Oil Price and Gasoline Price Forecasts

Oil and Gasoline prices are expected to rise in 2024, pushing ever higher over the next 5 years as the US and global economies recover from the pandemic inflation rollercoaster.

Yet today prices fell 4% on news that Russian crude supply is back up. It seems there is little political resistance to Russia’s war nor with its continued sale of oil to China and India. Hold onto your hats regarding that issue, as Russia commits further atrocities in the Ukraine. Last week’s destruction of a dam killed Ukranains, threatens a cholera outbreak and may affect wheat exports to the European regions.

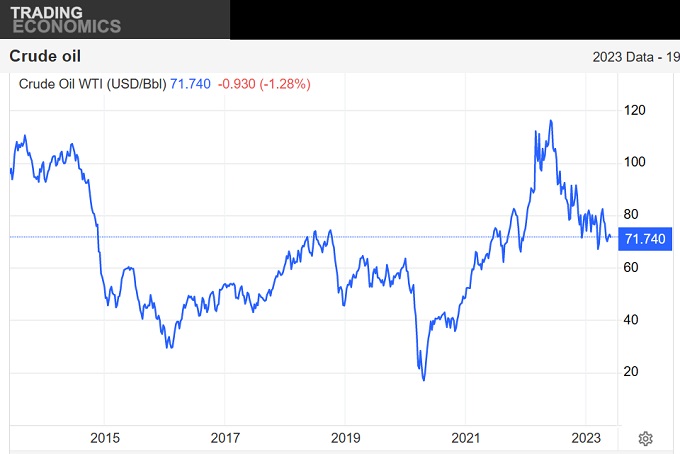

Brent crude futures traded at $73.99 a barrel, down 1.07%, on Monday morning, while U.S. West Texas Intermediate futures stood at $69.43, then dipped to $67 during day trading.

Goldman Sach’s Jeff Currie

In a recent interview with CNBC, Jeff Currie of Goldman Sachs discussed how higher interest rates are causing oil companies to liquidate holdings, and the recession outlook too is causing liquidation because no one wants to hang onto oil that will sell for less. In this market, oil is liability.

Currie readjusted his December 2023 outlook for WTI, today down 10% to $89 per barrel to $81.

In a CNBC International interview, Dominic Schnider, head of commodities and Asia-Pacific forex CIO at UBS said to watch inventories, and is looking for a floor for prices. In the US, not much growth in supply is happening so he’s hinting at a $95 a barrel price by year. At these prices, gasoline would rise significantly.

This suggests oil stocks will enjoy a significant jump. OPEC’s intent is what oil investors are watching.

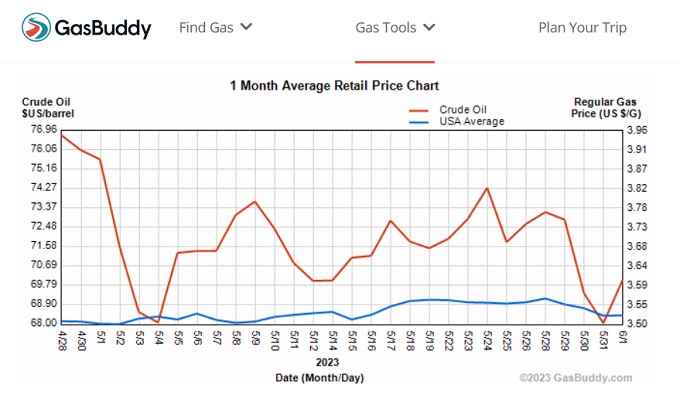

Next Week’s Gas Prices

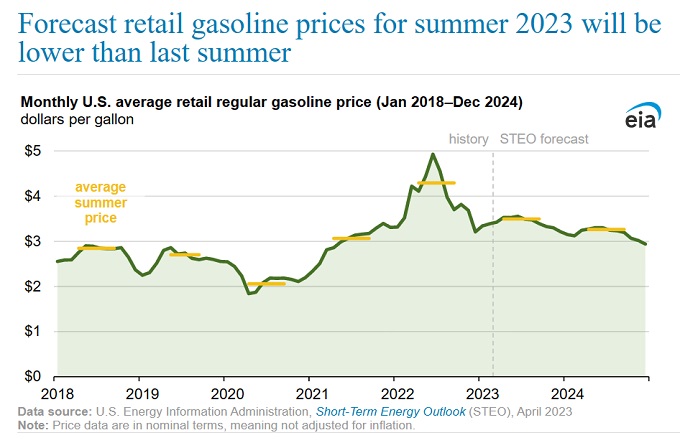

EIA has been predicting lower oil prices and gas prices for summer 2023.

The key factor is whether Europe and the US will tolerate Russia selling oil to fund its war with Ukraine? The Biden regime favors sending billions in military supplies and jets to the Ukraine, and teach them how to fly a $100 million jet.

But the optics aren’t good and the DEM media can only distract so far. At some point the EU and the US will have to put a stop to the cheap oil flowing to India and China. When Biden killed the Nord stream pipeline, it’s set of a series of dangerous events, and in hindsight was very bad judgement.

Strife between OPEC and Russia is boiling given Russia is dumping cheap oil in India and China thus cutting into OPEC sales. Obviously communications with Putin are not going well, and Sankey believes there could be an oil war ahead, where the Saudis increase production wildly. That would cause significant pain to producers but help the global inflation issue.

A severe oil price crash would give Biden an opportunity to replenish the oil reserves which would keep oil prices from sinking too far. Cheap oil and gasoline would be a big political win for Biden and hit his targeted victim — Texas republicans. The SPR is down 360 million barrels and Biden likely only has 17 months left in office. It makes for an interesting 2024.

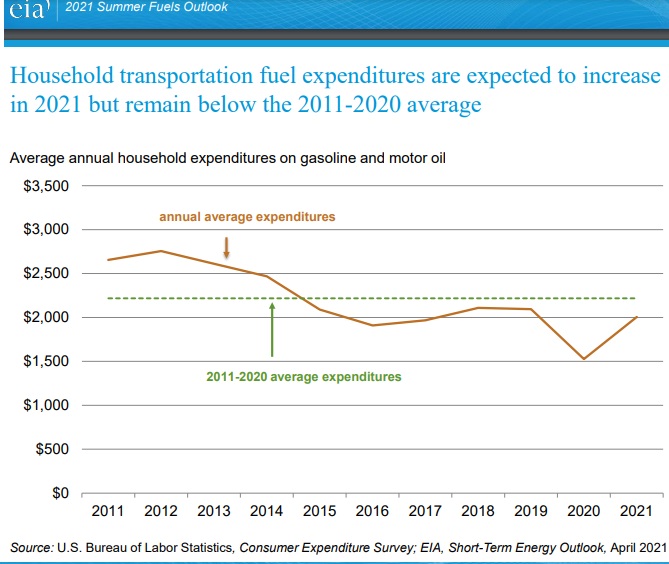

Excess oil at a cheap rate for the rest of 2023 would encourage and support oil consumption thus affecting expenditure on fuels for transportation and manufacturing. Cheap oil changes business decisions. An oil flood would also cause a shutdown of drilling and production, which sets up a revenge price rise in 2024 where demand would be high and supplies not ready if at all. That would make a $200 oil price a possibility.

Good news on the strength of the job market and that inflation is up, may have added buy orders, as did growing demand for gasoline and jet fuel for this summer season. AAA says air flights, train trips and bus trips are expected to rise strongly, while car trips will be slightly less than pre-pandemic levels due to gasoline prices.

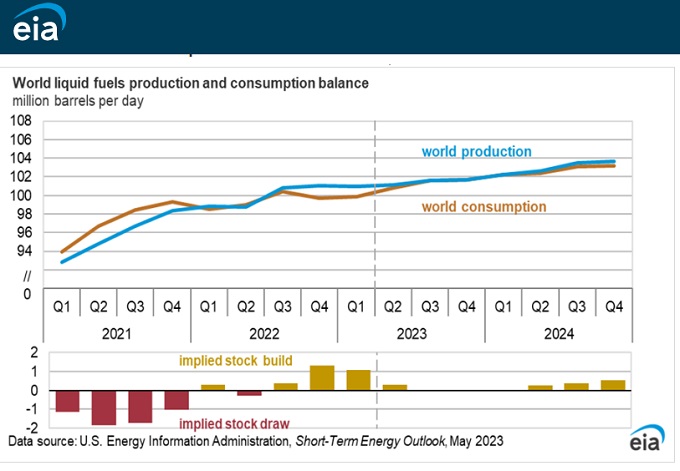

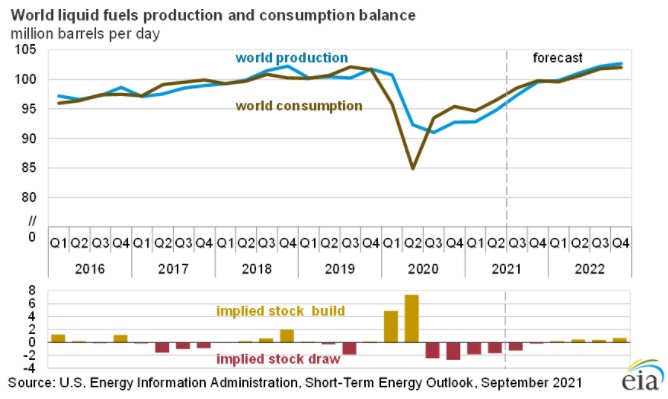

EIA forecasted an increase in OPEC production which has not happened and instead further cuts may have to happen to keep prices from collapsing. EIA’s forecast of higher production right to the end of 2024 is suspect given the tension right now. OPEC countries would likely not go against Prince Abdulaziz bin Salman’s dictates for cuts.

The Problem With China and India

As China’s economy warms back up this summer, oil demand is stronger than anticipated and they’re getting theirs from Russia. That won’t sit well with OPEC as well as US/Europe who want to block and punish Putin for his attacks on the Ukraine. As Ukraine’s defense strengthens, the conflict with Putin will be intense. The US will be forced to put big pressure on India and China to stop the illegal imports or face steep sanctions. That could jump the price of oil considerably.

China’s economy is a little more sluggish than expected, otherwise oil would have been up higher today.

The May drop in oil prices actually helped keep inflation under control that creates lower exploration and drilling, and the costs of producing carbon-based energy rises, 2024, 2025, 2026 are three years where oil can’t meet demand. With the murderous Putin excommunicated from global trade, Europe and the US will be desperate for oil and natural gas supply. With no new refineries, gasoline prices are likely to rocket in kind.

The rise is due to oil and gasoline shortage reports as we head into the summer consumption season, so it’s not quite a signal of a bull run for oil. With the Fed crushing the economy and President leaking SPR oil, oil and gas prices have sunk. Yet OPEC+ may make cuts. Read more below.

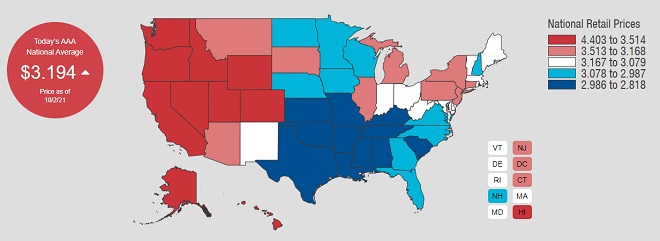

Gasoline Prices

Most consumers are focused on gasoline and jet fuel prices which can add to their inflationary price woes as they commute and travel. The outlook is worse for consumers since a finite number of petroleum refineries exists, putting hard limits on production. And in the plastics industry, it is Canadian heavy crude that’s used. Canada’s oil is kept out of the US for many political and competitive reasons (Keystone XL abandoned).

Oil prices are trading weakly around the $73 a barrel range, while gasoline rose to 2.71 cents, both a climb of 2% this morning. Key drivers of the growth are the debt ceiling default, low gasoline reserves before the 2023 summer holiday season and OPEC+ comments that more oil production reductions might be happening soon. This would certainly put oil stocks in the spotlight and encourage more investment in oil stocks.

API reported that gasoline inventories fell 6.398 million barrels on top of last weeks 2.46 million barrel reduction. Distillate inventories declined by 1.771 million barrels after decreasing by 886,000 barrels in the previous week. Analysts at Standard Chartered reported that speculative shorts across the four main Brent and WTI contracts rose 90 million barrels.

Yesterday, the Saudi Arabian energy minister warned speculators against shorting oil. Those speculating long grew by about 100 million barrels, so there’s price pressure from both directions. Short sellers stand to lose big before the June 7 OPEC meeting. A number of passionate energy experts believe oil will surge into 2024 due to a lack of investment in drilling and production infrastructure.

Alex Kimani of OilPrice.com said Standard Chartered economists forecast there is a high probability that OPEC+ will announce a fresh round of production cuts when it meets on 4th June, and that “OPEC+ cuts will eventually eliminate the surplus that had built up in the global oil markets at the beginning of the year.”

If interest rates do decline around the world, it is easy to forecast economic growth would increase demand for oil. Currently, the summer driving season will provide immediate pressure that can’t be rationalized away by the media. The US is under pressure now to not enact high interest rates and reduced money supply any further given inflation has been receding. The next official release of CPI data is CPI scheduled to be released on June 13, 2023.

Further rate hikes would lead to lower demand for energy.

What’s not said often is President Biden’s deliberate release of SPR oil to combat price rises. It seems likely he will react again with another large release to calm prices. Yet, the Saudis and OPEC may respond with more frequent cutbacks. Since prices are rising to their liking, Biden might wait to release reserves until after the next OPEC meeting.

OilPrice.com Coverage

S&P Global came out with a statement that the oil price is completely due to the impending US government default on its massive debt payments. However, that has been ongoing for many weeks and months, so it is likely not what’s driving this new surge in prices. See more news on the stock market today.

Rigzone just reported that a Standard Chartered report forecasted WTI will average $88 per barrel this year and be in the range of $85 per barrel in Q3 2023 and then $91 per barrel in Q4.

Price Volatility Ahead of Summer Driving Season

The volatility of oil prices and gasoline prices of late show big actors are manipulating the market for some politic or public relations purpose. Gas at the pumps has increased.

Certainly oil companies listed on the S&P, TSX, and Dow Jones are enjoying the windfall from $110+ barrel of oil price. Europe on the other hand is beginning to suffer. Transportation costs (see gasoline price forecast), food costs, heating costs, alone a signal that it may happen in North America and Asia too.

The question is whether you should be all in with these high flying oil stocks and sell your tech stocks? The US oil stocks and Canadian oil stocks are worth a good look. The argument here is from the lack of supply and the limited capacity of oil companies to produce more.

Whether next October’s elections will bring investment back to the US and shutting out imports is difficult to forecast. Oil analysts are likely beginning to look to the Republicans intentions regarding oil production, and it is likely positive which would mean higher US production and lower oil and gasoline prices in 2023/2024.

Canadian energy sector expert Eric Nuttall believes the most bullish factor pushing oil price upward is the exhaustion of OPEC+ spare production capacity. The lack of exploration and the ever rising cost of development means oil production will not keep up to growing demand.

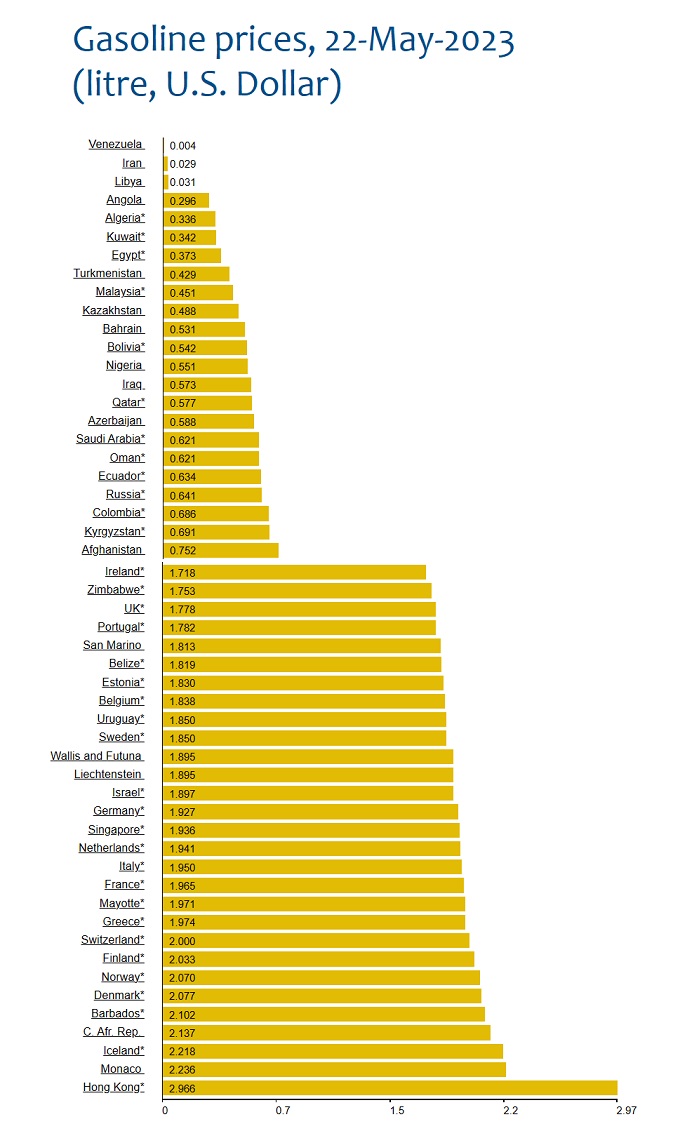

Current Wholesale Gasoline Prices around the World

Is it fair that some nations pay ridiculously low gasoline prices? Or are they just intelligent?

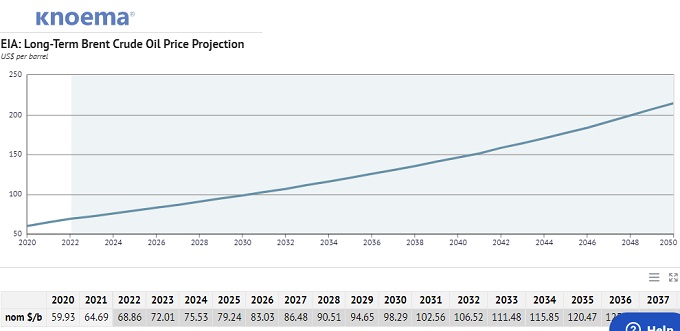

What is the Long Term Outlook for Oil Price?

In this graphic from Knoema, we see the long term price will continue to grow, and we’re already $50 a barrel up on this model.

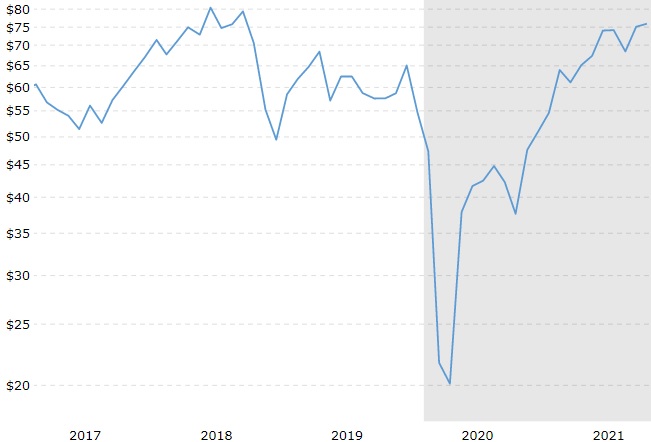

Oil Price History Chart

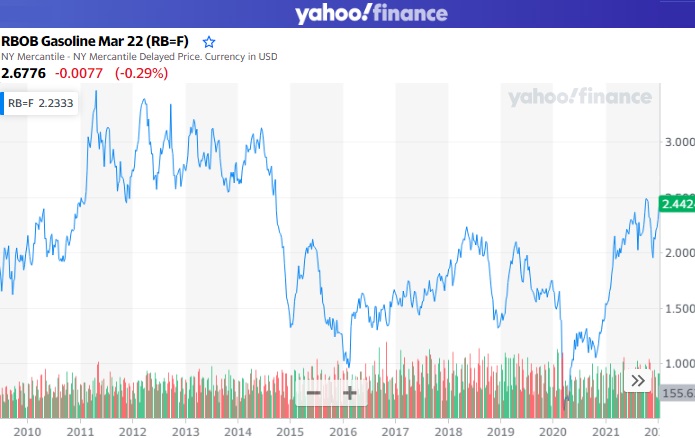

We’ve been in the $100 range before in 2011 to 2014. Even though the price of oil has grown fast and looks on a trajectory much higher than before, oil stocks have not risen to their previous highs. One stock in particular is at only 2% of it’s former peak.

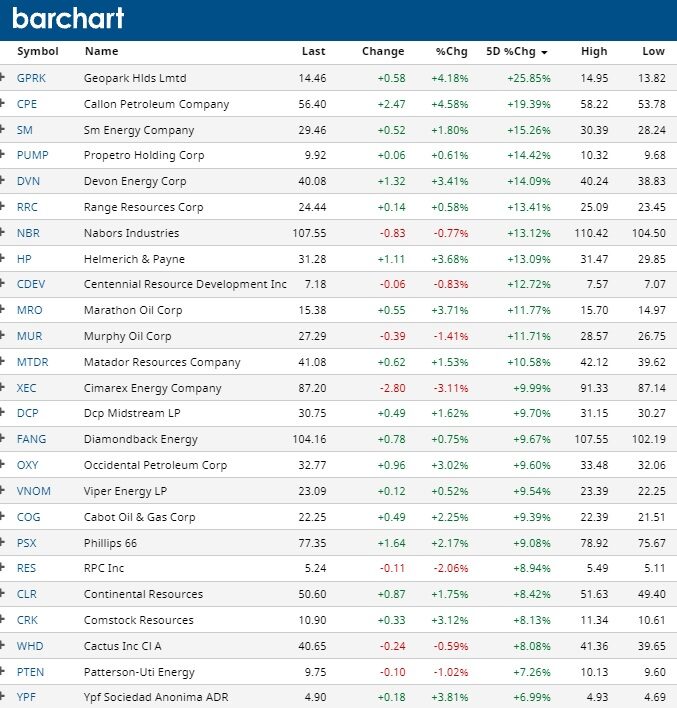

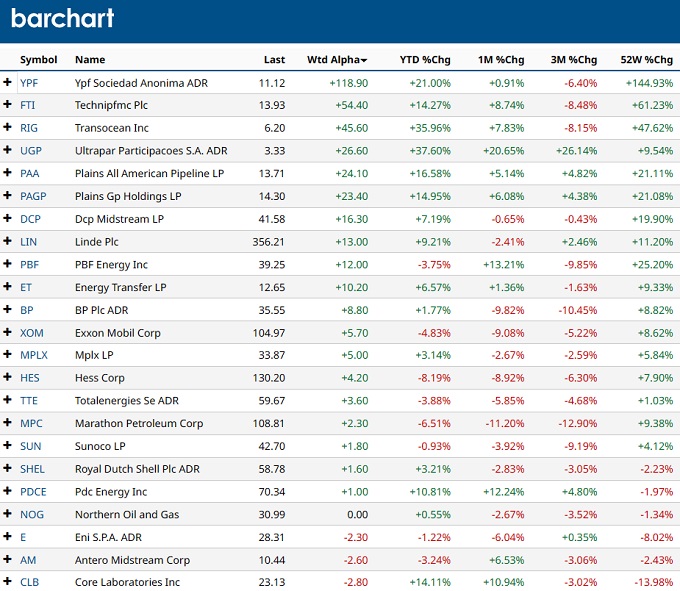

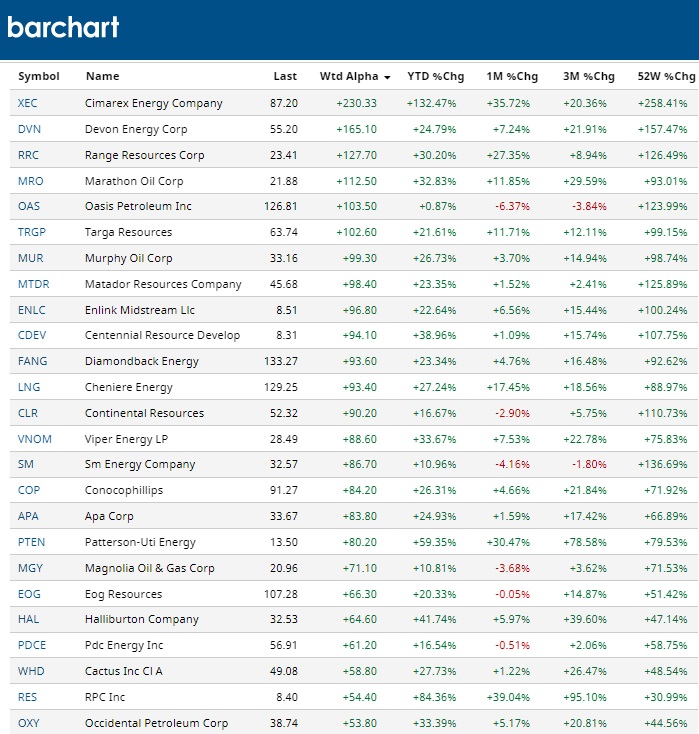

Best Oil Stocks Today

As of May 28th 2023, these are the best performing oil stocks by price. See more below and drill down on the Barchart Website with a premium account for best current insights.

Should You Buy Oil Stocks?

If you’re investing for the 1 year to 5 year term, buying oil stocks has to be a brilliant purchase. After this brief but pathetic move to suppress oil prices, they will rise with a vengeance this winter and spring. The US may only have 5 years of oil reserves left, and that’s counting fracked oil reserves, and without further exploration and production, Americans will have to import foreign oil from Saudi Arabia.

The Saudis and OPEC may not be in a cooperative mood in 5 years, thus the price of oil could rocket. Remember that EVs will only solve perhaps 10% of oil usage, so the public has been mislead about the source of oil demand and our supplies. This means we could have a severe crisis of supply with no ready solution.

For smart investors, it means oil stock prices are rock bottom right now. Intelligent investors are going to like the supply/consumption dynamics that point to ultra high prices in the coming years. As the global recovery continues, demand for oil will rise significantly.

Last time oil prices went up, oil stock prices rose 6 to 10 times what they are now. And prices might go higher this time with oil producers pumping out more crude. That translates to much higher revenue. Investors are beginning to see the potential. Should you buy oil stocks? Definitely review the possibilities.

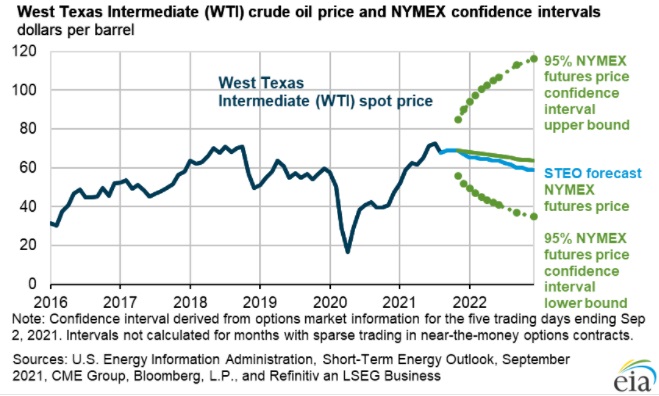

The EIA forecasted that Brent crude oil prices would average $71/b in the second half of 2021 and $66/b in 2022. WTI oil surpassed $86. Winter isn’t even here yet so we’ll see prices rise through winter and into the 2022 driving season.

The President’s crashing popularity is in great part due to inflation. The price of oil and natural gas are holding back the economic recovery causing grief and added strain on the social safety net. More Americans are losing belief that a sudden move to green energy is even possible let alone wise. The anti-oil ruse can only go on so long.

If energy prices do get out of hand, and some believe prices well over $100 is certain, the economy, jobs report and stock market are going to take a hit. Check out the many forecasts for oil in the next year below.

Investment advisors have forecasted $200 to $300 a barrel and most are accepting that $100 will happen. Media investment celebrity (Cathy Woods) suggested oil will be much like Whale oil centuries ago — worthless. Yet right now and for the foreseeable future, oil prices suggest oil stocks will be paying big dividends. Already oil companies are big forces on the S&P and Dow Jones.

Oil Price.com’s expert believes OPEC will not increase supply in the coming year. Why would OPEC or Russia increase supply to ease US problems? MarketWatch is holding out a candle for a gush of oil coming from Iran which could ease the global supply problem. It’s a long shot.

The US has an adversarial relationship with Iran (a deadly terrorist dictatorship which threatens the west with nuclear bombs).

It’s only a matter of time before the price of gasoline stirs resentments and a few Republican comments toward Iran would sour any trade freedoms with the terror nation. At some point, Donald Trump will speak out against Iran whether he plans to run in 2024 or not. It will warn and rankle Iran’s leaders.

With a cold winter ahead, restrained output, failing alternative energy solutions, and big demand add up to very high oil prices. Experts say this issue will be persistent and will add to the inflation problem. Natural gas prices are slipping, but there is huge supply reserves and the lack of pipeline infrastructure to deliver will be solved. But oil prices are a different story.

Dems Weakening and Wobbling

As part of the anti-fossil fuel legislation, US production has been sabotaged and must import oil at great cost. This hurts the US economically as billions of dollars are sent out for imports. The transition to green energy will take decades. The recovery is raising demand and the US can’t capture supply it needs.

As prices get out of control, the call for the President’s resignation will be loud. He has the second lowest rating for any US President already and we’re not into winter yet. His own party is balking at okaying the spending bills. But the Demo party can’t go back on their anti-oil promise. And the US President doesn’t control OPEC production.

As demand for US oil grows at high prices, oil companies in Texas, Oklahoma, Colorado, and Alaska will do very well. 3 years from now, it’s likely the Republicans will regain total control of the US government and they will open oil production back up. That will significantly raise revenues for US oil producers (and raise oil stock prices) and make the US energy independent again. But demand will be high as the recovery continues and prices won’t fall quickly. Current oil companies will do well. Only a recession will drive oil prices down again.

With world leaders meeting in Europe this week to try to solidify carbon reduction rules and penalize oil usage, the price of oil will stay high. Global manufacturers, farmers, and other businesses need oil products. The world is dependent on oil based products. For the next 3 months, oil prices will remain very high as winter hits. Going into May, prices will depend on how much the Dems back down from their policies.

Alternative energy experts trash oil, but when WTI oil prices reach above $60 a barrel, oil has big investment value. The economies in Dallas, Denver and Calgary are likely to boom. Canadian oil stocks listed below have a special allure and are gaining attention. They’re held back by pipeline blocks which could be removed by the Republicans in 2024.

Oil is at the center of US and world manufacturing and production output. Consumers have huge demand for oil-based products, from jet fuel to electronic devices. The demand never ends.

Right now, the US government’s decision to abandon fossil fuels is looking particularly bad. As gas prices keep rising, and headed to $US5 a gallon, the cost to consumers will change their vote in 2022.

Best Oil Stocks to Buy

Which oil stocks should you buy? Check out these best performing oil stocks today for consistent performers. There are penny oil stocks, risky, but may be your best bet to make a lot of money. As investment pours in, these stocks might jump later in the year when supply gets desperate. See also the best Canadian oil stocks.

Remember 2020 when some investors had the opportunity to jump on oil last year when they were paying people to take it. They were so smart. The price has risen ten fold for some. Other than that dip, the price has been consistently high. And with no US fracking and further oil exploration and the blocking of the Canadian pipeline, US oil companies in Calgary, Houston, Denver, and abroad are certain this year is going to be their best ever.

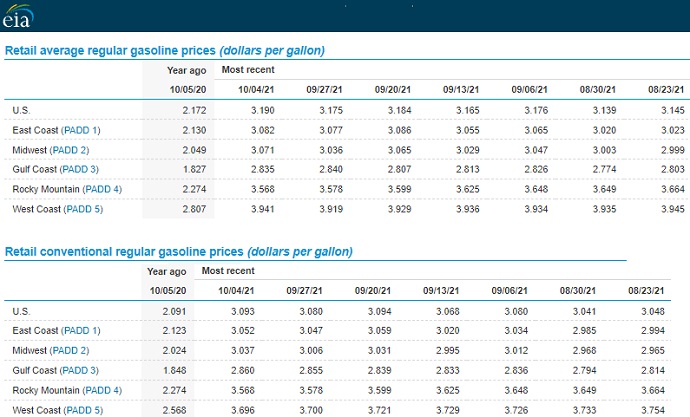

Highest gasoline price in the US? $4.11

The US national average for gasoline hit 3.19 cents and that hurts those who commute. With lithium batteries and electronic microchips in short supply, there is little concern about EVs taking over the market anytime soon. There are huge issues with electric charging stations (however, check out EVGO share price) too which makes the electric savior seem ludicrous for many, many years.

Oil is the fuel of this decade and prices will rise, until US frackers and new production gets going again. Without fracking, there are big oil reserves that can be developed to help keep the US energy neutral. That means not adding to the burgeoning national debt.

Best Oil Stocks to Buy?

Barchart shows the best performers. Geopark Holdings is a south American energy producer and it was rated as a top sell stock just last month. investorsobserver.com gave it a good rating. Callon Petroleum is rocketing of late too. In a timely action with good foresight, they just closed the acquisition of leasehold interests and related oil, gas, and infrastructure assets of Primexx Energy Partners and its affiliates. Devon Energy has been rising fast for two weeks, after its third-quarter 2021 earnings report. Seeking Alpha reports that Marathon Oil is on pace to generate $2.0 billion in free cash flow this year, which will do wonders to balance sheet health, and dividend growth. With oil prices rising even farther, it might be the best and safety oil stock to buy.

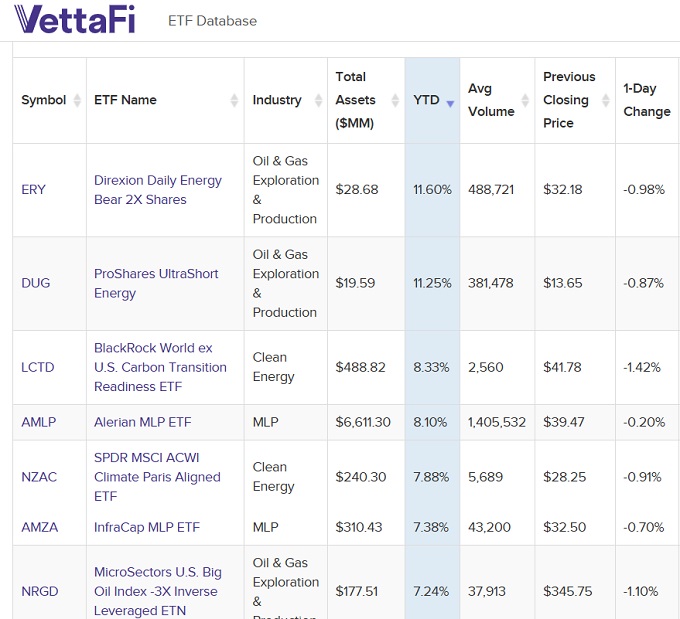

Oil ETFs

Experts believe the best time to invest in an oil ETF is in a period of rising prices. USO ETF took a big loss last spring when the price of oil dropped. It’s not necessarily a safe way to invest but as you can see, ProShares Ultra Bloomberg Crude Oil ETF has seen incredible growth.

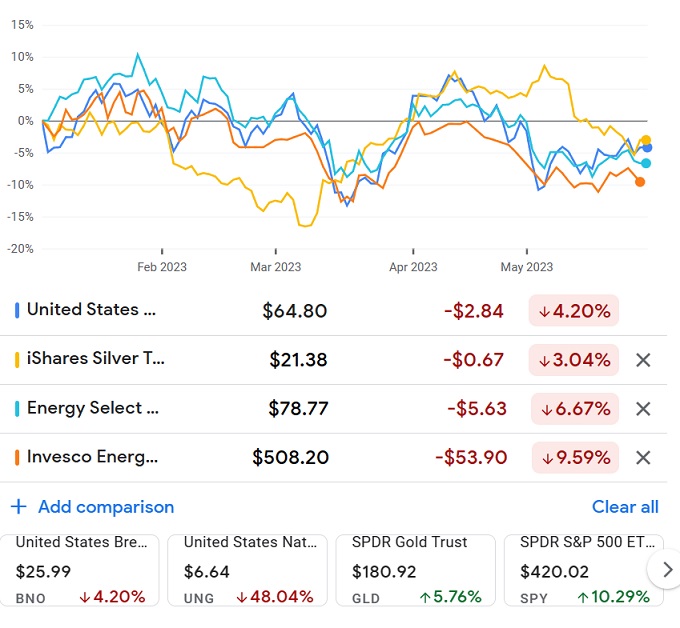

Google Finance Oil Gas Energy ETFs

Year to date, these large energy ETFs haven’t fared well.

US News offers up their best oil stocks to buy:

Okay, to whet your apetite for oil stocks to buy, let’s see what US News suggests. There are many other oil producing companies globally too that offer big upside.

- Exxon (XOM)

- Chevron (CVX)

- Conoco Phillips (COP)

- Schlumberger (SLB)

- Marathon Petroleum Corp. (MPC)

- Pioneer Natural Resources Co. (PXD)

- Phillips 66 (PSX)

And Yahoo’s experts chime in with their best oil stock picks:

- Renewable Energy Group, Inc. (NASDAQ: REGI)

- Exxon Mobil Corporation (NYSE: XOM)

- Energy Transfer LP (NYSE: ET-PD)

- PDC Energy, Inc. (NASDAQ: PDCE)

- Chevron Corporation (NYSE: CVX)

- ConocoPhillips (NYSE: COP)

- NX Resources Corporation (NYSE: CNX)

- Devon Energy Corporation (NYSE: DVN)

- Pioneer Natural Resources Company (NYSE: PXD)

- Renewable Energy Group, Inc. (NASDAQ: REGI)

You can check out more about these companies on InsiderMonkey.

It’s wise for longer term investors to look at Canadian oil companies in Alberta Canada. they’ve been suffering through a bad period, but it’s changing. The tired US administration has blocked Canadian oil, but if the Republicans come back into office (guaranteed), then Canadian oil will flow again. This will ease US oil and gas prices, and leave the US less vulnerable to Saudi Arabia and OPEC.

See the Canadian oil companies below.

For those looking for the best stocks to buy right now, it’s hard to overlook Canadian oil stocks.

The rising price of oil too, has provided a big boost for the economies in Dallas, Houston, Denver, Billings, Anchorage and Austin economies and the economy up in Calgary Canada. The Dallas housing market, Calgary housing market, Houston housing market, Austin housing market and Denver housing market are some of the hottest going.

Oil is going to power the US for a long time, and the world for even longer. Despite the push to alternative energy, the reality is that only oil possesses the power and utility people and business needs. With the stimulus bill from the house in jeopardy, the alternative energy sector may not get the trillions it wants to develop. Not that alternative energy is a bad thing. It’s amazing technology. However, the cost and the output have been misrepresented to a gullible public who are beginning to catch wind of the politics.

3 Month to 6 Month Outlook

Oil experts don’t know what the 3 year to 5 year outlook is right now. Most of the price forces are political, and certainly if the Republicans regain the senate in 2022 and win the 2024 election, it could bring a return to big production increases.

Please do check out stocks to avoid, the best stocks to buy, best tech stocks, and the forecast for the next 6 months.

US Economic Outlook 2022

Please do share this post!

The higher oil prices are due to:

- reopening economy driving up demand due to commuting and manufacturing growth

- reduced production due to the pandemic

- shale production down in the US

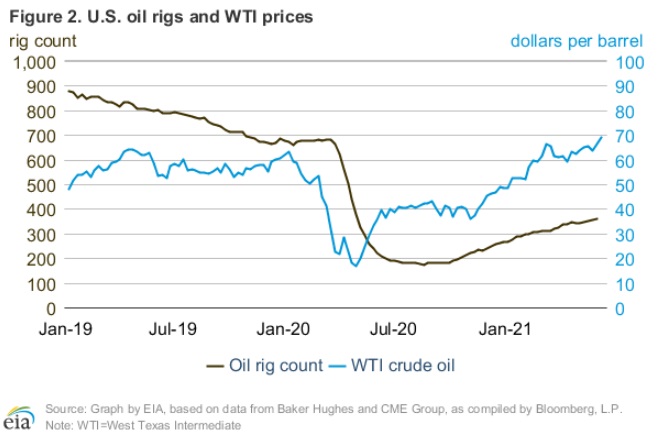

- political restrictions on fossil fuels is discouraging investment and oil rig counts

- speculators like the supply/demand equation

- restriction of oil imports from Canada

- high cost of importing oil from Saudi Arabia

- added taxes and anti-fossil fuel production legislation

Goldman Sachs predictions of $80 a barrel prices almost came true. Very good forecasting. Now the questions is how high oil prices will rise.

Oil Price Forecast 2022 and Beyond

Breakeven price though is considered to be $50 so an $80 a barrel price will give Texas, Montana, Colorado and Alaska a sizable boost to their economies. The Austin, Dallas, Fort Worth, Houston, Denver, Billings and Irving housing markets should see significant growth.

According to EIA’s report, U.S. economic activity keeps rising after reaching multiyear lows in the second quarter of 2020. US (GDP) declined by 3.4% in 2020 from 2019 levels but will grow by 6.0% in 2021 and by 4.4% in 2022.

EIA says that more than 90% of crude oil production in the Federal Offshore Gulf of Mexico (GOM) was taken offline in late August due to Hurricane Ida. That caused GOM production to fall .03 /bpd less then the 1.5 million b/d in August.. They expect crude oil production to come back online during September to average 1.2 million b/d for the month before returning to an average of 1.7 million b/d in 4Q21. Full production is for November and December.

EIA believes oil production will increase to an average of 11.7 million b/d in 2022, driven by growth in onshore tight oil production.

Gasoline Price Forecast

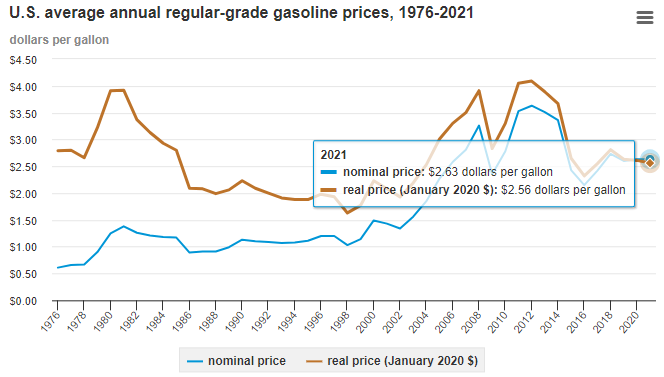

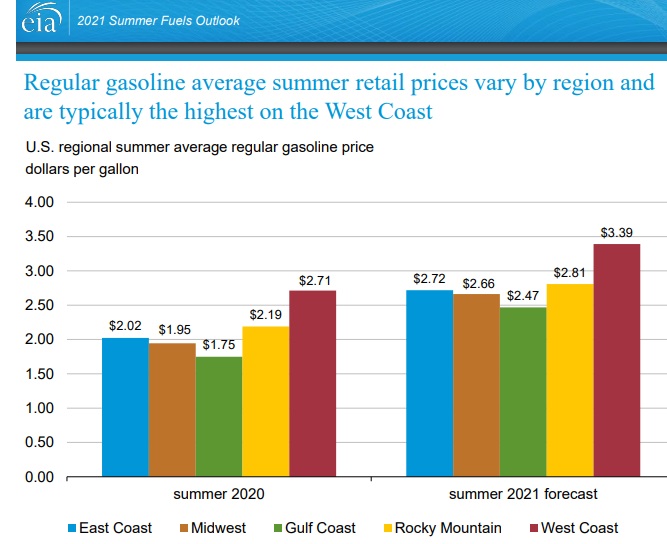

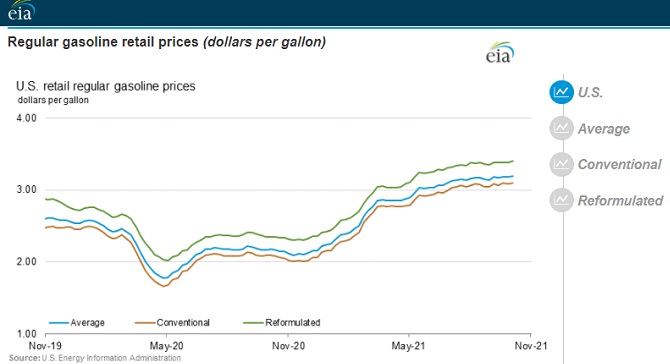

EIA expects the retail price of regular-grade gasoline in the United States will average $2.78 per

gallon (gal) during summer 2021, which is more than last summer’s average of $2.07/gal.

And lower oil prices is fuel to a strengthening US economic outlook.

Best Oil Stocks

US News believes these oil stocks have the best outlook:

- Exxon Mobil Corp. (XOM)

- Chevron Corp. (CVX)

- ConocoPhillips (COP)

- Schlumberger (SLB)

- Marathon Petroleum Corp. (MPC)

- Pioneer Natural Resources Co. (PXD)

- Phillips 66 (PSX)

Gasoline Prices Rising Quickly

The hurricane IDA was devastating and gasoline production in Louisiana still hasn’t recovered.

OPEC is the world’s major oil producer and they have agreed to limit production. When supply falls, prices rise. And many sources of oil are drying up (e.g. United Arab Emirates, Venezuela).

The Long Term Future:

IEA said that once US tight oil plateaus in the late 2020s and non-OPEC production falls back, the market becomes increasingly reliant on the Middle East to balance the market. There is a continued large-scale need for investment to develop a total of 670 billion bbl of new resources to 2040, mostly to make up for declines at existing fields rather than to meet the increase in demand. — from report in OGJ.com

For non-oil producing countries, relying on the middle east for oil, and a $100 barrel of oil price is worrisome. Over time, it drains significant wealth out of their countries and jumps inflation. That’s especially so for the US, Germany, France, UK, Japan, Australia, and Canada.

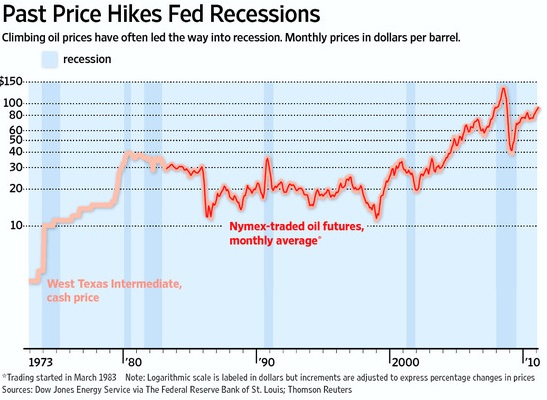

The last time oil prices spiked at $150, they soon crashed along with the US economy and the US housing market. And with real estate prices so high, could we see another housing crash?

Pierre Andurand, an oil-focused hedge fund manager made headlines when he said oil companies won’t invest in new production, thus suggesting a $300 a barrel oil price was “not impossible” within a few years.

Since investors believe green energy is ready for prime time, investment in oil exploration is way down, and oil refineries aren’t being built. As a result, the price of gas is likely to skyrocket in the next 5 years.

So the real story is not crude oil predictions, but rather rising gasoline prices in the US, Europe and Asia.

Adding to potential demand comes from the failure of the Kyoto Accord and the Carbon Tax regime. Once it fully fails, demand for oil will surge.

Never Say Never to Higher Prices

Could Los Angeles home prices double? Since 2012, they have doubled in price. In Toronto, home prices skyrocketed even more, and the local government had to kill the economy to suppress home prices. Canada lost jobs last month against expert predictions of +180,000 more. Constraints on US home building also could cause house price inflation too.

Housing experts: home prices won’t rise that much. They did.

Supply and demand in homes is steady, but demand for oil is much more intense during upward economic growth. With the US, Chinese, and European economies doing well, optimism high, and interest rates low, demand for oil will stay high.

What Drives Oil Prices?

Oil prices are driven by demand from industry for plastics, fuels, and also by supply constraints by producing countries. But the real determinant of prices comes from OPEC, who artificially control production to force prices up to suit their needs. OPEC cartel is a monopoly, whom President Trump warned he may file suit with the world trade organization.

The shut in of US shale oil and other reserves has kept 28 million barrels of oil out of circulation so far this year. That reduction of supply is pushing prices up high. The expectation is that as the world resumes its economic post pandemic activities, the WTI price of oil will surpass $100 a barrel.

The oil embargo of the 1970’s showed us supply and high prices can wreak havoc on economies. Political turmoil, sabotage, war, embargos and more could take a lot of supply out of global markets at a time when global GDP is growing.

Andurand believes high oil prices won’t affect economies, but how can it not? Even though the US is going to be the world’s top producer of oil, Japan, UK, France, Germany, and other nations won’t be able to maintain their economies with growing US protectionism.

Andurand says oil prices need to rise fast to discourage consumption, otherwise a huge price shock will happen in a few years. Everyone is buying huge SUVs and trucks now. Ford stopped making cars. Consumption will rise from vehicles and from commercial products (plastics).

For President Trump and the US economy, high oil prices and gas prices may actually stimulate US GDP growth boosting US gas consumption. The US can grow its exports significantly with oil based products. That’s a big incentive once everyone realizes what an oil rich US is all about. The US is becoming one of the top oil producers and US industry will like what they can do with this new opportunity for lucrative export products.

With Trump putting sanctions on Iran, it could set off trouble. Further, if the Trump government was to come to an end, the US Dems could decide to close down shale oil production and off shore oil production, thus pushing dependence back on the middle east.

Eric Lee of Citibank forecasted $60 for oil and still clings to lower oil price forecasts (in hindsight good call!).

Goldman Sachs predicted this back on Feb 5th: The decline in excess inventories was fast-forwarded in late 2017 by stellar demand growth, high OPEC compliance, heavy maintenance as well as collapsing Venezuela production. Goldman revised their estimate from $62 to $75 and then onto $80.

How times can change fast. Here, Jeffery Curry, head of commodity research at Goldman Sachs discusses oil and business. Expert opinions are that mideast turmoil, greed, and high demand will not raise prices of gas and oil.

Do High Oil Price Rises Predict a Recession

According to a Wall Street Journal report, there is a correlation between price rises and recessions (seen in graphic below). It could be that oil price rises typically happen toward the end of a strong business cycle, which of course always ends. Did the business cycle end because of high oil prices or because all economic booms must die a natural death?

It’s at these times, especially this record length positive growth business cycle, when global economic pressure boosts demand well ahead of supply. And as we just discovered, no one wants to invest in old technology and fossil fuels. Yet, the green revolution is still a long way away.

Perhaps more people will realize how far away electrical energy is and we’ll begin to appreciate the ongoing role of fossil fuels in global economies.

Where to Invest in Oil Stocks

If this is a meteoric rise supported by US producer strength and big global demand for gasoline, it makes sense that the biggest producers will make huge profits. However, smaller oil companies might see their growth rocket even faster.

Take a good look at Canadian oil companies. Right now, pipeline problems are trapping Canadian oil from Alberta and Saskatchewan. Their stock prices may be suppressed as sellers are thinking it is a long term issue. As prices rise, the issues will be forced to resolution and the pipelines will begin to get oil flowing. See more on the US stock market forecast post.

Don’t forget to bookmark this page as it is continuously updated.

Canadian Oil Stocks | Gasoline Price Forecast | XOM Stock Price Forecast | Stocks with Best P/E Ratios | Five Year Outlook | Six Month Stock Forecast to 2024 | Stock Forecast for next 3 Months | Best Stock Market Sectors | Long Term Stock Market Outlook | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates | S&P Forecast 2024