Best Stocks to Buy Right Now

Time to look at the best stocks for December. We have some lists from the major stock market investing advisors. Too many of these recommendation consist of safer, large caps but right now, the Russell small caps might be the right choice for most investors.

With only a soft landing, it’s likely most of these businesses will survive and thrive by 2025. If your investing horizon is the next 3 months, then the list below is pretty solid. Review the Barchart list of highest price gainers for what’s happening right now and the week ahead.

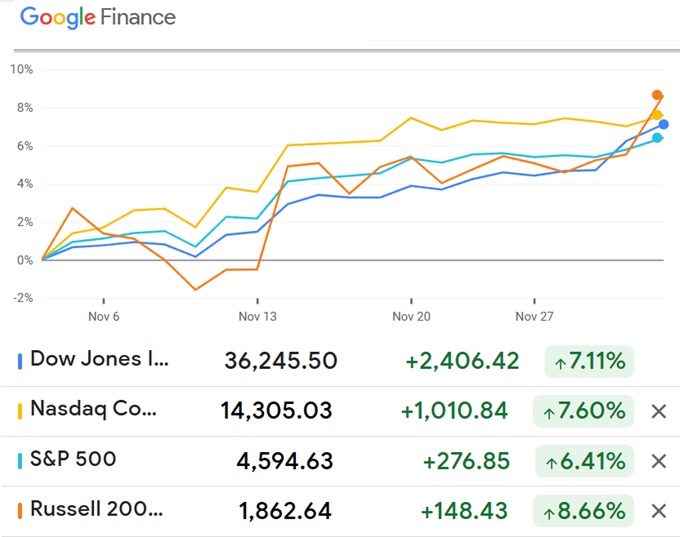

The Dow, S&P and NASDAQ have had quite a run of late with the Dow Jones Industrial and the Russell 2000 rocketing last week. That’s clearly the result of optimistic projections for 2024 as this week’s data and J Powell’s remarks suggest the FED rate has peaked.

Investors.com Stock to buy right now include:

- Microsoft

- Nvidia

- Amazon

- D.R. Horton

- Eli Lilly

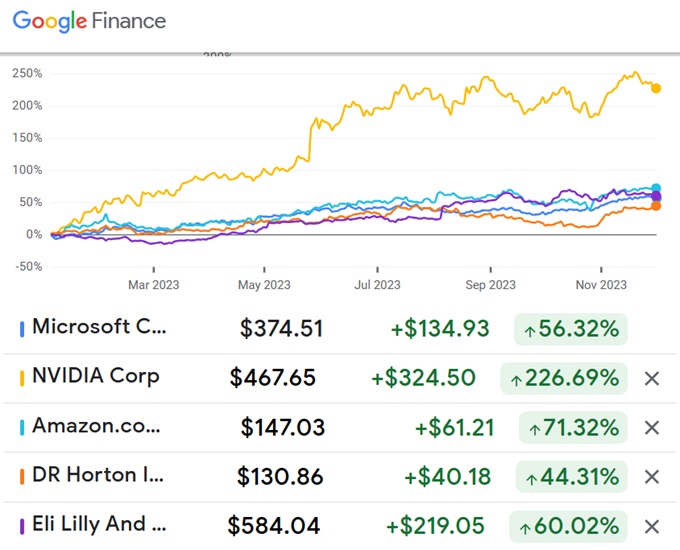

These stocks should rockets as the economy surges. Amazon will benefit from an apparently strong holiday season, but also has shoppers reduce shopping and go online to find bargains. Nvidia has been stellar but with questions, as AMD and others look to take away some of their microchip marketshare. Microsoft’s sails are being lifted by its powerhouse AI unit (ChatGPT) and the optimism around demand for AI-based services in 2024. D.R. Horton is the key homebuilder and they won’t be held back when interest rates fall, and demand for housing picks up this coming spring. Eli Lilly like Pfizer is looking to introduce its own weightloss drug, popular as more Americans are looking to lose their pandemic pounds. This chart from Google Finance shows their performance YTD.

Some analysts believe the S&P could possibly reach 5000. Bolstering that positive outlook is subdued inflation reports with continuing consumer spending combined with much lower gasoline prices and a weak outlook for oil and natural gas. It’s hard not to get excited about this bull market, but let’s not forget the political intent behind the high FED rate.

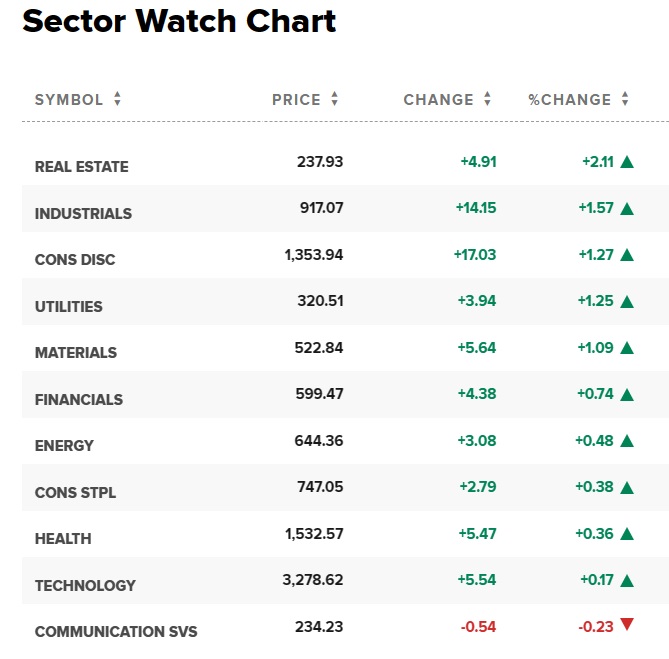

Real estate, industrials, consumer discretionaries and materials are up strongest of late, a sign of better performance in the housing market and for US production and consumer spending ahead.

Best Stocks during November

Barchart’s top performers shows the health science stocks performing very well. Health care stocks tend to fare well during recessions and should the economy grow, they stand to do much better. As Americans age and as diseases run rampant, the demand for health care, bioscience and pharmaceuticals grows. Seasonally, winter is always brings stronger demand for health care services.

See the list of best stocks to buy below and keep your eye on the 3 month, 6 month, 5 year and 10 year market forecasts. There is no forecast that has 100% winner predictions. The way ahead is volatile and you’ll need more insight.

Should you Wait a Bit?

Is this late year rally real? Some say it might fall flat after the new year, however January is usually a good month and signs are for a good 2024, but with continued volatility as pointed out by Fundstradt’s forecaster, Tom Lee.

Among these stocks listed as best stocks to buy right now, are many you have likely never heard of. Do your research with trusted sources before parking your 401k money in them. You can check out each stock individually on Google Finance or Yahoo Finance, The Fool, Benzinga, Trading View, and other stock brokerage websites.

Kiplinger’s top 12 recommendations of stocks to buy now:

- AMD

- Deckers Outdoors

- Amazon

- Rexford Industrial Realty

- Halliburton

- T-Mobile US

- Workday

- Lululemon Athletica

- Matador Resources

- Amgen

- Merck

- Archer-Daniels-Midland

Fortune Builders chimes in with their best stocks to buy:

- ServiceNow, Inc. (NOW)

- Alphabet Inc. (GOOG)

- Amazon.com, Inc. (AMZN)

- The Walt Disney Company (DIS)

- Palo Alto Networks, Inc. (PANW)

- The Boeing Company (BA)

- Prologis, Inc. (PLD)

- Johnson & Johnson (JNJ)

- MercadoLibre, Inc. (MELI)

- Costco Wholesale Corporation (COST)

Forbes Advisor top stocks to buy are:

- Boeing (BA)

- CSX (CSX)

- Five Below (FIVE)

- Kraft Heinz (KHC)

- Occidental Petroleum (OXY)

- Owens-Corning (OC)

- RenaissanceRe (RNR)

- Sarepta Therapeutics (SRPT)

- Teva Pharmaceuticals (TEVA)

Morningstar’s top stocks to buy now:

- Yum China (YUMC)

- Roche Holding (RHHBY)

- Pfizer (PFE)

- Estee Lauder (EL)

- Zimmer Biomet (ZBH)

- Imperial Brands (IMBBY)

- GSK (GSK)

- Campbell Soup (CPB)

- Corteva (CTVA)

- British American Tobacco (BTI)

NerdWallet’s 7 Best-Performing Growth Stocks to buy now

- Abercrombie & Fitch Co. (ANF)

- Daktronics Inc. (DAKT)

- Super Micro Computer Inc (SMCI)

- New Oriental Education & Technology Group Inc. EDU

- Meta Platforms Inc (META)

- Palantir Technologies Inc (PLTR)

- Applovin Corp (APP)

A few more stocks with great upside:

- Coinbase (COIN)

- Toll Brothers (TOLL)

- Upstart Holdings (UPST)

- Bit Digital (BTBT)

- Affirm Holding (AFRM)

- Soleno Therapeutics (SLNO)

- Carvana Company (CVNA)

- Clean Spark (CLSK)

- Myomo (MYO)

What’s Hot on the Dow Jones, NASDAQ, S&P and Russell Indexes

Stock prices on the Dow Jones, NASDAQ, S&P, Russell, TSX and overseas stocks markets have been recovering well.

You should be looking for the best stocks to buy while prices are low. But this recovery might be volatile and prolonged, so you’ll have plenty of time to pick the stocks you want. Begin with a good overall stock market forecast.

Should I Buy Stocks that Have Plunged the most in the last Few Weeks?

Buying the dip is the rule, however no one is sure when the market bottom will happen. Technical charts won’t help given the decision to suppress the economy is up to the President and the Fed. It’s a political decision.

Should you buy stocks on the Dow Jones or NASDAQ or the Russell Index? Keep your eyes on the Dow Futures.

Stock Market Forecasts – Dow S&P NASDAQ

* the above post includes opinions of the author and do not connote buy recommendations of any kind regarding stocks to invest in. The material is provided as information only. Please choose stocks cautiously after thoroughly reviewing the market and the company involved. Consider a qualified financial investment advisor to help you with your social directed stock investing strategy.

3 to 6 month Forecast | Market Rally | AI Stock Forecasts | ChatGPT Stock Forecasts 2024 | Google Alphabet | Facebook META | Stock Market Today | Tsla | 10 Year Stock Market Forecast | Real Estate Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate | Los Angeles Real Estate | Home Equity Lines of Credit | Home Equity Conversion Mortgages | Mortgage Rate Forecast |