Stock Market Best Sectors 2024 Forecast

Some smart investors specialize in certain areas of the economy where they gain deeper insights and thus become more intimately in tune with meaningful, helpful, credible news, expert reviews and economic changes.

Knowing which sectors of the economy are investible is the order of any intelligent investment strategy regardless of which the economy and equity markets are headed.

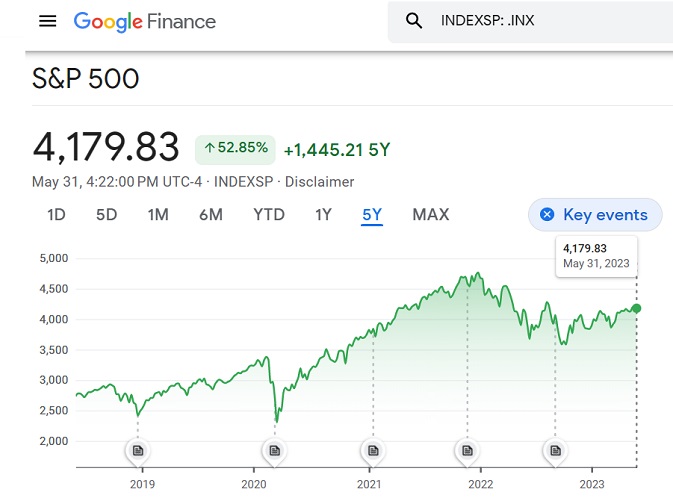

There’s little consensus in the stock market expert community as to whether 2024 is going to be a good year for equities. Some pessimists believe the S&P will dive by 2024. Yet the FED is going to pause, inflation will fall, and the government will have plenty of cash to assist with a recovery.

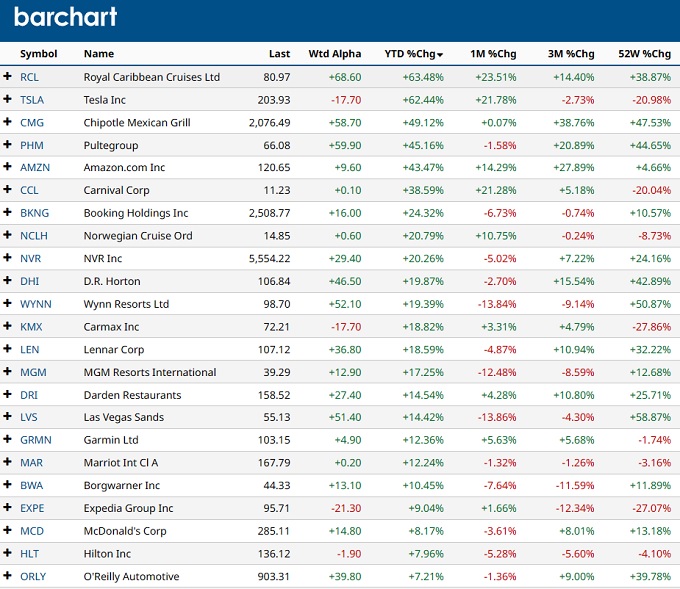

There remains a lot of demand certainly in the US housing market, which could stimulate significant growth in sectors other than real estate. If the real estate sector is looking bad, it only helps buy at a lower price point this year.

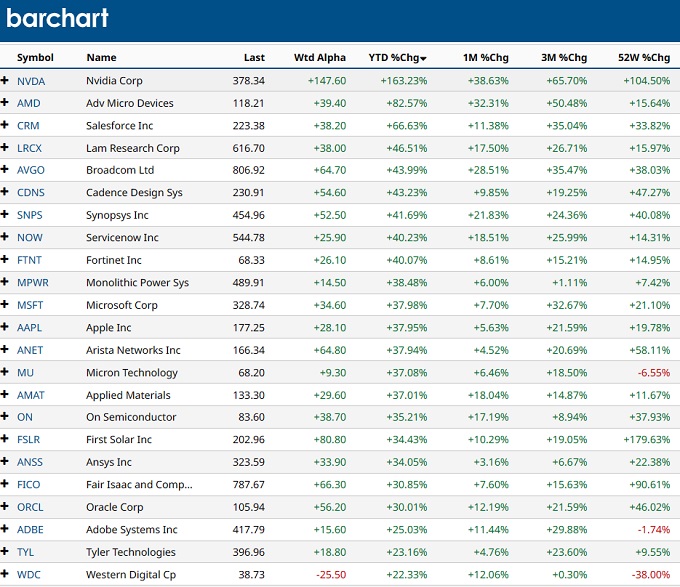

Below we’ve got some great views and info on this important topic of S&P sectors. 5 Sectors arise as the most likely ones to bring big profits for investors, but your selection deserves a more detailed review. Please do bookmark this page as it will be updated frequently.

There’s going to be volatility, but by mid 2024, June, we should see another bull market gaining momentum. The issue with fighting inflation is how angry it will make Americans by then, as they tire of media reports of bad times and high interest rates. If rates stay elevated, the 2024 economy should roll anyway. We had high rates in Q1/Q2 this year and NASDAQ and S&P have soared. It likely will next year too.

Smart investors look at sectors first, and absorb the many forecasts, projections, outlooks and predictions, to then find the top performing stocks post-2023. And a few S&P sectors will likely lead the way in 2024, as we’ll discuss below.

The wisdom in this is that you’re likely to make better decisions if you focus on an industry you understand and enjoy, such as technology, Consumer goods, finance, transportation or energy for example.

The Market Sectors

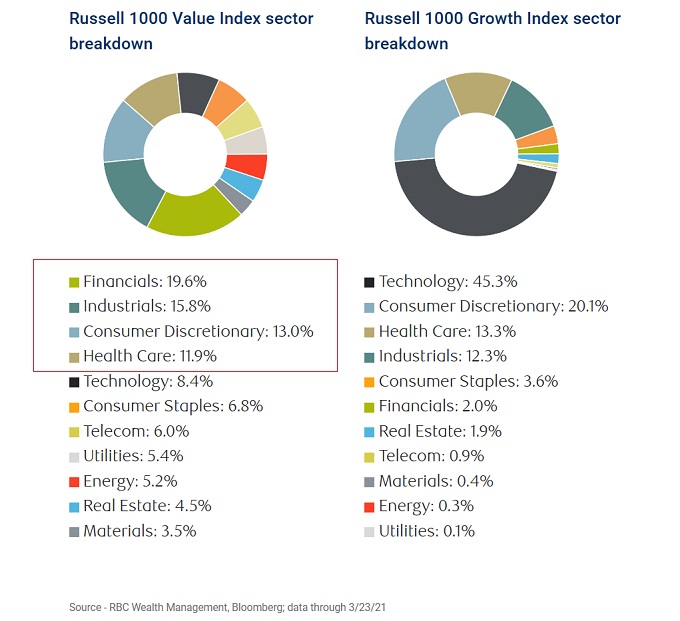

The S&P classifies industries according 11 different categories. And Trading View reports on 20 different stock market sectors. The broad categorizations of companies and stocks helps you get better oriented, but if you want predict which stocks will take off when the economy restarts in 2024, you’ll need to drill down.

For instance the energy markets are a diverse range of commodities and products and services. Natural gas may not perform well, but oil may rocket given the unique supply and demand dynamics.

Trading View has a great view of the 20 market sectors and which are performing best.

You may be eagerly searching and digesting the S&P 2024 forecast, NASDAQ 2024 forecast and Dow Jones 2024 forecast, pick a specific sector and a specific type of company to focus in on. Otherwise, you’ll know a lot of general information about nothing, in sectors you have no interest in. That makes no sense for smart stock market investing.

S&P Performance in 2023 YTD

The 11 Sectors of the S&P

The 11 sectors that make up the S&P are:

- Technology (Google, Facebook, Amazon, Microsoft, Tesla, IBM, Netflix, Nvidia)

- Health Care (Pfizer, Johnson & Johnson, Regeneron, United Health, Moderna)

- Financials (Visa, Bank of America, PayPal, Mastercard)

- Real Estate (DR Horton, REMAX, Prologis, American Tower Corp, Realty Income Corp)

- Energy (BP, Exxon, Exxon Mobile, Chevron, ConocoPhillips, Halliburton)

- Materials (Dupont, Sherwin Williams, Cemex, Arch Resources, Sigma Lithium)

- Consumer Discretionary (Best Buy, Home Depot, Lowes, Nike, Starbucks)

- Industrials (Honeywell, 3M, Black and Decker, Delta Airlines, Air Canada, Boeing)

- Utilities (Duke Energy, Dominion Energy)

- Consumer Staples (General Mills, Coca Cola, Procter & Gamble, Costco, Walmart)

- Communications (AT&T, Comcast, Fox, Discovery Communications, Dish Network, Starlink)

Energy and Real Estate are disparaged yet companies such as Exxon and DR Horton, should do very well in 2024. Real estate however suffers from a lack of supply to buy and sell. With interest rates falling, consumer expectations will be that more housing is their right. And rent prices should keep the rental property sector going strong for another year.

S&P Sectors Forecast for Growth in 2024

If 2023 is the year of controlling inflation, then mid 2024, we likely could see another stock market boom preparing for a very strong 2025 and the next 5 years. Consumers and investors hold a lot of cash, US production is being brought back from China and the global economy will be re-expanding.

China’s 2024 economic forecast isn’t so bright since without booming experts to Europe and North America, their output will sink. Warning signals are increasing on the communist-controlled state. US stocks are the best choices and the S&P should surge nicely. There are plenty of tech stocks and mega caps in the S&P 500. See more on the 2024 forecast for the S&P 500.

Here’s CNBC’s Jim Cramer on all the S&P sectors this year so far, good and bad:

Bankrate believes the see the S&P 500 index will grow 8% over the next four quarters. They’ve been correct in 10 previous predictions.

RBC Wealth Management has a good read on what sectors might jump back first in a 2024 recovery. They favor value stocks which can turn a profit in a recovery, while growth stocks lag in performance. Of course the Faangs and mega caps will enjoy early success, but small caps should catch up, and may actually provide better ROI. Definitely check out small oil companies as energy will be in short supply against strong growing demand. Oil prices are dipping, but are projected to rise.

If the economy does recover with the lowering of interest rates (Biden’s spending bill for the next two years is still very high, which supports the economy and with lowered interest rates, it is likely to turn into a bull market for investors).

Tremendous opportunities to generate wealth are open to you in the next 12 months. Your research and clear purpose in choosing the right sectors and value stocks will help you buy low in 2023, and enjoy a great ride upward.

What you learn is your more vital investing asset. Winning is for those who inform themselves. Please bookmark this and return for up to date stock price forecasts for the stock market in 2024.

Stock Market 2024 | Price Earnings Ratios P/E | Stock Price Quote | S&P Forecast 2024 | NASDAQ Forecast | Best Stocks to Buy Now | Tesla Stock Forecast 2024 | Best Stocks to Buy | Google Finance | XOM Stock Forecast | BP Stock Forecast | Stock Market Today | Stock Market Prediction | Stock Market Forecast | Stock Market News | US Housing Market Forecast 2024 | S&P 500 Forecast 2024 | Dow Jones Forecast 2024 | Oil Price Forecast 2024 | AI Stock Prediction Software | Stock Market Today