Real Estate vs Stock Market Investment

Buy House or Invest in Stocks?

Where can you better build a fortune, or at least ensure you have the best long term investment? Is it stocks or real estate?

Are you reviewing the buy a home vs buy hot stocks as a better decision? It shows you’re on the ball. You’ve got a lot of years ahead of you, and this one decision could determine how your financial life will turn out. And the future comes fast. You’ll find many points to consider below, some of which experts don’t discuss because they make assumptions (politically, economically).

For many the stocks vs real estate decision is made for them due to the out-of-reach price of homes. Instead, they’re living a mobile life in apartments or travelling during this era of high prices. They’ll rent and invest what they can in good stocks, gold, or even cryptocurrency. Very smart. Could you travel, yet still own real estate? In 2022 and beyond, people will be doing this.

Studying next year’s outlook is just as important as the next 5 years or next 10 years. 2022 is a transition year. And the 30 year outlook is a difficult one to predict.

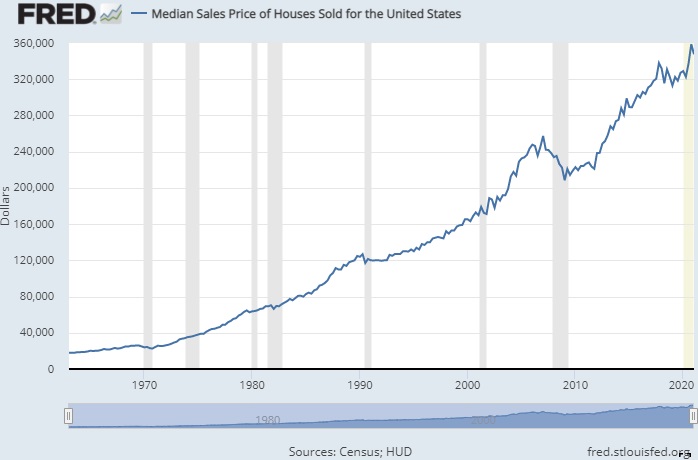

Will the housing market crash in 2023? Would waiting to buy the dip in home prices be worthwhile? The long term US house price chart shows home prices don’t head too often. Housing markets in the UK, Canada and Australia look exactly the same as the American housing market.

Hot Trending Topics for 2021/2022

Are people investing wisely as the markets peak?

Please start that conversation with your friends!

Industry Pros Always Tout Their Financial Products

Experts in each industry argue that their industry is better. Real estate agents skew it their way, and stock investment advisors skew it to the other side. You can’t blame them. They need to sell product and their conversation always comes back to what they must sell.

One aggressive investment advisor says it has to be stocks and that a house is not even an investment! That’s an old adage that needs to reviewed. Others say a house is a leverageable asset during low interest times and is more stable and insurable. The truth is that house or other property is a leverageable asset that can generate enough income to pay off your debt. That fact is difficult to ignore.

The arguments for the stock market as a better choice for investment often aren’t sound. And justifications for buying a house by itself with no other strategy seem flawed too. Our parents and grandparents bought a house with no other investment strategy, and sure enough they ended up with a dilapidated house and a low paying pension to exist on for a few years. It’s no wonder most people died within 3 years of retiring.

And when I was young, no one told us houses would be worth a million dollars. We had no idea our civilization would become so materialistic and that politics would drive the cost everything so high. Will all that stop? Will house prices rocket back down?

If you buy a house in 2021 or 2022, through leveraging your parents assets, in some city you can actually afford, rent part of it out, you will have extra money to invest any way you like. And yes, when mortgage rates are fixed to 3% over 30 years, then maybe it’s a no brainer.

As inflation grows and stock prices and dividends increase, those investments might look very good. But house values will grow with inflation too and rent prices will rise. It might dawn on you that a hybrid investment choice might actually be the best route. But let’s review the issues facing investors.

The Data is Flawed, and so are Expert’s Assumptions

One study found that if an investor missed on buying stocks on 10 specific days in the last 100 years, their portfolio wouldn’t have grown much. Most of the growth in stock prices happened during key boom events. If you miss them, the returns are not so hot. Markets are emotional and you must be sharp minded and equipped with tools and insight to capitalize on these key events.

And the past growth of stock market returns is ancient history. We all know stock prices have risen like crazy in the past 12 years, post-recession, but that’s not going to happen in the next 12 years. Consumers will get satiated, taxes will rise, and the economy will flatten over the next 5 years and beyond.

So stock market investors will face more difficulty in keeping their stock investment value and in growing its value. A house keeps its value over time, but companies become obsolete due to technology changes, and market and trade agreement changes. Stocks are much more risky and risk has to be factored into your decision. And whether you buy stocks or REIT’s, you can be sure the people inside are ripping you off. And, I’m not talking about paying CEO’s tens millions in salary. They find all sorts of ways to gauge you as the faceless investor.

So, wouldn’t that turn investors heads to the real estate market or owning a house? While stock investors have had capital gains protection in the past, they may not have that with the Biden administration in the US. In other, countries such as the UK, Australia, Spain, Italy, Canada and Germany, taxes are on the rise too.

Of course the housing market has it’s big, inescapable taxes as well.

However, the housing market may present buying opportunities in regions, cities and countries where prices are lower. Take the Florida housing market or Texas housing markets as an example. Home prices in those states are low, and in some areas, are very low, and quite the bargain for those wanting to sell in New York, New Jersey, Boston, Atlanta, San Francisco, San Diego, Vancouver, Toronto, Philadelphia, Chicago, or Atlanta. For many work from anywhere workers, buying or renting in remote places with an Internet connection changes the value equation quite a bit.

Of course, there are cheap, underpriced stocks you can buy too. If you check the latest stock market reports, you’ll see the cheapest stock price report and a list of top gaining stocks too. The upside potential is there, but investing in stocks is still a gamble.

With property, you own the land and the house. You can live in it. You can rent part of it out to pay your mortgage. This buy to rent out feature is something stock market investors can’t find in the markets.

But to confuse issue, you can buy REITs and real estate ETFs, and even home builder stocks. You could walk that bridge between the two investment options.

Comparing Stock vs Real Estate Investment

It’s not simple calculation. There are a lot of possibilities which if leveraged, changes the long term profit picture. For instance, you can buy and sell stocks like a day trader, using AI stock prediction tools and earn way more than let’s say the S&P average.

Most millionaires made their fortunes via property, not the stock market and losses on stocks means you lose your investment. Most millionaires didn’t acquire properties at their highest price level. They bought low, sold high.

Before you choose, consider the potential of real property, and the drawbacks.

- houses are very expensive now and you may need bank of mom and dad

- are going to get married? Divorce will cost you half of the houses sold value

- housing construction will eventually improve, but it likely will not catch up to demand

- buying a house as an investment creates tax advantages, but also operating costs (roofing, plumbing, insurance) and sometimes repair bills that hurt bad

- rental income will be taxed if you can’t protect it

- interest rates are really low

- homeowners insurance ensures against catastrophic loss

- rent prices are rising and rentals look to be in growing demand (immigration, mobility, high home prices)

- home values are stable, unlike stock prices and if the housing market crashes, it’s just temporary event to you, and will actually help increase demand for your rental

And then there’s the upside/risks for Stocks

- investing in individual stocks is difficult since great insight into balance sheets, company history, and demand in a particular industry and the economy is required

- investing in stocks you know little about is pure gambling

- stimulus funding bailed out a lot companies and investors, but after 2022, there won’t be anymore bailouts

- capital gains taxes are menacing and the US is now investor unfriendly

- you can’t write off your investments unless they’re part of your retirement savings plan (401k)

- the US dollar is falling in value

- after 2022, the economy and stock market could go flat

- foreign stocks might produce much better returns

- stocks are liquid and can be sold quickly when prices go well up

- your holdings can be diversified and using hedging strategies against ruinous losses

Do grow your education on property sales and keeping an eye on the 2022 housing market forecast. It’s a pivotal year. And experts are divided on whether new home construction will ramp up over 2022. They forecast reduced demand for homes, which might be pessimistic. The slow recovery is pushing a lot of demand forward, so you can low mortgages and rising rent prices. Rental income should be a fixture in your wealth building plans.

More interesting insight: More on the Housing Market Forecast for 2024 and the Stock Market Forecast for 2024 and Stock Market for Next Week.

3 to 6 month Forecast | Travel Software Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO | Advanced SEO