Fast Stock Quotes

Looking for quick stock quotes online? There are plenty of websites that offer live stock price quotes including Google Finance, Barchart, Yahoo Finance, and TradingView.

It’s often wiser not to do research on your favorite trading platform because you’re likelier to make rash buy or sell decisions. Which is why Google Finance, Barchart, Yahoo Finance, and TradingView are safer places to search, learn and reflect. Most sites use the same core data sources (exchanges themselves).

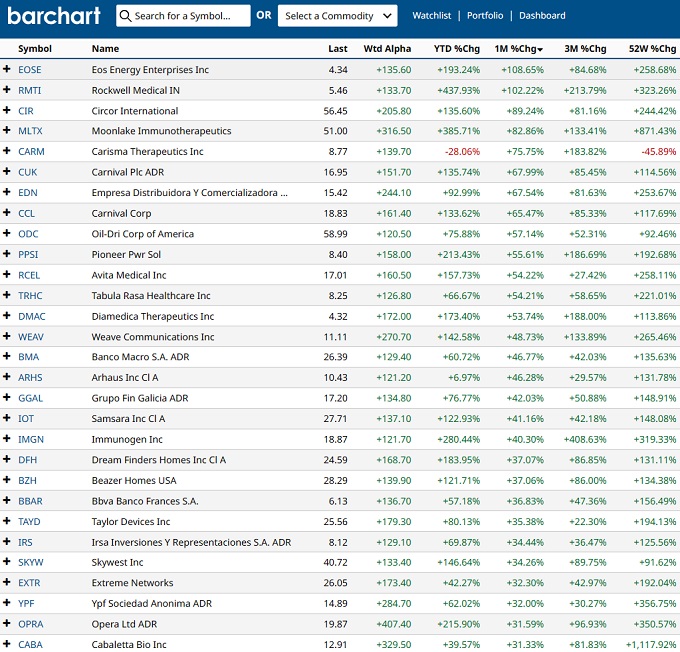

Barchart.com for Today’s Stock Prices

Barchart is an excellent and affordable resource to do your research. Their stock price quoting system is current and offers real-time prices, and amazing views of the latest alpha ratings, one month, 3 month, and year-to-date performance columns. You’ll see the hot stocks and which market sectors are in demand. It reflects the mood of the market and lets you see your stock’s price performance more clearly.

They deliver a good selection of the latest news stories too and it’s not biased or slanted to get you to buy what they want. Their charts, expert analysts’ ratings, dividend and earnings reports, and most active pre-market stock lists are very timely.

Quotes and Live Trading Platforms

For live trading, if you don’t have a trading account, you can visit any of these stock trading sites: BMO Investorline, Merrill Edge, Fortrade, Charles Schwab, Robinhood, TD Ameritrade, eTrade, Fidelity Investments, TradeStation, WeBull, Interactive Brokers, eToro, TradingView, Lightspeed, JPMorgan Chase, SoFi, Ally Invest, Thinkorswim, Betterment, Firstrade, Questrade, and TradeZero America. Find out more about these stock trading platforms.

Securities day traders who understand the stocks they’re risking with, use the above services too for real time decision making.

Price Quotes are the First Step: Caution Advised

Acquiring a price quote is just your first step in making the decision to buy a stock.

You’ll definitely want to look at the stock’s historic price trends, get expert insight into what drives that stock and company’s performance. That means examining its profile, and reviewing the sector its in. And finally, get a comprehensive view of the 3 month, 6 month, 2024, 5 year outlook and the 10 year outlook.

Very often investors are intrigued by a particular stock they read about they immediately investigate its price, P/E ratio, revenue and earnings reports, and then compare to similar stocks.

Those comparisons are wise and you’d be wise to run a stock screener on Barchart, Google or Yahoo Finance to determine which are one with the best return potential.

Many self-directed investors jump too quickly on buying a specific stock that’s enjoyed a big price run up. It’s best to contain your impulse and read up again thoroughly. A price quote doesn’t do much for you since all stocks have a price.

More important than the specific stock’s price growth is what category it’s in. Value stocks, growth stocks, defensive stocks, have high flyers in them. Weigh the stock’s risk profile against what you want to achieve. If you’re okay about risk then Bitcoin might be a good choice. For those with risk tolerance who still want safety, then Apple, Alphabet, Tesla are worth a closer look.

Of course, the economy and political decisions and news stories often create volatility, and that sends many investors away. So a lot of the news may be engineered to cause trouble as it’s hyped and distorted.

Good luck with selecting the best stocks.

6 Month Stock Market Forecast | Stock Prediction | Stock Prediction Software | Tesla Stock Forecast | Stocks | Stock Market Today | Stock Market Long Term Outlook | Dow Jones Forecast 2023 | NASDAQ Forecast 2023 | S&P Predictions | Bitcoin Forecast | Bitcoin Price Predictions | Bitcoin Stocks | Stock Trading Platforms | Stock Trading Platforms | Google Finance | Author Gord Collins