AI Stocks to Buy

Artificial intelligence companies come in many forms and profitability for investors.

For several years, AI stocks have been the hottest commodity they may be the best stocks to buy. And below, you’ll discover why and which AI stocks investment analysts like best. I know you want to get to the good stuff — which AI stocks to buy, but you’d better get some background on markets and these companies.

The AI company that’s hot right now, might not be next year. There’s risk even with the mega AI companies.

Watch out for the Hype Media

The internet is fake and it could get worse. You’ll appreciate opening an account with the most credible and trusted sources of stock market investing knowledge. With the coming boom, fraudsters will be convincing.

There’s been a lot of hype about AI for at least a decade, and that was a long runway till 2023 when some AI-related companies actually started to produce big revenues. Some look like excellent long-term investments, and they may be what you need to focus on. You might be thinking FAANG stocks but they’ve been inflated by fearful investors looking to park their money for a while, until the economy restarts.

Read up on the New AI Economic/Market Structure

Speaking of AI economic and business infrastructure, Nvidia is just one company that most AI investors are focused on. They are central to AI because it’s all physically built on advanced GPU processors that power the cloud and business and manufacturing applications. They are the leader with so many advantages and could eat all the other microchip company’s breakfast. It’s hard to overtake a market leader, or even catch up.

However, the current price of NVDA may be too high. AI stocks are still awaiting lower FED rates which will power up industry again and with this new economy, artificial intelligence will be implanted in it. Forecasts of AI stock prices are likely too conservative. At some point, these companies will produce astonishing advantages (data, processing, application) and will leverage these to build endless market leadership over other big, medium and small businesses.

AI Will Power Everything?

Experts believe AI will drive everything in the economy and it could be viewed as an optimization layer on top of companies, infrastructure, products and services. Theoretically, everything will be improved in one major leap in the next 10 years. AI will be a key part of the computing infrastructure and take hardware and network management to a new level. It’s already making its mark via Google, Facebook, Amazon, Palantir, Microsoft and IBM. Microsoft has been reborn with it, and it’s more than ChatGPT.

Consider how it’s being used in AI stock forecasting software. Companies such as Finbrain and others are intriguing investors who think AI might be able to invest better. Are we at that point yet?

And real estate, travel, government, military, and entertainment will be powered up too. Your next International vacation will involve AI applications from air flight management to car and hotel bookings, to travel management software platforms.

Trillions to Be Pushed into AI

AI technology is still in its infancy, yet the commitment of major corporations to inject money into the development of AI solutions is attracting attention. Rumor is that as this economic recovery happens, investors will be ready to go all in on AI. We wonder how much of the $6 Trillion in money markets will move over to AI stocks? It might depend on timing.

And AI stocks may produce profits and ROI that make everything else pale in comparison. Certain companies are pivotal to AI business applications. Some say Nvidia will supply the microprocessors for this revolution and Microsoft and Amazon will host the realm of business.

Sure, there will be many startups seeking funding and competing in the space, however that is a risky venture best left for millionaires with money to gamble. I’m assuming you’re not a multi-millionaire. AI midcaps on the Russell 2000 might be able to survive the coming AI business battles.

A Major Economic and Technology Revolution

The opportunity and potential of AI is like none before it. The waves of wealth and data and technology available is like the perfect storm. This is the best, once-in-a-lifetime opportunity for you as an investor. You’re very fortunate if you choose the right AI stocks and see yourself get rich in the next 10 years.

AI is the next revolution, more important than the Internet, cell phones, and cloud computing. And we’re way past chatbots and into software that can give businesses a big competitive advantage. And the US is best positioned to capitalize on the AI revolution given its new trade strategy. And AI leaders will dominate the world, not just the USA.

And individual companies which don’t adopt soon AI risk becoming obsolete and bankrupt.

“AI is going to transform the global economy as surely as electricity and the steam engine did in their own times,” says Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank.

AI Offers Too Many Applications and Advantages to List

AI is promising business insights, work efficiencies, predictive forecasting, new product development enhancement, performing work that humans can’t, processing data fast, improving decision making and generating incredible output. The speed at which AI is able to learn is improving fast too. As more data is collected in every industry, there is more for the AI systems to work with. The outcome is continuously better results.

Tesla is the company with the big data advantage and the program to capitalize on it. It’s not about EV’s but about services delivered by AI — any services Elon wants to serve.

You might think of AI as an optimization layer on top of all business types. Whatever a company is doing, it will do it better and more profitably in the next 10 years. Others consider something completely new, undoing the old, to change business culture, production, trade and marketing.

The growth of AI could take a massive leap in 2024 because of the improvement of GPU microchips supplied by Nvidia, and other companies such as AMD or Intel which produce microchips capable of serving AI processing.

Demand for AI Empowerment Will be Brisk

The demand for AI is driven by many sectors including consumer, business and government buyers. Consumers and investors were really perked up this year with the release of ChatGPT which created a groundswell of use and promotion.

So now, self-directed investors such as yourself are wondering whether to be an early investor with a 5 year timeline, and which companies will see the most growth in 2024 and beyond.

Some predictions suggest the value of AI companies could rise 20x by 2030 and AI will expand the global economy by 14%, or almost $16 trillion, by 2030. Global revenue associated with AI software, hardware, service and sales will likely grow at 19% per year, reaching $900 billion by 2026. So it’s all right in front of us.

Old reports before 2022 said China would be the greatest benefitor of AI with the US about half of that. Well, things have changed and it looks more like the US will grab the lion’s share with China struggling to find a market and capture the funding to develop AI and use it.

Beyond the Magnificent 7

Many of the top companies such as Google, Facebook/META, Amazon, and Nvidia are very profitable companies who are keen to maximize the development and use of artificial intelligence in their businesses.

At this time a few stocks are frequently mentioned and promoted. That would include Microsoft, AMD, Nvidia, and Tesla. One sector that seems to benefit from it and looks profitable is the healthcare sector.

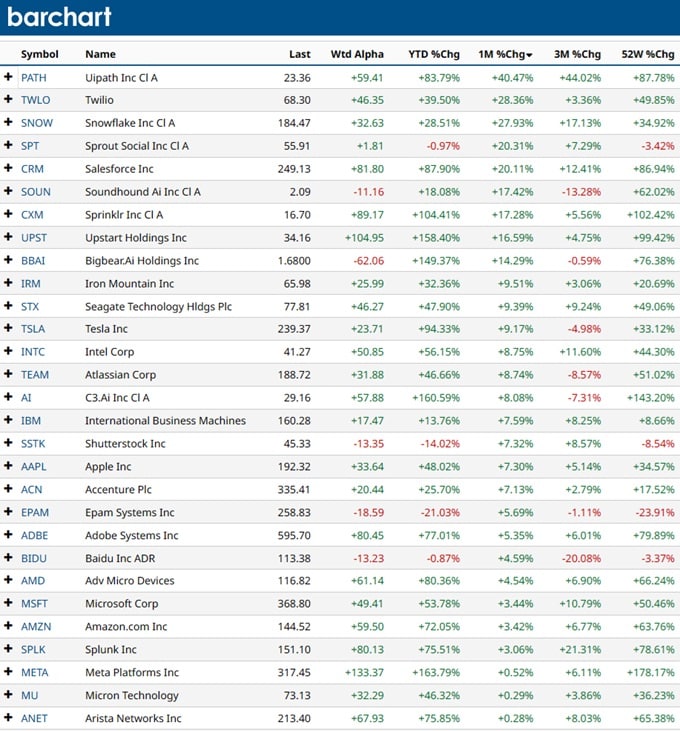

Top AI Stocks on Barchart.com

See this list of the best performing AI stocks over the last month. Which ones are the laggards with the highest growth potential? See more at Barchart.

Here’s some more great AI companies to research:

- Nvidia NASDAQ:NVDA

- Microsoft NASDAQ:MSFT

- Alphabet NASDAQ:GOOGL

- IBM

- C3.ai NYSE:AI

- Amazon NASDAQ:AMZN

- Intel

- Baidu

- Apple

- Tesla

- Meta Platforms

- AMD NASDAQ:AMD

- Taiwan Semiconductor Ltd. (TSM)

- ASML Holding NV (ASML)

- Salesforce

- Adobe

- Apple NASDAQ:AAPL

- META Platforms NASDAQ:META

- NASDAQ:BIDU

- NYSE:PATH

- Alteryx

- SentinelOne

- Palantir Technologies

- PROS Holdings

- Snowflake

- Duolingo

- iRhythm Technologies

Insider Monkey scanned Jim Cramer’s 10 Best AI Stocks and here they are:

- Broadcom Inc. (NASDAQ:AVGO)

- Oracle Corporation (NYSE:ORCL)

- Adobe Inc. (NASDAQ:ADBE)

- Advanced Micro Devices, Inc. (NASDAQ:AMD)

- Salesforce, Inc. (NYSE:CRM)

- Alphabet Inc. (NASDAQ:GOOG)

- NVIDIA Corporation (NASDAQ:NVDA)

- Meta Platforms, Inc. (NASDAQ:META)

- Amazon.com, Inc. (NASDAQ:AMZN)

- Microsoft Corporation (NASDAQ:MSFT)

* Note: the information provided on this page is not an exclusive recommendation of any kind for the stocks listed. The info is for learning and entertainment purposes and investors should carefully research any stocks they might buy.

See more on the: Best Stocks to Buy | Stock Market Forecast | Stock Predictions | Stock Market Outlook Next Week | Is Yahoo Finance Helpful? | Google Finance Review | ChatGPT Stock Forecast | Stock Market News | Stocks with Best P/E Ratios | Best Stock Market Sectors | Dow Jones Predictions 2024 | S&P Forecast 2024 | Q3 Outlook | 6 Month Outlook | 5 Year Market Predictions | 10 Year Stock Market Forecast | AI Travel Management Software | Google Stock Predictions | Toll Brothers Stock Forecast