Russell Index Forecast

Russell Small Caps 2023/2024

If you’ve missed out on buying the megacaps like Google, Apple, Tesla, Microsoft, Nvidia and others with their mountainous rises this year, there’s still hope to make big gains.

While the Magnificent 7 tech stocks soared this year, they might be peaking. The small caps are market laggards and there are hundreds on the Russell 2000 that might give you huge returns.

What’s injured the Russell 2000 stocks is high-interest rates and squeezed credit availability. While the mega caps were stuffed full of stimulus cash and privileged favoritism during 2021/2022, small business was as you well know, crushed.

However, given no one has invested in them, the best have some incredible potential which we’ll look at in this post.

The Russell small caps come in three indexes: Russell1000, Russell2000, and the Russell 3000. There are Russell ETFs for you to consider as well, so you can cut your risk from individual stocks.

Best Russell 2000 Stocks to Buy?

Not many experts are venturing their picks for 2024. The Russell and all small caps are volatile, yet if they were up on their analytics game, they should surely be able to pick their top ten best bets for 2024. And the 2024 stock market picks are what we’re interested in. Those stocks that will start to rise in Q1 may be the key since this is just before the FED begins to reduce interest rates.

This is also the time when investors move their money out of the money markets as interest rates erode and the US dollar stays low (needed for the US to compete internationally).

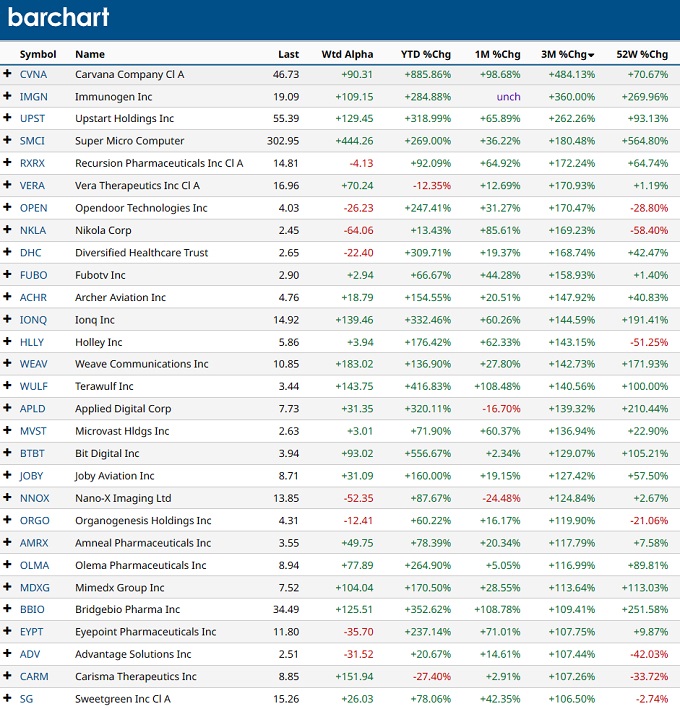

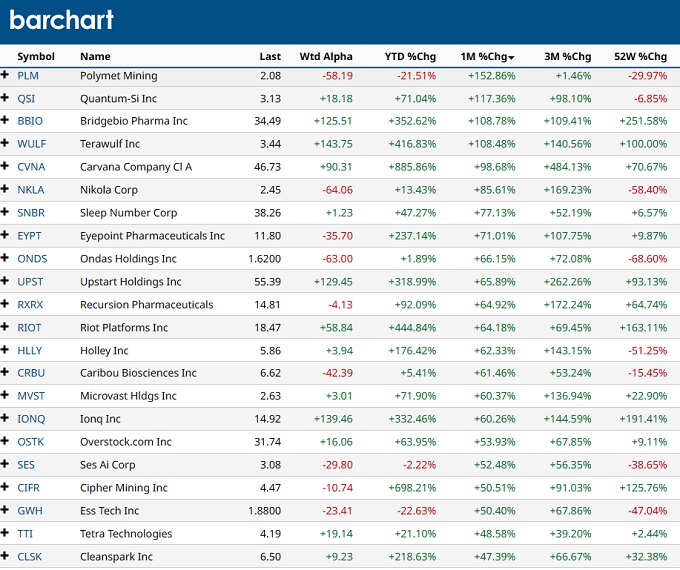

The Russell indexes are not spoken of vs the favored and promoted Dow Jones, S&P, and NASDAQ indexes. Yet, the Russells are up 16% since early May 2023. A few such as Carvana, Super Micro Computer, Ionq Inc, Terawulf, Applied Digital, Bit Digital, and Olema Pharmaceuticals are up astonishingly this year to date.

These stocks from Barchart.com, show the most impressive performers which you may want to add to your portfolio however, it’s the next wave of high performers to pay attention to. As the FED rate eases and capital flows again to the small caps, and the Russell-listed companies find ways to access funds, they might enjoy explosive growth similar to Carvana and Super Micro Computer have enjoyed.

These Russell stocks are ranked according to stock price growth in the last month.

Investor mood toward small caps soured considerably, but as the chart from Google Finance reveals that sentiment is reversing.

Growth of the Russell 2000 as you can see rivals that of the S&P in the last 3 months. The Dow Jones has lagged as well, which sets up an interesting combination with the small caps if you can find those stocks that will benefit when manufacturing returns. As this chart from Yahoo Finance shows, the Dow is on a weekly upward trend of late.

What is the Russell 2000 Index?

The Russell 2000 index is a gauge of the 2000 smallest market cap stocks in the Russell 3000 index. There is also a Russell 1000 index. The 2000 index seems to be a better gauge of the real economy and of how small businesses are faring.

The Russell 2000 index (US Small Cap 2000) is a the leading global index in the US, created in 1984 by the Frank Russell Company, which is part of the London Stock Exchange.

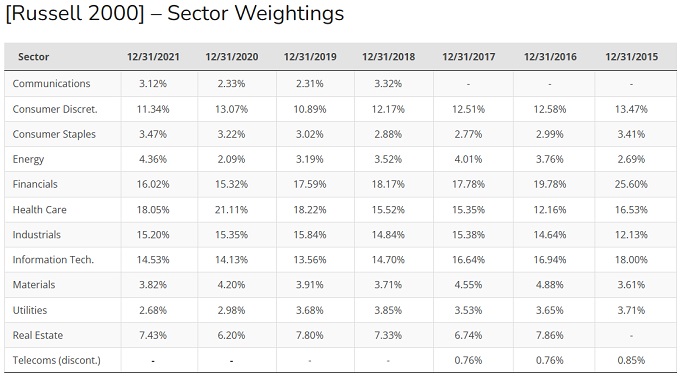

The chart below shows the sector weighting of the Russell 2000. Health Care, Financials, Info Tech and consumer discretionary stocks are favored. Industrials, energy, and materials are gaining ground of late. Small cap stocks in these sectors may be ideal.

NASDAQ.com cites 3 companies worth a look: iRobot,

In this video, the Motley Fool’s Brian Richards talks about why Russell Index stocks might be a wise choice in general. And currently, these stocks might offer the best stock price growth potential.

See more on the outlook for the 2024 stock market and in-depth views of critically important market data and news.

Stock Market Forecast 2024 | Stock Market Crash 2024 | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ Forecast Next 6 Months 2023 | Oil Price | S&P Predictions 2024 | Stocks Next Week | 6 Month Outlook | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates | Google Finance | Author Gord Collins