Are Home Prices Going to Rise or Fall?

The February housing market reports from Redfin, Zillow and NAR shows home prices are rising. Other reports show buyers are optimistic about buying, perhaps in 2024.

And housing supply is growing via new construction and more resale homes being listed. If mortgage rates were to fall 1%, it might encourage even more buyers to prepare to buy and start looking, and homeowners to list their homes. Potentially, we could see a flood of homes listed this year given the massive backlog of rate-locked homes. If the FED rate was to fall this summer, it could stimulate the economy and fire up the housing market.

Real estate mogul Barbara Corcoran believes prices are on the rise. On Fox Business, she suggests a 1% drop in the Fed rate is all that will be needed to begin the housing rush. Her key point is the low supply of homes.

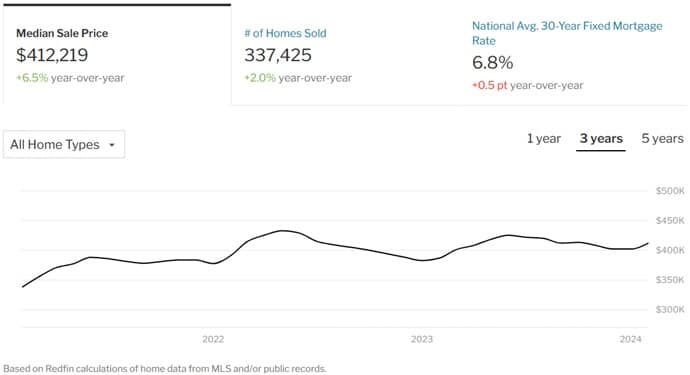

Home prices are rising and appear to be headed to record heights this summer season. In February, they were up 6.5% vs last year.

The housing market has that air of uncertainty, even the scent of fear for buyers and sellers. Because with inflation continuing and the FED stubborn, we wonder if we’ll see a big change from the current situation. Lots of homes are being listed, but sales aren’t happening at the affordable level (lower than $250,000) where most buyers can afford them.

The FED is Between a Rock and a Hard Place

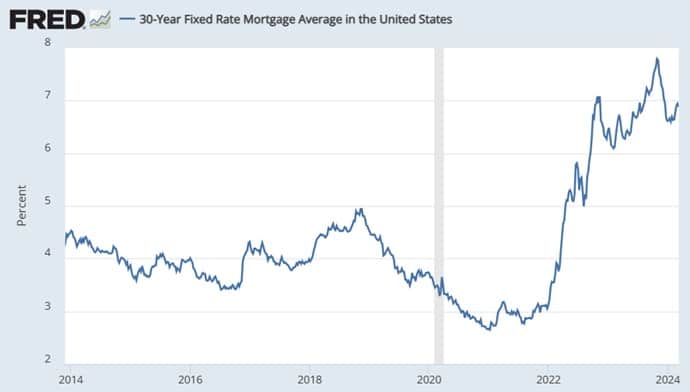

With the FED squeezing buyers and sellers relentlessly with high mortgage rates, some economists, doomsday people, and real estate moguls believe a housing market crash is coming. The point I want to make is that politics and politicians (government) are the wild card or catalyst for bad events. The FED may not be able to lower interest rates.

They say the FED is in between a rock and a hard place with rates. Either way, there are negative consequences for the government and inflation. Yesterday’s CPI report showed inflation rose to 3.2% in February against estimates of 3.1%. Since the summer spending season is just ahead, should we expect inflation to rise perhaps even to 4%? We have to remember that production has slowed with the recession thus supply will not be picking up to match this seasonal consumer demand.

Some housing experts anticipate higher prices given limited inventory/supply against enduring demand amongst key buyer demographic groups (millennials and increasingly Gen Z’s). And the economy is not doing badly with employment strong and wages rising. Actual qualified buyers might be able to buy a home. For the rental crowd, it’s the status quo if they can hang onto their jobs.

Others expect a flood of homes will be unleashed as mortgage rates fall and that could prices falling. It’s all theory but a popular one. And still others see mortgage rates staying high pushing overleveraged homeowners to the brink of bankruptcy, thus threatening a big price correction via foreclosures.

What housing market forecasters in the media shy away from are the political influences which actually are the number one determinant of market prices. It’s a political decision to raise interest rates and stifle supply.

As the lagging effects of last years big rates really take hold this year, we’ll need counterforces to keep the housing market going.

With Biden wanting to get elected, he may have to act in lieu of the stubborn FED to give the housing market life, if there’s anything the Whitehouse can do. Even if the rich-get-richer problem is killing the United States, taxing the rich is a risky way to increase financing of risky multifamily housing development. A political shock is the wild card throughout 2024.

Here are the key factors affecting home prices to watch:

- a slight rise in home listings as mortgage rates drop

- FED reduces rate very slight in late summer or not at all in 2024

- a rebound in inflation that is usual after a major inflationary period

- weakening economy due to persistent tight credit at persistently high rates

- consumer spending weakens

- mortgage refinancing goes badly in 2024/2025 as rates stay high

- new construction lags as rates stay high and land is hard to acquire

- rising tax on the wealthy brings cutbacks in new construction

- Biden makes new promises/giveaways to lure voters for November election

- infrastructure spending will begin this year (increasing 12.9% to $436 billion in 2024)

NARs February Report

NAR.Realtor’s February housing market report shows active homes for sale increased for the 4th straight month, this time up 14.8% higher than Feb 2023. You’d think that would drive prices down, but no, they’re up again by .3%. Unsold homes grew by 8.8% meaning, homes listed are unaffordable or unwanted.

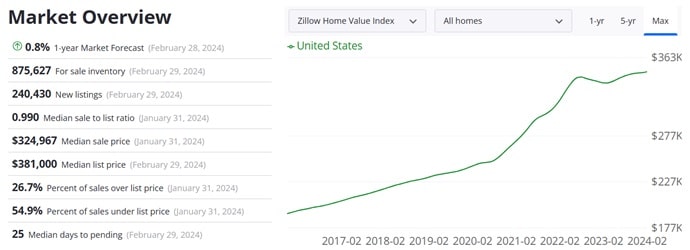

As Zillow’s chart below shows, prices look to keep climbing (and buying conditions are better this year).

60% of home sellers in major US metros reduced their price in February, up from 11% in January. It looks like sellers are getting nervous and may poised to push the sell button on mass on FED rate cut announcements. That flood of homes would result in the limited number of buyers having much more selection, and prices would fall.

Prices are up or down depending on which city or state you’re in. Prices in Los Angeles (+16.8%), Pittsburgh (+16.2%), and Richmond (+14.3%) saw the largest pice increases among large cities. Prices were up 10.4% in Buffalo NY, up 7.4% in Nashville, but down 3.6% in Denver and down 2.7% in San Jose CA.

Uncertain Price Directions

There’s not much consensus about the housing market’s direction. Everyone’s waiting for the FED to announce a rate cut, but in truth, it may not happen until the second half of the year. “The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” said FED Chair Jerome Powell at the most recent March bank meeting. According to the CME Group’s FedWatch Tool, there’s about a 95% chance the Fed will rates where they are at the March 20 meeting.

Positive CPI reports, employment rate, wages and more economic stats suggest the economy is still strong. Food, rent, fuel are all rising, so it’s not reasonable for the FED to lower the rate anytime soon.

Mortgage Rates Going up or Down?

It’s an important discussion however, given buyers are active in pursuit of homes and aren’t deterred by high mortgage rates. Many have saved plenty for a downpayment. The fact is, a lot of potential home buyers have dropped out of the market and have become renters. Rent after all, is about half of what a mortgage payment costs.

Mortgage Bankers Association forecasts that mortgage rates will still be 5.5% at the end of next year. That seems highly unlikely for 2024, but perhaps for mid-2025. However, with high rates and limited supply, new home builders will be doing well since they should sell at a nice price. See more on Toll Brothers.

I’ve always said that governments and politicians create our problems. Their responses generate crises for homeowners and the policies and spending manipulate markets unnaturally, luring unsuspecting buyers into a dicey situation, and they do not support housing supply increases (construction, tax breaks for builders) which would ease prices.

The jumble of influences include high mortgage rates, stimulus spending, high immigration, aging Millennials getting past their prime family formation period, government subsidies (for votes), land use restrictions, excessive land development fees, a pending refinancing crisis, while 85 % of pandemic era homebuyers hang onto their properties, locked into their low rate mortgage.

New Construction Dreams

Will new construction save the day and present buyers with opportunities? Right now, it doesn’t look that way. The January new residential construction report from Census.gov shows building permits fell 8.6% year over year, housing starts down .7% (but down 14.8% from Dec 2023) and home completions are down 8.1% year over year (but up 2.8% from previous month).

NAHB Chief Economist Robert Dietz said “With future expectations of Fed rate cuts in the latter half of 2024, NAHB is forecasting that single-family starts will rise about 5% this year.”

If rates are in a higher for longer scenario, buyers will pull back and prices will fall, after a frenzied period.

However, there is so much demand against limited supply, that it’s tough to believe home prices will fall.

A failure in the commercial real estate sector could result in investment companies having to sell off their holdings, which could push prices down. That’s a realistic possibility and J Powell did say that some regional banks could fail this year.

Experts have cited stats that suggest another wave of inflation typically follows an inflationary peak. So after this lull in yearly 2024, stats apparently show inflation will jump back up significantly. It’s a lot, not a little. And this fact may be on the FEDs minds as they plan out the rate drops in the next 2 years.

Redfin Chief Economist Daryl Fairweather said mortgage rates are likely to remain well above pandemic-era record lows because financial markets increasingly believe the country will avoid a recession in 2024 and mortgage rates will fall to about 6.6% by the end of 2024.

Robert Dietz, the chief economist for the National Association of Home Builders is forecasting a gain for single-family housing construction starts in 2024. He pointed out that it is new construction supplying 30% of inventory. He’s also predicting a big drop in multifamily units which is where the majority of residential sales are happening. High financing makes it impossible.

The FED’s rate cut horizon is much longer which means homeowners would have to wait much longer to be able to finance their next home purchase. And sellers would be subdued for much longer too.

NAR’s Lawrence Yun stuck his head out with predictions of big price increases for 2024, which may still happen. Yet he based it on much lower interest rates. He believes home sales will grow 14% and home prices will continue to climb in 2024 to a new all-time high, with the median price for a home rising .9% from 2023 to $389,500 this year.

“We’re going to see both falling mortgage rates and rising incomes in 2024, which will increase demand for housing,” Yun said.

Supporting higher prices for 2024/2025 is the fact that it will take years for supply to fulfill demand. The fact is, housing market expert’s faces are getting redder and redder as the FED balks at suggesting rates will fall appreciably.

If I had to offer a forecast, I would say most of the up/down catalysts will cancel each other out, resulting in limited change in prices.

Buyers and sellers want big decreases this year, to cut financing for buyers and refinancing for homeowners. They won’t get it. Owners will be stuck with their properties and will have to take a big loss via their new mortgage debt. And buyers won’t be out in force which means fewer and lower offers.

Check out the 2024 housing forecast post for more factors that may affect where prices go this year.

Real Estate Housing Market | Real Estate Forecast | Housing Market Crash | Dream Homes | California Housing Market Forecast | Florida Housing Market Forecast | Real Estate Housing Market Predictions for Next 5 Years | San Diego Housing Market | Denver Housing Market | Boston Housing Market | New York Real Estate Housing Market | Will Home Prices Fall?