New York Real Estate Market

January’s sales and price numbers for the state of New York were impressive given what NYC has been through the last 12 months.

Tens of thousands of New Yorkers have exited the state citing high taxes and high prices and limited quality housing supply as too much to bear. They’ve left for Connecticut, Philadelphia and Florida. But will workers begin to be drawn back into the Big Apple and push prices up slowly again?

With Covid 19 receding, vaccines being distributed, and businesses reopening are the markets in Manhattan and NYC ready to recover in 2021? Are the spring housing markets going to reflect a country-wide recovery? Will work from home be an ongoing thing for New Yorkers? Can people and will people move back to NYC? Are NY banks willing to lend freely?

Is there still be big shuffle happening? Are homeowners ready to sell and leave the big Apple? New listings rose strongly in January, but it’s not enough to fulfill demand and prices are rising.

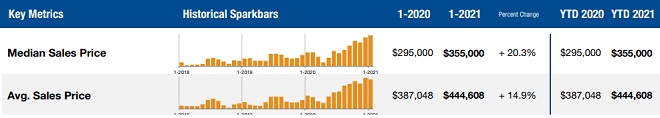

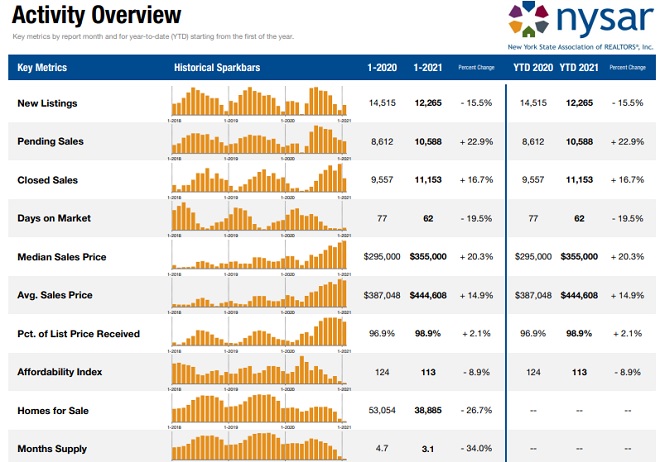

Closed sales across the state rose 16.7% (11153 homes sold) from last January of 2020 when 9,557 homes were sold. Pending sales too also rose by almost 2,0000 to 10,588 units in January 2021 compared to 12 months ago.

Of housing supply in New York is always an issue, and as the economy returns, buyers will find it very difficult to find an affordably priced home, particularly single-detached houses. Inventory has fallen 26.7% compared to 12 months ago with now only 38,885 homes available this January (compared to 53,054 in January 2020).

New listings of homes fell 15.5% year over year from 14,515 last year to 12,265 listings available in January 2021.

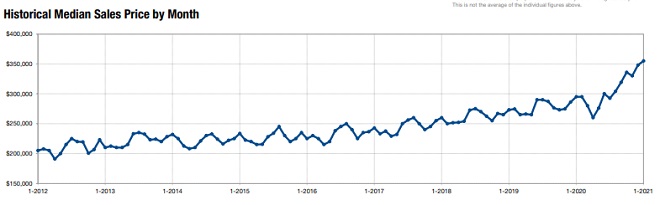

The median sales price of a New York home rose 20.3% to $355,000 last month., from $295,000 median price in January of 2020. The sharp rise in prices in 2020 is an eye-opener and many wonder if a housing bubble is being inflated?

January’s Real Estate Stats for New York

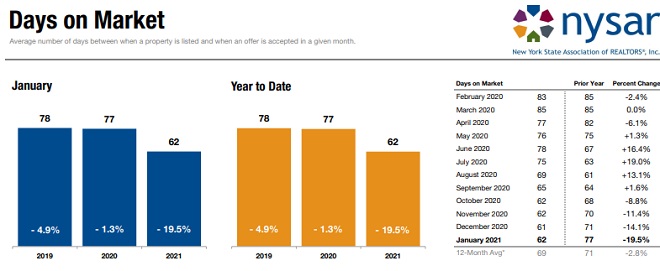

Days on market and months of supply have to be the key stats going forward. Homebuyers are plentiful as many have a fear of missing out on this market, there is latent demand, and Millennials are trying to form families and need more room to live. With mortgage rates stuck at record lows, it’s only rising prices and falling supply that’s stopping New Yorkers from buying a home.

New York is a unique city given what’s happened in 2020, but the sales charts look much the same as any other year. Buyers will be facing huge property tax increases if they can find a home to buy. There aren’t the bidding wars you see in other cities, but by July, the New York real estate scene will be heating up.

New York is one of the most important real estate markets in the country, and in the world. Troubles here inevitably translate into economic and businesses woes for the country.

NYC and Manhattan: While businesses scramble for more office space in NYC, residents are hoping to sell their home in urban areas and move to the burbs or even further afield where housing is available. This is a trend most major cities are seeing right now.

Price Growth by County

Price growth in some smaller counties has risen as much as 80% since last year. The exodus from NYC and Manhattan likely leading to buyers showing up there. In Queens’ and Richmond, home prices aren’t up a great deal so perhaps buyers can find some bargains?

| New York County | Home Price January 2021 | Home Price January 2020 | Change % |

| Bronx County | $410,000 | $470,000 | 14.6 |

| Broome County | $107,000 | $136,000 | 27.1 |

| Chattauqua | $91,775 | $121,794 | 32.7 |

| Duchesse | $275,000 | $358,250 | 30.3 |

| Monroe | $150,000 | $168,000 | 12 |

| Nassau | $529,500 | $600,000 | 13.3 |

| Niagara | $132,000 | $146,800 | 12.2 |

| Onandaga | $147,000 | $165,000 | 12.2 |

| Queens | $599,000 | $654,500 | 9.3 |

| Richmond | $542,500 | $585,000 | 7.8 |

| Suffolk | $400,000 | $475,000 | 18.8 |

| Ulster | $239,900 | $275,000 | 14.6 |

(above data courtesy of NYSAR)

Bidding Wars and Higher Home Prices?

Across the US, a return to normal, growing jobs and income, a plenty of Fed cash pumped into the economy means house buying will be brisk this spring. Many Millennials and Gen Z’s have moved back with their parents and are now eagerly awaiting finding a place of their own. This will help push up NYC and Manhattan rent prices.

Will Workers Come back to Manhattan in Droves?

Most don’t see any risk of bidding wars for single detached homes and of course higher home prices. New York and San Francisco have had dramatic shifts given how high priced and dense. But will Manhattan companies and Silicon Valley companies function optimally in the work-at-home era? Something tells me many workers will want to go back to work in a Manhattan or San Francisco office later this year or in 2022.

Contrast the New York market to those in Miami, Boston, Los Angeles, San Diego, Dallas, Philadelphia, Denver, Salt Lake City, Atlanta, Tampa, Seattle,and San Francisco.

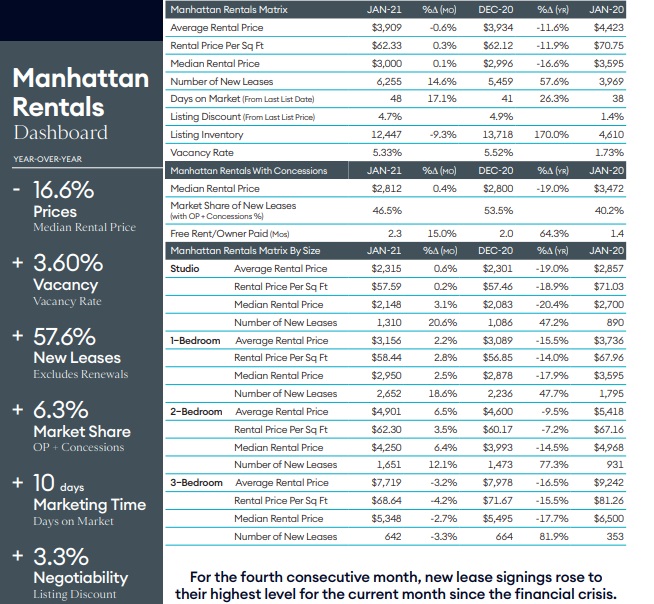

Manhattan, Brooklyn and Queens Rental Market

Douglas Elliman’s rental reports shows rent prices are moving back and inventories are falling. Median rent prices are down $600 per month on average from 12 months ago, so it looks like renters have time to find their next aparment or condo.

Just like the Boston housing market, San Francisco market and Los Angeles real estate market, and most major city markets across North America, the New York housing market is under pressure. The NYC forecast is for more of the same.

It’s pretty far-fetched that New York’s real estate performance could deviate too much from the US national forecast. Given how stressed New York property owners and landlords are and how stimulus money won’t be enough given the fall in taxes for the state, the possibility of a national housing market crash and a New York housing market crash is real. The economic fallout from the shutdown has cascading and lasting effects.

The New York governor is complaining the Federal Government should bail NY out but all other governors could ask the same. The fact is, the governor’s own housing policies have created a housing bubble that may burst loudly.

Is 2020 the right year to invest in rental income property? Contrast the stock market to investing in real estate. The current stock market volatility is a concern and could impact the housing market. with unemployed Millennials and with wealthy individuals selling off assets to cover their leveraged positions.

3 to 6 month Forecast | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News