Amazon’s Monopoly and Amazon Prime

Walmart and Amazon: the Grocery Wars Continue. 2 of the biggest retailing giants are waging a war in the online grocery sector — a sector which has actually failed to launch previously.

What both could never have conceived is the Corona Virus pandemic. It has introduced millions of new customers to online shopping and online grocery shopping.

It was thought inconceivable that some consumers including seniors would bother to learn how to shop online. But in 2020, they are.

Amazon

As Amazon the world’s most valuable company speeds toward true monopoly status, it’s set to consume its next retail commerce victim — Costco, who is in the grocery game too. While the battle of Walmart vs Amazon groceries is the focus of this post, and we compare the two, Amazon is waging wars in many sectors which you should know about.

The big story that overshadows everything including the food industry (could there be Amazon restaurants in the future?) is Amazon’s unchecked monopoly power. They’ve positioned themselves in such a way that all their acquisitions seem natural and right.

With respect to monopoly, Amazon avoids the penalties of monopoly by riding on the “it’s not us, it’s just that physical retail is disappearing” justification. All the while, they’re opening new physical retail book stores and physical grocery stores.

“Amazon is so powerful, that anything that stands in its way is toast”

Amazon leverages its vast financial clout to crush businesses big and small in many sectors. The only one who could stop them from attaining complete global domination is Donald Trump and he’s suspicious.

Vox’s Matthew Yglesias wrote, “Amazon is opening a bookstore for two big reasons: 1. It can. 2. It is driven by a relentless desire to conquer literally everything in its path.”

Jeff Bezos has Immense Financial Clout to Dominate the Billion Dollar Food Industry

Undaunted and seemingly aware of something we don’t, Jeff Bezos is all in on selling groceries online at Amazon.com. How can we argue now that he’s the wealthiest man in the world with a fortune estimated at $90 Billion. The only thing he hasn’t done yet is walk on water.

The purchase of Whole Foods makes the surge into groceries complete. And Whole Food’s condition matters not, because Amazon can make even the worst failing brands and companies suddenly rocket to market leader status.

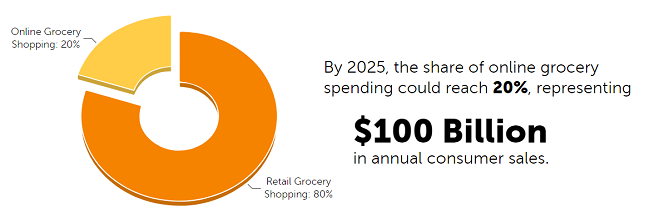

With global grocery shopping already hitting $50 billion and US grocery shopping online soon to hit $20 Billion, it seems this is where the grocery ecommerce tidal wave is going to hit. It looks like this is a major cultural and marketplace shift that’s occurring.

The entrepreneurial Bezos was a Wall Street banker when he took the risk to move to Seattle to launch Amazon. With only his financing experience and $1 million dredged up from family and friends he started what will soon be the largest company in the world.

The entrepreneurial Bezos was a Wall Street banker when he took the risk to move to Seattle to launch Amazon. With only his financing experience and $1 million dredged up from family and friends he started what will soon be the largest company in the world.

Amazon’s key competitive advantage is lower costs with no retail locations and less than 10% of the staffing costs as Walmart. Amazon has infinite selection of products including electronics, clothing, and now food purchased online.

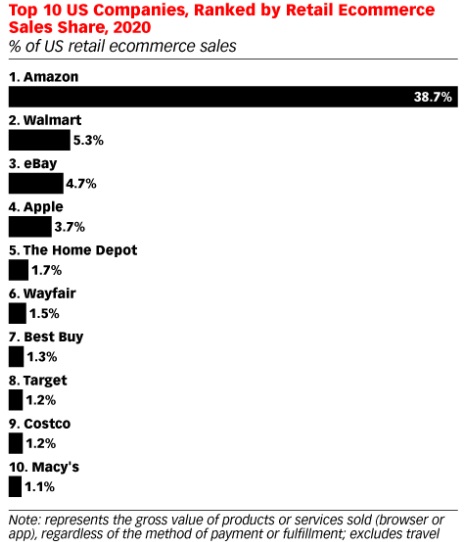

emarketer’s newest report of e-commerce sales in the US for 2020, shows the top ecommerce companies lead by Amazon. Check out the Amazon stock price forecast.

Due to the Corona Virus pandemic is online grocery shopping finally about to blossom into the next big thing? Or will grocery shoppers desperately hang onto what might be termed a lifestyle choice?

If you operate an ecommerce or retail shopping website or Facebook store, the matter of Walmart vs Amazon is important. These 2 goliaths have the might to get the supermarket ecommerce ball rolling, and roll right over your business. And for those who live online, and don’t like retail stores, this could be the start of something really good for you.

Amazon is on the hunt for a new 2nd headquarter location and the front runners in that race include Toronto.

Online Shopping: Trying Hard but Slow to Launch

While online grocery shopping hasn’t been a hit, the cultural, demographic, technological, and financial drivers may now be in place to make online grocery shopping a standard feature of people’s lives in the US, Canada and the UK.

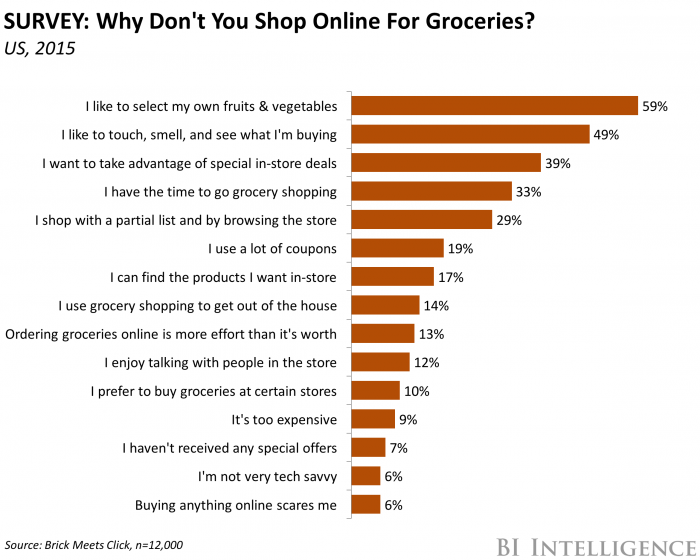

However, I’m sure you enjoy shopping for your own food, picking out unbruised apples, getting the cereal on special, and just buying whatever is your fancy at that moment. Do we go to the grocery store to enjoy some spontaneity and impulse buying? Can online shopping provide that emotional rush?

I’ll bet the supermarket chains have you coming back on a frequent basis almost like it was a convenience store. Retail shopping has a social, people element too which adds to resistance to online shopping. It takes time to change, yet the youngest generations will not view supermarkets like their parents and grandparents did.

Supermarket eCommerce Ready to Rocket

There’s one key reason in particular why online groceries are ready to rocket: Walmart vs Amazon. If both sink tens of billions into the competition, it’ll sweep all other supermarket brands, retailers and distributors into the fray.

However, are the smaller companies ready, or will your favorite local grocer come to an unfortunate fate? Amazon’s success online is notable earning it ratings as the most innovative company in the world. Innovation is everything now.

Sharing is Good for Your Social Health

Does Home Delivery Need be a Key Part of Online Shopping?

Online grocery shopping and home delivery have been around for a long time. In fact, Grocery Gateway in Canada was launched in 1997 and is still running. Grocery chain Longo’s bought it in 2004 and it’s their online shopping service. Grocery Gateway’s delivery trucks have been a common sight for those in the Metro Toronto region.

Adhering to the old home delivery model was a mistake and these companies are recognizing that.

Grocery Gateway Celebrates 20 Years

Digital Grocery Shopping in the US

In the US, Home Grocer was perhaps the original online grocery shopping service launched in 1997 with more than $400 million in financing. Well, long story short, Home Grocer wasn’t sustainable. But why did they fail? Attitudes, habits, technology? We must know why and what they all plan to do about it.

Okay here’s a little spoiler about that reluctance below.

According to Statista, in 2016, just 5% of U.S. consumers were buying online. In total, U.S. online grocery sales amounted to about 7 billion U.S. dollars in 2015 and are expected to rise to 18 billion U.S. dollars by 2020. That might only amount to 15% of all consumers who will buy online within the next 2 years.

In the UK, online grocery shopping has his hit 7% marketshare and is dominated by Tesco.

That’s still a small portion of the enormous supermarket grocery sales volume in the US, Canada and UK. So it begs the question about when an online tsunami will begin and how big will it be? And should food companies get serious about marketing and selling online?

Here’s Kroger’s online shopping page. Does it appeal to you?

The Digitally Engaged Food Shopper Report

The Digitally Engaged Food Shopper Report is a comprehensive look into the behaviors, motivations and expectations of the digitally engaged food shopper. It’s produced by the Food Marketing Institute (FMI) and Nielsen Research. They had this to say about the rise of grocery eCommerce.

“While we are more connected than ever to influence what shoppers buy, the window to influence those moments is narrowing… FMI and its members will need to seize the opportunity to harness new skills and collaborate more seamlessly than ever before to effectively reach these digitally savvy food shoppers. We’re building the tools to help our members assess where they are in their connected commerce strategies.” said Mark Baum, chief collaboration officer at FMI. — Digitally Engaged Food Shopper.

From the report, it’s suggested these 5 factors below will drive the latest push to online shopping:

- Multi-channel shopping: shoppers are increasingly buying more of their groceries across channels. 23% of American households are buying food online today and 60% of these consumers are forecasted spend over a quarter of their food dollars online in 10 years.

- Digital Experimentation: Grocery retailers and manufacturers are now sincerely experimenting with business models and technologies to find their way online yet their path to success isn’t paved.

- Grocery Saturation: Grocery shopping will reach digital maturity and saturation faster than publishing or banking.

- Middle Store Migration: Middle store categories are already migrating online and this migration is expected to continue.

- Young & Digital: Younger, newer and more engaged digital shoppers are expected to grocery related digital technologies and will hasten digital grocery shopping further.

What they may have missed is the in-store retail shopping experience and prices. If Amazon prices fall and the brick and mortar store shopping experience deteriorates as it has in many retail stores, shoppers may start shopping online in bigger numbers. Urban intensification and overpopulation could make shopping at a big supercenter a big pain too.

Who Will Want to Shop Online?

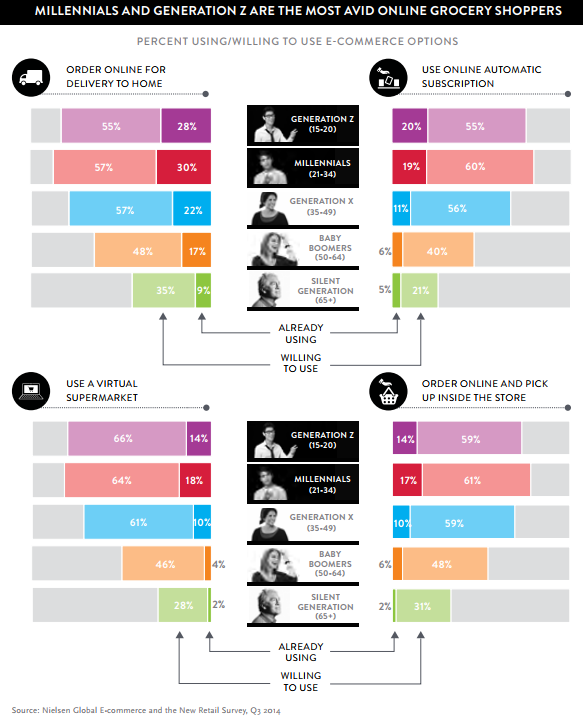

This graphic from Nielsen’s Future of Grocery Report reveals how most age groups are open to online shopping but that it’s a little more welcome to those under 35.

Are You Ready for Online Grocery Shopping?

A select number of companies are offering online grocery shopping already. What may have caused issues in the past, was the belief that home delivery had to be the focus of the service. Home delivery it turns out is an expensive proposition often resulting in higher prices and food spoilage. With margins so thin in the grocery sector, supermarkets and online grocery sites are focusing on the “click and pick up” service.

Loblaws, a Canadian supermarket chain is focused on this opportunity. As you can see here, they are promoting their sharp looking new smartphone shopping app.

What Will Amazon’s Share Be?

The results of a poll reported by AOL, suggested that 75% of online shoppers rarely buy groceries online. 60% of those polled said they never buy groceries online or do so just a few times a year. Based on that account, you’d have to wonder why Amazon is ready to sink $13.7 billion into the online grocery market and why Walmart is ready to compete with them.

Major Supermarkets Who Have Entered the eCommerce Grocery Era

Here’s a list of major online grocery shopping sites in the US and Canada who offer online shopping and/or home delivery services:

- Amazon Prime Pantry Canada/US

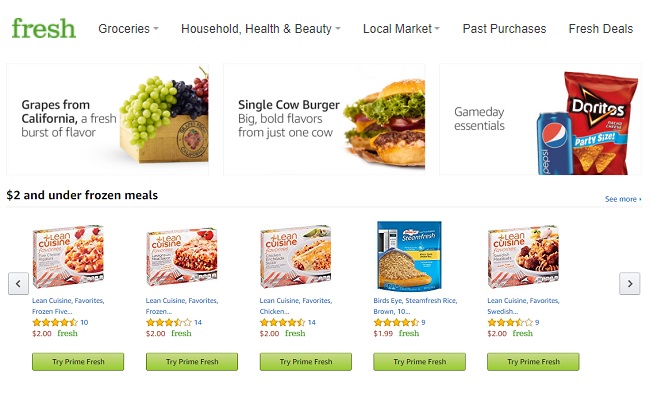

- AmazonFresh (Canada/US)

- Albertsons Online

- Peapod (Midwest/East)

- Fresh Direct

- Safeway Inc.

- Walmart Canada/US

- Whole Foods Canada/US

- Winder Farms (West Coast)

- Publix

- Krogers

- Longos (Grocery Gateway) Canada

- Loblaws Canada

Which of these do you believe will survive the coming era of digital grocery shopping?

Grocery Wars: Walmart Vs Amazon

Many pundits are suggesting this market will definitely be owned by Walmart and Amazon, who are pouring money into their ecommerce operations. They may also feel that Krogers, Loblaws, and others simply won’t be able to get their act together fast enough online to compete.

Krogers has a huge market share in the US and is unlikely to fall by the wayside quickly. With online adoption growing slowly, Kroger has plenty of time to figure it out. Or do they?

Who Will Win: Amazon or Walmart?

Amazon caters to a wealthier crowd and the products they sell are more expensive, so they will win during good times. Walmart sells the basics to the lower income crowd and they will survive a recession.

If the US economy continues strong, Amazon looks to be the clear winner. And with its innovative and profitable Amazon Web Services and venture into artificial intelligence guided shopping, autonomous vehicles, the company is the clear leader for the next 5 years.

Amazon and other grocery brands will be aided by AI marketing software with its data collection, content testing, clickpath assessing, and future behavior predicting capabilities. AI compensates for many ecommerc weaknesses.

For the supermarket chains, retailers, manufacturers and SMB’s who sell via online, a new commitment to digital marketing and ecommerce might be required. And since some believe they’ve balked so far because it would dry up business for their distributors and retailers who buy from them. Amazon has no brick and mortar operations really and worker/reseller resistance isn’t a problem for them.

“The need for retailers and manufacturers to know the differences around how consumers shop online versus in-store is greater than ever before. Analytics will be key for retailers and manufacturers to understand the digitally engaged food shopper on a deeper level.

Beyond unified insights that connect the dots across consumer interaction and platforms, the winning strategy will turn metrics into action steps towards effective digital engagement.” – from the Digitally Engaged Food Shopper report. Longos appears to be using Unata of Toronto who provide a white label cloud based platform for grocers. It includes ecommerce websites, digital couponing, customer loyalty programs, 1 to 1 automated personalization, payment gateway integration and a lot more. Very impressive.

And Unata’s CEO Diego Maniloff was once a research assistant at The Artificial Intelligence Laboratory at the University of Chicago. There’s no doubt he would be in the process of augmenting Unata with AI. It would be fascinating to see which customer journey issues they’re trying to solve with AI.

How Do you Attract and Engage Online Grocery Shoppers

Grocery consumers are just like any other online consumer. They want the right products, good service, best prices, discounts, great selection, and a friction free customer experience. Some eCommerce retailers pay a lot of attention to removing friction with superfast websites, optimized shopping carts, and of course good analytics.

It’s Personal – This Shopping Thing

Because grocery shopping is such a personal experience to consumers, online ecommerce marketers likely will have to pick and choose opportunities to get the new online service seen and used. Any place in the store where there is big friction, fatigue, disappointment, etc. would be a good time to present the online service.

If we go back to the shopper survey results, we know the biggest reasons people don’t want to shop online is that they don’t trust they’ll get the clean, high quality produce they can visually select and touch in the store. And they feel they won’t get to find the instore bargains themselves.

They also think they have time to shop, so time savings and other activities they could otherwise be doing are good to mention. And show them how they can use food to enliven their home social life so they don’t use the store as a social thing. And they’ll want reassurance they’re reducing their food bills.

Online promotional strategy and tactics are an art/science and increasingly driven by data. In order to find out which of these tips below actually work, you can do simple and multivariate testing. This is where Amazon’s artificial intelligence capability give them an edge in the battle with Walmart. Discovering which works best and knowing what shoppers are likely to buy next is a huge advantage. That’s why AI marketing software is so vital now to marketing and sales.

Here’s a lengthy ist of grocery store ecommerce promotional tactics to boost sales at your online retail food store:

- Give them a big warm welcome coming into the online shopping area

- Assure shoppers that they can see and get any discounted item that’s actually present in the store

- Focus on safe products people are already buying online

- Focus on the assurance that produce will be highest quality (no bruises and bad spots) and is ready on time for pickup

- Use product quality trust marks where product quality is very important to the shopper

- Focus on meaningful cost savings

- Focus on price discounts

- Crowd the page with items so they can’t justify with “not enough selection”

- Use words such as quick, fast, convenient, time-saving, modern, smart, discounts, savings, deals, and fun at home, delicious etc to build a consistent word theme that gets your value proposition across

- Use a “buy now” button on the lower right

- Use a centrally located search bar so they can find their favorites right away

- Focus on people who are busy such as moms with kids who must take the kids into the store

- Focus your imagery on kitchens, fridges, cars and the home environment — not the retail store!

- Use big, higher resolution photos done expertly by a web graphics expert because shoppers are highly visual about what they’re going to eat

- Use javascript that lets them click to see a larger high res photo

- Show pictures of juice bursting out of oranges or other fruit because it is elicits the senses and may even active their memories of the smell of certain foods

- Show pictures of milk, juice, wine being poured into glasses

- Use a few videos such as how to peel an orange, cut a pineapple, or

- Show ingredient lists and health info

- Encourage shoppers to share on social media (good to associate the food with their family)

- Give discounts to shoppers who give reviews on Google+ or Facebook

- Offer a free samples product (e.g., hand cleaner) with purchases over $20

- Show a picture of your delivery truck or the pick up area

- Eliminate their post purchase anxiety by offering money back guarantees (and let them peruse their food before they actually pay for it)

- Use warm descriptive language of products

- Use drop down cascading menus for quick access to all products

- Offer them a 1% discount if they get to the store within 15 minutes

- Use medium sized, round fonts for product descriptions

Amazon Stock Price | Rooftop Swiming Pools | Rocky Mountaineer Train Tour | Banff Lake Louise Alberta | Coffee Shops Near Me | Car Insurance | Best Cities for Digital Nomads | Sell House Now | Backyard Offices | New Home Construction | Luxury Travel Maldives | Wineries | 5G Phone Plans | Best Smartphones | Luxury Car Insurance | Solar Energy Systems