Forecast for the 2024 Stock Market

2023 was a choppy uncertain year for the markets making investors and business managers nervous about the road ahead.

Their courage and optimism is about to be paid off handsomely in 2024. Many analysts are down on 2024, burdened by the higher for longer them by the FED. They can’t get over it. Yet, it does look like inflation is under control for now, with concerns about it picking back up in the spring.

U.S. real GDP increased at a 4.9% annual rate in the third quarter of 2023. Real GDP growth is projected to slow sharply but remain positive in 2024. — St Louis FED

The two factors that create issues are interest rates themselves, supply chain issues, and high prices of materials, goods and services.

Goldman Sachs offers their opinion: “As higher-for-longer interest rates make valuation expansion from here difficult to justify, our market forecasts are broadly in line with earnings growth. On a weighted basis, we expect 8% price returns and 10% total returns for Global equities over the next year, taking them towards the upper end of the Fat & Flat range that they have been in since 2022.”

On the other hand, JP Morgan believes the S&P 500 Index will drop to 4,200 by the end of 2024 — roughly 8% from its current level — as global growth decelerates, household savings shrink and geopolitical risks remain high. That’s a very dark view of the US economy going forward. It dismisses the current strength of business and consumer spending. And if the economy sunk that badly, the FED would cut rates fast to avoid being blamed for pushing the US into a needless and badly timed recession.

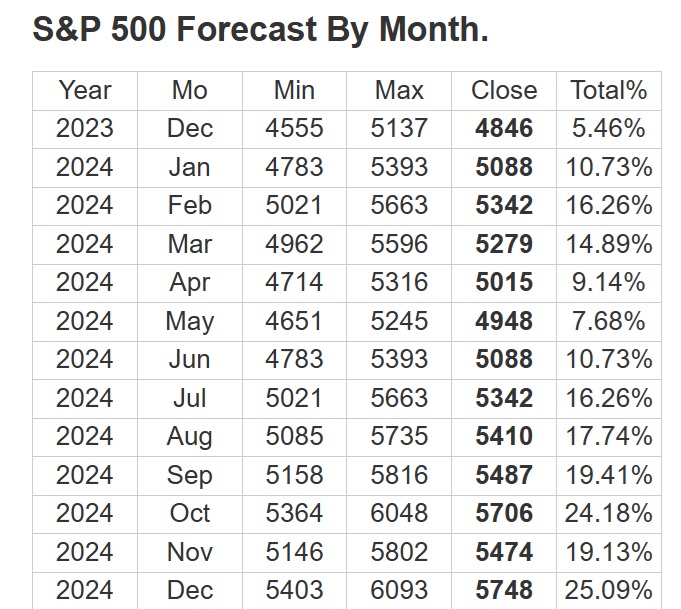

As you can see in this Longforecast prections chart for the S&P, they’re expecting major growth. By April, they believe the S&P might hit 5,000. Based on the current market rally, this may actually be conservative. 25% growth on top of 5000 if reached on December 30th, could produce an estimated of 6200 by year end 2024! That will make a lot of investors happy.

Keep in mind, that few predicted the markets would be where they are no. The negative, bearish sentiment is obviously overdone and shows some analysts are swimming in a sea of exhaustion and bewilderment.

However, with cuts in Fed spending, a much lower FED central rate may balance each other out. But a reduction in FED spending would have a very positive impact on inflation pushing it well below 2%. In fact, deflationary talk is rising. Deflating prices and a rising US dollar means Americans will have some big spending days ahead in 2024. They likely won’t be buying a house given the steady high prices, but they’ll probably be spending on travel and other discretionary items.

FundStrat’s Tom Lee Prediction

Investors are starting to respect Fundstrat’s Tom Lee of late. He forecasted a 20% for the S&P back in late 2022, to 4750 and we’re not far from that now. Other analysts suggest it could hit 5000. Lee points out that this is a major economic expansion we’re in, not a recession. The indexes show the resurgence this 2nd half will be more broad-based.

Companies have gotten used to the higher rates, so lower rates are a nice bonus.

The recession mongers are pretty well used up at this point. Mike Wilson of JP Morgan still sees a recession in late 2024 and the S&P possibly hitting 3000. Two very opposite outlooks for you to digest.

And if it is as good as Tom Lee says it will be, heading into 2024, how will it look in 2025? J Powell suggested inflation is sticky but could be at 2% in 2025. He sees a soft landing or he wants to create one. Tom Lee points out how corporations have been running lean and mean and will benefit from the next up-phase. We’ll see how profits go in the next 3 months, and late winter will be telling.

Jeremy Siegel of Wharton is enthusiastic at a number of positive signals for the markets and he doesn’t see it stopping.

Yardeni Research Forecast 2024

Ed Yardeni of Yardeni Research predicts the S&P will reach new heights by the end of 2025. His model shown below suggests slow growth than others within a range of between 4640 and 5800 as we enter 2026. His 10-year chart shows a clear long-term trend in that direction.

Without strong catalysts for a stock market crash, it makes sense that this is the path. The lagging effects of the rate hikes might erode the gain, but it looks like investors are locked on the 5-year outlook now and won’t be deterred. Those looking for quick profits from buy and sell strategies will likely hide in large caps.

“We see the bull market that started on October 12, 2022, continuing through at least the end of next year with the S&P 500 reaching a new record high somewhere between 4,800 and 5,400 over the next 18 months,” said Yardeni in a recent release.

Get the FED Out of Here!

I’m sure you’re fed up with the FED by now. And with this unnecessary FED misery out of the way, you might want to be all in on the stock market by 2024. That means picking a basket of quality growth stocks that will give your 401k or portfolio a big lift. See some of the best stocks to buy right now.

Of course, they won’t all lift in the same tide. You might catch successive waves in different sectors if you’re a well-informed investor. At this point, self-directed investors should learn all they can about which S&P sectors will be hot, and which stocks they can be confident of. Some may not be appropriate for you if you lack technical insight into a sector. Don’t buy a pharmaceutical stock if you know nothing about that sector.

Research companies now so you’re ready to buy soon. If stocks should fall this October, then you have even more opportunity to plow your money into some stocks at the bottom.

Looking Back to Look Ahead

Looking back at the last 5 years as in the chart below, we can see this year’s stock performance was as good as ever. And look how much room there is to grow. Although the steep interest rate rise has hurt US business, the white house has plenty of money to spend next year on capital infrastructure projects, boosting US manufacturing onshoring, and more.

Despite the high-interest rates and tight money supply, it’s looking good. Most of the growth of course is via the large caps, particularly the mega tech stocks.

Here are 3 key reasons why the 2024 market outlook is positive:

- Joe Biden needs to get re-elected and he won’t if it’s a recession

- The Democrat bills continue to release trillions into the economy

- manufacturing is being reshored to the US attracting investment money away from China

- US needs to compete with China or lose the world domination race to a communist dictatorship

- AI and automation are boosting productivity

So inflation really isn’t the big evil it’s made out to be. In fact, low inflation is part of strong growth as demand precedes supply and encourages business investment.

The NASDAQ and S&P indexes had a phenomenal first half. And with lower interest rates, the NASDAQ will impress, while the Dow Jones is at the dawn of a bull run. While the market bears stick to their gloomy outlook, we can see the markets are ready to soar. It’s not a great environment for business profit with demand down, costs up, and money becoming very tight.

2024 is a Special Year

2024 is the year rates stop rising, which lets investors and businesses make serious plans for growth, sales, and innovation. This might be why AI is so compelling. Many feel this AI stock bubble will burst, but in fact, it will play out further where the winners will be announced. That will take us beyond 2024 however.

With respect to macroeconomic factors, estimates of GDP growth for the developed nations is for a low 1.3% and a measly 0.9% in 2024. Experts believe persistent tight monetary policy will dampen demand. The low GDP expectations stem from continued FED balance sheet tightening, which they could reverse, and from elevated interest rates which should fall.

So we begin with that bleak projection for next year, which suggests governments won’t drop interest rates in the face of defaults, banks can’t lend, and continued economic pain for most businesses. That would be very unpopular politically and the Dems are skating on thin ice.

The slumping popularity of Joe Biden and the Democrats likely means they will begin giving in to economic growth as the November 2024 election nears. It looks like inflation will decline through to end of 2023 and early 2024. The bell curve clearly shows we’re out of the danger zone with inflation even if it will take the rest of the year to cool off completely.

By increasing supply to markets with slumped demand, prices should fall. If rates are lowered, the 2024 economy will rush back. My guess is that Biden will ease up on the inflation fighting talk and avoid stagflation which the FED is apparently obsessed with.

Full Market Outlook: This post combined with the stock market forecast, 3 month forecast, 6 month outlook, and 5 year projections helps you generate a wide and deep view of the investing marketplace going forward. Ensure you make your investing decisions from every important perspective and avoid the corporate/political hype.

A More Positive Outlook is the Likelier One in 2024

Bank of America recently commented on a potential scenario for the 2024 year, although it should be noted their forecast last year called for a 24% drop this year, which didn’t materialize.

It might tell us that forecasting and predicting are no easy task even for those with all the data in front of them, and even for something like ChatGPT. Never theless, BofA believes 2024 will be a good year for investors. They attribute the positive projection to:

- 2023 will remove excess capacity resulting in leaner cost structure and improved margin profiles

- strong corporate earnings which will outpace the economy

- trillions of cash sitting on the sidelines waiting for good, reliable investments to appear

- US credit situation should improve or at least not deteriorate

- first quarter 2023 earnings of S&P 500 companies have been positive beating estimates

- credit conditions may hold steady if private equity and venture capital firms deploy their $2.2 trillion cash pile

- capital/private equity firms still sits at record levels

Additionally, BofA’s technical research strategist Stephen Suttmeier cited 2 bullish signals (market breadth and technical signals from 73 country indices) that could push the S&P 500 to 4,900 by March 2024 (up 19% from current levels).

In a Business Insider post, Suttmeier said “This 2023 trend for the S&P 500 is like other ‘wall of worry’ bullish turns in 2020, 2019, 2016 and 2012.” So based on past trends, he suggests a similar event will occur in 2024.

That outlook seems fairly realistic. What might be added to the mix is that the US government will have to reign back spending due to debt ceiling crises. The Biden regime will have to stimulate the economy via measures they don’t like — deregulation and lower taxes.

Consumer confidence is one the wane this year, and high interest rate policies are beginning to erode growth, spending, employment, and investment. Instead, the choice to let the economy produce more is the better path to take.

As this graphic from Statista shows, the forecast is more positive, for roughly $1 trillion in GDP growth each year to 2025.

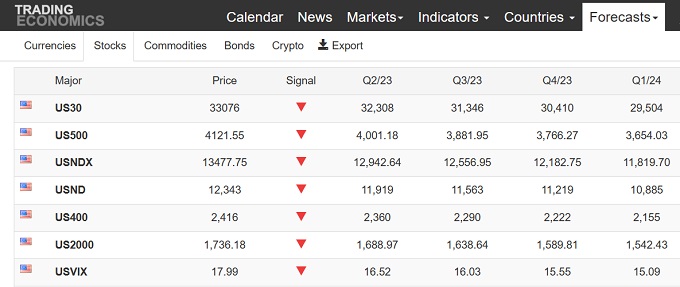

LongForecast and Trading Economics on the 2024 Stock Market

Trading Economics is penciling in a decline of the S&P by 350 points by Q1 2024, and Dow Jones falling by almost 2800 points, and the NASDAQ falling by about 1100 points. Clearly the view is a declining performance until deeper into 2024.

Long forecast sees the Dow Jones dropping 17% by the end of 2024, the NASDAQ down by 12% and the S&P 500 down by 10.9%. Clearly, they see the FED sticking to high rates and balance sheet stasis.

In the final analysis, there is a lot of cash sitting in bank accounts and money markets. When rates fall, investors will want to move that cash to equities to catch the bull train leaving the station (FOMO). They’re waiting for the Fed’s tightening and high rates to ease as a key signal to start buying stocks. That money movement will affect the S&P forecast for 2024, NASDAQ forecast for 2024, and Dow Jones forecast for 2024.

Once inflation is crunched, experts believe the Fed must ease off rates soon to avoid a hard landing and recession. Politically, it’s not a good time for a recession and Americans anticipated something better after the pandemic.

If the Dems don’t call off the recessionary dogs, Biden will lose the 2024 election by a wide margin.

Overall, after a low performance for Q3, Q4 and Q1 of 2024, the S&P, Dow Jones and NASDAQ should recover well. 2023 is a buy the dip opportunity and investors will be looking for the market bottom and the best stocks with the most growth potential.

More on the 2023 2024 2025 Forecasts:

Stock Market Forecast Today | S&P Forecast Today | Stocks with Best P/E Ratios | Best S&P Sectors | NASDAQ Forecast Today | Dow Jones Forecast Today | Tesla Stock Forecast | Market Rally 2024 | Stock Trading Platforms | Stock Trading | Stock Price Quote | Best Dow Jones Stocks | Best Stocks to Buy | Stock Market Prediction Tips | Stock Prediction Software | Stock Market News Today| Google Finance | Author Gord Collins