S&P 500 Forecast

As perhaps the best performance indicator of large-cap US equities., the S&P is regarded as the “real stock market” by many investors. Compared to the Dow, the S&P is estimated to be 170 times larger in value.

The S&P 500 is a collection of large-cap stocks, the best of the market which fund managers turn to when they don’t know what else to invest in. These equities are often used as hedges and a safe haven when the stock market looks to turn downward. These stocks are least likely to fail given they often have market monopolies or are market leaders. That makes them safest and most likely to retain their value if not produce returns.

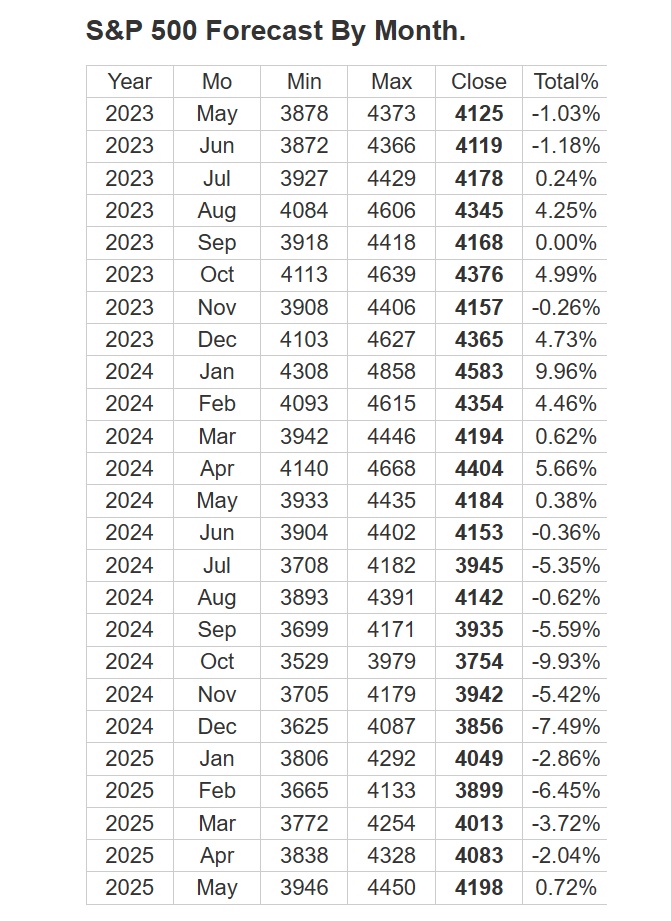

So far in 2023, the S&P has fared very well being the leading index with 7.8% growth year to date. That’s impressive but are S&P stocks still investible today? The experts below believe the S&P will perform well and thus represent safety and performance. Charts show monthly projections for 2024 and 2025.

S&P Global Market Intelligence reduced its forecast for U.S. GDP growth for 2023 and 2024 after warning of risks from the US debt limit default and credit standards. Joel Prakken, at S&P Global Market Intelligence cut his U.S. real gross domestic product (GDP) growth forecast for 2023 by 20 basis points to 1.2%. They also reduced their 2024 GDP growth forecast by 90 basis points to 0.9%.

Certainly the bank failures and crisis is affecting the confidence of many analysts who believe this contagion will spread, and even the big banks billion dollar bailouts might not help.

S&P Forecast for 2024

The Conference Boards forecasts that real GDP growth will slow to 0.7 percent in 2023, and then fall to 0.4 percent in 2024. Business investment cooled in Q1, 2023 as high interest rates and economic concerns have companies to cut back spending and staffing.

They expect year-over-year inflation readings to remain at 3% to the end of 2023 and that the Fed’s 2 percent target will not be achieved until the end of 2024. Rates then would remain elevated and damage profitability of the S&P stocks.

The heights the S&P 500 reached in Q1 and Q2 2023 were not predicted by the experts and instead, it’s 500 points higher that their projections. But with tongue in cheek, let’s see what they all see for year 2024 ahead, given we’re almost to Q3, 2023 now.

Goldman Sachs continues to believe this recession will be mild. “Our U.S. growth forecast for 2023 remains at a well-above-consensus 1.6% and our 12-month recession probability at a well-below-consensus 35%,” said Goldman’s chief economist, Jan Hatzius. He points out that Q2 GDP is on track to grow 1.8% annualized and that the banking industry has adjusted to the SVP and First Republic bank failures. He believes the banks’ hit to the US economy would need to be greater than 0.4% to push the economy into recession.

Hatzius sticks to his predictions that the FED will push above 5% even though now inflation is falling slightly below 4%. He said the FED will not cut rates until 2024. That would make early 2024 and ideal time for investors to move their savings into stocks and enjoy another bull run as the US fully recovers from the pandemic.

If you’re preparing to buy the dip you could see yet another opportunity in these volatile times. Despite that volatility, the FED has likely choked the economy to the max and must begin to let it grow again. The last two months have brought huge gains for investors.

Just yesterday, Google made some news announcements and GOOG stock jumped. Be careful of news bites that are temporary and sensationalist. The real stock market forecast is about sustainable profitability for US companies.

Are S&P stocks the best of breed regardless of the stock market forecast? Or will you find good picks on the Dow Jones, NASDAQ or Russell? Inflation is still high and government is obsessed with controlling inflation, and inflation is set to be high for some time ahead. Will the extended battle create stagflation and raise unemployment to painful levels?

The S&P 500 enjoyed a phenomenal bull run, much of that in the last few years due to US stimulus spending. But in the era of Fed balance sheet tightening, interest rate rises, credit tightening, rising interest rates and a potential small business and housing market collapse, the indexes recent surge makes little sense.

Investors wonder if there are still investible stocks to buy. Many are waiting for the Fed to stop raising rates to signal the buy the stock market dip might be ending. When will the S&P rise again?

Predictions for the S&P 024 2025

On Friday, Goldman Sachs reduced its end-of-year target price for the S&P 500 to 3,600 from 4,300. On the other side, JPMorgan sees the S&P 500 spiking to 4,800 by the end of 2022. They believe the Fed won’t continue fighting inflation and this will excite investors. Interestingly, JP Morgan has posed arguments for a potential $380 a barrel for oil, should crude production be shutdown or shutout of markets.

Bank of America predicted a ‘mild recession,’ and cut their S&P 500 outlook to 3,600 points, yet as we know it’s at 4100 now. Not a high quality market forecast for America’s key bank with very high paid analysts.

Longforecast’s projections have the S&P rising by another 400 points in 2024, with a volatility reflecting changing economic fundamentals and news. Their findings bode well for the 5 year and 10 year stock market performance. Investors who aren’t sure about 2023 should invest with a long term view and hold until your picks hit a pitch.

Some investment advisors have suggested buying a basket of S&P stocks or finding specific value stocks that will outperform the S&P, Dow, and NASDAQ. Let’s take a closer look at which S&P stocks are improving.

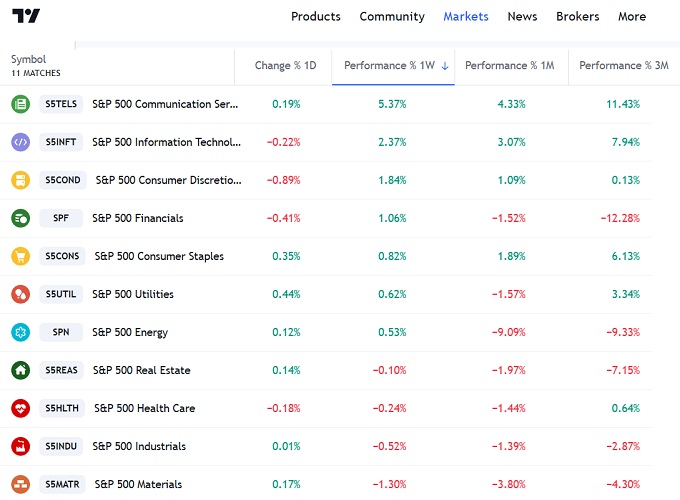

Which S&P Sectors are Performing Well?

Communications, Information Technology, Consumer Discretionary and Consumer Staples are all given the buy recommendation from TradingView.

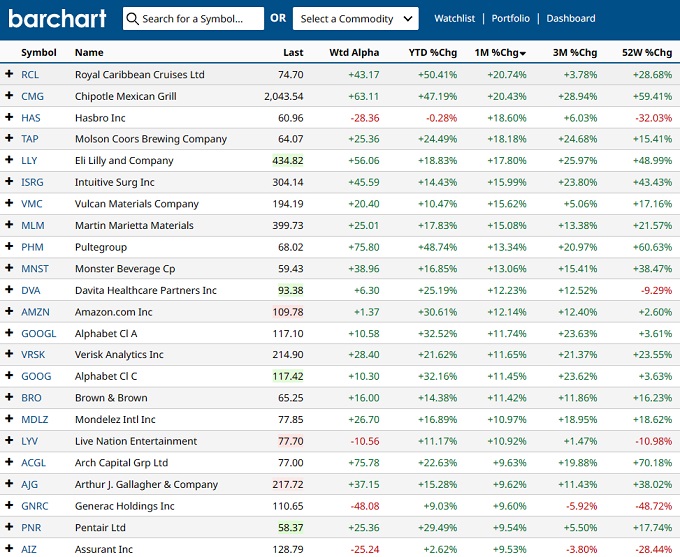

Hottest S&P Stocks May 2023

Here are your high performance, momentum stocks for this week:

See more on signals of stocks to sell, and on the best stock picks of 2021. Which post pandemic stocks are best and check out the best stocks on the Dow Jones and NASDAQ indexes.

For newbie self-directed investors, you can learn learn more about the S&P below and be introduced to the listed stocks below. You’re looking for the best performing S&P 500 stocks to invest in and you’ll find them here too. In fact, you’ll discover that certain stocks on the S&P 600 are actually outperformers.

Last year, some forecast modellers actually had the S&P 500 predictions seeing heights of 6,000. One expert whom most people ridiculed two years ago said it would hit the unrealistic price of 3500. Well it hit 4,162.

Today, history showed everyone what they should have expected. When you pour $5 trillion into an economy recklessly, it will come back to haunt. With that surge of liquidity still evident (consumers are spending), there is little way that high inflation will cease. With the Fed pushing rates up, a recession is the outlook and that will push the S&P down further this year and into next.

The calls for a bull market forecast have a weak case. Investor’s will have to research and find only the best of the S&P stocks, and there might not be many.

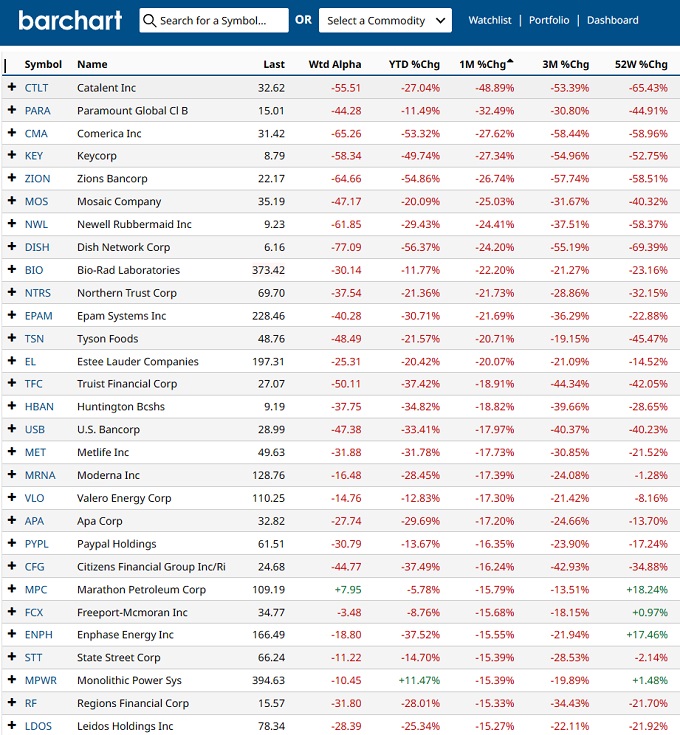

S&P Big Losers of Recent

Barchart gives us a good look stocks that are plummeting and show big downside risk. Retail, travel, among a host of companies we’re used to seeing soar. With President Biden making scary nuclear deals with Iran to get the price of oil down and China buying coal and Russian oil, Chinese corporations will find their labor situation better, with lower energy prices and improved competitiveness on world markets. US companies with a very high US dollar will find it tough to compete.

The key to this is oil production is at maximum unless US oil production is rekindled, and the Biden camp has vowed solemnly to stop them. With the US dollar rising, and China imports flowing into the US, US companies are in tough for the rest of this year and into 2022, until the GOP can act to stop the bleeding.

The S&P, DOW have shown moderate volatility and similar returns while the NASDAQ has suffered much more ups and downs, which might appeal to day stock traders. Investors are uncertain right now and are reviewing forecasts and predictions for today, next week, next month and 6 months.

Safe Investing in the S&P 100

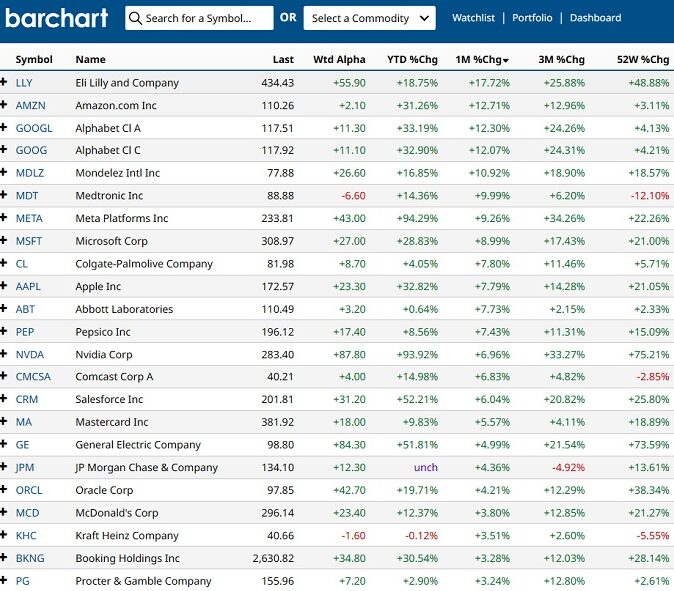

Here are the top S&P 100 stocks of the last month. Check them out further on Barchart.com and for more on the S&P 100 forecast.

Top performers on S&P100 (as of May 12, 2023). As might be expected, Microsoft, Meta, Alphabet, Nvidia, General Electric and Bookings Holdings are the strongest of late.

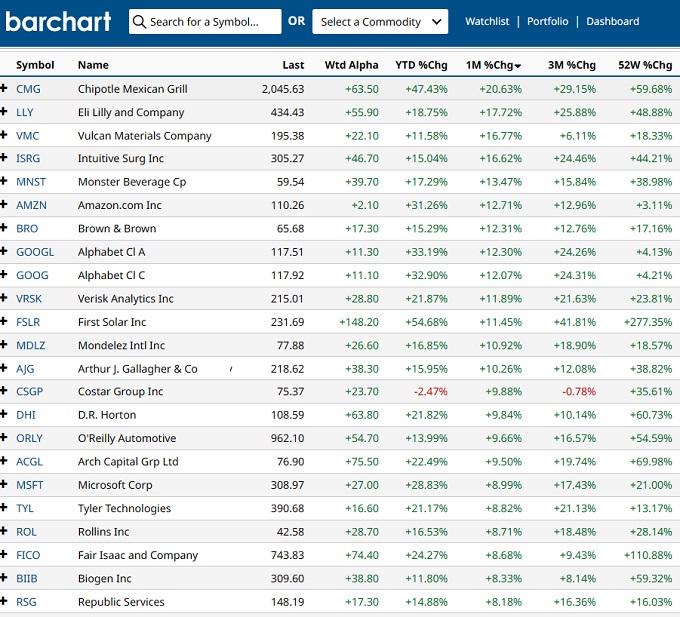

Introducing the S&P 500 Growth Stock

This chart below reveals the S&P growth stocks have been phenomenal the last two months. And as you can see the 3 month to one year price growth has been excellent. Happy investors of Chipotle Mexican Grill, First Solar, Eli Lilly, Monster Beverage, Fair Isaac and Nvidia enjoyed incredible returns over one year.

What is the S&P 500?

What is the S&P index? The S&P 500 or Standard & Poor’s 500 Index, is a weighted index of the 500 largest U.S. publicly traded companies (large-cap U.S. equities). The index has a 69.0% trailing 1-year total return. It’s a measure of how well the top US corporations are doing. It can be contrasted with the Russell Index which is a measure of small to medium-sized companies. The Russell Index has actually performed well in 2020, and warrants a good look for investing. Check the Dow forecast and the NASDAQ Forecast too.

Stocks in the S&P 500 include Google Alphabet, Amazon, American Airlines, Facebook, Apple, McDonalds, NASDAQ, Nike, Delta Airlines, Sherwin Williams, Netflix and other high valuation companies. Facebook, Apple, Amazon, Netflix and Google — the FAANG stocks — now make up more than 11% of the S&P 500 index.

S&P 500 Forecast 2022, 2023

Take a further look at the US Economic forecast, housing market forecast, oil price forecast and the Forecast for the Stock Market for 2023 2024 2025 including Stock Market Predictions for Tomorrow , the 6 Month Forecast and 3 Month Forecast along with opinions of an impending Stock Market Crash.

Stock Market Forecast 2024 | Stock Quote Live | Stocks with Best P/E Ratios | Best S&P Sectors | 2024 Outlook on US Equities | Oil Price Forecast 2024 | Stock Market News | Stock Trading Platforms | Market Rally | Stock Market Today | Stock Market Next Week | Tsla Stock Price Now | Stock Trading | Lines of Credit | Housing Outlook for USA |Reverse Mortgages | Low Mortgage Rates Today | 2023 2024 2025