Signs the Economy has Started its Turnaround

Is the Post Pandemic Economic Recovery Underway?

As we approach June, the final month of the 2nd quarter, is it too early to speak about the economic recovery? The optimism of the stock market could help encourage more companies to resume business and for more employees to earn a pay check again.

Earning a pay check is a big thing now. Serious harm has evolved across the US as the lockdown continued. With rent payment and mortgage payments due on June 1st, and money running out for food, staying in shutdown mode isn’t really an option.

Business must reopen and stock market investors seem to be aware that it’s going to happen. Stock prices are rising this week again and the Vaccine stocks are the talk. Time for renewed optimism.

Big Media Still Trying to Talk Down the Economy

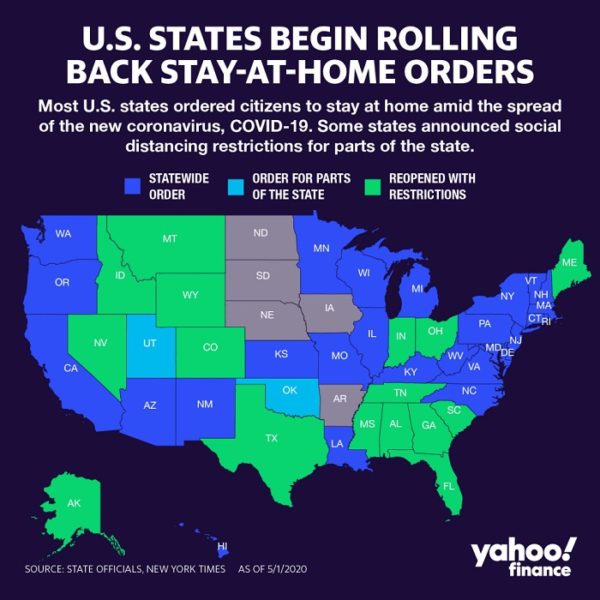

Media reports are still citing April’s glum numbers, and May’s shutdown numbers won’t be a lot better with some states still in lockdown. A good guess is that June’s numbers will be better than economists predict as the blue states have to reopen.

This isn’t to say the reawakening will be without its hurdles and volatility. The attitude toward the Covid 19 outbreak is to learn to live with it, and contain it through distancing and PPE. As more Americans acquire face masks and as business uses disinfecting equipment, the rate of transmission will fall.

President Trump laid out a plan this week for states to reopen as its safe to do so. The reopening won’t be meteoric but steady against restrictions on social activity to stimy the disease transfer

And if measures are improved as we head into fall, the chance of a 2nd outbreak is lowered. Americans are learning to be careful. Online shopping, home delivery or pickup at store will color retail and restaurants will suffer a great deal, but other businesses can flourish with work at home digital solutions.

This weeks strong rise in prices shows what the real momentum is. Despite bad behaviour from a few well publicized beach parties and park parties, most Americans have done admirably by staying in place at home for months on end. For some, it was a remarkable achievement.

Although we’re a long way from a Covid 19 Vaccine, businesses are following CDC guidelines and trying to make the workplace safe again.

US China Cold War

Clouding the return of the economy is the looming US China trade war which will accelerate repatriation of businesses back to the US (and other countries). The global community is appalled by China’s behavior in not reporting the Corona Virus and now in invading China. China’s supply chain will erode.

The development of new supply chains in the US should appeal to entrepreneurs who are seeing once in a generation opportunity to set up new businesses.

This is capitalism aided perhaps by another bailout. Yet the recovery is underway and any bailout will be temporary to bridge the gap to 2021 and a Corona Virus vaccine.

Is A US Economic Recovery Happening?

What are the Signs the Economy is Restarting?

There are a number of fundamental signs that reflect a growing, reawakening economy:

- Employment Trends (continuing jobless claims dropped by 4 million last week and first time claims dropped to their lowest levels in the pandemic)

- GDP – manufacturing (trading economics forecasts a rise from -3.6 up to 1.0 in the third quarter)

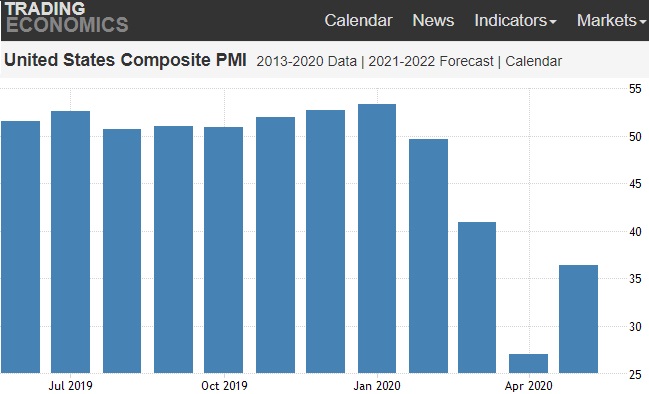

- Business Confidence (trading economics forecasts a big jump from 30 points in 2nd quarter to 48 in the third quarter)

- Consumer Spending and Consumer Confidence (the Conference Board’s consumer confidence index rose to 86.6 this month from 85.7 in April).

- Goods Shipping Activity and PMI activity (PMI was forecasted for 38 for May, but it’s already hit 39.8)

- Sales growing – sales couldn’t happen during the lockdown

- Banks lending again – homebuyers buying homes and applying for mortgage loans

If businesses are reopening, spending will grow, sales will happen, banks may lend, and more workers will earn pay checks again, then the economy is moving forward.

Thus far in May, there isn’t a lot of data to give us exact numbers. The media is trying to talk down the economy and extend the shutdown, but they don’t have recent data either to prove their argument. Fewer people are believing it’s anything more than trying to take down President Trump before the election.

Many economic reports focus on April’s stats, and May’s preliminary shutdown period stats wouldn’t show a change in direction.

Is the Stock Market the Leading Indicator?

Stock investors have been severely maligned as they poured funds into companies before the recovery.

The stock market is an important signpost for the economic recovery. Right now the Dow Jones, S&P, Russell Index and the NASDAQ index are climbing. The Forecasts are positive. It’s been a good week for the indexes as investors seem to believe the pandemic is passing. Who wouldn’t say good riddance to it?

With gasoline prices and inflation subdued, there is less resistance to business growth. April’s inflation fell .8% and inflation was not a problem in the last few years.

In the housing market, April sales of new homes actually grew 2% after being forecasted for a 22% drop.

To conclude on the US economic forecast for June, it looks like the worst is over and business owners can refocus on restarting. Just putting business back in motion will greatly aid the psychology of the recovery.

3 to 6 month Forecast for the Dow S&P NASDAQ | Stock Market Today | 10 Year Stock Market Forecast | Real Estate Market 2023 | 5 Year Stock Forecast | Dow Jones Forecast 2023 | NASDAQ 2023 Forecast | Florida Real Estate |Boston Real Estate | Los Angeles Real Estate | Forecast for Housing Market | Housing Market News