Google Stock Price Outlook

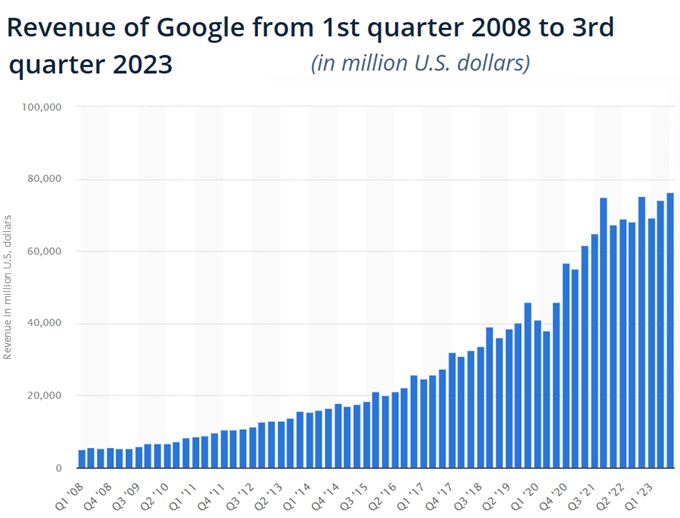

Google Alphabet is one stock many analysts are giving the green light on. The company’s stock has grown 59% this year and as you’ll read below, analysts believe it has continued upside.

Google is looking to cash in on Generative AI but a question remains as to how this will affect its advertising revenue. AI-powered search could reduce the number of search queries made by users, this resulting in less exposure to ads. However, Google is blazing trails in new profit centers.

Although earnings disappointed in October, the company’s strengths in AI, Cloud services, and of their search monopoly makes their 2024 outlook strong. It’s definitely one stock you should be tracking with your Google Finance account and perhaps be ready to purchase as the economy resumes in mid-2023.

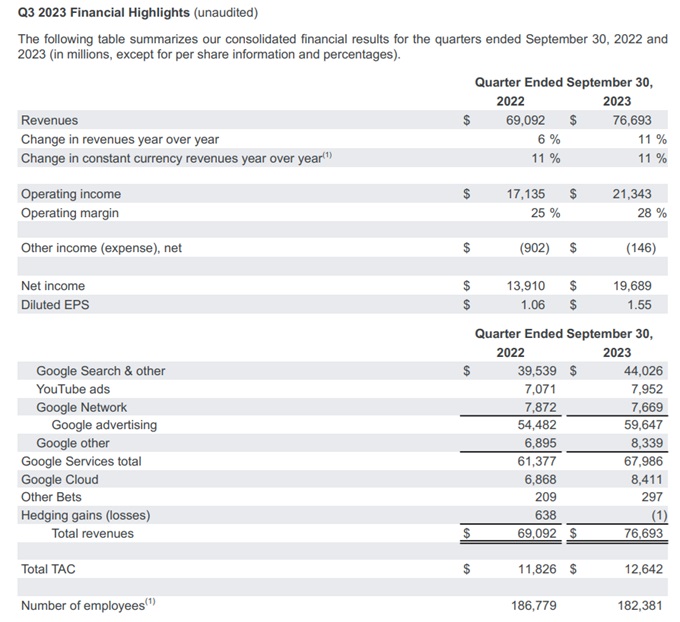

During Q3 2023, the company reported earnings growth of 11% to $6,493,000,000. Analysts had projected earnings per share of $1.46 on revenue of $76 billion yet it returned $1.55 per share. It’s cloud-computing revenue jumped 22% to $8.41 billion, just lower than analysts estimates of $8.64 billion.

Also, Google’s Q3 advertising revenue rose 9% to $59.6 billion vs. estimates of $59.1 billion. And YouTube ad revenue rose 12% to $7.95 billion above analyst’s forecasts of $7.82 billion. In Q3, capital spending came dropped by $1 to $8.1 billion, and the company $15.78 billion of its own stock, simiar to Q2, 2023. It’s Q3 traffic acquisition costs rose 7% to $12.64 billion.

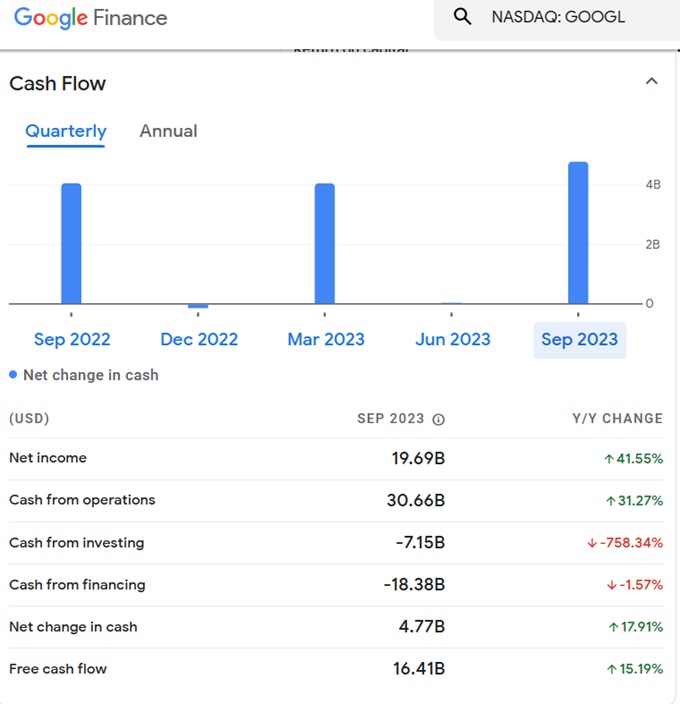

The company’s free cash flow grew 15% to $15.4 billion while cash from investing and financing fell dramatically.

2023 was a strong year for Alaphabet and given its market dominance, is a wise choice of stocks to buy for the next 5 year or 10 year period? It’s certainly one of the best AI stocks to buy. If you’re focused on the 2024 2025 outlook, then GOOG is likely to meet your investment requirements. As one of the highly bought Magnificent 7 stocks, it is seen as a good hedge against recession. Investors may shift their investment dollars to small caps on the Russell 2000 in 2024 as the economy picks up steam, however Google won’t be left out of the profit parade.

Some refer to Google as an artificial intelligence stock. The company continues to roll out AI enhancements to its money making products including Google Ads, YouTube, Search, Maps, and Google workspace.

Why is Google So Successful?

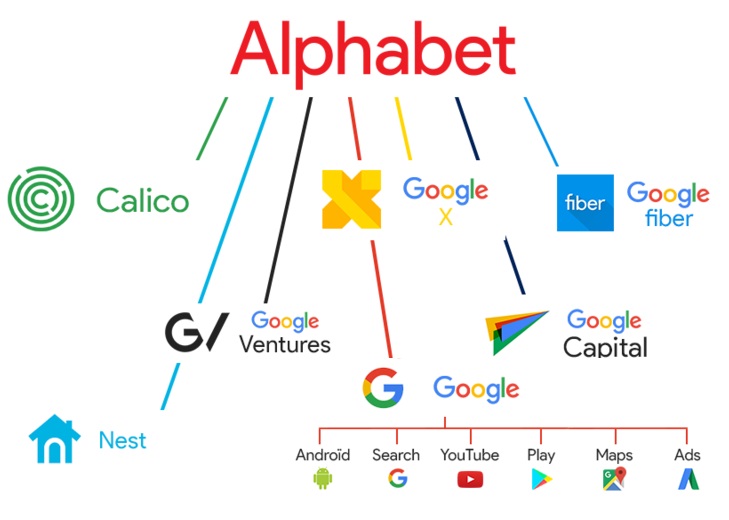

One key reason is the size of the company, its financial strength, monopoly power, diversification, and how it’s able to position itself at the center of digital business including its Google Play portal. Experts believe its commitment and investment in artificial intelligence gives it the biggest advantage for the next 5 years, although Microsoft is competing well of late.

It maintains its massive revenue pipelines and will definitely benefit from the US and Global economic recoveries when they happen. The firm is facing numerous monopoly and anti-trust accusations and lawsuits and these could result in massive fines, but likely not enough to hamper its ongoing revenue. Additionally, Google appears to be well behind Apple in providing smartphone or mobile device apps.

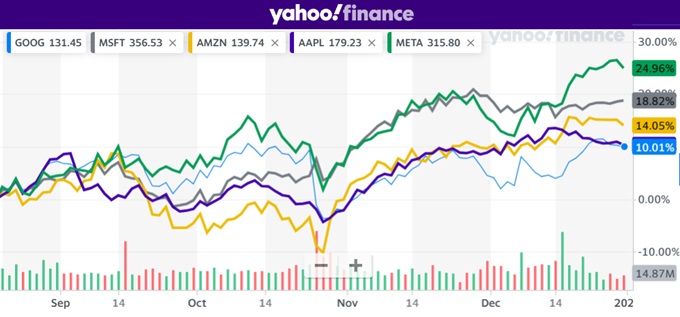

How Google Fare’s Against the Other Magnificent 7 Stocks?

Compared to other Magnificent 7 stocks, GOOG was the weakest, yet some analysts believe it is undervalued.

Is GOOG a Good Stock to Buy?

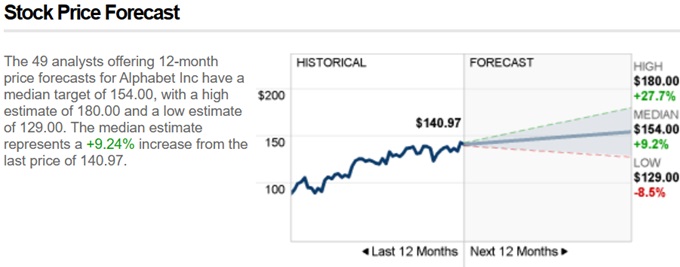

Investors want to know whether GOOG is a good stock to buy right now. 49 investors polled by CNN Business believe it may be a great stock to buy with an average target price of $154. Currently, it trades at 140.93 ending the 2023 trading year.

See more about the Faang stock forecast and the best stock picks for 2020. Are Google, and Apple and Amazon ready to rocket if a trade deal is approved? Will tariff reductions and economic surge mean big profits for Google and Apple in 2020?

But Google is such a successful, powerful enterprise that you can expect it to win at anything from advertising to cloud to video to artificial intelligence.

What investors might want to consider as Google’s real issues are the global political environment (negative), competition (Facebook and Amazon could invade their markets) and the future health of the US economy (excellent). Will Google face GDPR regulations and find themselves handcuffed to collect and use user data? Will anything threaten the advertising duopoly of Facebook and Google?

How Does Google Make Money?

Google’s primary revenue source is advertising, and its flagship product Google.com search is the kingpin. Alphabet is more of a proxy name for Google’s search engine which controls about 80% of the web search market.

Google makes revenue from a growing list of phenomenal products: Google Pixel phones, Adsense ads, Chrome laptops, YouTube premium subscriptions, Android operating system, Google home automation, cloud computing, and Google play subscriptions.

In my humble opinion, Google needs to work more closely with American businesses to create higher-quality tech products in the US. The gamble with autonomous cars is risky against the very popular Tesla. It’s estimated that autonomous vehicles on our roadways are a long way off. And the legal disputes and potential conflicts with human drivers and motorcycle riders who want to continue driving hasn’t even hit the political fan as yet. See more on the Tesla stock price forecast.

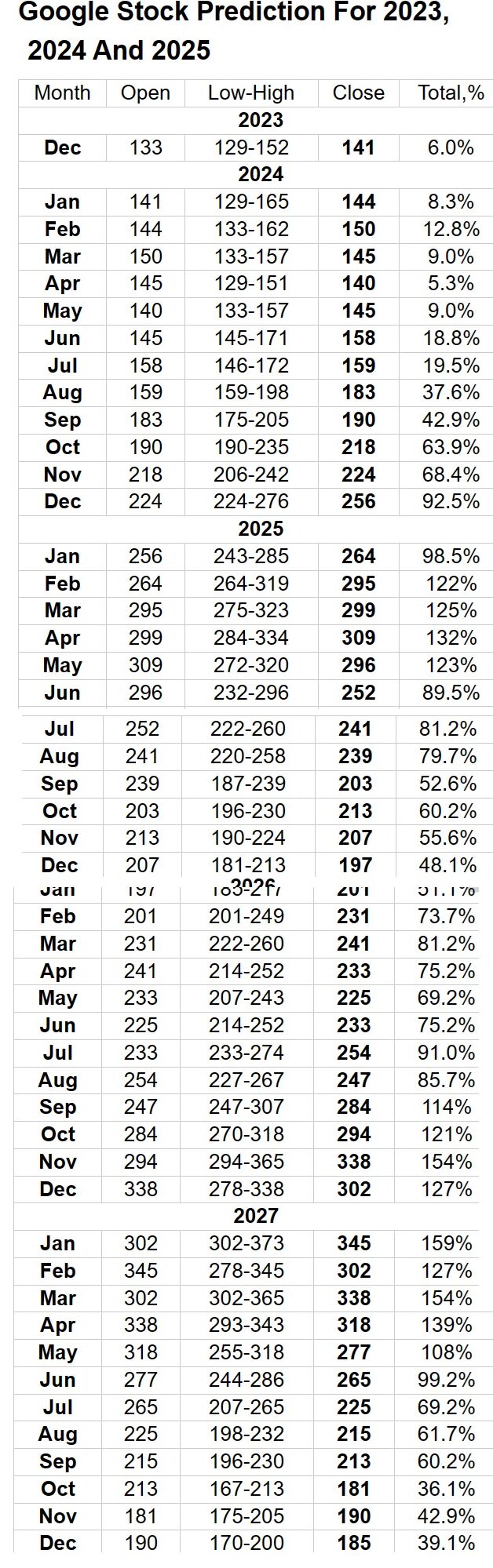

Google Stock Forecast By Month from LongForecast

Longforecast sees the potential of Google. They forecast 100% growth in the next 12 months.

This report is a snapshot of performance and analyst reports and is not a recommendation. Please refer to many sources and detailed analyst reports before making your buy decisions. It should be a good year for stocks even if not as profitable as 2023. The US economy forecast for 2024 is better than the expert’s pessimistic outlooks.

See more on the: Stock Market Forecast 2024 | Google Finance | Yahoo Finance | Stock Quotes | Stocks with Best P/E Ratios | Best S&P Sectors | US Stock Market Next 5 years 2023 2024 2025 | Dow Forecast | S&P Forecast 2024 | Real Estate Market Crash | 3 Month Outlook | 6 Month Outlook | 5 Year Outlook | 10 Year Outlook | Best Stock Picks