USD Dollar Forecast | Foreign Exchange Rates

USD Forecast

Today’s jobs report (rise of 2.3 million new jobs) acted like its own protest against economic oppression. So many calls for bad job reports, crashing stock markets, and a failing economy.

A very deflated Democrat party tried so hard to talk the economy down, and brought in all their media outlets to push it. The full power of major news media all got crushed today.

This means the USD forecast is for a rebound, despite the temp slide. The big news is the failure of the media to derail the economy. There opportunity is gone. You may want to sell your gold stocks.

Betting Against America’s Timeless Spirit is Not Wise

Europe, China, Middle East and Russia aren’t good options. And that’s what currency traders will be thinking as 2020 passes and we head into 2021. The US dollar is the world business standard and it’s grossly underrated.

Once the price of oil rises to $50, the shale sector will be revived, and the US China trade war ensures manufacturing will grow faster.

Now the tide has genuinely turned. After the worst of the pandemic, the economy is rocketing. The hidden stat in this weeks turmoil is the lower USD. Currencies rose against it, but is this going to last with the US economy rocketing back to its recent highs in March?

Foreign exchange is a $5.1 Trillion business and likely will be for many years, despite the rise of bitcoin and ethereum cryptocurrencies.

Where to Buy Foreign Currencies?

Where to Buy Foreign Currencies?

For travellers, the difference in cost is minimal. Vacationers might want to use their credit cards and ATM machines, or buy currency from their banks to get best USD conversion rates. Buying from currency exchange retailers, at the airport, or at a destination retailer might be the worst way, although it may be convenient.

For international businesses buying and selling across borders, particularly large corporations, the matter of currency exchange rates and exposure to foreign currency fluctuations is about managing large financial risk, and easing high forex commissions.

Needing to buy forex at a future date is common in international business, creating what’s called currency exposure and not managed carefully, it can erase profit on an international shipment of goods.

Foreign Exchange Management Services for Businesses

Forex as it’s called is an interesting market and a popular one for investors wanting a little profit from speculating on currency volatility. During turbulent times in business, currency exchange rates vary and that’s when current traders seek to play the forex market.

Businesses need to work with a good foreign currency exchange company (forex company) to help with good decisions and on forex forecasts and planning and perhaps find a better exchange rate for US dollars, CAD, Euros, Yuan, British pounds or Mexican Pesos. The effort is worth it.

Forex experts have foresight in foreign currency exchange rate forecasting. They know the trends and help you avoid losses. And if you’re buying real estate including rental income property in another country, there may be tax implications to review.

Companies that advise on international business trades use various brokers and advisors to manage the purchase and sale of property and goods overseas. A good forex advisor can help with currency rate predictions and make the transactions troublefree. There is a risk of not getting paid in the realm of cross border trade.

If you’re involved in buying a foreign real estate asset and need a sizable purchase of foreign currency, don’t rely on a foreign exchange app or currency calculator to guide you. Foreign exchange requires a little more strategy usally involving currency hedging.

Are you Buying rental income apartments in Los Angeles, San Francisco, San Diego, Miami, Seattle, Boston or Houston?

Exchange Rate Advisors

Who has the authority, credibility, experience, data, skill and trustworthiness to advise you on your currency exchange rate decisions? That is the question. Would you trust your local bank branch representative or an online forex company you don’t know?

And if they are a reputable firm, they will ask for a percent commission on trades which will eat into your profit.

What is Forex?

The exchange of currencies and managing currency exchange rate risk is the realm of forex. Forex brokers typically serve commercial businesses such as real estate companies and stock market investment firms, helping customers exchange currencies safely.

There are currency risks and legal risks in exchanging money across borders. In many cases, companies use hedging strategies to avoid losses from sudden currency drops and fluctuations, which after all, could cost a business tens of thousands of dollars.

If you’re a traveler looking to exchange USD for Pesos, Euros, or Yuan, then it should be easy enough to check how much your money will exchange for with a currency calculator.

If you’re an investor, you may want to check currency rate forecasts to see what you’ll need to pay when you take possession of your home, land, or other asset.

Forex Brokers — Facilitating Business Currency Exchange

Forex brokers are non-bank companies who deliver currency exchange and delivery to bank accounts including international payments. Forex firms are distinct from companies who offer currency transfers to another country.

And they are distinct from a forex trading firm which are one involved in trading of currencies for speculative profit just like investing in the stock market. The term forex may be used to describe global payment providers or speculative traders.

If you’re in Canada, you’ll want to look for a Canadian forex company such as Cambridge Mercantile which is not only a forex company, they provide hedging strategies, and global payments service. They were a client of mine, in Toronto so I know a little about them.

In the US, you could use Tempus US, a global payments provider or Commonwealth FX who have offices in New York, Los Angeles, San Francisco and Washington.

Online Currency Exchange

Should you use some of the many online forex or foreign currency exchange companies in operation today. It all would depend on your appetite for further risk. If you’re exchanging large amounts of currency, or have complicated transactions, it might be wise to choose a larger, reputable firm with sufficient insurance and experience to prevent losses.

Forex Trading

Enter currency exhange rate speculators and fx traders. It’s a risky business, but can be lucrative. There are few markets more complex than forex, with some companies using artificial intelligence algorithms to foresee currency exhange rate fluctuations.

Investors can make a lot of profit on currency fluctuations. When the Canadian Dollar drops for instance, investors typically sell quick to buy USD. You’ll want to be very familiar with exchange rate trends and the factors that cause fx rate changes. These investors buy short and sell long which is risky business.

If you have an appetite for risk, you can open an account for forex day trading with companies such as Questtrade, FXCM, or XE.com. This is more or less gambling.

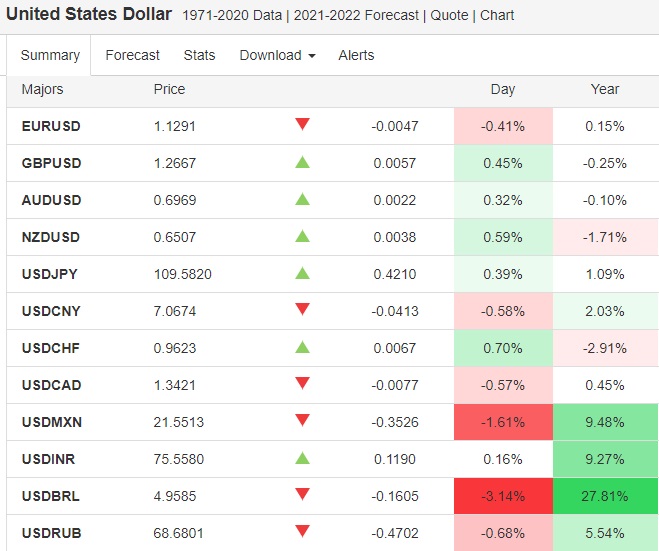

Current Forex Rates

| Currency | Price | % Change | Day | Q1/18 | Q2/18 | Q3/18 | Q4/18 |

| EUR/USD | 1.2371 | 0.0039 | 0.32 % | 1.21 | 1.19 | 1.17 | 1.15 |

| GBP/USD | 1.3963 | 0.0057 | 0.41 % | 1.35 | 1.32 | 1.3 | 1.27 |

| AUD/USD | 0.7892 | 0.002 | 0.25 % | 0.78 | 0.77 | 0.75 | 0.74 |

| NZD/USD | 0.73424 | 0.00484 | 0.66 % | 0.71 | 0.7 | 0.68 | 0.67 |

| USD/JPY | 106.9 | 0.5 | 0.47 % | 112.72 | 114.79 | 116.9 | 119.06 |

| USD/CNY | 6.3184 | 0.0017 | -0.03 % | 6.5 | 6.56 | 6.62 | 6.68 |

| USD/CHF | 0.94471 | 0.00289 | -0.30 % | 0.98 | 1 | 1.01 | 1.03 |

| USD/CAD | 1.28438 | 0.00028 | 0.02 % | 1.27 | 1.29 | 1.31 | 1.34 |

| USD/MXN | 18.5292 | 0.0514 | -0.28 % | 19.34 | 19.9 | 20.47 | 21.06 |

| USD/INR | 64.895 | 0.095 | -0.15% | 64.09 | 64.69 | 65.3 | 65.91 |

| USD/BRL | 3.2448 | 0.0168 | -0.52 % | 3.31 | 3.43 | 3.55 | 3.67 |

| USD/RUB | 56.6437 | 0.2112 | -0.37 % | 57.95 | 59.5 | 61.09 | 62.72 |

| DXY | 89.76 | 0.14 | -0.15 % | 92.94 | 93.86 | 94.78 | 95.7 |

| Data Courtesy of Trading Economics | |||||||

Currencies to Exchange

Not only can you exchange or trade in USD, CAD, AUS, EUR, YEN, or Yuan, you can also buy and sell bitcoin. Find a good live currency exchange rate calculator or bitcoin calculator.

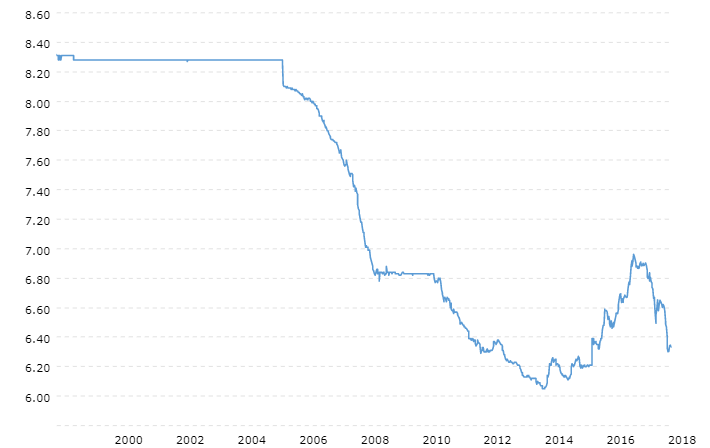

Currency Exchange Rate History

Three currencies dominate foreign exchange: Chinese Yuan, Euro Dollar and the US Dollar. The USD is considered the gold standard for most businesss in global trade. These three historical exchange rate charts show how each currency has fared against the USD during the last 20 years. Overall, the USD have risen against a basket of global currencies which have weakend in value.

US Dollar Forecast

Will the US dollar rise in value? Given the strength of the US economy, repatriation of investment money back to the US, Jobs and Tax Cuts Act, and the insistence of the US President to persist in fair trade in commerce means the forecast for the USD is to rise against world currencies.

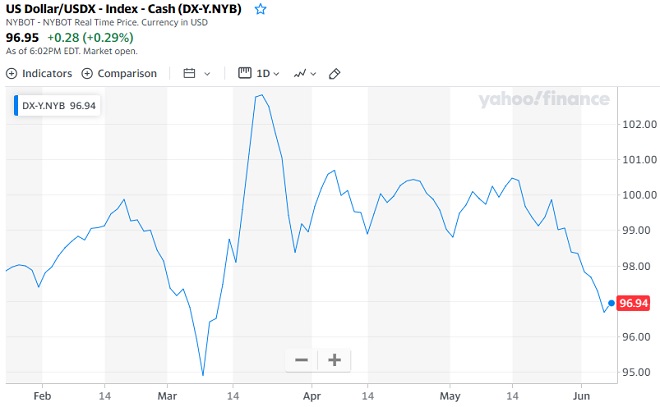

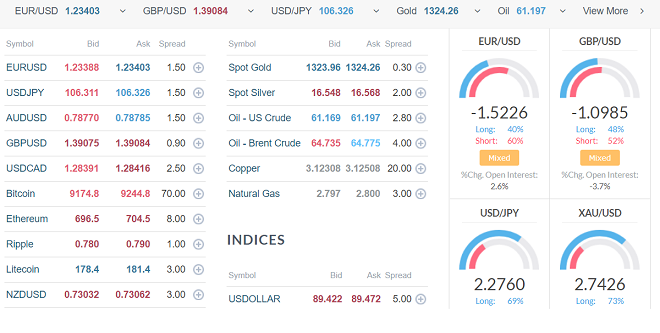

You can check the latest forex rates on Yahoo Finance or Dailyfx.com where you’ll see charts such as this one, updated live. It covers the new cryptocurrencies including bitcoin and ethereum.

Check the USD/CAD forecast if you’re buying rental income property in the US. Don’t forget to look at 2021 housing market predictions in your neck of the woods.

3 to 6 month Forecast for the Dow S&P NASDAQ | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News