Stock Market Forecast for the Next 6 Months

The six-month period puts us past the 3 month spring period through the spring and summer and into early September.

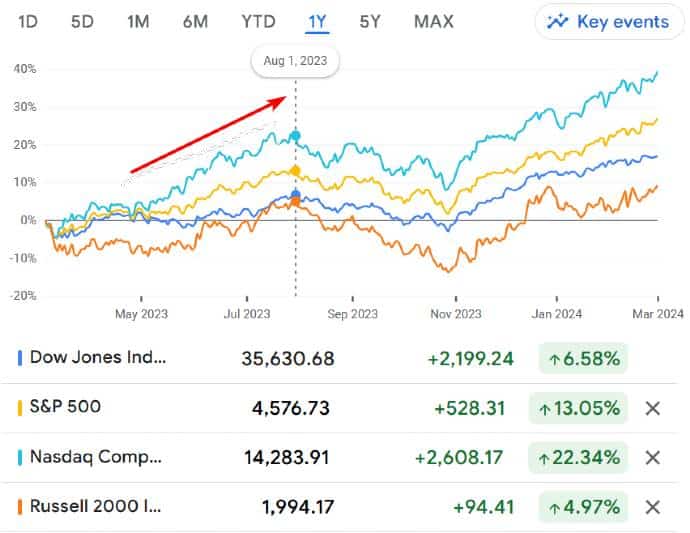

As this chart from Google Finance reveals, all the indexes have performed well in the past year despite significant headwinds such as high interest rates, high inflation, and calls for a recession in late 2023.

Well, the conference board gave up on their call for a recession and we’re in the midst of a strong rally pushing stocks to near all-time highs. If not for high interest rates, the Russell Small caps would be roaring too.

After a lull in the first 3 months of 2023, stocks roared from May to August.

The chart above looks like what may play out in 2024, although this year, we’re starting much faster. If the FED cuts rates in July, we likely will see the DOW, S&P, NASDAQ and Russell 2000 power up much higher.

For certain, we will see the NASDAQ roar to new records and the S&P will likely reach 6000. View the forecasts on the stock market forecast post and you’ll see that after revising forecasts, economists and equities analysts are still conservative. The fact is, they keep missing on their predictions and they’re not reliable for investors.

That’s why we need to tackle this challenge ourselves.

Forecast for majors for end of 2024:

- S&P: 6000

- NASDAQ: 20,000

- Dow Jones: 43,000

- Russell 2000: 2450

Sounds crazy? Last year, everyone though Tom Lee’s forecast of 4750 for the S&P was foolish and he nailed it dead on. With 15% to 20% growth, we can hit these new numbers 10 months from now.

So the point is that the economy will grow perhaps slowly, but the signals and cash flows are so overpowering that FOMO investors will gush into equities and some of them they’ve been drooling over for a while — Nvidia, AMD, and Bitcoin ETFs.

If you think irrational exuberance and euphoria are hot now, wait till Trump is elected and US business gets the green light.

Biggest Factor of all: $5 Trillion to $8 Trillion in money markets will have to move once interest rates fall. Investors won’t hang onto low-return bonds and treasuries as inflation stays at 3+%. That massive wealth will explode every area of the stock market with AI stocks such as Nvidia, AMD, along with Bitcoin ETFs rocketing upward. At lower rates, the US dollar will fall just as the world embraces Bitcoin, which means Grayscale and iShares ETFs will explode too.

Good Stocks to Buy

Investors, including FOMO investors are hunting for the best stocks to buy now or in the next 3 months, to get ahead of this big jump coming over the next 8 months before the Presidential Election.

A prediction for the economy is one of strength given a new pro-US economy is developing, driven by leadership in AI technology, advanced microchips, massive US energy output, and demand from a massive Millennial and Gen Z population who have delayed much of their lives due to political survival tactics by the Democrats. D’s have tried to suppress demand as part of their political platform, but it’s normal human demand and can’t be stifled for long.

The fact American consumers and businesses have money is one thing ($5 to $8 Trillion in money markets), but being able to borrow again at low rates, and refinance debt and obtain home loans at a much lower rate will free up a stunning amount of money for other purchases. That may include automobiles, travel, and a home purchase. For sure, the housing market will get heated as buyers compete for in a grossly undersupplied real estate market.

The 6 Months Ahead: Volatile, Uncertain, Contentious

Experts have cautioned about a potential pullback or correction, but if you’re investing for one year or more ahead, then volatility and the short term mean nothing. You sell when they rise too high. By next July to September, you should be able to enjoy a significant boost from your ETF or from a basket of good stocks. That keeps your risk lower.

If you jump at the hottest stocks, then your upside is very high. It’s just the nature of highly visible stocks such as Nvidia, AMD, and iShares Bitcoin ETF that means more money will flow to them. They will benefit most from the euphoria. Support for Bitcoin in particular keeps strengthening. More hedge funds will be able to move money into these securities which creates a massive price inflation event you need to get in on.

I’m not suggesting you throw all your eggs in one basket but rather make sure 50% is your portfolio has AMD or Bitcoin ETF. Do your due diligence and see what Cramer, FundStrat, Goldman Sachs, IBD, Investors.com and others are saying about the stocks you’ve discovered. See this list of best stocks to buy. Head over to Barchart or Google Finance to see the high flyers.

AMD: Top AI Chip Stock with Highest Upside?

AMD is catching a lot of attention, and so far, the AI services side hasn’t even been part of that conversation. And AMD hasn’t done a great deal of marketing either. A big marketing campaign could really float their boat on this rising tide of AI technology companies.

In a sea of desperate FOMO investors, technology marketing may offer the biggest return on investment for AMD, Nvidia, Intel, Broadcom, SuperMicroComputer, and others. We’ll see what they do in 2024.

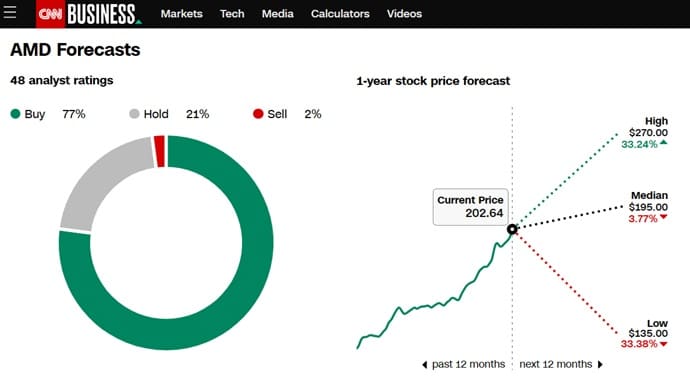

Here’s AMD’s forecast. The company is making strong gains with its new AI microchips and are competing well against Nvidia. While Nvidia dominates, and is anticipating major sales from AI services, AMD is on the same path. AMD is increasing its sales of lower-priced chips for data centers and for PC computers. Nividia’s microchips cost 4 times more than AMDs. We know price is important when buyers are more desperate.

The PC market is very attractive as chips on laptops allow the full exploitation of AI software and they save battery power. The lower power consumption of AMD chips also creates cost savings for large data centers. Nvidia may not be able to supply all the chips the market needs, thus manufacturers may look to AMD. A further 50% growth is not impossible.

Will AMD be the next Trillion Dollar Company? — Motley Fool article.

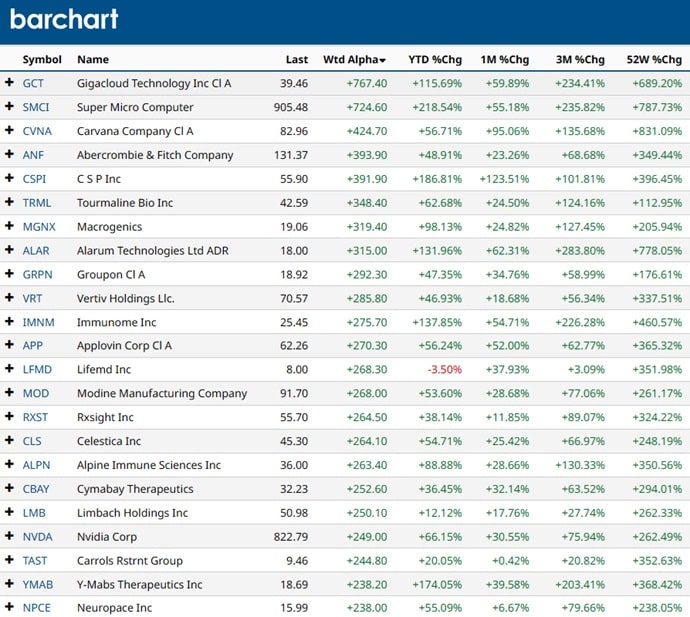

The AI stocks and Bitcoin ETFs aren’t your only choices for big gains. This list shows other extremely hot stocks of late. They likely will continue this year, perhaps not at the same pace. Do your research to discover when their big earnings season is and when it will happen. By 2025, as the economy surges forward, you may want to sell tech stocks and move your massive fortune into oil stocks. Once the US economy rolls into 2025, oil consumption will rocket pushing oil prices to $100 for real this time. The US is importing more oil from Canada and Canada is building pipelines to bring it. Oil imports from the Middle East and Russia will drop which means it’s wise to look at Canadian oil stocks which are grossly undervalued.

Best S&P Sectors to Invest In?

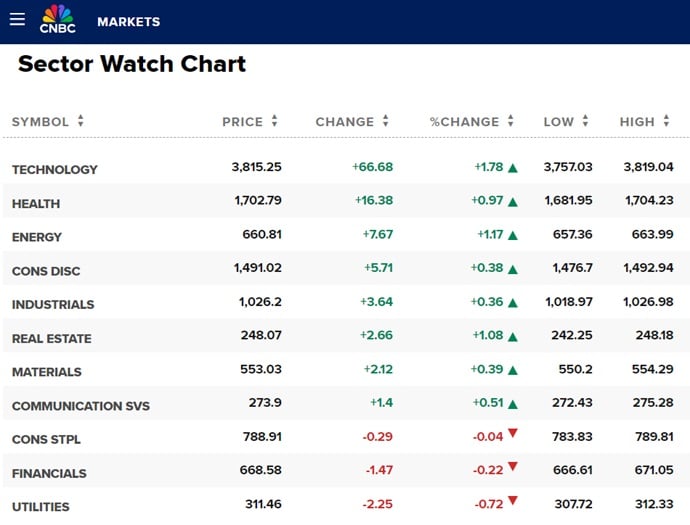

Researching sectors is part of your quest to ensure the macroeconomic winds support your selected stocks and give you guidance on when they will enjoy maximum demand/sales. Top sectors mentioned are: technology, healthcare, communications, and consumer discretionary.

Threats in 2024

The U.S. debt and trade deficit are no laughing matter, yet the government can and will print money to kick the can down the road. The massive Uturn to pro-US business and investment in AI will give this country global leadership again and with imports falling and exports rising (lower USD aids exports) and a lower FED rate will supercharge the economy.

The FED only cares about itself, but at some point they will have to choose between fussing over a 3+% inflation rate and holding back an angry country and economy that wants to roar.

6 month timeframe for the DOW, S&P, NASDAQ and Russell Indexes. is a good one for what’s expected to be a hot period, the last 6 months leading to what might be a record holiday season.

Over the June to December forecast period, we’re going to see more stock market index records. The Dow, S&P, NASDAQ and Russell are poised to reach their respective records soon. Sure there’s debt based crash talk and volatility test investors convictions. Yet, the momentum is clear and any inflation that occurs might encourage more investment (bond market hates inflation).

Take a good look at the fastest gaining small, mid and large cap stocks with an eye on safety and hedging. Experts believe the market will cool, but they’ve been saying that for years, so you have to take their predictions and projections with a grain of salt. See more on the best tech stocks, 5G stocks, and oil stocks.

Quick Links: Stock Market Tomorrow, next Week, Dow Jones Forecast , NASDAQ Forecast, Stock Market Correction, Don’t Buy These Stocks, Best Stocks to Buy, and Stock Trading.

CBO Report: Positive for 5 Years

“Specifically, real (inflation-adjusted) gross domestic product (GDP) is projected to return to its pre-pandemic level in mid-2021 and to surpass its potential (that is, its maximum sustainable) level in early 2025. In CBO’s projections, the unemployment rate gradually declines through 2026, and the number of people employed returns to its prepandemic level in 2024.” — CBO Overview of the Economic Outlook: 2021 to 2031.

The final word on the forecast for the next 6 months is volatility, political squabbles, government debt, and a FED that may not take mercy on the US economy in a self-absorbed obsession that’s proven wrong before.