Compare Lowest Home Mortgage Rates

The talk of the stock market and housing market is all about the FED pivot and when the central bank rate will see its first cut.

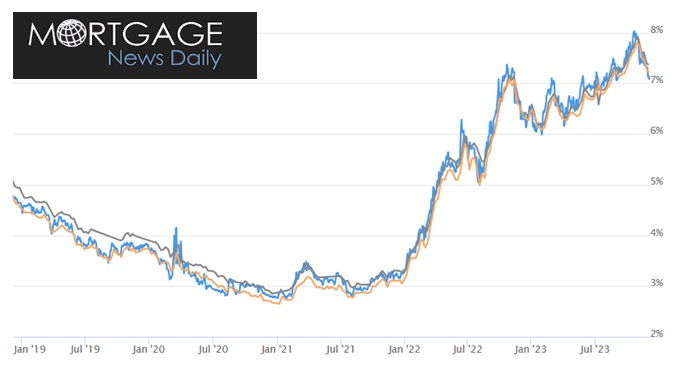

As the Mortgage Rates Daily chart below shows, mortgage rates have been on the decline and homebuyers and loan refinancers are anxiously hoping for deeper drops coming. Especially, those refinancing their mortgages, the issue is urgent. Many, perhaps yourself will be renewing their mortgage in 2024, and by most reports, it will be a large jump in mortgage payments.

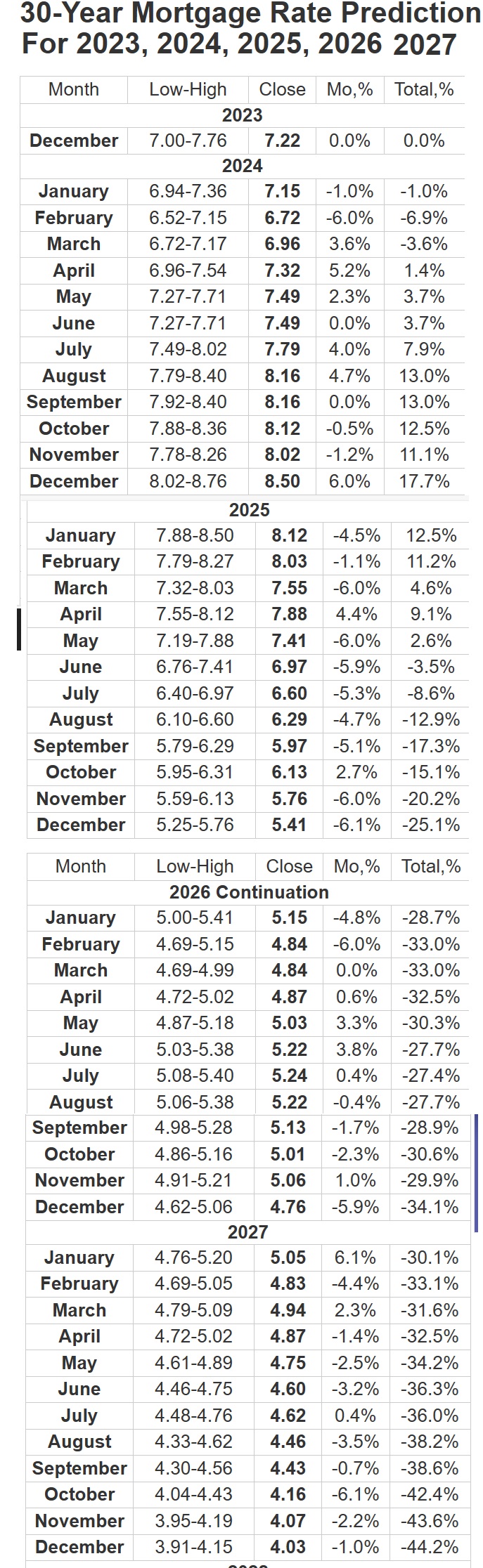

And they’re asking “when will mortgage rates drop?” The decline is ahead of the FED rate drop and most economists believe a rate cut won’t happen until July 2024. Some are looking for the first cut in March, only 3 months away. Fortunately, banks are already cutting their rates in anticipation. However, there is still concern about 1 more rate cut.

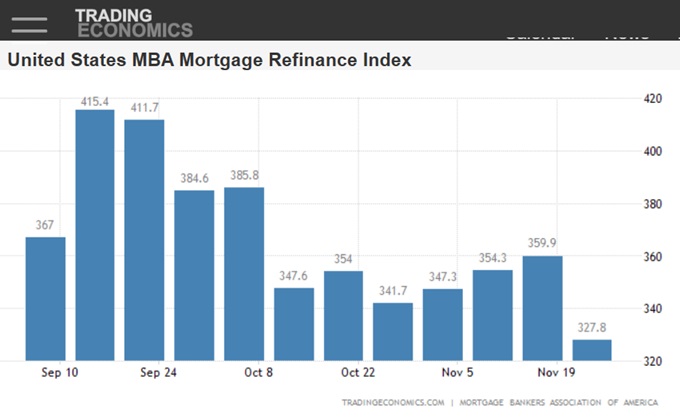

The economy however is sagging and the steam really is leaking out of the inflation bubble. Mortgage loans and refinancing logans are at their lowest in 20 years. Given how many will have to refinance in 2024, we should see a fair number of homes come onto the market. Home prices should slide a little this year so buying will be slightly easier for many. And the new home market will be brisk drawing interest in companies such as Toll Brothers.

If the GOP can block some government stimulus spending, that could also help reduce inflation. There’s still some politics in the way, but the FED has to be concerned about overshooting and pushing the economy into a steep downward slide. If that happens, you might enjoy a much better refinancing rate this year.

Across the US, the average mortgage is $224,398 ranging from $153,405 in Iowa up to 464,994 in Hawaii. Mortgages overdue are rising quickly to 3% and yet foreclosures are still very low at 110,600 in the first 3 quarters of 2023.

Mortgage Banker’s Association’s baseline forecast is for mortgage rates to end 2024 at 6.1% and reach 5.5% at the end of 2025. Bank of America head of retail lending Matt Vernon believes significant drops in mortgage rates might not happen in the early months of 2024. If any reductions occur, they are likely to be in the latter part of the year.

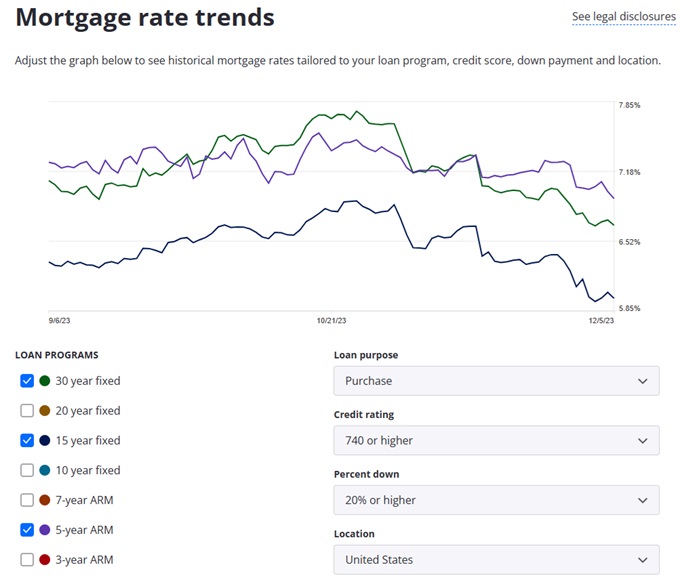

Zillow Mortgage Rates

Zillow publishes its rates for the 15-year fixed, 30-year fixed rate and the 5-year ARM rate.

How Have Mortgage Costs Changed?

See the 3 month and 6 month forecast for the housing market.

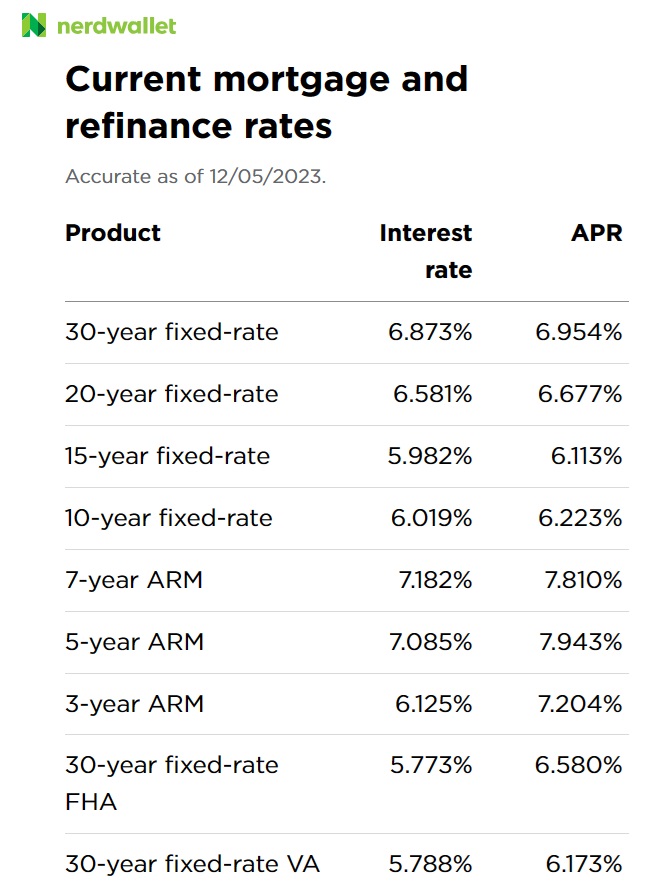

Current Mortgage Rates (Nerdwallet)

3 Year Mortgage Rate Prediction

Saving Money Means Shopping Around for Better Rates

Save your money by checking out several mortgage rate quotes from as many brokers as possible. More people are shopping for mortgages and refinancing this year.

The mortgage rate quote, auto insurance quote, refinancing rate etc. you currently receive is likely not all that competitive. It’s a good time to refinance or shop around for an entirely new mortgage solution.

Keep a close eye on lower mortgage rate brokers in the secondary market. You’ll save a lot of money. Consider how much savings a few points translates to over a 5, 10, or 20-year mortgage and it’s tens of thousands of dollars.

Saving Money on Your Mortgage – Is Money in Your Bank Account

That money is yours. You worked hard for it. Count how many hours and days you will have to work for the next 30 years to buy a home in 2020. See what I mean? People are penny smart and dollar stupid. It’s part of our culture.

Financially wise people on the other don’t get duped when they shop for a mortgage or their auto insurance. It’s your money, get full value for it.

You’d better shop around. According to a report from Consumer Finance.gov, 77% of consumers apply to only one lender when seeking a mortgage.

You can Save a lot of Money just by Shopping for a Better Mortgage Rate

There are some particularly important tactics you can use to lower your mortgage payments.

Ten Mortgage Rate hunting tips:

- search on Google – the top ranking websites are there because people like them

- get quotes directly from bank websites – compare them

- clean up your credit score – make extra big payments for many months to show your intent to pay down your debt. Bank credit score rating expectations are ludicrous, created only to justify charging high mortgage rates

- don’t leave your current job until you’ve landed that long term mortgage successfully

- check out the mortgage rate quote tools below

- use a mortgage rate calculator and crunch some numbers yourself – at least it’ll be harder for lenders to pull the wool over your eyes

- talk to your current provider and ask for a much lower rate – tell them you’re unhappy and intend to get a cheaper mortgage

- take a shorter term home loan, let’s say 3 to 5 years – it’s risky however it can you a cheaper rate

- take the bank’s teaser rate on a short term then shop for a better one when that expires

- check out a mortgage broker, many of whom advertise online. They’re eager to compete and they’ll do more to offer that lower rate and better terms

All you need to do is search for a lower mortgage rate. The offers are plastered all over Facebook, Google, Bing, news websites and even a blog like this one. How easy can it get!

Mortgage Loan Options – Which the Best Mortgages?

While the lowest mortgage interest rate is one of the primary criteria home buyers take into account, there are other financial and real life issues you need to prepare for. Ensure you check out these popular and vital mortgage loan benefits.

- fixed or variable rates

- open mortgages

- long term loans

- amortization periods

- payment schedules

- skip a payment

Free Mortgage Calculator

Mortgage rates from Lending Tree. Lending Tree’s mortgage rate inquiry process is a bit nasty. I include it just to let you know that not all online mortgage lenders are high quality and they may not see inquirers as human beings.. They will ask endless irrelevant (to you) questions that don’t relate to a simple mortgage rate request (just give us the rate) and some of them you may not like at all.

It might be tough to sell your home in its current condition so you’ll need to research with the help of your real estate agent, which types of home improvements make the best sense. Your home will sell quick whether you’re in Los Angeles, San Francisco, Seattle, Phoenix, Denver, Dallas, Boston, Miami, Vancouver, Toronto or New York.

Stock Market Forecast for 2024 | Housing Market Forecast | Best Cities to Buy Property | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | California Housing Market 2024 | Florida Housing Market 2024