Dallas Housing Trends

So much has gone in Texas in the last year, yet as the pandemic misery recedes, we’re in for more change in 2021 and 2022. Texas overall is perhaps the hottest housing market in the US, is looking very good despite what Biden is doing with oil and at the border.

With oil surging toward $70, housing markets in the cities of Dallas, Fort Worth, Austin, Plano, Houston, San Antonio and El Paso should be fine in the next two years. The US boom period will drive strong growth in home prices, but with fewer sellers, sales will likely begin to decline in the Long Horn State and in Dallas.

With the Dallas Forth Worth population having grown 120,000 in the last year, and prices roaring, a good number of buyers will be priced out of the market, and pushed into the rental market.

10,152 single-family homes were sold in North Texas during April — 28% more than a year earlier. Condominium sales more than doubled.

In a North Texas Realtor’s report this month, Paige Shipp, a Dallas-based housing analyst said “I’m running out of adjectives to describe the market — astonishing, astounding, mind-boggling, but in reality, the best way to describe it is ‘insane’, A year-over-year increase of 28% is unprecedented for D-FW and frankly, unsustainable. With monthly sales over 10,000 and under 7,000 homes for sale, that equates to 20 days of inventory. With so little inventory, monthly sales growth over 25% cannot continue.”

And the median single-family sales price set a record at $325,000, 18% higher than in April 2020, according to the latest data from the Texas Real Estate Research Center and North Texas Real Estate Information Systems.

Hot Topic for 2021/2022

Is Texas the place to be in the next few years?

Share your thoughts on Facebook!

This means Texans should expect strong economic growth with many companies moving to Dallas and Austin to leverage the tax benefits and harmful regulations in California among other states. Immigration from California and from abroad will demand to the full Texas market. More people are learning about Texas and as the state offers more, it in turn draws more interested buyers, and people wanting to work here.

With Austin powering up the tech sector, economists and housing market experts might appreciate how strong Texas will become. Texas A&M research reported that on a monthly basis. Houston and DFW topped the national list and accounted for most of the state’s new home construction, issuing 5,142 and 4,875 non seasonally adjusted permits, respectively. The bright side compared to most states, is Texas’s support of new housing development. However, the report also showed developable lots fell by 12.2% in April. A prediction of huge price growth isn’t outlandish then.

Tamu Edu Research reported also that single-family private construction values decreased every month this year to date, dropping 4.7% QOQ in real terms. Values in DFW and San Antonio sank for the second straight month, bringing them back down to normal levels for 2021.

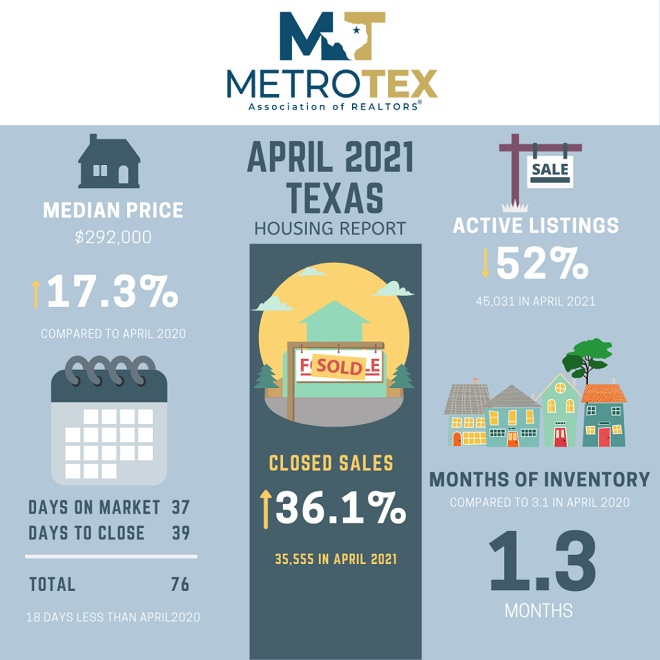

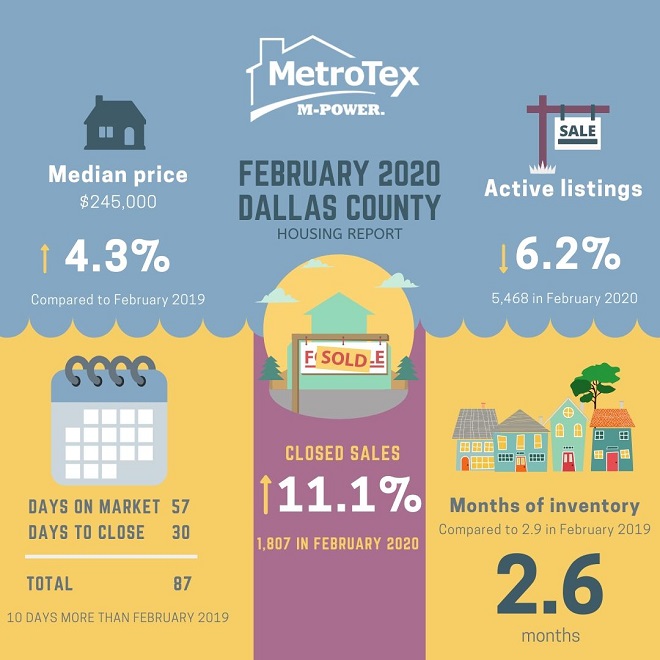

Metrotex reports strong sales demand amidst dropping supply, which can only mean higher home prices. Buyers ask if home prices will fall, and we may see a drop in demand toward the end of this year, but without home supply, the price can’t fall much.

Texas Home Sales and Price in April

The key statistic is a drop in supply of 52%. With 45,000 listings, there are still homes to buy.

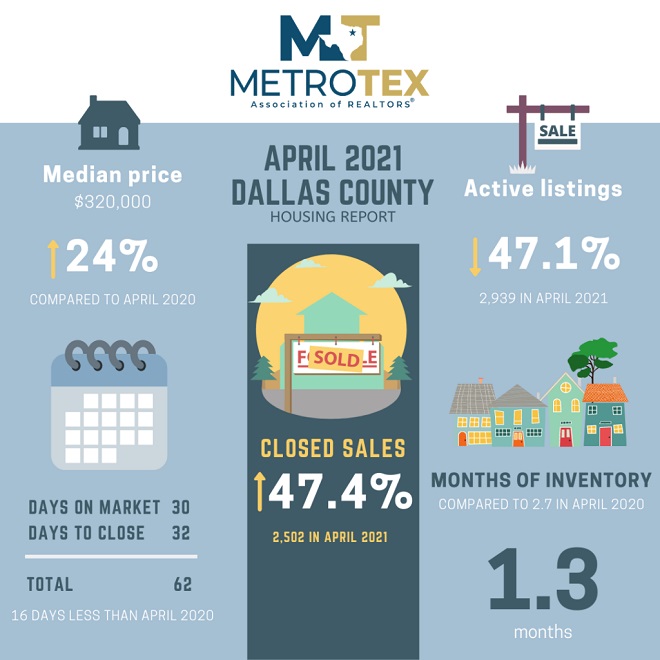

Dallas Real Estate Market April

Of course, demand is highest for the major metro of Dallas where prices have grown 24% year over year. Listings are down yet there will still 2500 sales in April 2021.

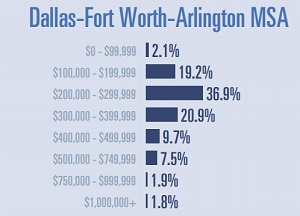

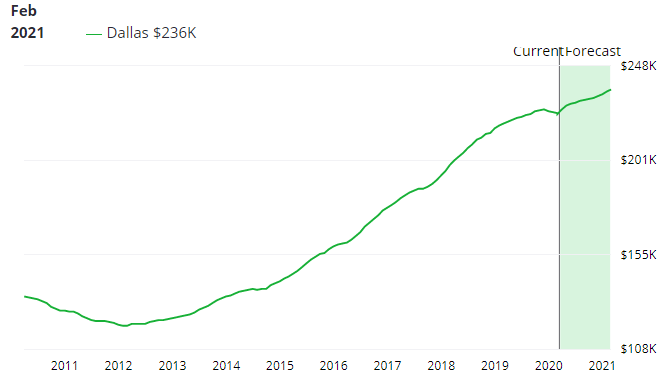

This graphic below prices have platteau’d in the last few months, mostly due to the big winter storm, but with the summer approaching and the easing of Covid 19 restrictions, hoards of pent up new buyers will be looking for homes for sale. NAR reports the average house price in Dallas is now $417,500 and there are only 3,720 homes for sale in Dallas.

Oil Price above $65 Makes Texas Irresistible

Last time I reported on the Dallas market, it was before the oil price crash, where I stuck my neck out to forecast prices could fall to $3 a barrel. Of course, prices went down further into the negative territory. Someone made a lot of money on getting paid to hold oil

Nevertheless, the oil market has returned. Oddly enough with the Biden curse, oil prices will actually rise because of reduced production from US fracking and Texas reserves. The Saudis will take advantage of the situation as they always do when the US heads into a boom period.

The Saudis and Russians wanted to eradicate the US shale oil production in Montana and California along with the Alberta oil sands if possible. Alberta heavy crude oil for instance was selling for $7 a barrel and they’re now receiving much more, much to the dismay of a certain Texas billionaire. Alberta is moving their oil by railcar since the Keystone pipeline was cancelled. Texas would have benefitted from that extra flow of oil to be processed and exported to world markets. It is a big loss to Dallas and Calgary.

What modifies the dour outlook for the Dallas housing market was higher home prices and lots of mortgage debt. Now with the threat of extended unemployment from low oil prices and a subdued US economy overall, there’s not much to support home prices in Dallas, Fort Worth or Houston.

It could be the euphoria driving the housing markets across the US from California to Florida to New York is done for now. And in places like Montana, Texas, Alberta, Canada, it’s an actual housing market crash.

Only a short while ago, Redfin rated Texas cities a most vulnerable to a housing crash. Austin, San Antonio, Dallas, and others. Redfin believed that a recession wouldn’t bring down the full US housing market, but given $40 oil prices, they likely felt Texas was a zone of vulnerability. At $10 a barrel, where it’s headed, all Texas cities are vulnerable.

Redfin’s Evaluation of Markets at Risk

Redfin’s study included rating a number of US cities based on these factors:

- home sale price to income ratio

- average home loan to value ratio

- home price volatility

- flips share of sales

- diversity of local employment

- share of the local economy dependent on exports

- share of local households headed by someone age 65+

Basically, they studied factors relatively independent of the the impact of low oil prices and other energy demand trends. Interestingly, cities such as San Diego, Los Angeles, Riverside, and Miami have much higher home price to income rations, but their economies aren’t dependent on oil.

Florida’s housing market however with its crashed tourism industry is in deep trouble now too.

Some Doubt it’s a V Shaped Recession

A few are suggesting the housing crash will last a lot longer than this v shaped recession. Another factor is fear and hype which was focused on the stock market. Now with mortgage payment defaults and lost jobs, it could turn into a housing market contagion. As economic conditions worsen, many buyer’s DTI (debt-to-income ratio) will suffer and they may not qualify for a purchase any longer. They may have to use the downpayment money they had to pay their rent.

In the Redfin report, one expert suggested there is no housing bubble because supply is low.

“Home prices are high right now, but they’re high because there’s not enough supply to meet demand, which means there’s not a bubble at risk of bursting,” said Redfin chief economist Daryl Fairweather. “

They couldn’t conceive that demand would disappear so suddenly based on OPEC and the Corona Virus, then return perhaps much weaker than it was in the fall.

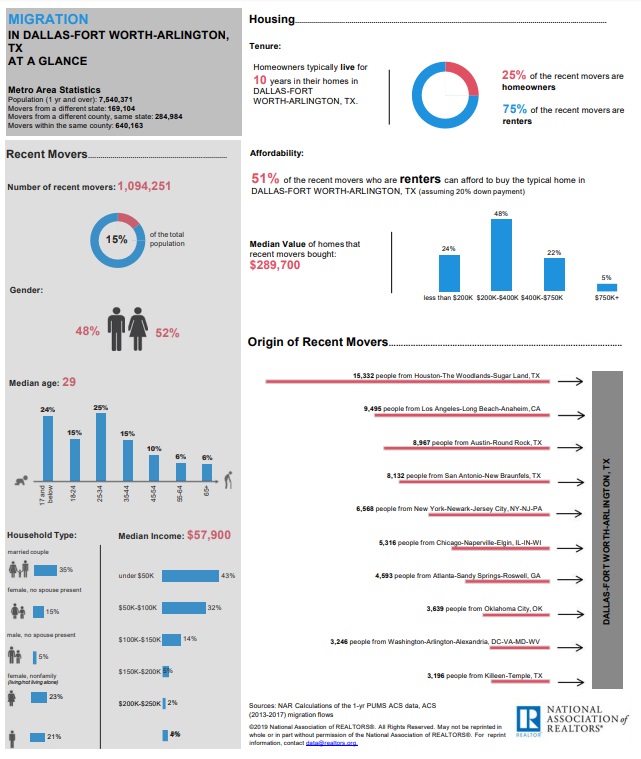

Dallas Fort Worth Arlington Housing Stats for February 2020. Screenshot courtesy of Texas Realtors.Dallas Fort Worth was an excellent housing market in 2019. Active listings grew by 13.7%, prices rose 3%, and homes sold grew 3%. The median income of home buyers was $66,982.

The region enjoyed strong immigration of new residents which fed the demand for housing and for rental apartments. Apartment rents have risen about 10% each of the last 4 years. Many renters were eager to become home owners.

Zillow was forecasting a 5.3% increase in home prices over the next year. They state that 5.7% of homes have negative equity, and 1.3% are delinquent on their mortgages. Zillow rent index shows average price of $1587 a month, a steep rise during 2019.

There is no way to forecast the Dallas Fort Worth real estate market over the next 5 years. The key factor is OPEC and the political mood of the times. It would appear OPEC has the US right where they want them. However, Saudi Arabia will be severely economically damaged if they persist with production floods.

The US government had a plan to stockpile a further $30 million barrels to the estimated 700 million barrel pool. According to a Reuters report, the government will buy up to 11.3 million barrels of cheap sweet crude and up to 18.7 million barrels of sour crude. It will be stored in caverns in Louisiana.

See more on the Forecast for the Housing Market and if the Stock Market will Crash?

Stocks | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2024 | 5 Year Stock Forecast | Dow Jones Forecast 2024 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Real Estate and Residential Housing Market | Housing Market News