Are TSX Listed Stocks a Wonderful Investment Opportunity?

With the stock market bottoming likely 3 months to 6 months away, investors have an opportunity to explore different investment choices.

You could stick with US stocks for their excellent potential. Or you could go with International stocks which generally mean Asian equities these days, given Europe has become a mess for investors. China too struggling with growth given US trade sanctions and their obsession with invading Taiwan.

But just across the northern border is a country with a low-cost profile, politically stable, with access to the US market and global markets. Canada’s international investment relations remain a strong attractor of investment funds. It is a strongly commodity driven economy and commodities still have value. The Canadian economy is performing reasonably well, but has a big upside for the coming years.

The best of the Canadian stocks are listed on the TSX, and we take a look at them now.

The Global Home of Oil and Gas Stocks

With energy stocks being the best performer on the stock markets in 2022, the TSX with the most oil and gas stocks of any exchange on the globe is the center of the oil universe. And Canadian oil stocks may have the best 6 month to 5 year outlooks of any.

While anti-oil carbon fuel activists have been damaging oil supply and crushing demand, particularly stopping the export of oil from Alberta’s oil sands, the failure of liberal/democrat government worldwide that is happening will ensure future demand for energy and carbon fuels such as oil and gas. Oil prices are predicted to rise substantially given dwindling exploration and drilling. However, if Liberal governments can suppress their economies, demand for oil and commodities will fall too.

Canadian Commodities in Demand

If the US government and the US Fed are successful in crushing the US economy, it will spill over into international markets including Canada. Yet Canada doesn’t look like it will suffer as badly. Then there is the possibility of a Conservative/Republican resurgence and election wins, which might bring the recessionary movement to an end, and an opening to growing energy production.

The TSX is all about Canadian commodities which fare better during strong economic expansions. After this recession in 2023/2024, we should see significant economic improvement. Heavy oil is used for industrial use, when regular WTI oil gets too expensive. Canadian oil is best for producing plastics.

The TSX is all about Canadian commodities which fare better during strong economic expansions. After this recession in 2023/2024, we should see significant economic improvement. Heavy oil is used for industrial use, when regular WTI oil gets too expensive. Canadian oil is best for producing plastics.

As the US becomes more politically hostile and trade restrictive, Canada actually presents a more attractive investible climate to global investors. Consider how much global investors have to invest with and you can see the potential of the S&P Toronto stock exchange listed securities.

We typically think of Canada in terms of oil, potash, and lumber, but there’s a wealth of unexplored opportunities. And American investors are going to begin to focus on the frozen wilderness just above the 49th parallel. What makes Canadian stocks in particular so attractive, is their costs are in Canadian dollars, and the CAD is running about 72 cents per USD.

Companies which can deliver commodities such as oil, gold, grain, potash, lumber and steel at low prices are a great choice for investors looking to hedge the recession in 2023/2024.

Source of cheap commodities will be a strong magnet for smart CEOs in the years to come. The Democrats are hostile to Canada, but the Republicans aren’t so much. They learned their lesson from the last Presidential era that tapping into Canada’s material bounty is ultrasmart, progressive and a ticket to US economic security.

As international trade and commodities themselves become unreliable, it makes sense that US companies will rely on Canadian sources. And Canadian stocks listed on the TSX will be attractive with much higher valuations and earnings to offer.

If the Repubs should be victorious in the elections in November, they will insist on opening up to cheap Canadian commodity sources, which can then put the US into a dominant export position globally. Given the high US dollar, lower manufacturing costs could give the US even more export growth.

In a post-China international trade environment, Canada will be the star. Which is why President Xi and the Chinese communists are cool to Canada. They see the future — and Canada is the future.

TSX Forecast 2022/2023

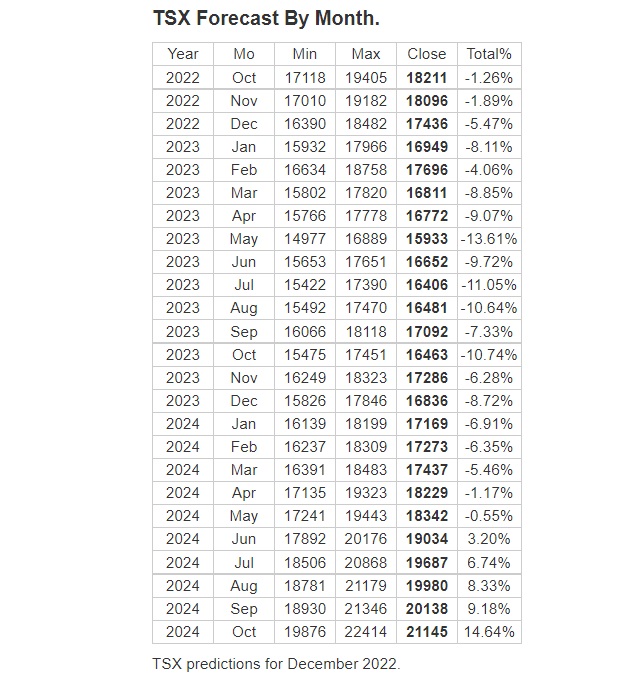

Longforecast shows it’s month by month forecast for the TSX until 2024. Given the political volatility in 2022, and the fact that government policy is controlling the US and Canadian economies and commodity prices, no one is able to accurately predict the stock market. The TSX should fare well should demand for oil, gas, lumber and other commodities continue.

Best TSX Stocks

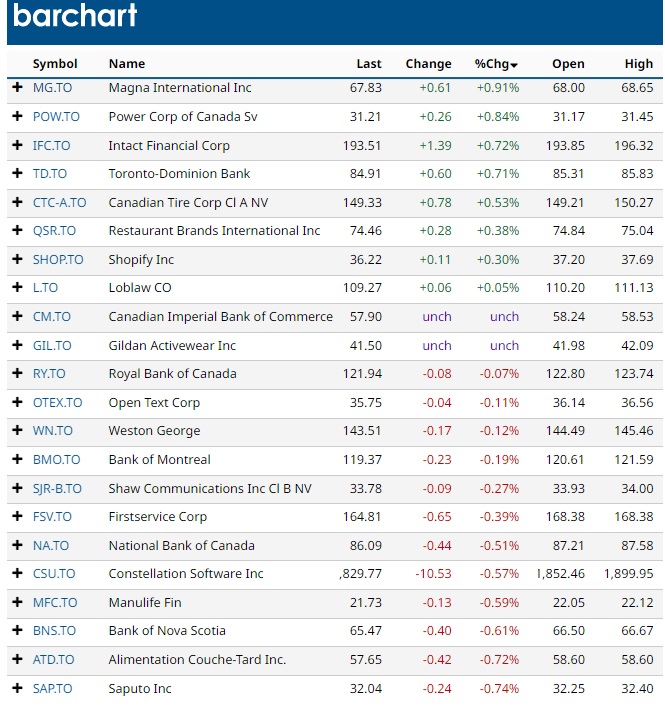

You’ll recognize some of the major stocks such as Imperial Oil, Magna International, Syncrude, Shopify, Toronto Dominion Bank, Air Canada, but there’s more than these and oil stocks on the S&P TSX index.

Top Performing TSX Stocks

TSX 60

The TSX 60 index is comprised of the top large cap stocks traded on the Toronto Stock Exchange. You’ll see some familiar names and some you should know more about. The S&P/TSX 60 Index also represents the Canadian component of Standard & Poor’s Global 1200. Also, the iShares S&P/TSX 60 Index Fund (TSX: XIU) and the Horizons S&P/TSX 60 Index ETF (TSX: HXT) are Canadian exchange-traded index funds tied to the S&P/TSX 60.

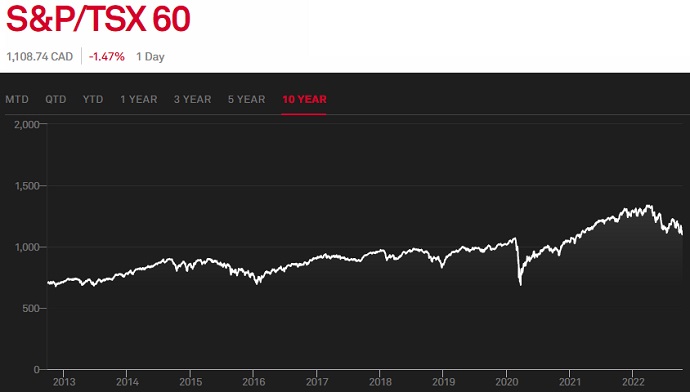

This graphic below from SP Global shows the consistent 10 year performance of the S&P TSX index. It mirrors the performance of the Dow Jones, S&P 500 and NASDAQ, yet the energy sector shows a much better gain for investors. Investors are eyeing oil and natural gas stocks right now. Check out the Canadian oil stocks to invest in by 2024.

The TSX forecast for investors is one of excellent prospects. The bigger promise of Canadian stocks however comes in a bull market. It’s not until business gets hot and prices rise, that US companies will turn to Canada. And when they do, it’s not just WCS crude oil that is in demand, it’s everything Canada produces.

Investors avoid the risk of trying to pick the best Canadian stocks and go with ishare funds or the S&P ETF see others vis that TMX stock screener: money.tmx.com/en/etf-screener.

See more on the S&P SPDR SPY ETF.

Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Oil Price Forecast for 2024 | Stock Market News Today | | 6 Month Forecast | Stock Market Crash in 2024? | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Dow Jones Forecast | NASDAQ Forecast | Oil Price | S&P Predictions | Stocks Next Week | Mortgage Rates | Home Equity Line of Credit | Reverse Mortgages | Best Dow Jones Stocks | Market Rally