Microchip Stocks – Semiconductors for the AI Era

The AI boom began in 2021 but now in 2023, it’s just swinging into high gear.

Stocks such as ASML, Nvidia, Intel, Super Micro Computer, Taiwan Semiconductor, Qualcomm, and Broadcom are leading the way in supplying the AI technology market with high-performance chips. These advanced chip sets incorporate GPUs that deliver more powerful, effective processing that’s demanded by AI applications.

Chip manufacturers, particularly ASML, are pushing the limits of physics, design and manufacturing in a race to build the ultimate chipsets and deliver what the global market needs. With President Biden’s US Chips Act, US-based chipmakers should see a boom in investment and production in the next few years. It even moves us closer to AI based stock prediction improvements we might like.

That makes the semiconductor sector one of the most promising for investors. You’ve no doubt been eyeballing NVDIA or Intel given their meteoric price rise. But on the other side of the issue, is this AI-boosted market another bubble as in 2000?

If the economy slides, it’s still understood that microchips drive our economy now and in future. Recession or bull market, some of these companies are producing microchips for use in many industries across the globe, and they may be the stalwarts for the next 5 years and beyond.

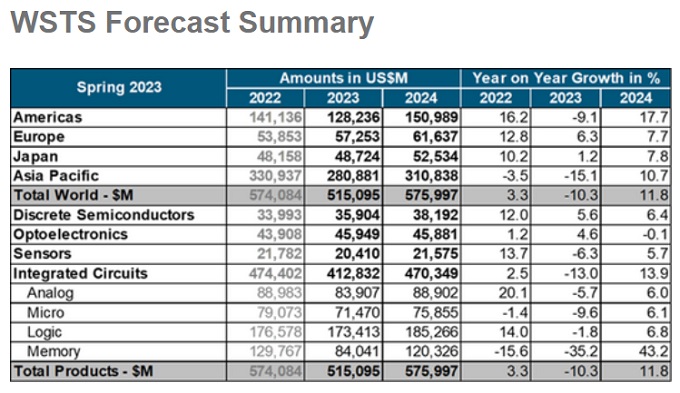

The Global Semiconductor Market is predicted to experience a downturn of 10.3 percent in 2023. However, this is anticipated to be followed by a robust recovery, with an estimated growth of 11.8 percent in 2024 — World Trade Semiconductor Statistics.

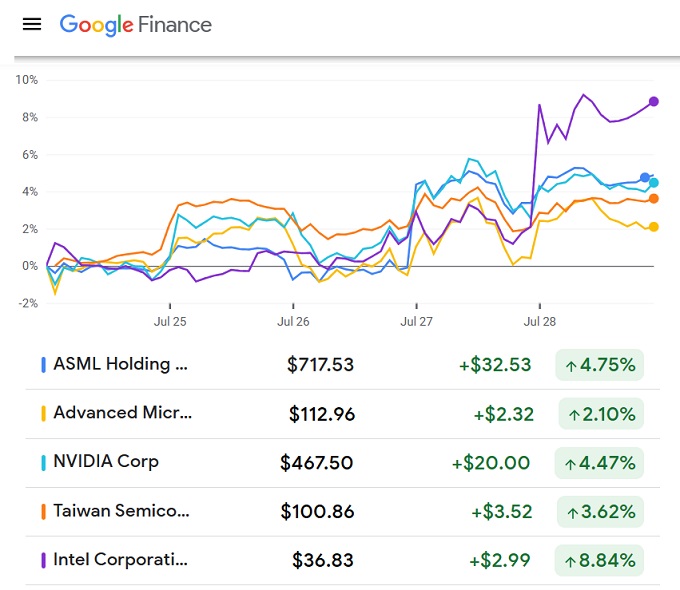

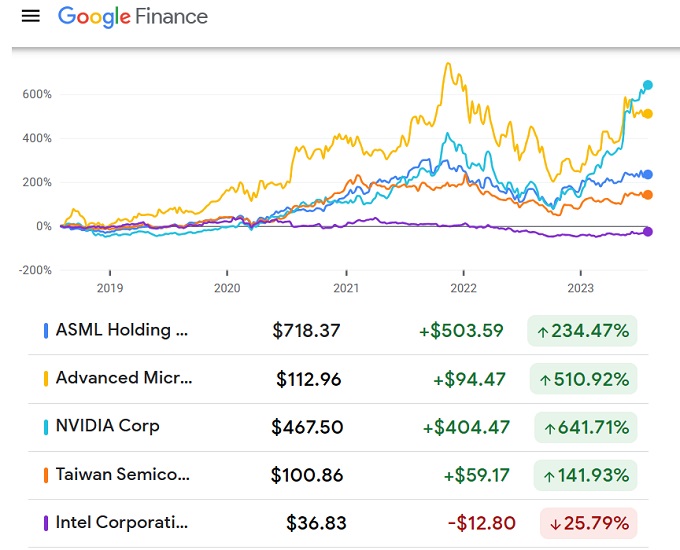

NVIDIA was the darling of the chipmakers with its astonishing price run-up in the last 8 months as depicted in this chart from Google Finance. Everyone’s hoping another AI-related microchip stock will take the same path in 2024. With investors stockpiling $5+ trillion in money markets, we wonder how many will take a gamble on the one product that drives the modern world. And those companies able to use and capitalize on the best chips will surely have an advantage in International trade.

AI Will Fuel a Whole New Set of Applications, Hardware and Services

The success of ChatGPT has shown the world is pivoting into a world of AI-driven products and services. ChatGPT is looking for more cash from Venture Capital firms to further its growth. But that’s such as small part of what’s happening.

Grandview Research predicts the AI Chip market will reach $42.4 billion by 2025 for an 11.3% CAGR over the forecast period of 2020-2025. They believe the demand from IBM, Apple, Tesla, Google, Amazon, will spearhead this growth. The rise of 5G networks, autonomous vehicles, and edge computing will support this trend further.

Corporations see AI as a catalyst for new products and new profits. Many of them have been investing substantially into AI product development, and they expect the benefits to show up by 2025. Google, Microsoft, and Amazon of course are all in on the quest for AI dominance.

Yet the AI revolution will impact businesses of all sizes globally in the next 5 years. From shipping and logistics to medical equipment to electric vehicles, the market seems endless.

ASML and the GPU Microprocessors

And all tech companies will be using or bidding on the advanced GPU processors being produced by the major chip manufacturers. The process and machinery used to create chips is astonishing, pushing the limits of light physics. The leader, ASML offers its latest chip maker at $300 million, a price that few buyers can afford.

The new wafer processors are the vital component driving innovations in AI algorithms helping computers handle evermore complex tasks quicker. When this AI processor and microchip boom plays out, we’ll likely have only a few winners.

ASML has been the leading supplier of these wafer chips and it has new orders of 4.5 billion euros in the second quarter, up 20% from Q1. That’s a strong indicator of where the tech giants feel about the 2024 economy and stock market are headed.

ASML’s 3rd quarter revenue is on track for €6.5 billion to €7 vs net sales of €6.9 billion in Q2.

Which Microprocessor Sector Stocks will You be Buying?

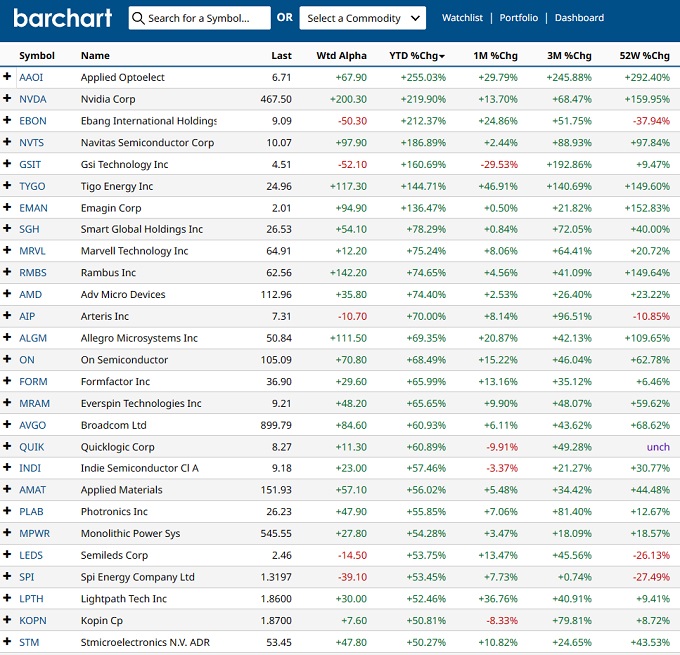

Here’s a look at the growth these companies have experienced.

Which AI-related stocks might Turn You into a Millionaire?

While Bitcoin and Tesla might be more tempting for investors now, the microchip stocks may have more potential with a safer investment profile.

Investorplace.com cites these 3 stocks as having the best potential:

- ASML Holdings (ASML)

- Marvell Technology (MRVL)

- Teradyne (TER)

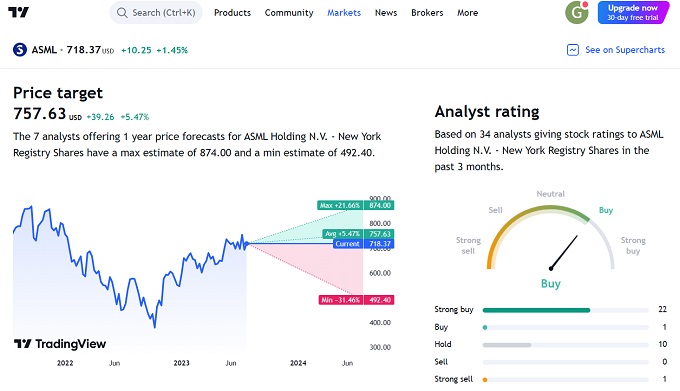

ASML hasn’t taken off yet, but if 2024 is the year as the experts suggest, then it might be the right choice. You can drill down deeper at Tradingview.com, but as this graphics shows, their analysts give it a strong buy. If the

Best Performing Microchip Stocks 2023

This is the latest list of high-performing chip stocks from Barchart.

Investing in Microchip Companies

Investing in micorchip stocks is a complicated matter, and so complex that the average investor would be challenged to pick the right stocks alone. It’s wise to read as much as you can, forecast where the market is going, and get expert advice on which will benefit most from the coming bull market.

Let’s take a look at the latest prices and price history of the top AI microchip manufacturers:

Intel Corp

ASML

NVIDIA

Broadcom

Taiwan Semiconductor

Advanced Micro Devices

Super MicroComputer Taiwan

See more on the 2024 stock market forecast as well as predictions of the 3 month and 6 month outlook. Out of 2024, year 2025 will lead us into a productive 5 year and 10 year period, where AI continues to redevelop products and services sold around the world.

Out with the old and in with the new as microchip companies create hardware that gives software such as ChatGPT powerful new capabilities. Learn more about Generative AI a key use of the new microchips.

More on the 2023 2024 2025 Forecasts:

Stocks | AI Stock Prediction | NVDIA Stock Price | Generative AI | Stocks with Best P/E Ratios | Best S&P Sectors | NASDAQ Forecast Today | Dow Jones Forecast Today | Tesla Stock Forecast | Stock Trading Platforms | Stock Trading | Stock Price Quote | Best Dow Jones Stocks | Best Stocks to Buy | Stock Market Prediction Tips | Stock Prediction Software | Stock Market News Today| Google Finance | Author Gord Collins