All About Short Term Stock Price Volatility

The stock market is unique in its difficulty with short term volatility. Even the Dow Jones blue chips surge up and down. It seems not much is safe from the volatility roller coaster these days.

Stock prices are a reflection of estimates of future value. When negative news hits, investors bail out and prices plunge. Volatility has a big effect on stock investing, which stocks to buy and timing of buys. It’s posed as an investment factor or signal (of crashes too) and truthfully, these volatile movements do indicate a lot about investor values and confidence.

Is stock price volatility a warning, a guide for long term investment or a source of big profits for day traders? Does volatility in stock prices foretell of something short term, or is it really telling us how to invest long term?

Volatility is a big topic, discussed by technical experts and market psychology strategists alike. Let’s ease into this topic now and find out how you can dig down more info and professional advice from advisors.

Last week’s big losses after weeks of solid gains, shows volatility is a factor affecting stock portfolios. And when we’re in the midst of big economic shifts, you see big divides in optimism and pessimism in investors. It’s a struggle between the status quo and moving ahead.

If the economic outlook is good, the optimists will win out, so money could be made on this turbulence. Pessimists lose their money.

You could use volatility as an aid to smart investing, or you could dive right in as a day trader and get some quick wins on the NASDAQ, S&P, or Dow markets.

Should you overlook stock price volatility and invest long term only? Day traders love it. Of course, some of them lose their shirts. Stock day trading is for gamblers, with really good data, or for those who have some pet stocks they know well.

What Does Stock Price Volatility Mean?

Consider what short term price volatility represents. It’s an immediate crisis of confidence in long term investing and future stock prices. It means investors are struggling with a factor (or factors) that could change the direction of the market forever. Volatility is about risk of investments in sectors, stocks or specific markets.

Volatility can signal where the markets are headed. Low stock price volatility often means the market is headed up, while high volatility reflects threats and earnings issues, which means fear wins, and prices fall.

Since volatility usually hits the Dow Jones, S&P, Russell and NASDAQ equally, it tends to reflect big picture fears right now. Some investors might feel it isn’t a temporary loss, but rather something that’s going to have longer term impact such as new jobless numbers, consumer spending, or trade relations.

If retail investors, day traders and online stock investors disappeared, would stock volatility still happen? Yes, even if the retail crowd are less educated, institutional investors are trimming and shedding stocks all the time. Stock prices plummet and stock markets crash before retail investors are even aware of what’s happening.

How To Reduce Volatility Losses

And let’s not forget that a bear market is the worst kind of volatility and we could easily see a big correction in the next 3 to 4 months.

- check which sectors have lowest volatility over past three months (corona virus period)

- diversify with etfs

- use hedging with the least volatile safe stocks

- consider hedging with options

- buy stocks listed on the Dow Jones

- use a risk management services such as Lightspeed Risk Suite

- sell stocks and buy real estate

Covid 19 Risk to Stock Prices

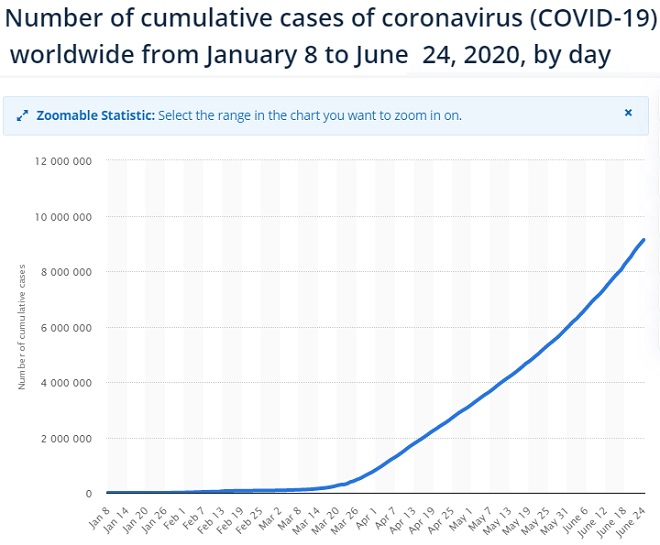

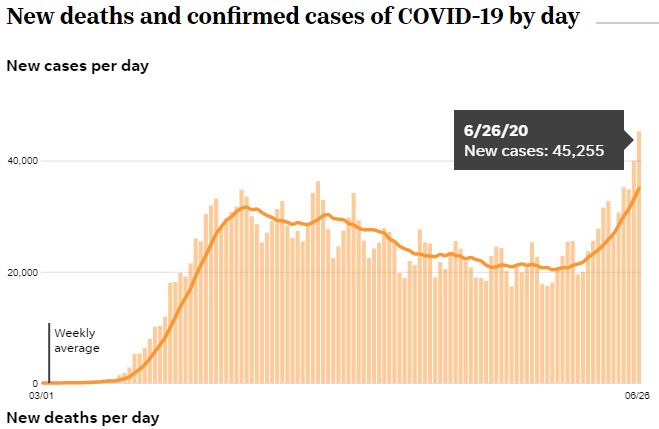

Take the spikes in Covid 19 infections for instance as a key volatility factor. Confidence about managing this threat is low. Management depends on cooperation and financial stability and there’s not much of that these days. People are betting on a Corona Virus vaccine which may not even happen. So the record level infections in California, Texas and Florida did deflate the markets last Friday.

Now investors are thinking that young people will not cooperate this summer with prevention and instead actually launch a devastating pandemic trend.

And should Democrats block additional Covid funding and needed stimulus, the economy could fall flat before it can get off the runway. So Covid 19 fears affect almost everything else. Even though China and other nations, and some US states have it under control, the looming fall season is in everyone’s radar.

Which vaccine company will produce the first Covid 19 vaccinations?

Volatility Makes You Uncertain of Your Long Term Strategy

So like a train conductor at the station ready to push forward, you’ve got a number of tracks you could follow. Volatility means there are a lot of investors who aren’t sure about which track to ride on (tech stocks, blue chips, energy stocks, medical services, transportation, real estate, ETF’s, bonds, etc).

So volatility can change the long term outlook and reflect bigger, deeper unexpressed fears about the economy, debt and consumer demand etc. Volatility is something to analyze. Some believe it can be used to predict the future price of stocks.

You can look for the best stocks to buy, focus on the Faangs (Amazon, Google, Facebook) who’ve proven their upward potential, or buy vaccine stocks, or look to the future with 5G stocks, or perhaps gold stocks since they’ve started to move. Depends on your own stock market outlook.

Of course, since many of you are considering day trading stocks, you’re wondering how to score some wins on the days highs and lows. Begin with a primer on stock investing and learn more about more about daytrading.

Stock volatility itself is a sophisticated market more like a long term stay at a casino, the exact opposite of what longer term value investors are invested in.

Covid 19 as the Top Source of Volatility

Covid 19 and social distancing are the big factors that affected the markets last week. And they’ll affecting the markets. There are more big disappointments coming. There will be a second wave in the fall when everyone moves indoors.

Investors have discovered slowly how virulent Covid 19 is and that it is passed through the air between humans. Yet, there’s not much talk of air cleaning and disinfecting systems that will control it. So you have a bad source yet no mention of what would contain it.

Imagine taking a commercial airflight, amusement park ride, or attending an MLB baseball game and breathing in others exhaled air. How about returning via the subway to an office building using elevators into 8 hours of stuffy coworking spaces?

There’s lots of risk, but no real authentic system and hands on training (and enforcement) to control infections. This erodes everyone’s confidence including stock investors.

The risk of exposure is often outweighing the social distancing measures. It’s obvious our systems, workspaces, and habits aren’t working to keep the virus at bay.

Now imagine millions of young people heading the to the playgrounds, bars, and beaches, deliberately disobeying Covid 19 prevention guidelines and laws, and you can see a second wave as a likely outcome. This would result in businesses closing and new patients overwhelming city services.

Pandemic Financing

Further volatility factors come in the form of government funding problems, a Trump election loss, and a collapsing trade relationship with China, and the volatility pressure gets intense.

On the upside, is that a formerly sizzling hot economy is getting rolling again. If workers and business owners can learn to do business without contracting Covid 19, then what reason would prevent the stock market indexes from roaring to new highs?

Employment, GDP, new manufacturing in America, new housing construction and home sales, are giving upward momentum on the mood and stock price rises.

Perhaps investors are ahead of us in this thinking because the markets are reach new highs. And new stocks to buy are being discovered, stocks which have Covid 19 immunity (Cramer’s Covid index) or which benefit from the crisis such as the vaccine stocks.

There are new treatments and drugs for Covid 19 too which helps buoy investors investing in S&P, NASDAQ, Russell, and Dow Jones stocks. See the Dow Jones Forecast.

What gives the Covid 19 threat such weight as a threat:

Media Hype Celebrates Fear and Doom

These numbers are published frequently on the media, yet the media doesn’t cover handwashing, disinfecting systems, and social distancing very often. The weight comes from the frequent publishing of numbers, boosting a feeling that we’re all doomed. Thanks media.

Best Way to Deal with Stock Price Volatility

Don’t run around like a day trader trying to find specific stocks to buy. Even Cramer suggested picking specific stocks, but really for an average stock market investor, that’s unwise even if you’re just buying Dow stocks. Putting all your eggs in one basket is risky.

So before you buy after let’s say checking the latest Apple stock forecast, Google price predictions, Facebook stock price outlook or Amazon stock price quotes and moving averages, look for indexes or funds that avoid Covid 19 setbacks.

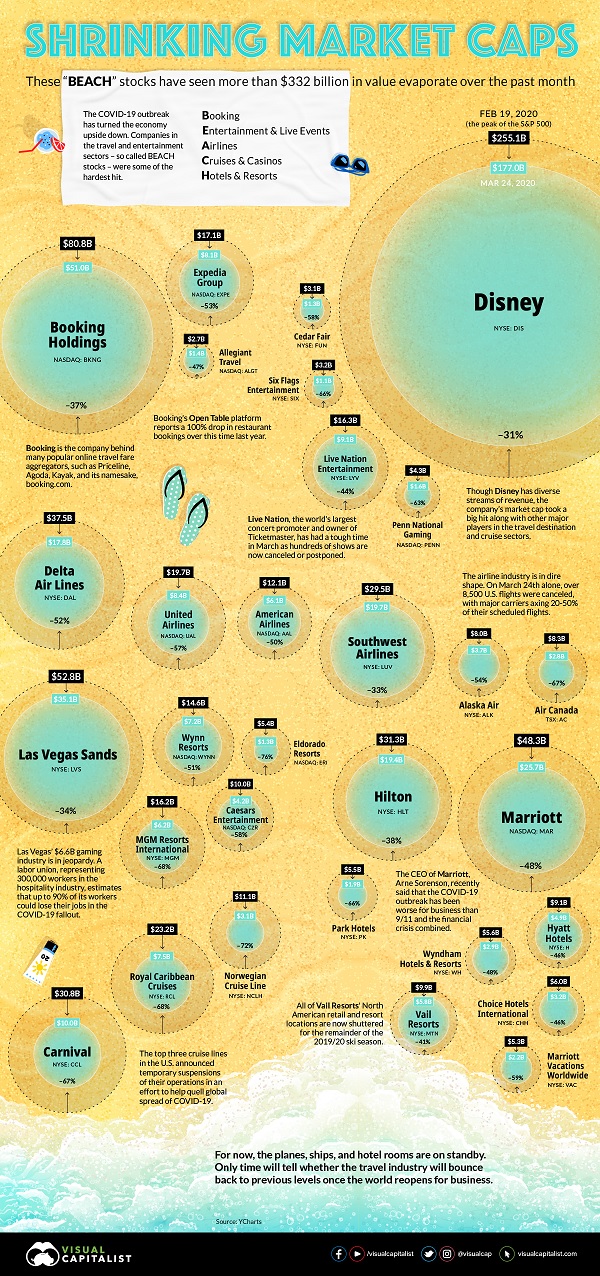

Those companies who can sell regardless of Covid 19 are likely the ones you want. That excludes airline stocks, pro sports, theme parks, casinos, vacation resorts, restaurant brands, hotels, downtown real estate, small business retail, and booking services.

Have a gander at the Visual Capitalist’s excellent infographic covering the most affected stocks. It’s 3 months old but still highly accurate.

For more information on stock market volatility, self-directed investing, and day trading, please see these sites: lightspeed.com, Marketwatch, Bloomberg, Fool.com, Merriledge, TDAmeritrade, Ally.com, Nerdwallet, Questrade.com, Schwab.com, etrade.com, Wellsfargo.com, Investorvest, Warriortrading.com, Interactivebrokers.com, jasonbondtrading.com, wealthsimple.com, Barrons.com, fidelity.com, zacks.com, Robinhood, fortrade.com, stockinvest.us, investors.com, investorjunky.com, kiplinger.com, investorplace.com, investorplace.com, BMO Nesbitt Burns, Royalbank.com, CIBC.com, and benzinga.com.

Stocks | Tsla | Stock Market Tomorrow | Real Estate Housing Market | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ Forecast 2024 | S&P Predictions 2024 | Stock Prediction