Stock Market Forecast for the Next 5 Years

The 5 year forecast period is still a key timeframe for investors. That number represents cautious, sound and strategic investing, in contrast to day trading and get-rich-quick gambling.

In 2023, there was a lot of concern that the markets would crash and underperform for years. With the great performance of recent and how the breadth of the stocks rising are growing, we can see the 2024 stock market forecast is shaping up nicely. Check out all the macroeconomic charts and forecasts below that support a fairly positive outlook.

The long-term economic outlook of 5 to 10 years is about constant growth in US manufacturing, innovation, and the breakup economically with China. Yes, global growth is subdued but it’s overstated. Non-US growth is poor because the US has raised credit rates and is committing to US production and market protection. A big investment in technology such as AI and microchips will give the US a substantial, sustainable advantage in trade and innovation.

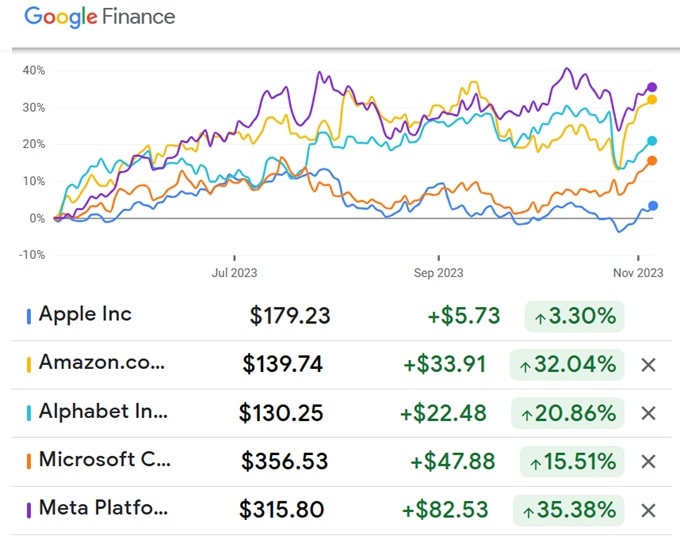

Tech company earnings have outperformed nontech companies by far and that won’t change as technology becomes increasingly important for performance for any business over the next five years. Technology has even permeated the booming global travel industry. Whether biotech or generative AI content, the US is leading the way to a technology-dominated future.

China will struggle to compete if it has less access to US and European capital and markets. The outlook for the US’s major competitor then is dim. For the US, it’s a massive turnaround that could give it the same growth that China has enjoyed for the last 20 years.

Who do you turn to for investment guidance and economic forecasts? The experts tend to be conservative of course to save face. A bad call can make them look incompetent, thus risking losing their current clients and turning off new ones. Tom Lee of Fundstrat hasn’t been one of them. He has held to his bull market 4700 S&P prediction, and almost on queue it has transpired. That’s impressive, so this is one expert to turn to for the 3 month to 1 year view.

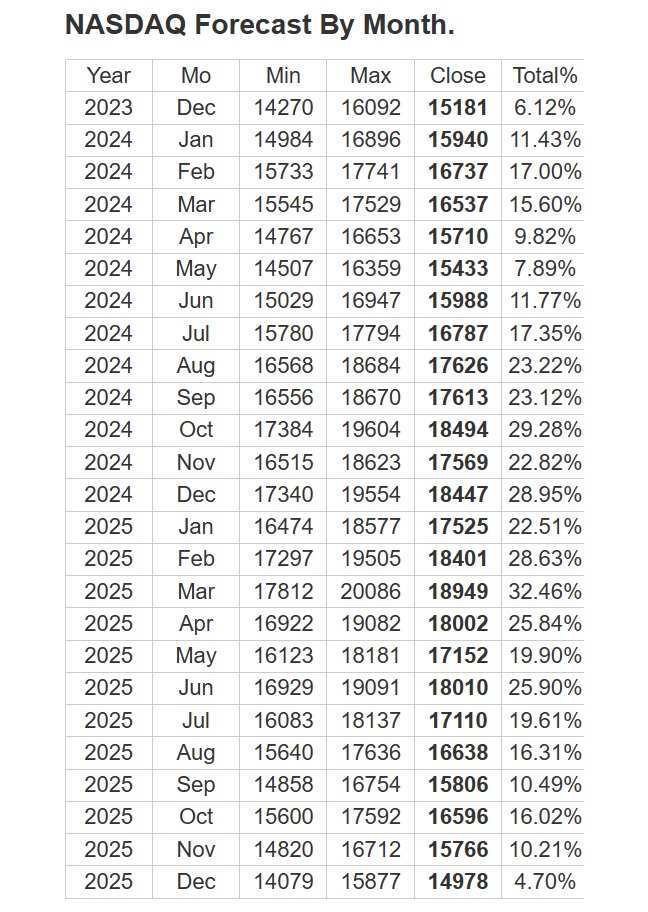

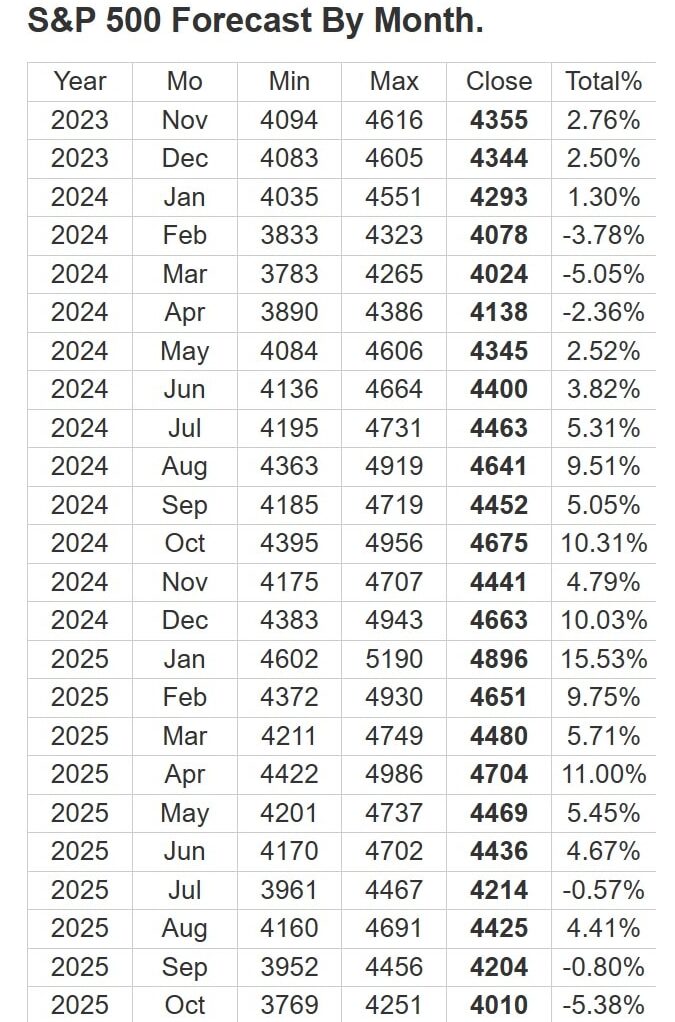

For the next 2 years, Longforecast sees the NASDAQ rising moderately until next August of 2024, where it takes off to hit a peak in March 2025 at 20,000. It’s a vote of confidence for America’s tech sector, and there’s no doubt tech will be propping up the S&P as well.

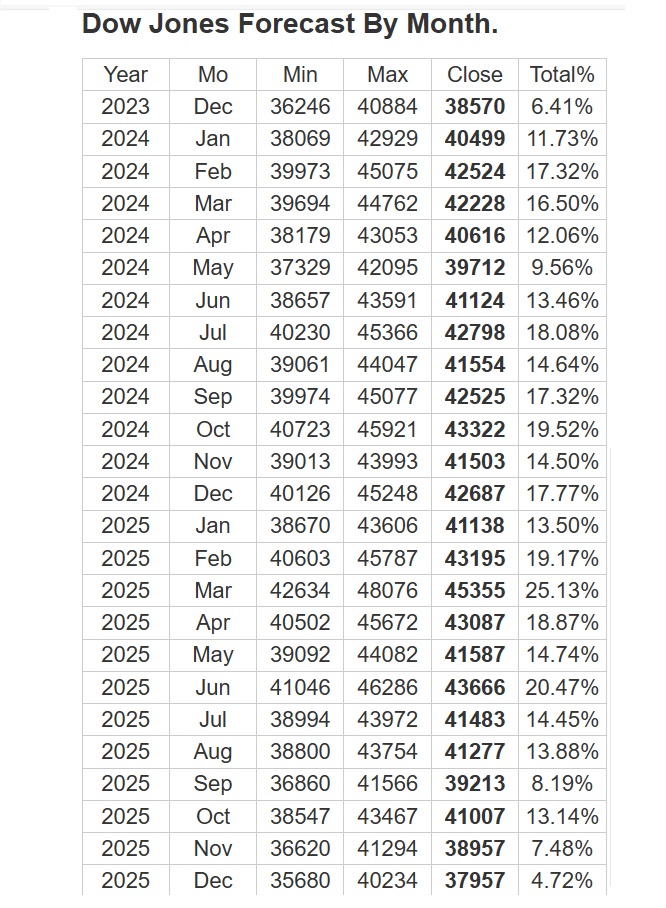

Longforecast sees the Dow Jones Average performing better in 2024 and similar to the NASDAQ, they see it peaking in March 2025 at 48,076 points +25% from now. If you hold some of the better industrial stocks, you might enjoy an even better return.

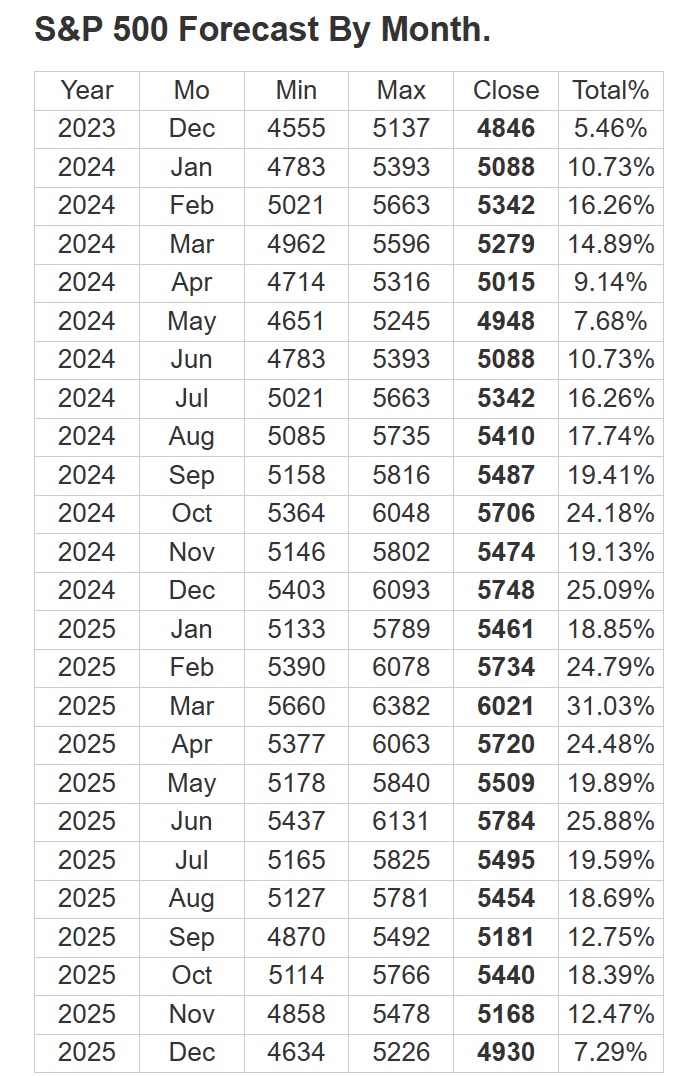

And for the S&P, the same growth is expected with a peak in March of 2025 at 6382. That represents a gain of 32% from today.

But What About the 5 to 10 Year Period?

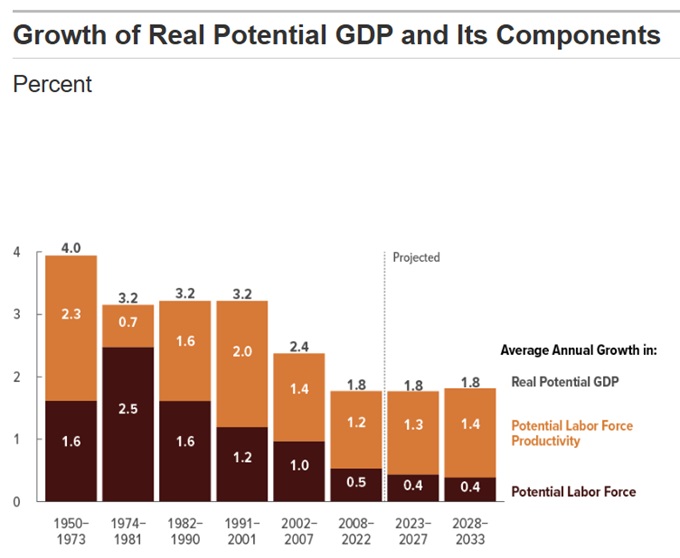

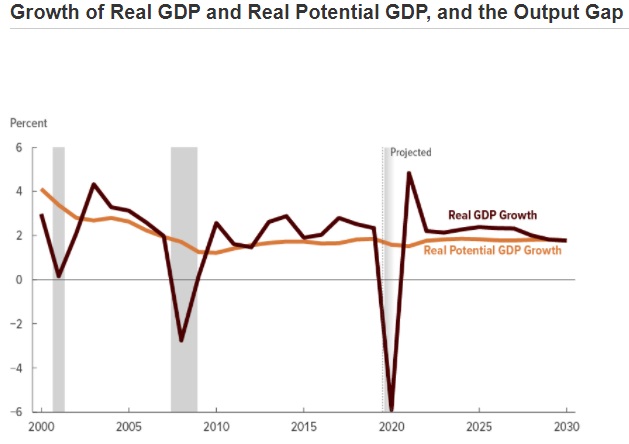

The CBO has put out its consumer price and GDP economic projections and basically says they will return to long-term norms and continue that way. They’re a little dour on the US economy, based too much on past performance and the belief there hasn’t been any political or cultural change. For them, it’s same old, same old. It will take time to be ex-China and to build belief in America again.

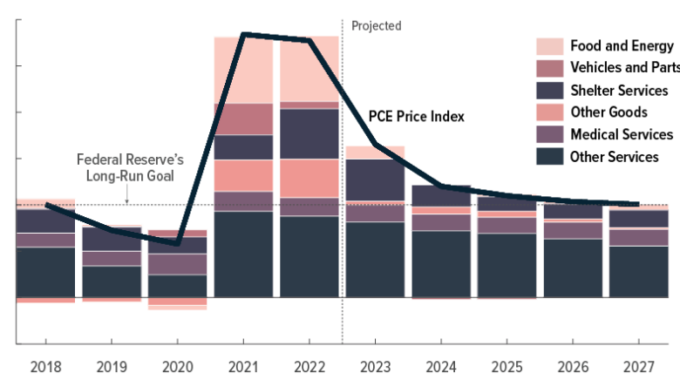

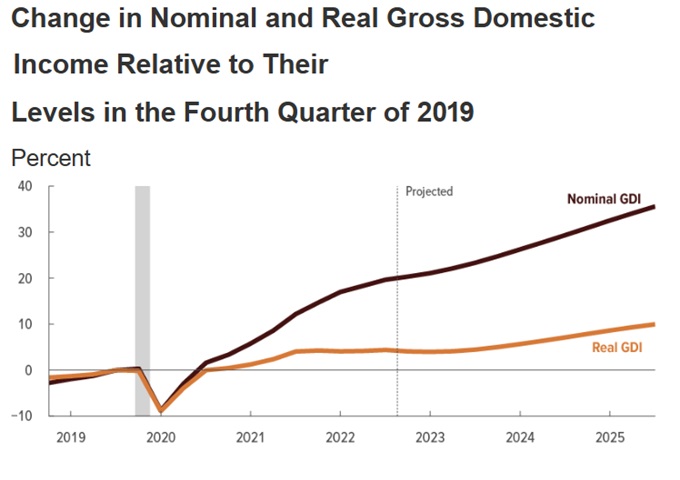

CBO sees consumer prices moving back to historic norms.

CBO’s opinion is the GDP will stagnate until 2033.

CBO sees gross domestic income on a strong upward trajectory, which fuels domestic goods and services purchases.

Which Sectors will Produce the Best ROI to 2028?

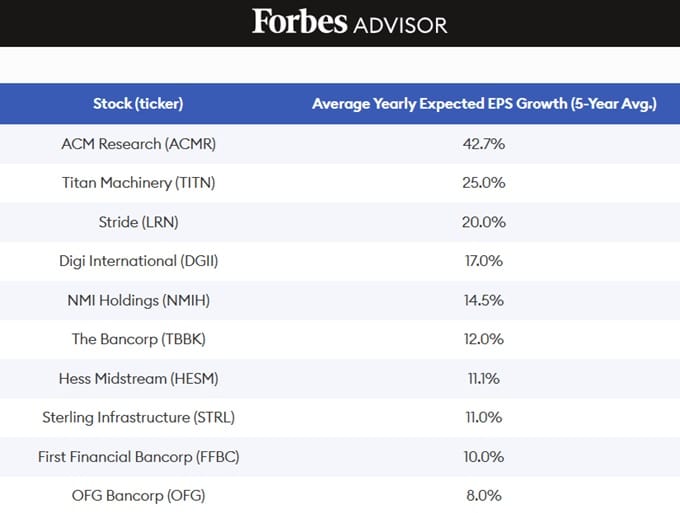

Popular investment sites are pushing their products and picks, usually involving large caps, but the real potential is in small caps. The Russell 2000 has been doing well and it might be the only index that has big upside potential.

It’s very tough to pick small cap winners, which is likely what you’re wanting. You might have the best luck to review the latest stock market forecast to help find the best stocks to buy for 2024 and the 5 year outlook. Have a peak at the 10 year view and keep investigation because historical performance data could help give a clear view of what might be best.

Of hand, you would be wise to buy a basket of AI microchip stocks. It’s a certainty that AI and GPU processors will be a big part of the long-term economic output, innovation and growth. As well, the housing sector desperately needs new home construction so companies such as DR Horton look to be good bets. In a cramped, bored world, travel will always be in demand as well. Check out the best travel sector stocks such as Marriott hotels.

Of hand, you would be wise to buy a basket of AI microchip stocks. It’s a certainty that AI and GPU processors will be a big part of the long-term economic output, innovation and growth. As well, the housing sector desperately needs new home construction so companies such as DR Horton look to be good bets. In a cramped, bored world, travel will always be in demand as well. Check out the best travel sector stocks such as Marriott hotels.

Many stocks are laggards and will continue throughout 2024, so sound investors like Warren Buffet will be looking at a longer-term horizon, with dips into short-term investing to boost Berkshire Hathaway’s total returns.

They were hampered by high rates whereas mega caps have so much cash they don’t need to borrow. And the monopolies don’t seem to be in much danger as no anti-monopoly penalties/actions have been taken since the Microsoft era 30 years ago.

That’s why conservative investors will likely move their money from lower-performing bonds to large-cap equities. But a basket of top Russell2000 stocks might be the better choice for wealth gain.

Best Stocks for 5 Year Period

Investor Place just released its picks. I don’t know if I would agree with (APPL), but here are their favorite picks. I would counter that any China-dependent stocks are going to decline in price (.eg., NVDA, APPL, Intel (INTC), Ford (F), Tesla (TSLA), Starbucks (SBUX), and Nike (NKE). NVDA, for example, a great stock to buy will likely have its $5 billion order from China canceled. Seekingalpha says it doesn’t matter and that NVDA is still the stock to buy.

NVDA has advantages with its advanced GPU processor where growing markets in gaming and laptop computers are making investors excited. It will be difficult for competitors to surmount Nvidia’s advantage

The safe bets are stocks that will gain from the reshoring of manufacturing back to the US.

If you’re into safety, then GOOG, NVDA, MSFT, AMZN and META might be your goto choices for the next 5 years.

Here are Investor’s Place Top Picks for Next 5 Years

- Alphabet (GOOG)

- Microsoft (MSFT)

- Apple (APPL)

- Adobe (ADBE)

- Luminar (LAZR)

- Ouster (OUST)

- Netflix (NFLX)

- Unity (U)

- Tencent (TCEHY)

- Upstart (UPST)

- PayPal (PYPL)

- Block (SQ)

- Roku (ROKU)

- Nike (NKE)

- Crocs (CROX)

- Amazon (AMZN),

- Shopify (SHOP)

- Sea (SE)

- Spotify (SPOT)

- HubSpot (HUBS),

- The Trade Desk (TTD)

- Teladoc (TDOC)

- Enphase Energy (ENPH)

- ChargePoint (CHPT)

- EVgo (EVGO)

Small Caps

Small cap stocks will benefit from falling interest rates, a rising economy, strong dollar, and lower unemployment rate. The higher FED rate really is targeting small caps who need credit to operate. The key to this is that small caps were crushed in the last year so they’re ready for a bigger rebound.

Ex China is a Big Opportunity

There is huge resistance in the US to economic improvement and the abandonment of dependency on China, but the China US rift is certain now. Out of necessity, it couldn’t continue. With reshoring and AI-based dominance, the US is positioned for substantial growth. If a new President is elected in 12 months, it would likely lead to a massive lift for the US economy.

The reduction of regulations, pro-American policies, reduced taxes, investment incentives, and cheaper energy if they happen, make the 5-year forecast fantastic.

Investigate the small caps on the Russell 2000 and Russell 3000 indexes. This is where the big money will be made. If your payoff period is long and you’re not just doing volatility trading for quick profit, then the greatest gains will be found in the best small caps.

Best Stocks for 5-Year Market Outlook

A Yahoo Finance report offers up its best US sectors for the long term:

- Real Estate

- Industrials

- Consumer Defensive

- Materials

- Energy

- Telecommunications

- Financial Services

- Consumer Cyclical

- Health Care

- Technology

In the 5-year window, energy is expected to reign. A growing economy, unrestrained from crippling regulations, high interest rates, restrictive lending, reduced money supply, and high taxes will spawn demand for electricity, natural gas, and oil.

As forecasted, the price of oil has risen strongly. While Biden can release millions of barrels of oil now to control gasoline and oil price rises, the loss of the SPR means the reserves will have to be repurchased and refilled, thus driving prices up from 2024 to 2030. With a new US President, the suppression of that industry will end allowing a full production mode of cheap energy giving businesses and American consumers a big boost in their finances.

Cheap oil and nat gas would also weigh heavily on EV sales. I would avoid ESG stocks including EVGO and Tesla.

Lower mortgage rates and new housing construction initiatives will also spawn economic growth — resulting in growth in spending in furniture, appliances, and new local infrastructure spending, which right now is not flowing. The housing market will be the major catalyst for economic growth in the coming five-year forecast period.

Give the oil stocks and natural gas stocks a close look right now, because their outlook is positive, prices low and their P/E ratios are the best available.

Key Factors To Watch as Clues to Long Term Performance

The 5 year to 10 year period are more influenced by politics and macroeconomic forces and swings. If you’ve never thought about macroeconomics, then it’s wise to do a crash course so you don’t allow tomorrow’s, this months, and 3 month and 6 month views to cloud your judgment.

And you’ll be looking for quality stocks that might provide a combination of security, growth and dividends such as GOOG. Of course other stocks might provide better returns over the 2 to 3 year term. Oil and energy stocks fit that category. Take a good look at Canadian oil stocks too for near rock bottom prices. Everyone should have them in their portfolio. US oil stocks have a better near term outlook (lighter WTI oil rather than heavy crude).

I said previously that the US’s new competitiveness with China will support growth in the tech sector thus taking the NASDAQ up from its recent doldrums. It’s up 17%. Yet, at this point with the Dow Industrials so sluggish, that they represent a better buying opportunity.

Experts are Increasingly Positive on the Market Outlook

Retail investors know the 3 month, 6 month and 2023 forecasts are just a recording of volatility and temporary sentiment. Retail and institutional investors are looking forward through the 3 year time frame, because they might believe growth is slow until then. This flattening of the outlook allows everyone to project further ahead and keep their focus on long term growth. Getting rich quick seem unlikely, and picking individual stocks is a tough prospect.

5 Year MacroEconomic Factors and Signals

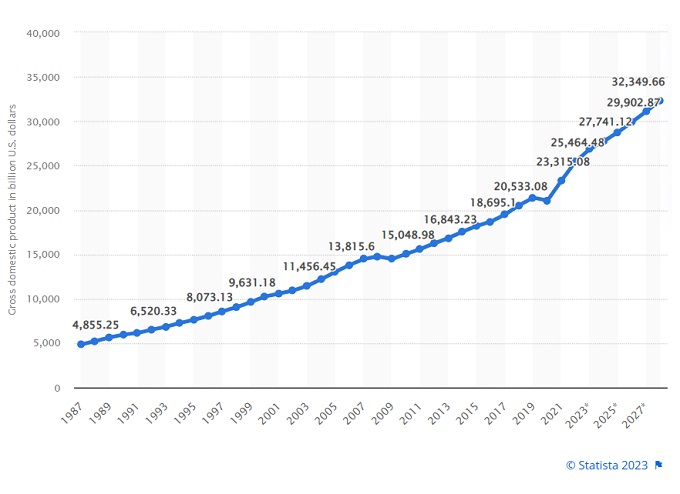

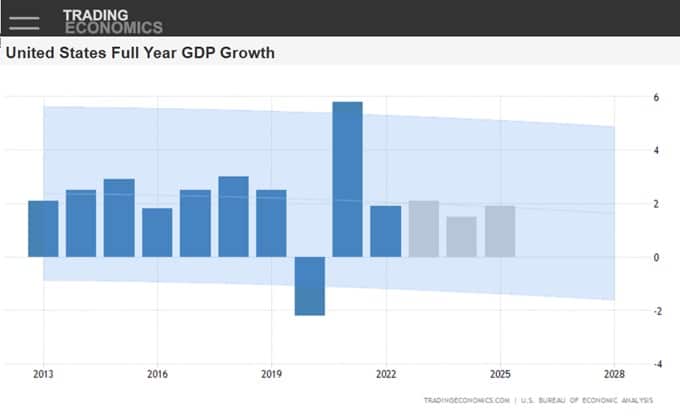

5 Year US GDP Outlook

The first macroeconomic signal to look to is estimates of US GDP. While the current crisis with the US government is real, their is reason to be optimistic. GDP is still positive despite the draconian increase in interest rates. There is huge money in US savings accounts and it could be unleashed into the stock market as the US economy recovers.

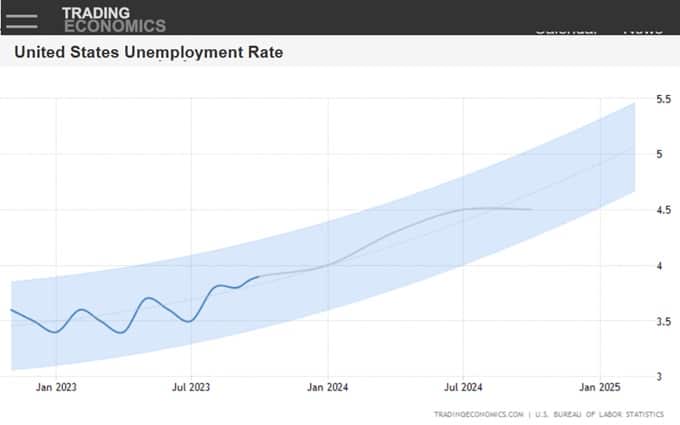

US Unemployment and Jobs Report

Unemployment is expected to rise, but the US reshoring mandates may create a lot of jobs for Americans. However, more unemployment means downward pressure on labor costs which makes businesses more profitable, especially small business have difficulty finding workers.

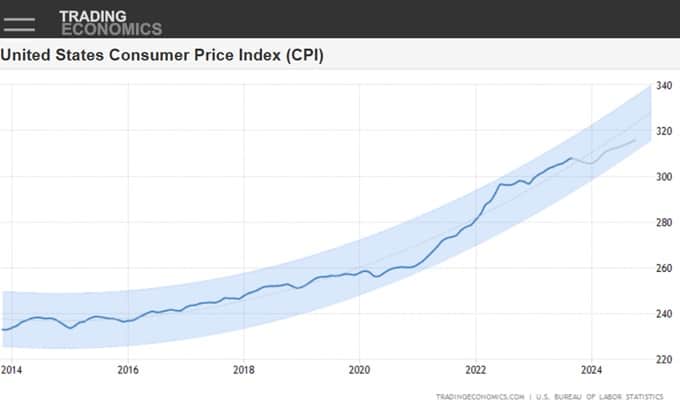

CPI and MPI Forecast

US GDP 5 Year Outlook

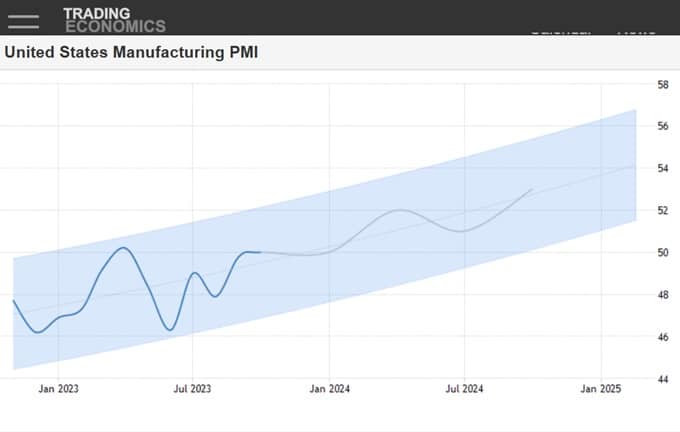

Manufacturing PMI

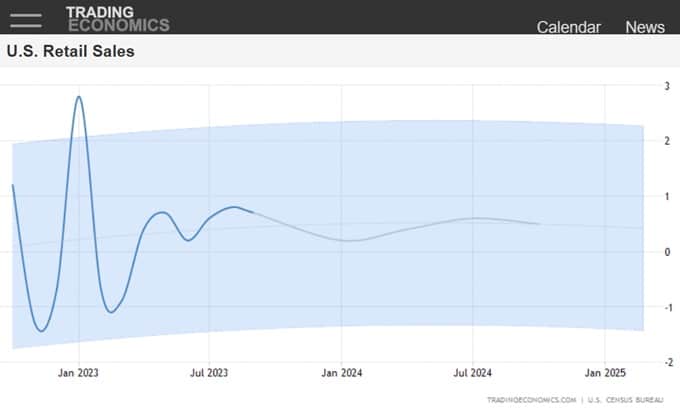

Retail Sales Forecast

They’re not projecting out too far on retail sales estimates but the line is horizontal as you can see, so we have to wait for the recession to end to see sales improve. US debt, student debt, war funding, and high interest rates will weigh on spending for many years.

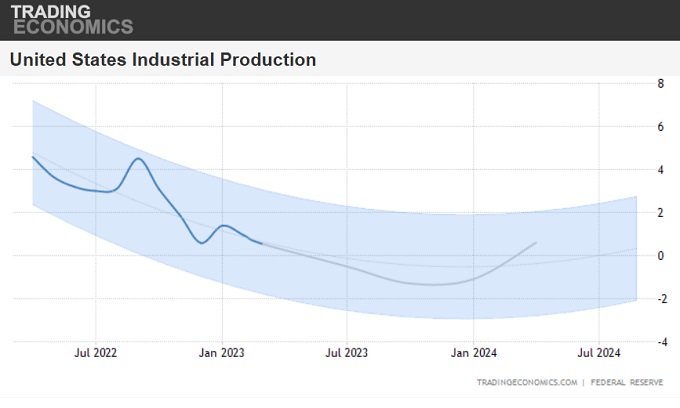

Industrial Output Forecast

5 Year Study Protects your 401k or other Investments

Fund managers and institutional investors also see the 5 year and 10 year models as more informative. Of course they have some insightful forecasting tools including technical charts, GDP forecasts, commodity prices, demographic demand projections, and more data to make better predictions.

Of course, even with those expert forecasting tools/software and massive data, they aren’t too bold about venturing 5 to 10 year forecasts. Because too much of it tends to be political and organic.

You can invest in good dividend stocks, growth stocks, or even bonds and you may ride this artificial recession out.

After the Recession, The US Economy Will Return

2023 may not be much fun for investors, after the losses of 2022. But consider these factors as a run from 2023 to 2028:

- interest rates will slowly reverse down to affordable levels, thus stimulating housing construction and home buying which is a key economic engine

- consumers will resume a normal lifestyle

- small to medium-sized businesses will find growth after a terrible pandemic

- commodity prices will rise slowly but should be manageable

- resistance to open trade with China will increase — raising production within the US

- oil prices and energy costs will rise over the next 5 years

- taxes will rise to pay for government spending

- Pent-up housing demand launches housing market boom

- millennials still driving big demand with huge Gen Z’s soon to follow

- housing stock increases allowing Americans to move more comfortably to a new home

- US economy is more de-centralized away from big urban centers and costly California

- move away from low-profit/high-cost green energy in 2025 to practical sources

- wages won’t drop as much as Fed wants meaning inflation will continue above 2%

- Fed rate increases will end in 2023

Start Investing for the 5 to 10 Year Period?

Investigating the 5 year or 10 year outlook is a sure sign you’re a wise investor. After all, if you don’t know what’s ahead for US business, then all of your investing is basically gambling (i.e., Bitcoin, FTX). You have to know which stocks are long term investments and be certain about when you’ll need to dump some of the speculative stocks you have now.

Would you rely on an AI stock prediction service for your 5 year outlook? Of course not, because the driving factors are human and emotional which machines can’t understand as yet.

More Market Forecasts

See more forecasts on the real estate housing market, and the latest home prices and sales trends for numerous major metros in California including San Diego, Los Angeles, San Francisco, and Sacramento. See stats on other cities, including Denver, Dallas, New York, Boston, Atlanta and in the Florida housing market in Miami and Tampa.

See more on effective online marketing for Realtors.

Google Finance | Author Gord Collins | Stock Market Rally | 2023 2028 Forecast | Google Stock Forecast | Stock Equities Forecast 2024 | Stocks with Best P/E Ratios | Best S&P Sectors | Will Home Prices Fall? | 6 Month Stock Market Forecast | Stock Market Predictions | Long Term Stock Market Outlook | S&P Predictions for 2024 | Dow Jones Predictions 2024 | Stock Market Today | Stock Quotes