Nvidia Stock Price Forecast

Nvidia’s stock was one of the superstar performers of the NASDAQ and S&P in 2023. While other tech stocks and AI stocks were sold off (AMD), NVDA just keeps going strong.

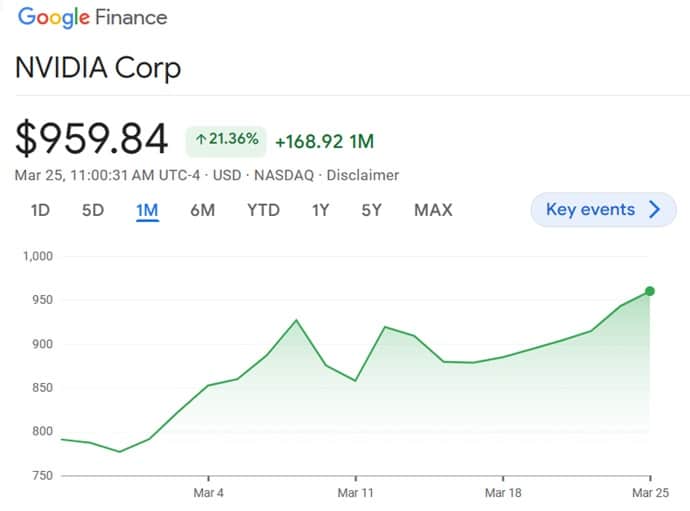

As of March 25th, it’s back up to near records. Last week you might have seen/heard about the Nnvidia Nvidia GTC 2024 held in San Jose, California. A drew tremendous media coverage including the usual interview with Jim Cramer. They announced their breakthrough technology in AI chips.

Judging by the unfaltering price level of NVDA, investors are fully confident of this company and its leader. Jensen Huang showed how important marketing is in reaching all investors about AI technology and the hardware that will underpin the AI revolution in business. It’s a key component of the new US economy featuring repatriation of industry, protective tariffs, and AI rewriting of everything. It’s a whitewash of the US economy just when it needs to grow. A Presidential change would seal the deal on a booming economy for another 5 years. Let’s cross our fingers.

Nvidia’s connection with Amazon (AWS Cloud), among other megatech companies shows it’s in the driver’s seat of the AI chip market, and ready to roll out AI-powered services when they’re ready. Amazon is up in trading too.

Despite the wall of worry and skittish retail and institutional investors, this stock continues to perform as one of the key stocks on the S&P and NASDAQ, spearheading the 2024 rally.

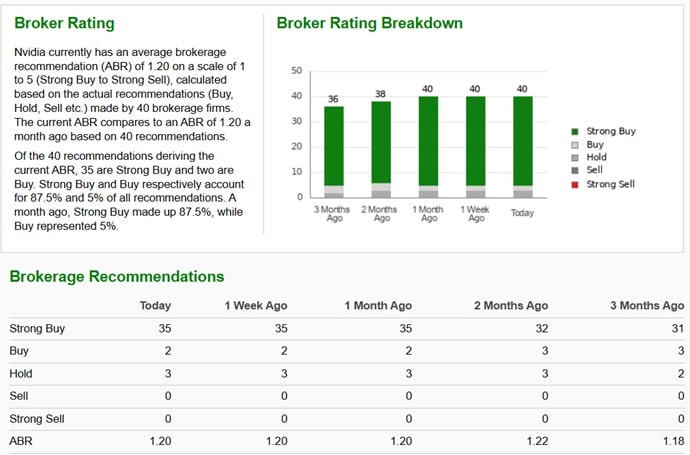

Investment Analysts Like NVDAZ

Zach’s broker/analysts rating are increasingly a strong buy rating.

Survived the Pullback

NVDA and AMD among others took a scary pullback dip recently, but low and behold, investor’s faith has survived. In fact, it does look like this flat period without up catalysts is playing out well. NVDA is recovering while AMD is in the dog house. AMD’s shockingly poor marketing is injuring that company’s future. Intel, Micron, Supercomputer are making noises but getting anywhere up against Nvidia.

In any event, there is plenty of enthusiasm for AI stocks, AI chip stocks and soon, AI services stocks.

As this chart from Google Finance shows, the price has more than doubled in the last 6 months and is up 80% in the last 3 months.

Nvidia has plans to create their own service cloud using their own GPU’s.

The AI chip company has built an 80% share of the high-end AI chip market. The firm headed by Jensen Huang looks to want to secure a big portion of the cloud-based market for custom AI chips and protect against a growing number of companies pursuing cheaper alternative processors.

Grandview Research estimated the global AI market is valued at nearly USD $200 billion and is projected to expand at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030. And Gartner predicts global spending on AI software will 19.1% annually from $124 billion in 2022 to $297 billion in 2027. Generative AI (GenAI) software will spending could increase from 8% of that total in 2023 to 35% by 2027.

And in yet one more exciting market, NVIDIA is offering the new GeForce RTX™ SUPER desktop GPUs for supercharged generative AI in new AI laptops from every top manufacturer, and new NVIDIA RTX™ accelerated AI software and tools for both developers and consumers. AI-powered laptops offer

Investors love Nvidia, and I can remember the early days of the company back when it is fledgling and had created an innovative graphics-boosting chipset. It was quite a stir, but only the most informed and visionary would have seen its long term potential in artificial intelligence. Time has passed, and it really does look like investors have high conviction in this equity. So your investing peers have spoken loudly.

So when hedge funds and other money market managers want to move their trillions into stocks as the FED rate falls, NVDA, AMD, TSMC, and other chip stocks are going to get first look. That’s because these companies are thinking ahead, beyond just microprocessors. Because end users want services and to create profit, and the software side hasn’t caught up yet.

That might mean that the biggest potential is in AI related cloud-powered software applications are where the growth is. Palantir might be the top stock in that arena.

I hope you heeded my insights when I wrote this 8 months ago. I was late to committing to AMD and NVDA, but I’m happy with my positioning so far and I am all in on these AI-leading stocks for the next few years. It may suffer a shock here in February or March (it happened), but no matter. NVDA is destined to be the kingpin of the new economic era. A must-have tech stock in your portfolio.

Goldman Sach’s has given it a new price target of $800, which is 14% above where it closed today. As discussed below, such a stock might have 100% growth potential. Advisor gurus are underestimating this innovative essential presence in the AI era. The US Chips Act boosts funding, and a growing US economy will ensure Nvidia is in the driver’s seat.

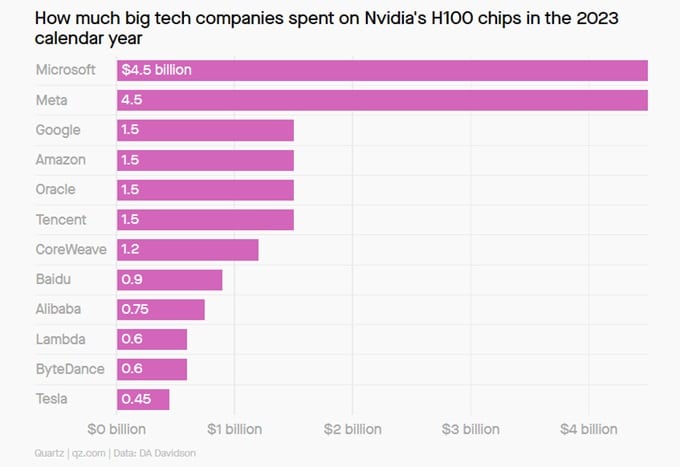

Nvidia as a company is now valued above $1.65 trillion. Microsoft, Google, and Facebook continue to buy Nvidia H100 chips even though they’re making plans to manufacture their own chips. But like most tech companies, they will learn to stick their knitting and avoid relying on subpar technology as this AI race heats up.

NVIDIA Stock Price. Image courtesy of Google Finance.Nvidia, MicroChip Tech, Qualcomm, Broadcom, Texas Instrument, Intel and AMD have blossomed on the promise of the AI boom. It’s happening now due to a convergence of political, economic, and technology factors. Corporations are pouring money into AI software development including AI stock forecasting solutions for investors, after the successful launch of ChatGPT. And crypto miners love Nvidia’s chips.

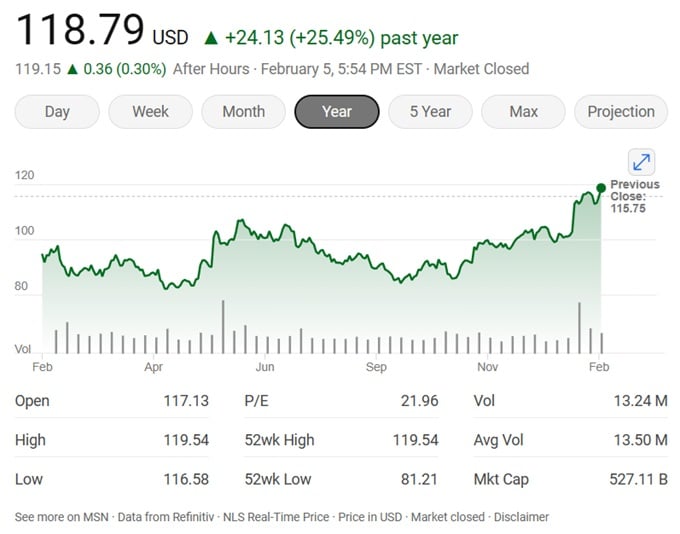

Nvidia Chips are manufactured by Taiwan Semi Conductor whose stock you might want to invest in. It’s a lower price point so there’s potential. Morningstar’s Felix Lee reports that:

- TSM should consistently earn higher gross margins than competitors, thanks to its economies of scale and premium pricing justified by cutting-edge process technologies.

- The company wins when its customers compete to offer the most advanced processing systems using the latest process technologies.

- TSM will benefit from more semiconductor companies embracing the fabless business model and internet giants designing their own data center chips.

The fact that the other AI chipmakers aren’t doing as well tells you a lot about where all the money market funds ($6 to $8 trillion) will go when interest rates drop. All the big companies are diving into artificial intelligence software, systems and business opportunities. That massive force will drive Nvidia chip sales.

For corporations, AI and chips have more to do with labor savings, although they serve everything from recruiting apps to stock forecasting to cloud computing. The hope too on a practical basis, is that AI automation can replace millions of high paid and low paid workers, and solve the unsolvable skilled worker shortage. And there is hope that customer service and consumer satisfaction might grow.

Yet, AI can also be used to create opportunities and jobs. Politicians will decide which way that goes.

Current NVDA Stock Price

CNN Business’s 45 market analysts provide their 12-month price forecasts for NVIDIA Corp with a median target of 460.00, high estimate of 600.00 and a low projection of 175.00. Their forecasters predict earnings per share for the coming Q3 period from 74 cents to $2.68. 36 analysts call to buy, while 8 evaluate it as an outperformer.

Nvidia’s chips are made by Taiwan Semiconductor which has also popped in price this year. Apple and AMD also buy their microchips. In 2024, the current battle between Taiwan and China, could threaten Nvidia’s supply chain. Combine that with a potential economic slide for the next 12 months, and we might want to be cautious about NVDA stock. If you’re a long term investor, confident in a status quo situation internationally, then NVDA still might be one of the best bets for the next 5 years.

Is AI Enough to Support the Chipmakers?

Certainly AI will support increased GDP per worker given fewer workers and higher production, along with presumably improve processes in every area of business. So the promise of AI is there for the corporations. How small businesses will access and leverage the advantage still isn’t well understood. We have to have faith that AI will be leveraged by small business.

Stocks like NVDA are driven by the relentless, progressive demands of artificial intelligence processing. A higher grade and faster processing speed are required, and companies such as Nvidia are the masters in this category. In fact, Nvidia has always had a reputation of innovation and being ahead of the market with respect to graphics chips. It’s their expertise in graphics optimization that made them leaders in the new AI chip realm.

Here are 7 Reasons why Nvidia is a leader in the AI chip competition:

- GPU Technology: NVIDIA pioneered the use of Graphics Processing Units (GPUs) for general-purpose computing, including AI. GPUs excel at parallel processing, which is crucial for deep learning algorithms that underpin many AI applications. NVIDIA’s GPUs are highly efficient and capable of handling large-scale data processing, making them ideal for training and deploying AI models.

- CUDA Architecture: NVIDIA developed CUDA (Compute Unified Device Architecture), a parallel computing platform and programming model. CUDA allows developers to harness the power of NVIDIA GPUs and accelerate AI and other computationally intensive workloads. Its wide adoption has contributed to NVIDIA’s dominance in the AI space.

- Deep Learning Frameworks: NVIDIA actively supports and collaborates with major deep learning frameworks like TensorFlow, PyTorch, and Caffe. They optimize these frameworks to run efficiently on their GPUs, enabling faster training and inference for AI models. NVIDIA’s involvement in the development and optimization of these frameworks has made it easier for researchers and developers to utilize AI technologies.

- Hardware Innovations: NVIDIA has continuously pushed the boundaries of hardware innovation. They introduced specialized hardware accelerators like Tensor Cores in their GPUs, which deliver dedicated matrix multiplication capabilities and significantly enhance AI performance. NVIDIA’s focus on developing specialized hardware for AI has led to the creation of powerful and efficient solutions for training and inference tasks.

- AI Ecosystem: NVIDIA has built a comprehensive ecosystem around AI. They provide software development kits (SDKs), libraries, and tools that streamline AI development and deployment. Their platform, NVIDIA AI Enterprise, offers solutions for AI infrastructure, data center management, and application deployment, catering to the needs of enterprises adopting AI technologies.

- AI Market Dominance: NVIDIA’s GPUs have become the de facto standard for AI research and implementation. Many organizations, including tech giants, research institutions, and startups, rely on NVIDIA’s hardware and software solutions for their AI initiatives. The widespread adoption of NVIDIA’s technology has solidified its position as a leader in the AI era.

- Continuous Innovation: NVIDIA’s commitment to innovation is evident in their ongoing research and development efforts. They continue to introduce new products and technologies tailored for AI workloads. For example, NVIDIA’s recent advancements include the launch of the Ampere architecture, which delivers significant performance improvements for AI tasks, and the introduction of the NVIDIA A100 Tensor Core GPU, designed specifically for AI and high-performance computing.

Of course, the company is well capable of introducing new innovations to gain more marketshare, which investors are well aware of.

Catch up the latest news and trends in the stock market.

See more on the: ChatGPT Stock Forecast | Stock Quotes | AI Stock Market Forecast | Stock Market Forecast 2024 | Stocks with Best P/E Ratios | Best S&P Sectors | US Stock Market Next 5 years 2023 2024 2025 | Dow Forecast | S&P Forecast 2024 | Real Estate Market Crash | 3 Month Outlook | 6 Month Outlook | 5 Year Outlook | 10 Year Outlook | Best Stock Picks | Google Stock