Is There Any Chance Home Prices will Fall?

The top question from buyers isn’t about how to save and qualify for a home mortgage, or how to win a bidding war, or how to choose a Real estate agent.

The top question asked is “when will home prices fall?” The rationale is simple. They want to buy when market demand is exhausted or some unforeseen force causes home prices to miraculously drop. But buying when the market is crashing is risky and banks don’t like lending during a crash.

Will Prices Drop?

It’s possible we could see prices drop in the near term or within two years. Likely next fall will be the big crash. All the signals for a stock market crash are blinking. Of course, smart stock market investors might be building up their wealth and are reading this post right now, thinking that moving their money to the housing market might be a great idea.

They’re researching when a price drop or housing market crash will happen. Some will do this right and make a fortune in savings. They’ll be buying homes at much less. It may be we’ll have an economic crash and housing downturn in 2023. That’s the first year when stimulus funding will end. It’s like a kid going through a sugar crash.

The housing market may not tell us much. It’s the US economy and what could happen with the US dollar, US regulations, and trade deficit that could cause events that crash the markets. With everything as crazy as it is, you have to think one monkey wrench in the stimulus-fueled machine could cause a crash.

Signals of an impending price drop:

- the housing market is overheated, inflation is rising, and the bubble could burst due to an all round abandonment of the market

- workers are returning to the city to work and find a condo/apartment, and may sell their house far from the city

- The current US administration can’t agree on a stimulus bill this summer with the Republicans

- weary buyers are giving up because of the intense price competition and mortgage qualification demands

- home sellers are getting worried that this may be the peak of the market this summer

- new home construction could pick up and flood more homes into the market

- pandemic destination buying is just about over

- inflation and home prices rocketing upward

- Federal and state government debt hitting ceilings while trade deficits signal mounting failure

- the Fed could jump interest rates up while believing it won’t hurt much

- the Dems big spending, high debt servicing, anti-fossil fuel, high tax agenda could implode into the next major recession

It’s wise to check out the best cities with the lowest home prices, find good neighborhoods that have some gems. Is there a time of year when home prices might fall? Find opportunities.

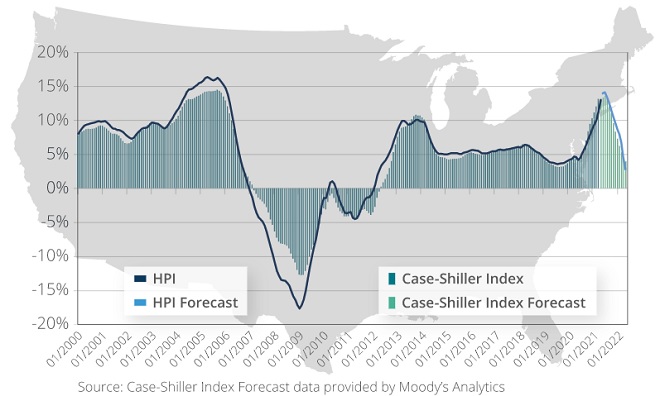

Case Shiller sees a strong likelihood of fast dropping home prices this summer. With a peaking of demand, the market could snap back to even lose price levels by 2023.

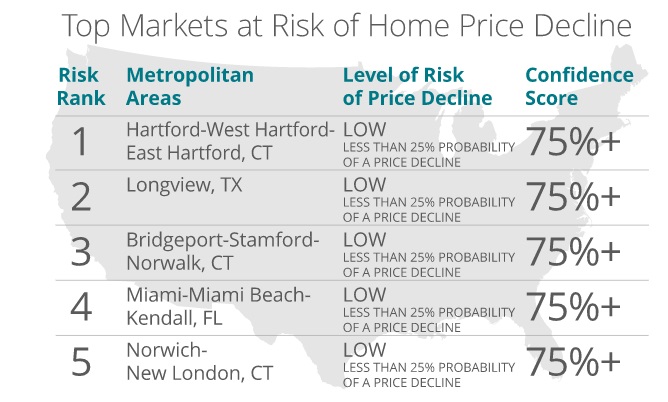

A better perspective on this is to find the cities and neighborhoods most likely to see home prices drop. Here’ Cas Shiller identifies the top ten most likely to fall and perhaps the cities most likely to crash.

Buyers have been asking whether home prices are going to fall for about 12 years now and prices have unfortunately never fallen. The home price history charts have only gotten steeper. The reason for that is lower home supply. But is the hopeful search for lower home prices hopeless, or is it a precursor to buyers approaching homebuying a different way.

I’ve recommended some different ways for home buyers to search for homes for sale and if you’ve got the cash, it’s worth doing. The silver lining to this frustrating rising home price trend is that those homeowners who would never sell are starting to list their homes. So instead of the unusual run of the mill, blah properties that are not really dream homes, and offer sketchy value, some spectacular homes are becoming available.

Many California, Colorado, and Texas homebuyers have questions about housing price trends. They’re wondering about whether they should buy a house now. Does this real estate or housing market have weakness?

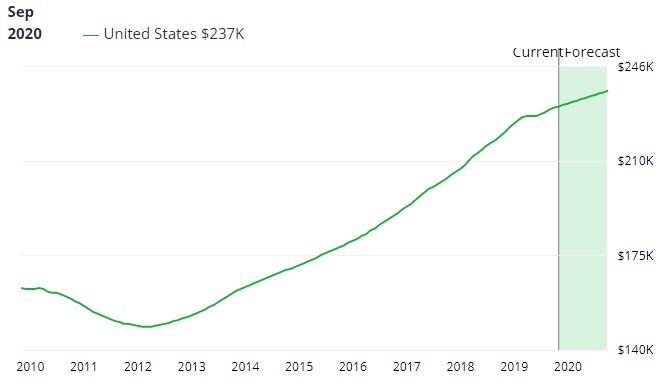

From San Francisco to Los Angeles to Denver and Seattle all the way east to Chicago, New York and Boston, homebuyers are asking when will house prices drop? See the housing forecast pages for the 5 year outlook. The chart below shows house prices will only fall during a major recession.

Rocketing Home Prices Must Eventually Crash

Are we headed for a housing market crash? Well, housing crashes are surprising events and there are political and international tensions that could create economic crashes. The tension with China is perhaps the greatest threat. China is aggressive with Taiwan and Hong Kong, and won’t take no for an answer. This could indeed create a crash for the US housing market.

Right now, with the economy reawakening, there is little chance of prices falling. Stimulus, Millennials forming families, slow post pandemic recovery globally, work from demand for space, return to work in the city means more sales. Unfortunately, sellers whether they are babyboomers or not don’t see to be eager to sell. Until there is somewhere to go, they won’t be selling.

The housing crisis will only increase in intensity and as home buyers discover anti development regulation will not ease, the move will be to build new homes in new cities or cities that will allow building. Your efforts should be to find those cities that are investment and construction friendly.

Is the Real Question How High Will Home Prices Rise?

As unemployment stays near historic lows, wages rise, GDP regains momentum, immigration continues, and as construction starts do not keep pace, house prices can only rise in the major metros in 2020 and beyond.

In fact, it may be most experts and economists may be in denial about how strong the economy can get starting in 2022. If they are the wet blanket, their efforts to slow the economy will keep housing starts down and thus push home prices higher.

When will the housing market crash?

In fact, experts are changing their tune quickly about the economy of 2020 for both the US and Canada. The gurus are dropping the 2020 recession rhetoric as the stock market surges to new records, US consumers keep spending, and a trade deal might be signed. The positives which can read more on below, keep piling up.

This graph below from FRED helps us see how ineffective previous mild recessions were in reducing home prices.

Certainly the financial crisis hit us all hard, but notice the gradual, halting climb since 2013. That shows a more managed market that won’t form a bubble. It appears to be heading a long increase until there is simply no more demand. Perhaps in 2025, we might see it decline.

Robert Dietz, chief economist for the National Association of Home Builders cites a “perfect storm of supply side challenges.” In an interview, he said the residential construction industry is grappling with a prolonged labor shortage and a scarcity of buildable land.

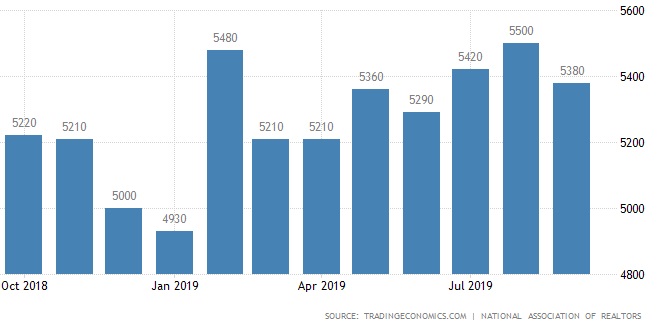

Freddie Mac in its recent report Freddie believes the housing market will continue to strengthen with home sales growing to 6.0 million by Dec 31, and then grow 6.1 million for 2020. Sam Khater, Freddie Mac’s Chief Economist says “ the housing market remains on solid ground with housing starts, building permits, existing home sales, and new home sales all outperforming the broader economy.”

Low interest rates plus government stimulus is continuing too and there is not enough housing. That would give sufficient reason to suggest house prices will not drop. And lower mortgage rates means higher buying power for homebuyers.

Sales of lower priced homes in the West dropped considerably because the scarcity of those properties (Will Los Angeles home prices fall?). Supply of homes have dropped from 4.4 months last January to 3.9 months supply in September.

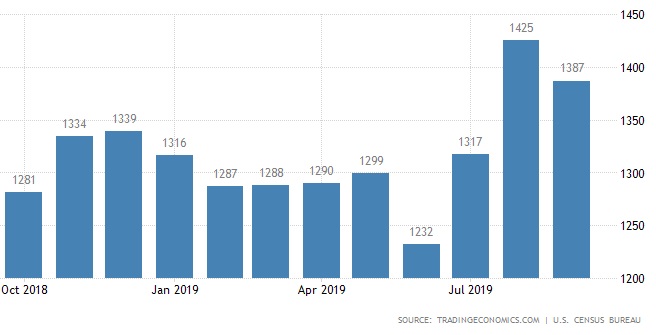

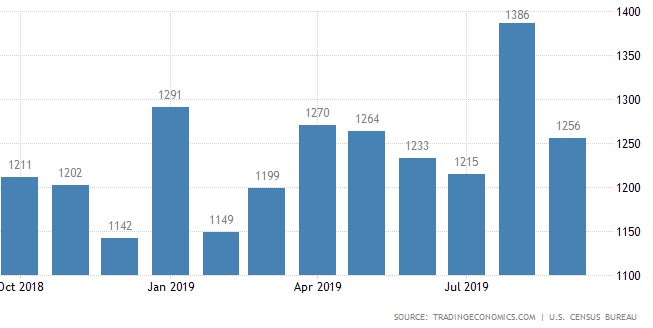

Building Permit Forecast

Building permits are much higher than last year at this time, although they seem to be dropping recently as depicted in the graphic below. The actual drop of 2.7% in Sept was much less than forecast (-26% consensus). The question is whether this uptrend of permits is going to satisfy the insatiable demand in cities such as Dallas, Phoenix, Houston, Miami, New York, Boston, Seattle, San Jose, San Francisco, and Los Angeles.

Bidding wars rose to 11% of offers in September, just up from August’s 10%, but this is well down from last September’s bidding war rate of 41%. But we should remember the tariffs imposed by President Trump and resulting fall back in corporate Capex spending is what caused that.

With those issues resolves, what’s stopping a return to 41% level bidding wars across the nation?

2019 was not really a good year for a number of reasons. However, with persistently low mortgage financing, buyers showed a strong urge to buy homes. And now it seems, according to the last report, more young first time buyers can afford to buy. Notice the strong upslope in sales throughout 2019. If the new trade deal is signed and adhered to, and the new USMCA deal is signed, it can only give the stock market and housing market a big boost. Yet without sufficient increases in housing stock, prices might rocket in 2020 and 2021.

The 2020 election is a big factor as well. Bloomberg reports that Trump will win next fall if the economy continues strong. That makes the 2022 housing market forecast kinda rosy.

It’s the same in Canada as heavy demand is growing home prices and rent prices in Toronto and Vancouver. Demand is spreading outward into rural areas where very little housing is being built. The commitment to construction of affordable housing simply isn’t there, and demand for homes $200k to $300k continues. In Toronto for instance, housing supply is drying up severely setting the stage for huge jumps in prices, creating bubble like conditions. Some are warning of danger in the Toronto housing market. Yet Toronto’s economy is hot, which will only fuel big price hikes thorugh 2020.

It’s same situation in US cities, except US buyers have much more money.

As discussed in the most recent housing market forecast and update, prices rose for the 91st straight month. The median price for existing-home of all housing types in September was $272,100, up 5.9% from 12 months ago ($256,900). Prices rose in all regions.

The political and media mood in the US has been very negative as well. If the constant stream of down talking of the economy, trade, and housing ends, we can expect and additional boost just on optimism.

For a fall/winter economy, this one seems to be excellent.

According to NAR, total houses available for sale at the end of September was 1.83 million units. That’s the same as August but is down 2.7% from 1.88 million units one year ago.

Zillow’s Home Price Forecast 2020

NAR recently said that if this recession happens, it will be short lived and that the housing market would not follow an economic plunge.

“I don’t think we’ll get back all the way to … the frenzy we saw at the beginning of 2018,” says Chief Economist Danielle Hale of realtor.com®. But “it’s certainly a possibility that home sales and prices will pick up, especially if mortgage rates stay low.”

When will home prices actually drop? A conservative guess would be in 5 years when buyer demand is satiated and the economy cools.

If the Dems can impeach their rival, and beat the Republicans in the 2020 election, we might see a drop in prices. But the experts have said that even if the Dems ruin the economy, it wouldn’t be enough to ease demand for housing.

Don’t bet on house prices dropping in the United States anytime soon. And a housing crash? Come on.

Real Estate Housing Market | 3 to 6 month Forecast for the Dow S&P NASDAQ | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News