Breaking Up With China

With a multi-decade, institutionalized export of money and technology, the US is long overdue for a return to freedom for its own burgeoning economy.

The reshoring of US manufacturing and the protection of valuable technology will boost US GDP, reward investment in the US, increase job growth, and raise the standard of living in the US. As the country has been grappling with neglect, homelessness and excessive taxation, it’s a beacon of hope.

Despite recent headwinds manufactured by the US Fed, it does give us optimism about the 5 year outlook for the USA. We can’t see how Biden will negotiate the route, but he’ll likely proceed like he does walking anywhere.

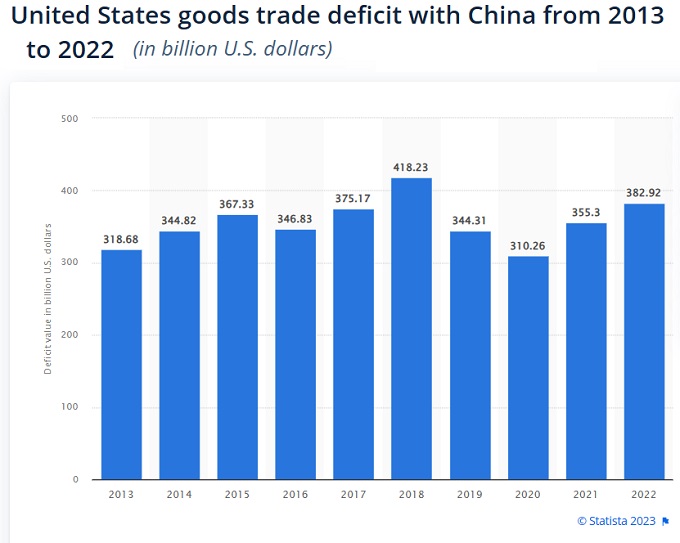

The insistence of corporations to outsource business to China and bowing to China’s unfair trade favoritism in the WTO has been disastrous for the world. But more so for the US which is now facing an unmanageable debt crisis with shrinking tax revenues and dubious investment opportunity.

China Favoritism Has Been a Plague in US Business for 2 Decades

The US media has portrayed China as the darling of the world suggesting it would become capitalistic and a free country. After more than 20 years, that has not happened. The experiment failed and the day of reckoning has arrived.

China’s economic growth, funded mostly by the US and Europe has been devastating for the culture, politics and economics of the free world. Now this decoupling of dependent ties is a challenge in its own right. Janet Yellen visited China recently to suggest President Xi shouldn’t panic.

Kyle Bass of Haywood Capital speaks on where China/US relations are headed.

The coming confrontation regarding Taiwan will surely seal the deal on a new cold war between the US/Europe and China. Xi’s insistence on taking over that nation totally disregards the economic fallout that will befall China if it’s that vindictive. Yellen didn’t comment on the Taiwan threat. In honor of her official visit, China’s People’s Liberation Army sent 13 aircraft and 6 vessels into airspace and waters around Taiwan.

Massive US Debt Threatens Everyone

The news that’s driving the US debt crisis concerns isn’t just with China, but also with most US trade partners. Reuters reported that the US trade deficit increased 23.0%, up 23% to $74.6 billion just in April. Goods imports jumped 2.0% and US exports fell 5.3%. 1/3rd or $24 billion was with China.

“The terms of trade are worsening and this will bring down second-quarter estimates of real GDP growth closer to the 1% stall speed where bad things can happen and the economy can stumble and go over the cliff,” said Christopher Rupkey, chief economist at FWDBONDS in the Reuter’s report.

US GDP did rise 2.4% in Q2 2023, however with high interest rates and squeezed money supply, we’re now looking ahead at a dangerous Q4 2023, and Q1 2024. There are plenty of market bears speaking of an economic slowdown and even stock market crash. This erodes confidence in the US economy, stock markets, and that might be hard to regain. With 5+ Trillion in held in money markets, it seems Americans aren’t too interested in risky stock market investments.

In my report, I laid out the many reasons why a 2024 recession can’t happen. Of course, fools can jump right into one.

Billionaires Still Looking for Loopholes in New US Trade Laws

As the ex-China trend grows, the wealthy will be trying to sell their multitrillion-dollar investments in the Asian Empire and salvage what they can. Many CEO’s and billionaires continue to apply political pressure, to discover trade loopholes to support their massive investment in China (tax reduction and higher profits), yet they are beginning to relocate production to Vietnam, Mexico and other non-US destinations. Their motto is clear — anywhere but the US.

US Economic Pain Simply Too Great

Aside from the massive, unpayable and growing US debt crisis, Americans are teetering on the brink of personal disaster. Any number of unplanned events could send the housing market, stock market and banking sector into a crash. Moody’s just downgraded the banks and Fitch Ratings just downgraded the US government itself.

As interest rates, mortgages, rent prices and energy prices stay lofty, a significant portion of Americans face default on their debts. The only way out of it, is to curtail imports from China asap.

The fact is, the US and EU must tackle this significant threat and help ease global economic tensions. For that to happen, they need to control debt, get finances in order and begin rebuilding their decimated societies and economies.

The break up with China is a significant and positive event that will lead to spectacular gains in productivity, infrastructure improvement and cultural rebirth. And as China adjusts, it will produce products at lower prices helping to ease inflation in Europe and North America.

Riding the AI Wave

The transition back to US economic prosperity comes just as the AI boom begins. And allowing China to control artificial intelligence in the military, economy and education sectors was a threat too significant to ignore. Lose this battle, and it would be game over for freedom.

As economic safety barriers are being erected to keep wealth in the US, new laws initiated by Joe Biden will help the US to protect its investments in technology. Theft by the CCP is another multi-trillion-dollar loss that just can’t happen.

These new trade laws (including restrictions on tech investments by or in China) are already cutting China’s economic outlook, and as their export output dwindles, they’ll be looking inward, perhaps to political change themselves. China is looking to transition to a service economy which is something they are entirely unsuited for. The next 5 years will be a challenging time for the communist-controlled country and may lead to significant political and cultural adjustments.

But for the next 5 years, China’s economy will shrink, as highly indebted countries around with world become more protectionist, seeking fairer trade agreements. China will desperately adjust its demands to be more equitable to its trade partners but they’re not known for equal treatment. Supply chains will be affected.

The development of new manufacturing facilities in the US (AI microchips) is already brightening the US’s economic outlook. Trillions of dollars are flowing into new onshored production facilities and this will generate significant economic growth for the next 5 to 10 years. AI and microprocessors are key to the next 20 years of growth worldwide.

So, far from a recession, this pro-US focus will produce an economic boom and push the stock markets to new, record heights. The outlook for NASDAQ listed companies is rosy and the Dow Jones will come alive by the end of 2024.

With US energy production increasing along with the alternative energy growth, the US can easily power its economic development. An investment in US oil stocks is one worth considering. Price/earning ratios of 2 to 3 offers an astonishing ground floor opportunity.

See more on the 2024 stock market forecast.

Stock Market Today | Stock Quotes | Stock Market Next Week | Best S&P Sectors | Stock Market 2024 | GOOG Stock Price | 3 Month Stock Market Predictions | 5 Year Stock Forecast | 6 Month Outlook | Dow Jones Forecast | NASDAQ Forecast | S&P Predictions | Housing Market Forecast | Travel Marketing Tips | Bleisure Travel Marketing | Travel Company Software | SaaS Marketing Strategy | Travel Marketing | Business Travel Marketing | Travel Author Gord Collins