What’s the Outlook for the Housing Market?

Most expert forecasts for the housing are calling for moderation in home prices beginning now and into 2022 and 2023. But are they just trying to talk down what is a very hot housing market?

In one controversial poll by Reuters, Mark Vitner, senior economist at Wells Fargo is quoted as saying market demand will fizzle out finally in 2022. His opinions might allude to unaffordable prices and that buyers will give up. But that doesn’t mean they won’t want to buy or feel a need to buy a home.

The latest predictions have house prices running hot until the end of the year, followed by only 8% growth next year. Does that make this winter the ideal time to sell your house?

Real Estate Marketing Packages: Realtors, are you looking to successfully launch your digital marketing campaign for the new season? See the real estate marketing package page for comprehensive service to help you excel online.

Prices Rising, Rates Rising But Still Looking Strong

After you see the reports from NAR, Zillow, S&P Corelogic, Goldman Sachs, and Freddie Mac, you might conclude 2022 will be a very good year for sellers but not so good for buyers. Home buyers are still hungry for a home, and buyers are thinking this might be the ideal time to sell.

Growing mobility, coming of age of Millennials and Gen Z’s and more immigration creates competition. Realtors report in their 2022 forecast report that 45 million Millennials are in the home buying zone. Rent is outpacing home ownership costs by 7.1%. People do not want to rent, and investors know it. They’re buying property like there’s no tomorrow.

Realtors™ reported that investor purchases of homes rose 103% year-over-year in April 2021, and were up 12% over the same time period of 2019. Nationally, investors bought 5.7% of homes sold in April. And if the stock market and bond market look like weak options, it makes sense that this group will look hard at real estate. Housing stocks are the hot ticket now on the stock market.

The job recovery hasn’t begun, Americans have lots of cash, and wages are rising. The great resignation/reluctance will subside and Americans will have to commit themselves to working again and that means finding a place nearby to buy or rent.

That sounds more like increasing demand is on the way as spring approaches. The real issue here is the unwillingness of those who homes to sell them. The US government could force construction of homes but it hasn’t done so. With a shortage of labor, lumber, and heavy regulation, housing starts will lag, and it will force home price upward. Simple issue of supply vs demand.

Even NAR’s chief Lawrence Yun agrees: “It’s all about supply. Reduction in supply of new home construction will lead to home prices rising above people’s income growth.” 80% of the analysts polled by Reuters said they expect housing affordability to worsen over the next several years.

According to the most recent report, new home construction starts and completions fell in October. Although new construction permits are up, supply chain and labor issues could result in few starts or completions. The US needs about 550,000 new homes per year and will fall far short of that. The shortage could be much worse than the decline in buyers, which would support rises in new home prices.

We can reasonably predict that 2020 home prices will be higher (economy, seller reluctance, reduced supply, low mortgage rates) and homes will be a tough purchase for hopeful Millennials and others this year and 2022. Mortgage applications are steady which shows continued interest in buying.

Record Home Prices in 2021 Creates Momentum into Next Year

We should keep in mind that home sales and home prices are up substantially from last year. 2021 has been very active and although sales are tapering off a bit, the expert forecast that the housing market may be weakening doesn’t seem likely. Momentum is a factor unless the economy sags.

Realtor’s™ reported the value of homes sold as of mid 2021 hit a record $34.9 trillion according to Fed data. This is momentum that has only subsided slightly and only because there is a home shortage. More homes means more purchases. If construction does increase, it will unlock potential sales and increase competition.

Experts are guessing the Fed would follow through with interest rate rises, yet the midterm elections are only 11 months away, and a faltering economy would put the nail in the Dems coffin. The interest rise projections are overstated, unless the current administration finds itself in dire straights (debt limits, zero stimulus), yet they have the ability to pass whatever legislation they want.

US GDP growth reported by BEA rose 11% in the first quarter 2021, in Q2 2021 and then plummeted to 2.1% in Q3.

Oil prices are rising quickly too, a Goldman Sachs believed they would hit $80 a barrel by fall and they did. After the recent manufactured crash in prices, the demand outlook is pushing prices back up ($70 already). Fuel, transportation, heating, and food will all rise in price. This might cause a pause in bidding wars for houses.

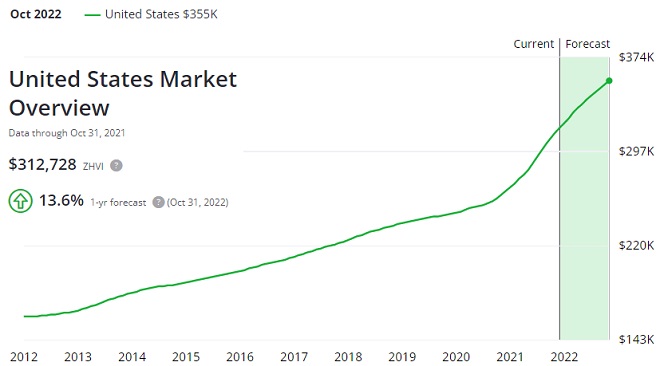

Zillow economists are predicting another year of rapid home value appreciation to the tune of 13.6% growth through October 2022.

Mortgage rate forecasts see rates climbing from the current level of about 3.1% to 3.5 to 3.6% next year. Is that enough to crush home buying demand?

The National Association of Realtors forecasted the 30-year fixed mortgage rates could rise to 3.25% in 2022. Redfin reported that 60.3% of home sales involved a bidding war. That’s down from the astonishing record high of 74.% last April (74.5%). Will April of 2022 be any different? We’re at 60% and the fall is typically a weak time of the year for home buying.

Freddie Mac says home prices are forecast to rise 8% in 2021 – up from the previously forecasted 4.2% – before decelerating to 2.9% annualized in 2022, as measured by the FHFA Home Price Index.

Goldman Sach’s prediction is for a slower housing boom in 2022 and they’ve reduced their 2022 house-price appreciation forecast from 4.6% to 3.9%.

Realtor’s ™ new forecast sees prices rising only 2.9% in 2022 with only 6.6% growth in homes sold. They believe existing inventory will rise .3% yet predict home sales will hit a 16 year high in 2022 of 6.6% more. That comes from a survey of homeowners that say most intend to sell within the next 12 months. An intent however, doesn’t mean action. Many will get cold feet when they realize they’ll be homeless, and there’s none for sale!

They also predict single detached family housing starts will grow by 5%. Wow, that is a bold forecast.

Should you buy a home now or wait till 2022? Prices are going to rise, supply is still going to be limited, and mortgage rates won’t be rising much. Buying now or then won’t be much different. Real estate markets of all kinds will still run hot. The question is where will you find homes for sale?

See more on the California housing market, Florida housing market, and New York housing market forecasts.

Strong Economy Will Keep Pressure on Home Prices

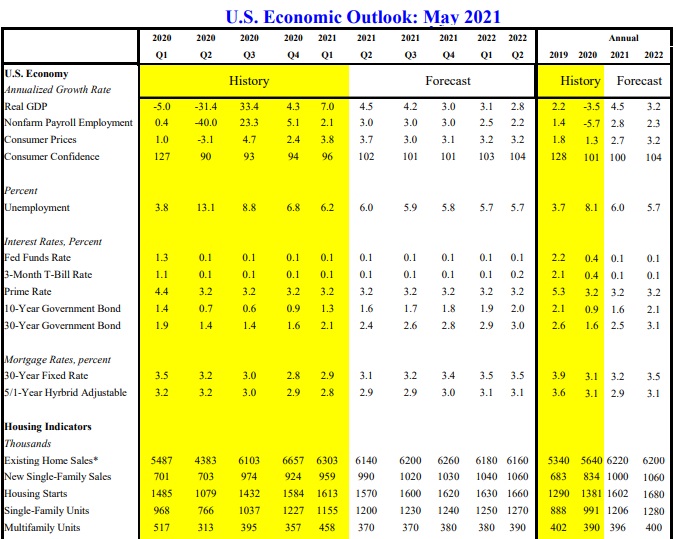

The economic outlook is also important in predicting home prices, sales and new construction. NAR feels GDP will sink in 2022 without specifying exactly why. They believe consumer confidence will grow, home building will climb moderately, and unemployment will fall slightly. Let’s remember how optimistic consumers were and how strong the economy was in early 2020.

There are a lot of factors playing into the economy including stock market forecasts, supply chain bottlenecks, interest rates, fed bond tapering, elections, and lingering effects of Covid lockdowns. But a recovery is a recovery and when Americans believe it is free to come out again, they’ll be spending big time. They won’t forget that real estate is desirable investment and you can live within it.

If GDP will sink in 2022, then why would inflation stay high? Some experts believe inflation is transitory and will cool a lot by 2022 and 2023. If mortgage rates stay low, then there’s not much preventing homebuyers from putting in their bids on a home. That will keep pressure on prices.

There is a good measure of pessimism in many of the predictions for 2022. This look into the 2022 outlook doesn’t seem to see the same dour thoughts. Much of the current clamor about Joe Biden’s tax hikes for the rich and rising inflation concerns doesn’t seem to be weighing down the stock market.

Let’s not forget the rising tide of legal and illegal immigrants pouring over the borders as they will demand housing too.

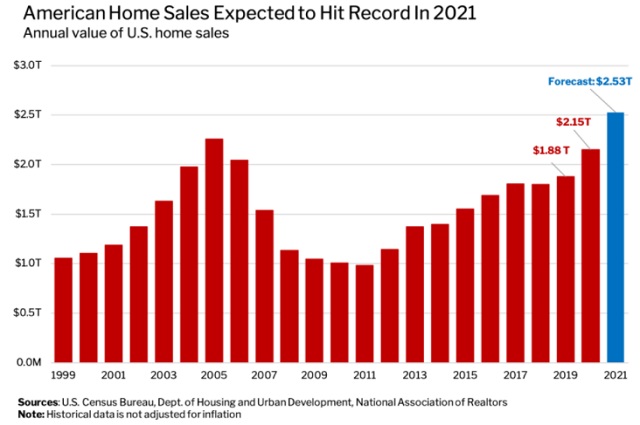

Redfin’s report shows a record $2.5 Trillion in home sales by the end of this year. Is there big negatives that could erode whopping number into 2022?

Highest Home Price Growth in 15 Years

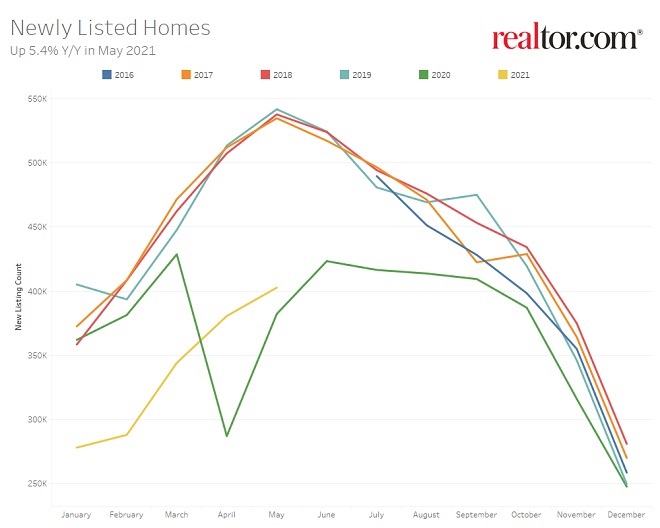

This graph from NAR shows home prices rising like no other time in May. The trajectory of the curve shows continuing momentum during a time when home prices typically rise.

The end of the Covid 19 pandemic is a special case that adds more money into the economy while business start up again. It’s hard to be pessimistic with hundreds of millions of people finally get release from a psychologically horrible time. They are motivated to move ahead, spend, and find a way to buy a home.

The real question is whether governments will assist in any way, with Americans buying a home. Would they offer incentives, keep mortgage rates down, ease up on mortgage qualification, or free up land for development? Current predictions are based on a hands-off model of the Federal government. On the other hand, raising interest rates and taxing big corporations could thwart home builder activity.

Similarly, a decreasing number of homes being listed (lower supply too) should be steeper than normal too. Home sales have soared, but there does come a point in time, where there are not many homeowners left who want to sell. They may be comfortable living in proximity to where they work, have relatives, and don’t want the expense of relocating.

A Deeper Look at the 2022 Housing Market Factors

Home Sales – still very high despite the recent easing. And this is primarily due to a lack of homes being listed for sale.

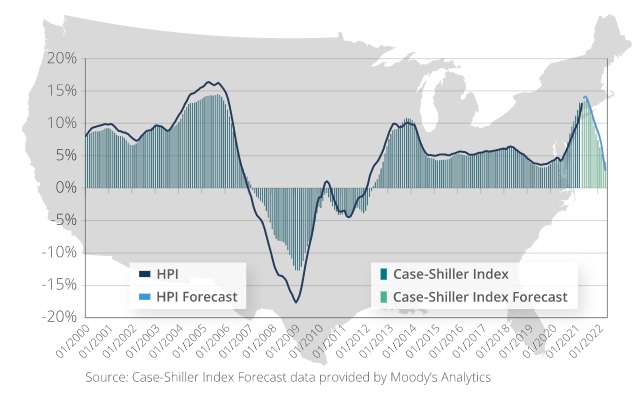

Home Prices – rose 13% in April 2021 the highest rate since 2006, which tells us the market is hot and momentum will carry price higher if demand remains. With employment rising, wages rising, and many Americans cash rich, there is plenty of latent demand to keep home sales going right through 2022. There will be no sudden turning off of the housing tap.

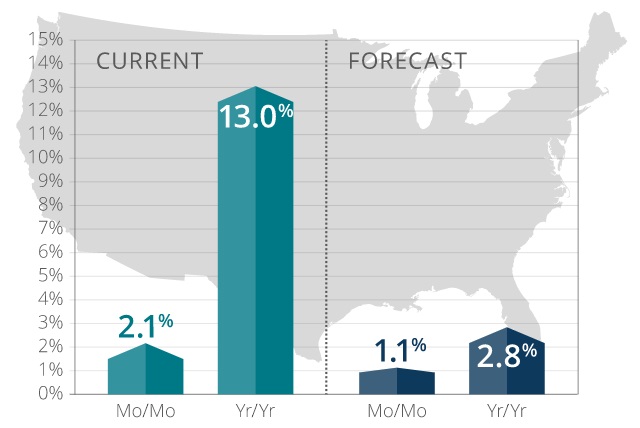

“The CoreLogic HPI Forecast indicates that home prices will increase on a month-over-month basis by 1.1% from April 2021 to May 2021, and on a year-over-year basis by 2.8% from April 2021 to April 2022.” from Corelogic report.

In this graphic, Corelogic forecasts that the rate of growth of home prices will fall to 2.8% in April 2022.

Persistent Demand – strong demand backed by financial capability at higher price points, but not so much at mid-priced levels and although demand is for cheaper priced homes, there simply aren’t many available and few being built, so demand should push the prices of cheap homes higher, and they will not come down in 2022.

While many potential buyers could fall into into rentership and poverty, it’s not expected to affect the millions of Americans who are financially empowered to buy a home.

Economic Support – Fed continues spending while businesses reopen which should help many homebuyers stay in the hunt for a home.

Interest rates and Fed stimulus spending – Easy, cheap money from every direction won’t stop in 2022, and may not stop in 2023, given it’s election year and the Democrats won’t want to give up anything to be re-elected.

Home Building Not Booming Exactly – builders have been a little pessimistic lately but most of that is about regulations which are making it difficult for them to develop land and build homes. Local housing regulations will not end soon, or ever, and it would require the Federal government to take control of land use laws and free up land for development. Privately‐owned housing completions were 4.4% less in April than March’s estimate of 1,515,000 units. NIMBY’s are still a big force in housing and they won’t be easy to defeat across all states.

Home Buyer Mobility – Americans are being more mobile, meaning they will move to find a house, and they know that their dream home might be far away in another city or state. 72% of baby boomers just want to live somewhere else and they’ll be selling their home, and 64% of Millennials want more space to live. Many are looking for cheaper housing for sale and lower income taxes. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming are the states with no income tax.

Demand in Particular States is High – Idaho (27.2%), Arizona (20.4%), and South Dakota (19.3%) have seen the highest price growth i the past year. Montana, Utah, Vermont, Indiana, New Hampshire saw prices rise 18% or more as well.

Demographic Profile of US Home Buyers – millennials using bank of mom and dad, inheritances to buy, and older homeowners wanting to trade their home for something else in tune with their retirement needs, and other from 25 to 55 still moving to get more room (work from home). If prices should stay flat and being to turn downward (2023) then baby boomers will sell in higher numbers. Since prices keep rising and they have nowhere to go, they will hang onto their home longer. If builders are only building high end priced homes and not enough inventory exists in Texas, North Carolina, Florida, Tennessee, and Arizona, then baby boomers will have to wait to sell their home. That waiting encourages home prices to rise.

Apartments and condo markets becoming tighter – due to affordability issues and those needing to get closer to workplaces.

Interest rates and mortgage rates staying steady – Lots of talk about rising interest rates, most of it to intimidate prospective buyers to get a mortgage now and start bidding. See more on the US housing market now.

California Housing Market | Atlanta Housing Market | Oregon Housing Market | Boston Real Estate | Housing Market Downturn | Los Angeles Housing Market | San Diego Housing Market | Housing Market 2024 | Florida Housing Market | Toronto Housing Market