Google Finance vs Yahoo Finance

Two of the most handy, searched for, and quick stock market references are Yahoo Finance and Google Finance. For investors looking for today’s stock market stories, news, and latest stock quotes, these two are the two primary sites they access.

There are other sources which provide extensive data such as Barchart and TradingView, which are very good resources to subscribe to. Google Finance and Yahoo Finance have the latest news for today, this week and for the longer term outlooks. Let’s review and compare these two financial information portals.

And while billionaires, bankers, retirement fund managers and hedge fund managers have the scale and inside information to improve their chances of earning profit from buying and selling stocks, small investors are still undeterred. Much of the growth in the stock market is attributed to new individual investors. This has spawned big usage of Yahoo Finance and Google Finance as well. They are two of the most trafficked stock and investment websites.

Most young investors are keen on using info gleaned via Yahoo or Google in their quest for investment riches. Some are even copying the investment strategies of the top hedge fund managers.

There is intense competition for finance-related audiences online. With the demise of network television and the transition of consumers to online channels, competition for finance related news and advisory and investment services sites continues to heat up.

First Stop: Yahoo Finance or Google Finance

Your choice between the two might be on what your needs are. Yahoo Finance is an extensive resource covering all markets, stocks, and commodities. Stories however aren’t extensive enough and tend to focus on big caps such as FB or GOOG or TSLA rather on more accessible and more profitable small caps which you typical find in the hot stocks listings.

There’s a lot of coverage of more sensational, click bait stories that mar the investor user experience. It’s better to find a reliable stock market news site that provides fresh commentary and has a small investor focus.

If you’re one of those investors, check out posts on best stocks to buy, trending stocks, best tech stocks to buy, best 5G stocks and coronas virus vaccine stocks for good upside potential. See also day trading success, Dow Jones forecast, NASDAQ stocks to buy, and about stock price volatility.

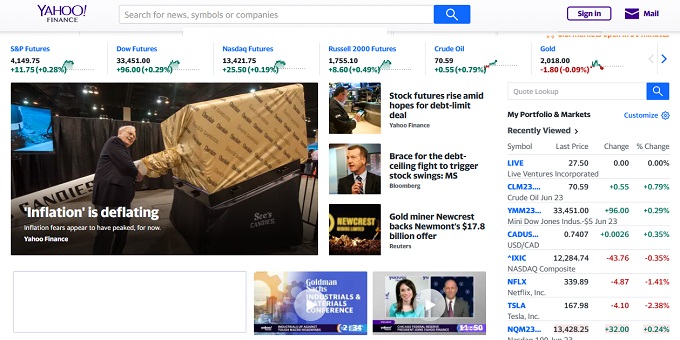

Yahoo Finance is credible, reliable, website with daily stock price stats, insight reports and blog posts, along with interviews with leading investment experts. Their live internet based Yahoo Finance Live show is well watched and highly regarded.

You can get the latest stocks prices, see the top gainers and losers, and dig down into corporate earnings reports and see stock advisor expert’s buy sell recommendations. It’s free to join and set up your own stock watch list.

Checking out Earnings Reports

Yahoo Finance has a handy listing of all companies reporting earnings this week and much more. You can read up on Google stock, Bitcoin, oil prices, and even Elon Musk and the Tesla stock price earnings outlook.

Who is Yahoo Finance?

Owned by Verizon Media, Yahoo Finance is the largest new media site in the US. Yahoo Finance competes directly with Google Finance, MSN Money, Investing.com, MarketWatch, thefool.com etc for financial news dominance online.

Yahoo Finance has launched a very popular video channel on Youtube called Yahoo Finance live.

Yahoo Finance offers a premium subscription service at $34.99 monthly or $349.99 annually. First-time users can try the platform free for 28 days. The service is aimed at retail investors with advanced technical charting, portfolio management, live trading services, and expert stock analysis.

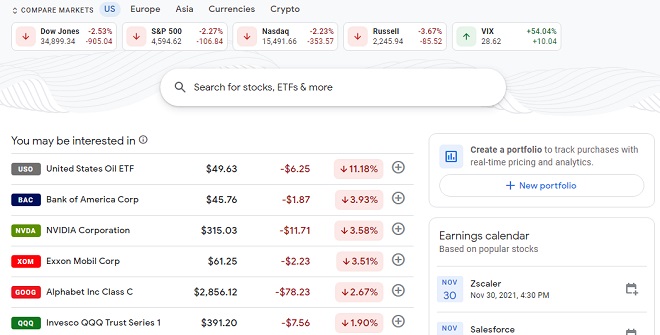

Google Finance

Google Finance at this point in time, is a very simple service that lists live stock prices, offers top trending news stories, and gives the visitor a chance to set up a stock watch list. The site also provides local and international finance stories.

The traffic success of Google Finance is a head scratcher given it doesn’t have the info or services or reputation to justify such a huge audience. Could be when investors do a search for Google stock price, or through advertising, they are lead somehow to the Google Finance website. It doesn’t compare to the information available via Yahoo Finance or big stock market information sites such as Barchart or Motley Fool.

The priority with Google Finance is allow users to check stock prices quickly and see how the major markets are performing. It’s quick, ease to comprehend, compared to Yahoo Finance which often has a lot of coverage which can overwhelm most retail investors.

Why the Huge Growth in Retail Investors?

There are a number of reasons for the huge growth in small investors. More people are investing in 401k’s and they’re not keeping their savings in cash in the bank because interest rates paid are about zero. And with the US dollar falling, more small retail investors are looking to buy stock. They want to manage their own portfolio of equities.

And they’re relying on the best stock market information sites to keep them informed of economic trends, market trends, technology news, political news, expert opinions, and make their buy, sell or hold decisions.

It’s all about reliable market data and good stock investment advisor advice. From Jim Cramer to Warren Buffet and endless selection of investment managers and stock market experts, small retail investors feel these finance sites are sufficient to give them ad edge.

Lots of Competition in Stock Market Information Sites

They typically visit websites such as Yahoo Finance, Google Finance, the Motley Fool, Bloomberg, Money Morning, Kiplinger, Morningstar, Seeking Alpha, Wall Street Journal, the Street.com, investors.com, Marketwatch, Forbes, Zachs, Merrill Edge, Advisor Perspectives, Charles Schwab, and numerous stock market forecast blogs including gordcollins.com.

Did any of these investing websites help investors see the stock market crashes in big sell offs? Those days of big losses are major loss events for 401ks and hedge funds. A good investment site should be up on the effect of health pandemics, and the effect of media coverage of economic and business events.

Any investing advice offered on news sites has to be taken with a grain of salt, because they are often focused on building clicks and transactions instead of definitive advice that might cool investors activities.

The number of investment websites is dizzying as are the articles, charts, stock profiles, and investment strategies they provide. The sheer volume of stock market information available confuses even the best. Most often the experts use a defined strategy and stick to it. That’s what they know, and have experience with.

But new investment vehicles and strategies are available and given the volatility of the markets and the political uncertainty driving it, old investment strategies are suffering. Right now equities are the place to be and the big stock market information sites offer info on on all stocks on the S&P, Dow Jones, NASDAQ, and Russell indexes.

Check out the latest Google stock price, Facebook stock price, Amazon Stock price and Tesla stock price.

Yahoo Vs Google in the Finance Sector

So how about Yahoo Finance and Google Finance? They’re two of the most popular general stock market investing information sites? Yahoo Finance is by far the most well known due to the fact it’s been in operation for 23 years, while Google Finance is relatively new.

Google Finance is struggling to provide better services and greater coverage than Yahoo Finance, yet with Google’s financial might, it may focus in on Finance at some point to grab up greater market share.

It’s not inconceivable that they would challenge the services of financial advisory and stock trading firms including Motley Fool, Bloomberg, Money Morning, Kiplinger, Morningstar, Seeking Alpha, Wall Street Journal, the Street.com, Investors.com, Marketwatch, Forbes, Zachs, Merrill Edge, Advisor Perspectives, Charles Schwab, etrade, Merrill Lynch, Bank of America, TDAmeritrade, Questrade, and other online stock trading companies.

What are Retail Investors Pursuing?

The mood for retail investors is for growth stocks. Some are investing to gain some income but most are likely playing the market like stock day traders – to make a quick fortune.

Experts comment that retail investors are making the stock market volatility and susceptible to crashes, yet this is the new reality — self-directed consumer services. All the finance apps being created for retail investors attests to where the finance market is headed.

There are a lot of investment analytics tools out there, yet the average investor likely can’t comprehend all the data available.

Good investing still comes back to good advisors who are up to date on the current political, economic, and market trends. Charles Schwab and Merrill Edge are two services to look into which are entering the retail space with products and services for self-directed investors.

The Motley Fool (fool.com) is perhaps one of the best for their daily in-depth coverage of stock price trends, news and investing tips.

For quickly keep up on the stock markets and trending stock news, I would lean toward Yahoo Finance because of its exhaustive range. It’s search results aren’t as heavily filtered and processed, meaning you’ll get a wider array of opinions of all sorts.

In any media, you’ll get very biased presentation of events, trends and values. In open ended free market, unprocessed search results, you’ll get more topically relevant and helpful news reports. Unfortunately, Google news is almost useless in presenting viable finance related news. This is why investors choose Yahoo Finance.

Yahoo needs to simplify their user interface to allow users to screen out what they don’t want, thus allowing each person to focus in on charts, news and services they do want. Yahoo could monetize this site much better. An alliance with the fool.com would be an excellent match for finance and stock advisory services and for the retail investor audience.

Will any new stock investment website arise to challenge Yahoo Finance or Google Finance?

More interesting insight: Stock Market News | Stock Price Quote | Best S&P Sectors | Stock Market Today | Stock Market Crash Predictions | Will Stocks Prices Fall? | Stock Market Forecast 2024 | Best Oil Stocks | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates | S&P Forecast for 2024