Gold Price Forecast: Back up to $2000 an Ounce?

Looking back on Gold’s performance the last few years, the gold promoters got it wrong. Investors did not seek it out as a haven. However, if turbulence hits, gold’s attractiveness as a hedge grows. Right now, the prices is rising. But will it head back up to $2000 an ounce.

Experts on Gold keep providing the same rationale, and points about Covid and recession, but the US economy seems particularly resilient. There is a lot of money floating around and at any time, Gold could become buyer’s object of affection. Right now, the trend is upward.

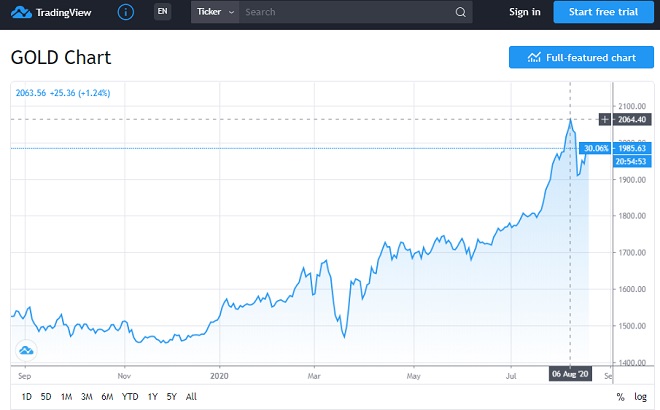

This chart from AG Thorson of FXempire shows gold is in a bull market. Look where Gold is coming and you can understand why buying gold stocks years ago has now paid off.

Are gold stocks and etfs going to be your best investment vehicle this year? Well oil prices and stocks were looking good too before the latest economic setback and Corona Virus effects. Is it enough to send investors over to Gold?

So odd that Gold is rising at a time when the stock market and new construction housing market look so good. VanEck’s CEO John VanEck believes it will climb as long as interest rates stay low.

Tom Lydon, CEO of ETF Trends also believes Gold supply is declining and mining is more expensive which helps drives Gold price higher. And Ben Carlson, director of institutional asset management at Ritholtz Wealth Management believes a low US dollar can juice up the price of gold.

Gold Price Falls did pass $2000 an Ounce

Yes, the experts as far back as a couple of years ago were forecasting a high gold price and it came to pass. There is much more money in the system to chase Gold (and silver). And with concerns about China’s supply chain disruption (most countries are dependent on it) due to the Corona Virus outbreak, investors could turn to Gold, platinum and silver as hedges against a recession in anywhere outside the US.

So is the upside really good this time to buy gold, gold etfs, or good miner stocks?

Will the Corona Virus Bring Down the Markets?

The latest report from fxstreet says this:

Economics, the coronavirus could cost the global economy more than $1 trillion in lost output and knock 1.3% off global growth this year if it becomes a pandemic.

Jim Cramer of Mad Money is wary of the Corona Virus, but sees some positives and ways to hedge against the threat. He’s turning bullish on Gold.

The point of that is that the virus if continued, could continue to plummet economies and push the world into a recession. I think the question then would be whether the corona virus can be contained.

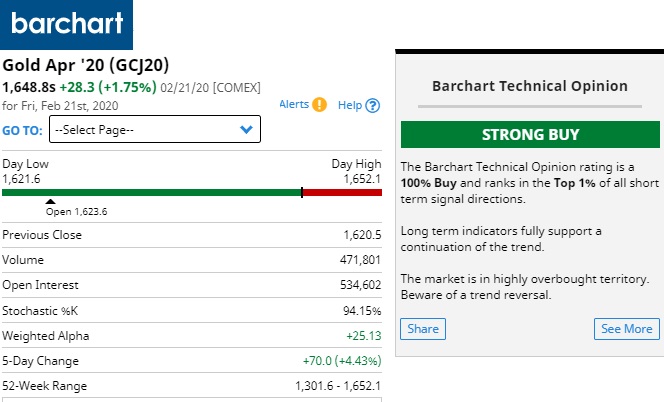

The experts say gold is overbought with a correction due, and that it will face resistance at $1700 an ounce. But this is all technical analysis. The price is driven by GDP stats, trade news, and about the Corona Virus spreading into new countries. Just shutting down China’s manufacturing production for a few months is a big factor.

With global economies facing recession, will countries allow Chinese imports that could flood in after the pandemic?

Cambridge House Gold Predictions

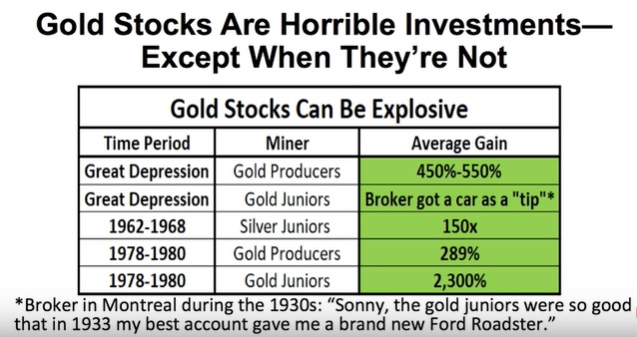

Definitely watch this video from Jeff Clark of Cambridge House International. He explains how and why the price of gold is climbing now. His forecast is starting to look pretty accurate. Should you buy gold? The question might really be which gold stocks should you buy?

Jeff advises to look for gold mining companies on the verge of developing big gold deposits. And if these companies have no debt and have bought up their assets cheaply in the past 10 years, all that much better!

His Best Gold Stock Picks? (Silver too, although he doesn’t touch platinum)

- Pure Gold (symbol: LNRTF)

- Gold Mining Inc. (symbol: GLDLF)

- SilverCrest Metals (symbol:SILV)

- MAG Silver (symbol: MAG)

- Renaissance Gold (symbol: RNSGF)

Sure the prices of gold (and silver) might keep rising, but perhaps not enough to make a good profit. Gold is trading right now at $1600 an ounce. If it rise to a record $2000, you’ll only make a 25% gain. If you buy one of the stocks Jeff talks about for instance, you might see 3 to 10 times your initial investment.

What is Barchart’s technical recommendation for gold: Strong Buy

Why is the Price of Gold Soaring?

Speculation by the big fund managers around the world hasn’t even started yet. They will be looking to buy the stock of big gold producers (above 1 million ounces per year) and there are many top producers who produce more than that.

Again let’s recount the reasons:

- fear of a recession

- bad news such as economic shocks and stimulus payment standoffs

- lots of money market cash

- scarcity of gold amidst supply shortages

- speculation

- low USD

Cambridge House Gold Forecast

As you saw in Cambridge House International’s Jeff Clark video, he was bullish on Gold and knew nothing about an upcoming virus or other catastrophe. If China’s economy collapses, along with Asia, could it set off tensions? If the price of oil plummeted, what chain of events would it set off in the Middle East?

Gold climbs when there’s a threat to economies. All economies outside of the US are looking rather glum with the end of globalism. They are outside the US looking in. Now that China’s production capacity is locked in, China’s GDP is plunging. And so is the rest of Asia.

With debts raging and a virus shutting down production across Asia, could the short term price of gold rocket much higher?

The Corona Virus outbreak is threatening to become a pandemic. If it spreads throughout Asia and India, and then into Africa it could create devastate the world economy. Central banks may have to raise rates to pay their bills, against plummeting revenues.

It may not be US buyers that are fervent about gold, but the rest of the world, including Chinese and Japanese investors, it might look really good.

Is the Stock Market in a Bubble?

The US stock markets are strong, based on a solid US economy. The DOW, S&P, and NASDAQ have all hit new records. This however we caught a glimpse of a response from investors. A little nervousness from being on the highest peak of price chart. Will investors panic, or is the US stock market a haven, just like like gold?

Keep in mind that many stock market experts believe US equities are highly over valued with high price to earning ratios. That could be a bubble ready to collapse. It’s not likely we’ll see a US stock market crash, yet this week we saw the DOW fall strongly. In the last 6 days, it’s fallen 500+ points.

Forecast Stock Market | Tsla | Will the Stock Market Crash? | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ Predictions 2024 | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Trading Platforms | Stock Trading | Reverse Mortgages | Low Mortgage Rates Today | Best Dow Jones Stocks