Miami Real Estate Forecast

The US housing market outlook for 2020 is improving and the Florida housing market is hot too. The pandemic may have created empty condos in its high density core, but with the vaccinations in full swing and a reopening Miami Dade County, buyers from many places are eagerly searching for Miami area real estate.

Prices are up and forecast to rise further through this summer and into the next fall season when a huge wave of snowbirds is expected to land. In March alone, the Sunshine state saw house sales grow 23.3% to 32,819 units, while existing condo-townhouse sales rose 52.6% vs March 2020 to 16,518 units.

Correspondingly, the outlook for South Florida and Miami Dade County market is a little healthier as the Florida economy begins to fully reopen. The fact all states and housing markets are not fully active yet helps to keep home prices from really running away. Still buyers will be looking at bidding wars and they should know how to win a bidding war.

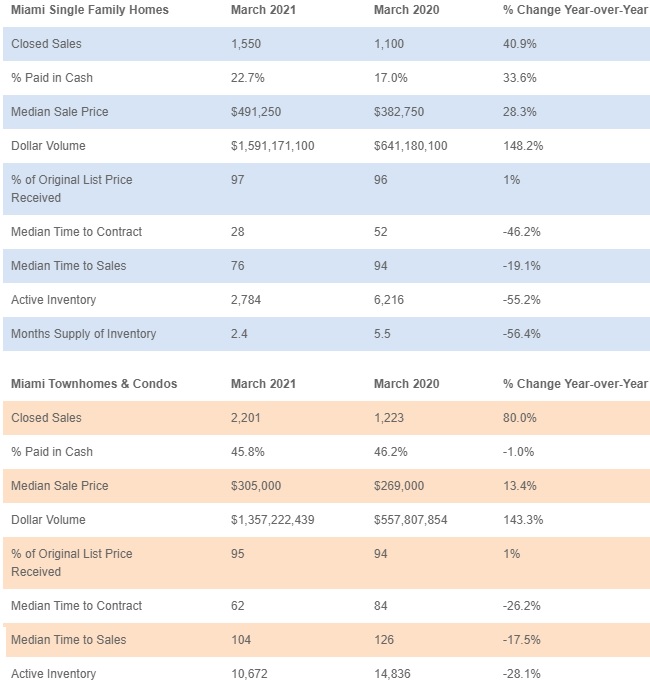

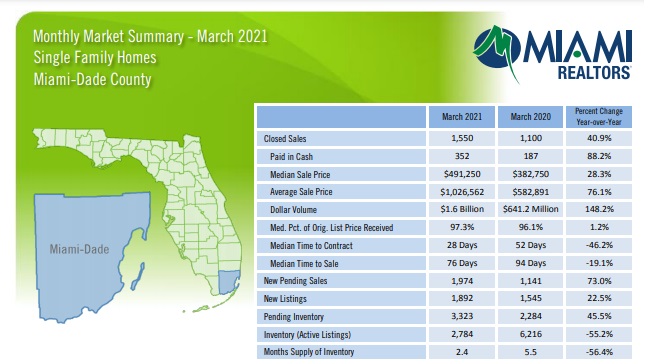

Home and Condo Markets

Miami’s home and condo market performed well in March, however, unlikely most US housing markets, Miami’s housing market was strong in March of 2020. So year over year percentage rises in sales and price aren’t the more spectacular variety you see in San Diego, Denver, Dallas, Austin, or Los Angeles, or in the extreme what is happening in the Canadian housing market in Toronto or Vancouver with 200+% increases.

Total home sales in Miami-Dade County jumped 61.5% year-over-year in March 2021, from 2,323 to 3,751 homes sold and bought. Single-family home sales in Miami rose 40.9% year-over-year, from 1,100 to 1,550. And existing existing condos sold in Miami grew 80% year-over-year, from 1,223 to 2,201.

Miami Realtors Association Chairperson Jennifer Wollmann said. “Low mortgage rates, the increased availability of remote work, relocating companies, Miami’s advancements as a global center for technology and finance, and increased interest from international buyers have all played a role in rising home sales.”

That’s the usual statement about Miami and Fort Lauderdale’s drawing power for real estate. However, this is the end of the pandemic and pent up demand will still show up here. Miami’s many condos will be a hot commodity for foreign buyers and for migrants from New York, New Jersey, Ohio, Pennsylvania and California.

What is driving sales here in Miami?

Miami Realtors added in this month’s homes sales summary that: Low interest rates; a robust S&P 500; the appeal of stable assets in a volatile economy; homebuyers leaving tax-burdened Northeastern states to purchase in Florida (no state income tax); and work-from-home and remote-learning policies have all combined to create a robust market for luxury single-family properties.

“The interest for now, though, is definitely still here. Similar to what we’ve been seeing from the Northeast, our foreign clients are also evaluating what life really means to them and where they want to spend their time in the near future. Finding a place in the sun has always been desirable, and now even more so,” said Carla Rayman Kidd, an international specialist with Coldwell Banker Realty in Sarasota. — from a Herald Tribune report.

China and Canada remained first and second in residential sales dollar volume in Florida at $11.5 billion and $9.5 billion, respectively, continuing a trend going back to 2013. and NAR reports these as their prime destinations:

- Sarasota-Manatee metro area ranked fifth in Florida as a foreign buyer destination with a 5% share.

- Miami-Ft. Lauderdale-West Palm Beach was tops at 53%

- Orlando-Kissimmee-Sanford at 11%,

- Tampa-St. Petersburg-Clearwater at 7%

- Cape Coral-Fort Myers at 6%.

Tax burdened buyers might be the key to new sales because states such as California, New York and New Jersey will see big tax surges.

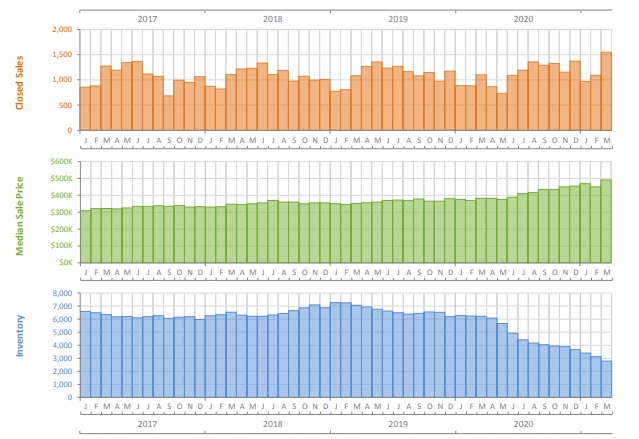

Miami Housing Market Stats for March 2021

It is an astonishing 112 months straight of home price rises in Miami.

Single-family houses in Miami selling between $400K to $600K jumped 81.4% year-over-year to 488 transactions in March 2021. And Miami existing condo sales selling for $400K to $600K grew 136.3% to 241 sales.

Luxury Property Sales in Miami

Luxury Single-Family Home sales in Miami also jumped by 225% in March 2021 year over year. Miami million dollar+ home sales jumped 225% year-over-year to 312 sales in March 2021. Miami luxury million dollar condo sales rose 204.4% year-over-year to 277 units.

Is the Miami Housing Market Overpriced?

With the presidential election coming, a falling US dollar, extra stimulus money, a potential Corona Virus vaccine, and continued reopening of business in 2020, we’d have to predict a more promising outlook for the housing market.

Should you invest in Florida real estate? Many Americans are investigating a move to Florida and buy a home or condo in the Miami region? With prices so reasonable in comparison with other cities, and the amazing Florida lifestyle, combined with more listings, along with low mortgage rates, this probably is the right time to buy.

A recent study by Florida Atlantic University suggests that Miami Dade County and Broward County real estate might be overpriced as much as 20%.

The conclusion evolves from decreased home buying demand vs large rises in home prices in the south Florida and Miami housing market region. But compared to cities in the Northeast, home prices here are very reasonable. It should be pointed out that Florida real estate is even more attractive given the better tax laws here and a new wave of work at home workers is creating a national wave of migration.

See also the Tampa real estate report and the Housing Market in Florida report.

Fort Lauderdale Report

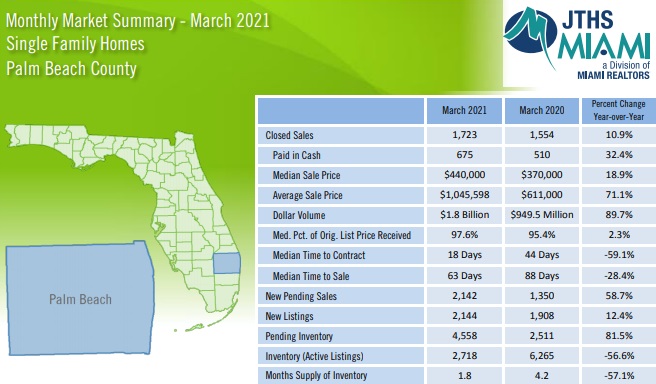

Palm Beach Home Sales Summary

The trend nationwide of course is to rising house prices due to constrained availability. The latest US housing report shows consistent strength in all major housing markets. San Francisco, the Bay Area and New York have lead the way with strong rises. Miami, Florida placed 9th in prices in the US, according to a report from Zillow.

The Miami housing market for 2021 buyer profile are very similar to what you’ll see in the Boca Raton South Florida real estate market forecast. Recent events have affected foreign interest. The biggest event here to affect buyers, and therefore prices, is Hurricane Irma, and several other hurricanes that passed through.

There was a lot of doom and gloom talk about the hurricane’s wiping out the South Florida economy, but it looks like they’ve already been a boon to it. Perhaps money has been diverted from buying new and resale condos to reconstruction of homes in the greater Miami area?

Miami – Good Time to Buy?

It is a good time to buy in Miami, before hoards of other buyers descend into southern Florida as the pandemic eases. Compared to home prices in New York, New Jersey, Boston and Los Angeles and San Francisco, prices in Miami are affordable. And home prices in Florida in general are even more attractive. The next Florida state housing market report will be out in late April.

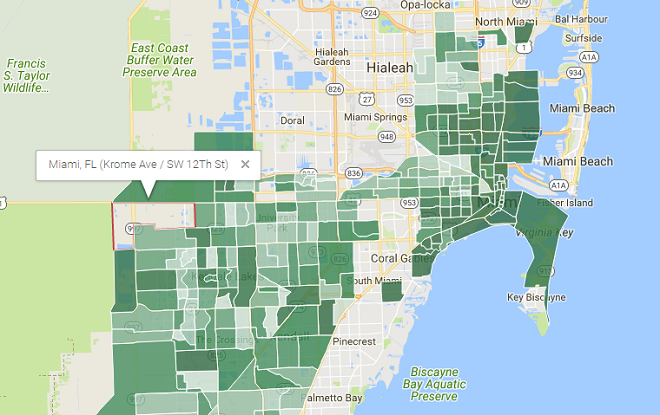

The real estate district of Miami includes the communities of Coral Gable, Cutler Bay, Doral, Homestead, Brickell, Medley, Miami Springs, Palmetto Bay, Pinecrest, and Sweetwater. It doesn’t not include Fort Lauderdale which is a separate MLS board.

Communities in Broward County include Fort Lauderdale, Coconut Creek, Deerfield Beach, Hollywood, Miramar, Pembroke Pines, Weston, Cooper City, Coral Springs, Hallandale Beach, Plantation, Sunrise, Tamarac, West Park and Pompano Beach.

Communities in Palm Beach include West Palm Beach, Delray Beach, Lake Worth, Jupiter, Wellington, Boca Raton, Palm Springs, Royal Palm Beach, Palm Beach Gardens, Boynton Beach, Atlantis, Loxahatchee Groves, and North Palm Beach.

Check out the neighborhood profiles on Neighborhood Scout. They include price appreciation, demographics, and more for Miami’s best neighborhoods and all the districts. Very helpful.

Looking to buy a condo or house in the Miami area? The typical buyer of homes in this region come from around the world, from New York and Toronto, to Dallas and Houston, to Dubai, Singapore, Beijing, Hong Kong, Sao Palo, Rio De Janeiro, to London UK. A good portion of buyers emanate from Venezuela, Columbia, Argentina, Brazil and Canada. Colombia consumers are most interested in Miami real estate this fall.

According to Miami Realtors.com, interest in Miami is strongest from buyers in

- Charlotte, NC

- New York City, NY

- Atlanta, GA

- Chicago, IL

- Los Angeles, CA

- Houston, TX

- Dallas, TX

- Auburn, VA

- Boston, MA

- Simi Valley, CA

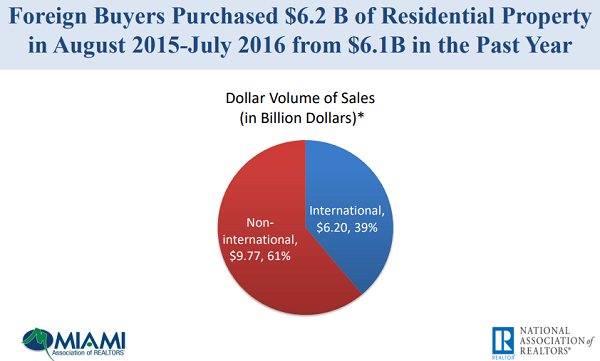

NAR reports that almost 40% of residential property is purchased by foreign buyers.

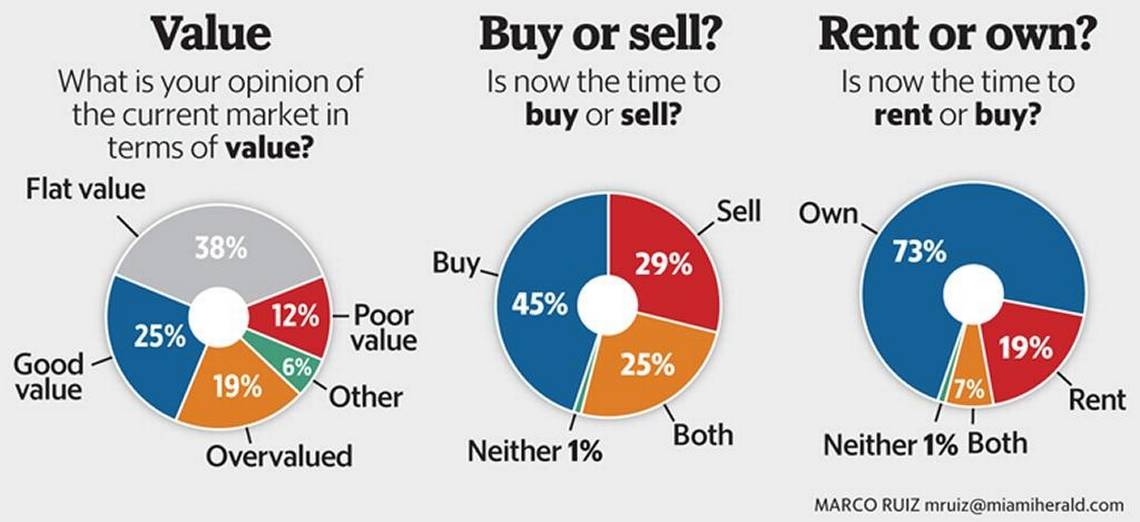

Buyers Forecast 2019: The Miami’s Herald’s buyer survey revealed the buyers forecast that residential home values will fare over the next 12 months, 36% believe they’ll rise, a third think prices will remain flat while 21% believe they will depreciate.

You can discover more about Buying in Miami via the Buyer’s Survey from Miami Herald

Graphic courtesy of the Miami Herald

The Miami Herald undertook an informative survey of buyer attitudes and the opinions definitely point to the buy side.

Miami’s beauty, incredible climate, business opportunities and proximity to Europe and the Caribbean make it a key position in International business and trade. With condo prices subdued currently, now may be the time to pick up a bargain before prices rocket again.

Bookmark this post for future update on the Florida housing market.

Real Estate Housing Market | 3 Month Stock Market Predictions | 5 Year Stock Forecast | Travel Software Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO | Advanced SEO