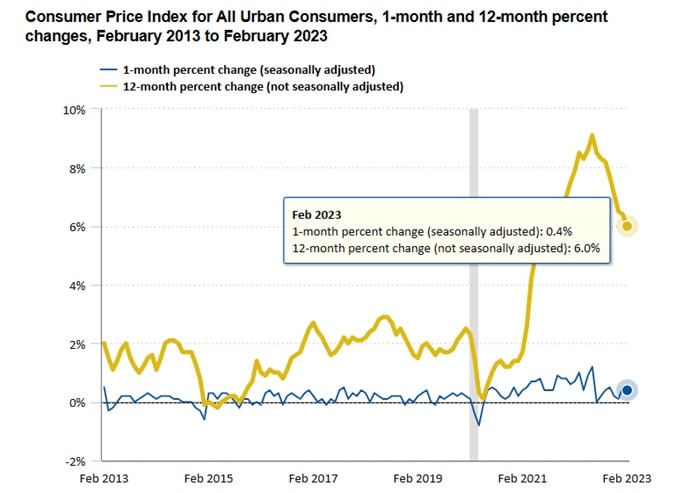

The week the CPI report has chilled the markets a little, with the Dow taking a dip. Goods inflation is falling however the switch is over to services (e.g., travel sector). Yes, inflation simply can’t fall like some economists hoped. The FED will have to raise its target or the xChina trend could resolve it too. Of course, xChina also means more opportunity for American companies which would make US stocks the place to find bargains.

And the bulls are in for some hand-wringing as inflation crept back up again in March. With few catalysts, the markets are on shaky ground.

Inflation Higher Than Economist’s Forecasted

BLS reports a 3.5% rise in food (eggs up 3.8%, lettuce up 5.9%), 4.2% rise in energy, auto repairs up 3.1%, 5.7% rise in shelter, 5% rise in electricity (what EVs use), and a whopping 10.7% rise in transportation. With oil prices expected to rise, there’s nothing to stop inflation from getting out of control. That’s J Powell reiterated the FED is in no hurry to lower rates.

The fact is, the US economy is rolling along, befuddling everyone. Seems there’s a hidden source of funds everyone is tapping into and it looks like that fountain will keep providing.

Here’s JPMorgan’s forecast from December for your review:

Our outlook for the new year is “2024”: 2% growth, 0 recessions, 2% inflation and 4% unemployment. A soft landing remains in reach, particularly as disinflation looks set to continue and the Federal Reserve now appears satisfied with its progress.

However, rates and stimulus spend (Biden’s budget) will ensure more inflation is added to the supply side shortages driving prices up. Shelter/rent/mortgages look worrisome as mortgagees can’t get out of their low rate loan and those needing to refinance won’t be able to afford a home. High rates for landlords and weak rental supply ensure rents are on the rise as April/May/June are strong months for rent prices.

April, May and June should see a pick up due to summer activity (travel, leisure, socializing) yet the rate hike expectations may have to be repriced back into the markets. With interest rates higher for longer, many small business owners, banks and mortgagees are looking at refinancing at high rates, or getting no refinancing at all. That will provide some stock for hungry buyers with sufficient downpayments.

Q2: What’s Next for the Markets?

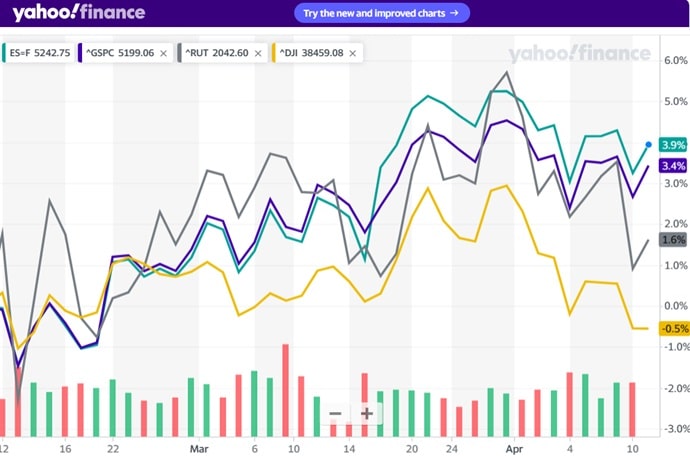

This chart from Yahoo Finance shows the downtrend as inflation returns. Commodities, gold and the US dollar are rising, which is not good for an economy looking to cuts costs and grow earnings. $1.2 Trillion dollars in new stimulus (budget) is added to the $5 Trillion in money markets to provide plenty of reserves for big spending.

Earnings might take a dive as a result and corporate spending might pull back which likely will lead to a pullback if not a correction. Investors are skittish and jump at any FED sounds, showing in the volatility. The greed/fear index is sliding back to neutral, but fear will win out in April/May.

We’ve already seen what some describe as trimming and profit-taking, but in actuality, a lot of investors would to sell their stocks but hate to suffer the loss. But many investors aren’t long-term investors, and will likely start divesting in April, May, and June as they realize there might not be any rate cuts.

And corporate earnings won’t matter. It’s the loss of confidence and expectations of lower performance for the remainder of 2024. Some analysts predict low growth for the year.

In fact, some experts believe the FED will have to induce a recession to reach their mission of 2% inflation. This could launch a big correction or mini crash of the markets. The FED is likely being very cautious because when an economy goes into a high speed wobble, with no control of factors, an economic collapse could happen. And in a flat period with no catalysts, fearful thoughts being to rise, with memories of 2006.

Stock Prices Last 3 Months

We reach peak euphoria highlighted by excessively overvalued AI stocks, now blanketed by the certainty of persistent inflation. We’ve actually enjoyed great luck with lower energy costs, a boom in multifamily building, and a drop in food prices. But that party might be over and costs will go up this spring. April’s CPI print will likely be higher. Experts underestimated last month’s increase.

The 2024 stock market should be stronger than expected even with no Fed rate changes. Just the fact rates won’t go up is sufficient for investors to go bargain-hunting now. As covered in the 2024 forecast, a number of major economic drivers give the green signal including infrastructure spending, pro-American trade policies, declining interest rates, strong corporate performance, declining China, import tariffs protecting US producers, strong employment earnings, low unemployment, AI productivity enhancements, flattening inflation, $6 to $8 trillion in money markets ready to move over to equities, along with the possible election of a new pro-American president could be elected in 6 months.

And the FED is expected to end quantitative tightening (sometime this year) which has been a drag on the economy.

The next 6 months is the twilight zone for markets.

The Next Quarter: April and May and June

As stated, the next 3 months might be a plateau for stocks as no major news stories are expected. A correction is very likely given the dim news from the FED.

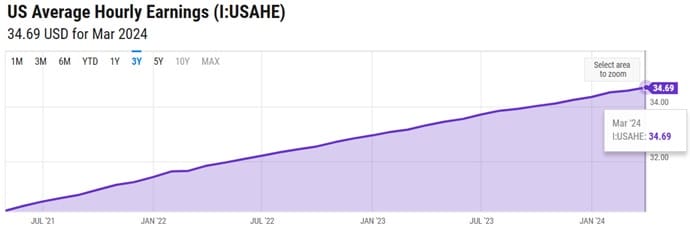

The March jobs report was strong with 330,000 new jobs added and wages rose by .3% month to month (3.6% yearly rate). As you can see hourly wages keep rising no matter what happens in the economy.

The Fed will not lower the interest rate by July because the economy is okay. It doesn’t need a rate cut. However, a responsible move is lower rates and point a finger at Biden’s spending habits and that key supply sources are the problem.

On Feb 20th, the Conference Board officially called off its recession call.

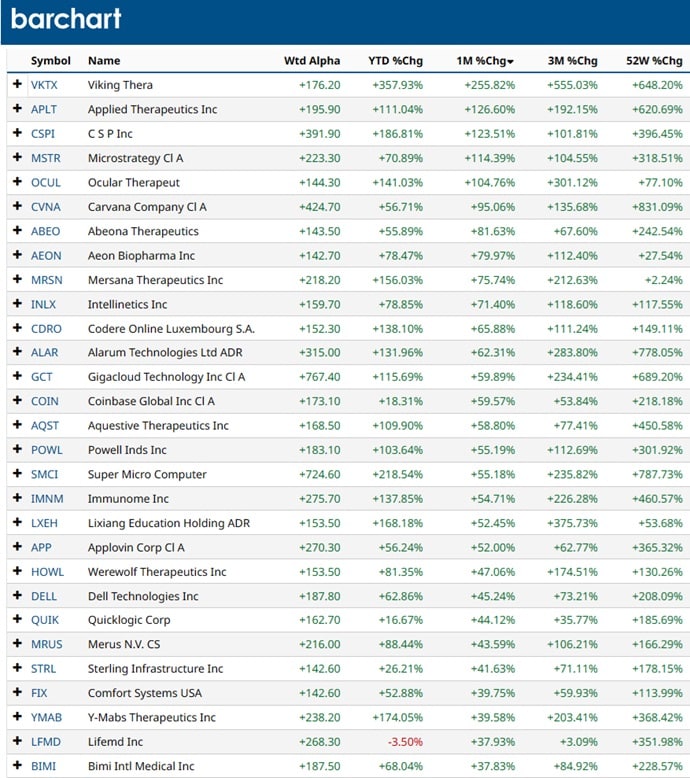

It might be true that the equities markets have been driven by the irrational exuberance of AI opportunities. It’s pushed Nvidia, AMD, Super Microcomputer, Broadcom, Intel and other stocks up crazily. It’s because so much money has been invested in AI with more to come this year.

Opportunity follows money, so it shouldn’t be a surprise to you that the AI stocks are the place to be. Artificial intelligence will support massive gains in new services and devices which makes all previous products obsolete. Data centers are the focus, but AI is supercharging everything. Expect the NASDAQ to do very well this year, and will pick up in H2 as the Fed begins easing rates.

Easing rate expectations may stimulate the housing market after we see home prices fall a little in the next 3 months. By summer some demand will return pushing up builder stocks such as Toll Brothers and DR Horton. However, right now, the AI trade is likely going to provide better returns. The housing market’s revival is still a ways off. Buyers right now are struggling with the down payment, and new condos are taking longer to sell.

Have a closer look at some of the projections for the next 3 months, 6 months and 5 years and overall it’s an optimistic picture. See the 6 month economic projections to gauge macro concerns.

Which stocks to Buy in March?

You might want to visit Barchart.com or Google Finance to check those stocks that have performed well in February because no big events in March, they might lead the way again. Something negative will have to happen to change the upward trend.

Yahoo Finance Top Stocks to Buy

Yahoo Finance too, believes these stocks are good opportunities for March (stats courtesy of Google Finance):

-

- Berkshire Hathaway Inc (NYSE:BRK) +4.17% in last month, p/e ratio of 9.24

- UnitedHealth Group Incorporated (NYSE:UNH) -2.67% in last month, p/e ratio of 20.5

- JPMorgan Chase & Co. (NYSE:JPM) +4.87 in last month, p/e ratio of 11.2

- Oracle Corporation (NYSE:ORCL) -2.24% in last month, p/e ratio of 41.6

- Merck & Co., Inc. (NYSE:MRK) +.62% in last month, p/e ratio of 885.91

- Bank of America Corporation (NYSE:BAC) +4.12% in last month, p/e ratio of 11.6

- General Electric Company (NYSE:GE) +15.21% in last month, p/e ratio of 19.88

- Broadcom Inc. (NASDAQ:AVGO) +12.55% in last month, p/e ratio of 42.4

- Danaher Corporation (NYSE:DHR) +4.09% in last month, p/e ratio of 45.2

- Union Pacific Corporation (NYSE:UNP) +2.57% in last month, p/e ratio of 24.2

- Intel Corporation (NASDAQ:INTC) +2.45 in last month, p/e ratio of 47.2

- Exxon Mobil Corporation (NYSE:XOM) +4.22% in last month, p/e ratio of 11.9

- Walmart Inc. (NYSE:WMT) +4.52% in last month, p/e ratio of 30.7

- Elevance Health, Inc. (NYSE:ELV) +1.79% in last month, p/e ratio n/a

- Johnson & Johnson (NYSE:JNJ) +4.06% in last month, p/e ratio of 31.5

- Pfizer Inc. (NYSE:PFE) +.075 in last month, p/e ratio of 41.6

What to Look for in the economy for the Next 3 Month Period?

- the Fed won’t likely cut rates until after the next 3 months in late June if at all

- lagging effects of rate hikes continue to soften the economy and business spending

- unemployment will rise slightly as multinationals layoff more workers

- corporate earnings reports will likely fade as consumer spending falls

- oil prices rising given global tensions

- US dollar will likely stay steady but fall by summer as the FED begins easing rates

- It’s risk on for investors who are confident that inflation has been beaten

- FOMO will draw money into the market

- large investment funds will bring money market funds in and buy AI stocks and Bitcoin)

- AI, Pharma, industrials, and consumer discretionary stocks will grow strongly in spring

The next 3 months should offer plenty of opportunity for investors to jump on board the rally that should continue throughout the year, even despite lower corporate earnings. The key here is that as interest rates fall, money will flee the money markets.

Looking ahead to 2025 when President Trump resumes another term in office as President, we can see much better circumstances for US companies with lower taxes, fewer regulations, and still enjoy the infrastructure spending that has been set for 2024/2025, and the implementation of AI technology into business. The forecast for the next 5 years looks very good and this should draw money continuously into the stock market. Inflation may not go down, thus keeping money in checking accounts and money markets is not a good investment.

Take more time to learn all you can about macroeconomic forces, sectors and the stock market forecast.

See more on the 6 month economic outlook, 6 month stocks outlook and the forecast for next week.

Stock Market Today | Nvidia Stock Price | Best AI Stocks | Toll Brothers | Chip Stocks | Tesla Stock Price | Stock Quotes | Stock Market Now | Best S&P Sectors | Stock Market 2024 | GOOG Stock Price | 3 Month Predictions | 5 Year Stock Forecast | 6 Month Outlook | Dow Jones Forecast | NASDAQ Forecast | S&P Predictions | Stock Quotes | Stock Market Crash | Stocks Next Week | Stock Market Investing Tips | Stock Trading Platforms | Google Finance | Author Gord Collins