AI Stock Prediction

What could be more exciting than having an AI-powered stock price forecasting tool that could seriously increase your ability to pick top gainer stocks?

Yes, if an AI-based forecasting service could identify the best stocks reliably. If you’re a self-directed investor, AI prediction software might even up the advantage of hedge fund managers. And such tools might offer insights into a potential stock market crash. Well, they actually exist and you can try them out.

A lot more research and money is being poured into AI-based stock prediction. Sooner or later, you and your investment advisor will be relying on the insights these solutions provide. The big stock brokerages are certainly relying on this technology to stay competitive.

From day trading picks to 3 month to 6 month stock price forecasts to 1 year predictions, there’s some obvious potential.

I’d like to introduce you to 2 AI stock forecasting services: FinBrain Tech and I Know First. Both names hint at the advantages their product offers. This isn’t an in-depth review of either solution, and is more or less a review of what they offer. Hopefully, we’ll see credible independent third-party reviews of their performance and how customers have won using their service.

Better Than the Experts?

Top-performing fund managers seem to be able to predict which stocks will do well. A few have enjoyed phenomenal fund growth and are lauded for their foresight. But in the last 10 year bull market, picking stocks was easy and sometimes just silly (Apple, Tesla, Netflix, Facebook, Google, Amazon). Such profit growth won’t be as easy to capture going forward into the the new US regime’s era of big taxes and regulation.

This coming profitability challenge will make everyone evolve to use better forecasting tools to improve their ROI. FinBrain Tech and I Know First are some services they’ll be reviewing.

AI Stock Prediction Software

Artificial intelligence solutions such as FinBrain Tech and I Know First are two recent software-related services to offer trading accounts to investors.

Why so few? We’re still in the early innings of the AI stock investing era. There’s a lot to learn, data to process, and AI systems are still in their infancy. Still, it appears they’re improving and investors should be trying them now.

These two firms are ahead of the race and probably learning more each month about what drives accurate predictions. They’ve developed an algorithm which is a weighted set of factors to apply to stock prices (signals).

There are a lot of people doing searches for Finbrain reviews so more are becoming aware but just aren’t sure of accuracy and reliability.

AI stock forecasting tools appear to be more accurate between one day and perhaps a month, yet the stats do show good results over 12 months. That’s a bit of a mystery however, FinBrain has data from previous years, it might detect patterns. Cyclicals would have a definite pattern.

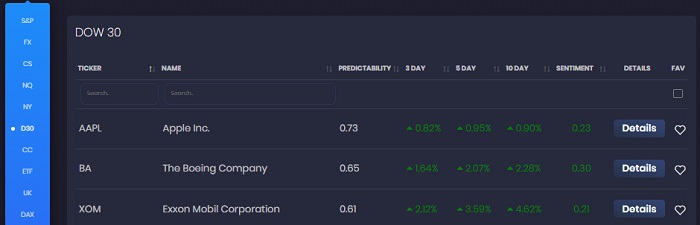

FinBrain.tech homepage. Screenshot courtesy of FinBrain.techAs you can see in this screenshot of Finbrain’s new homepage, they can offer 10 predictions on a particular stock, in this case of Apple stock. They expect Apple’s stock to level off so you can monitor this yourself over the next 10 days.

What does FinBrain Tech Do?

FinBrain offers tickers that show predicted prices of selected stocks over a time period of 1 to 10 days. They apply deep learning technologies to a variety of financial markets including stocks, currency, commodities and indexes.

Why Use FinBrain Tech?

- protect your investments against market volatility

- maximize ROI on your investments

- gain a better understanding of the behavior of stocks you’re interested in

- combine Finbrain insights with expert predictions and opinions

- short term and long term (12 month) outlooks

- export Finbrain prediction data into other analysis systems

- historical and current sentiment analysis scores for 4500 us stocks

- daily automated technical analysis report for each asset

- filtered reports for highest return and highest predictability assets

- available for a wide array of stock markets

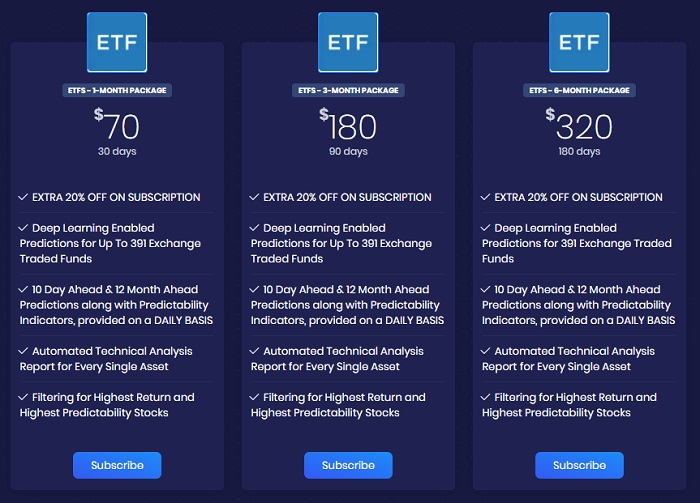

FinBrain has new subscription packages specialized for each of the different markets including the S&P, Dow Jones, ETFs, Foreign Exchange, Commodities, Cryptocurrencies, UK FTSE, HK Hang Seng, German DAX, Mexico BMV, Canadian TSX, NYSE, Index Futures and Mexico BMV.

If you like safety, you might want to focus on the ETF subscription package as seen in this screenshot.

FinBrain Technologies LLC

99 Wall Street #2023

New York, NY 10005

info@finbrain.tech

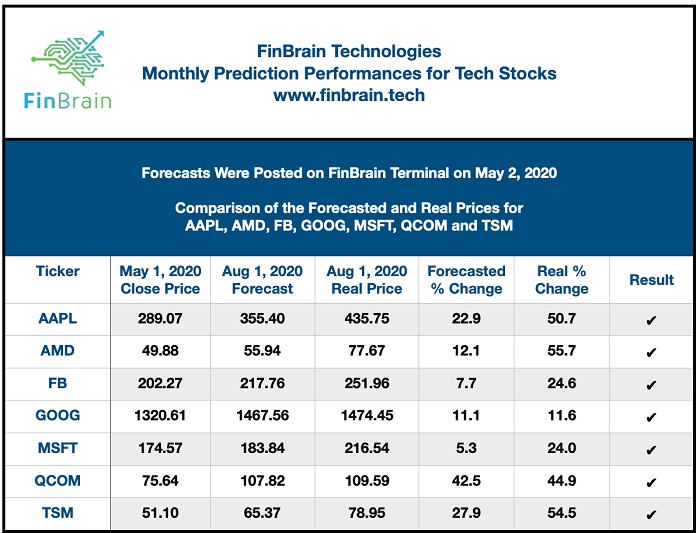

FinBrain Performance Results

FinBrain reported last year a return of above 50% in just 3 months on tech and semi-conductor prediction results including AMD, AAPL, FB, Google and others.

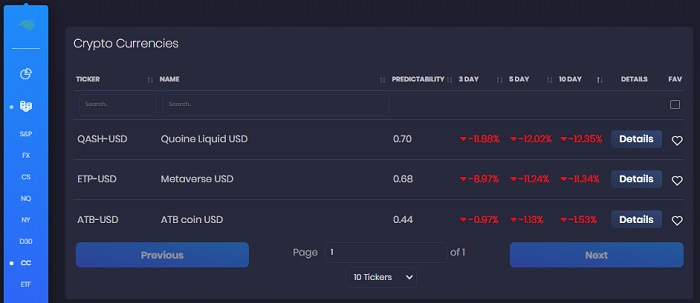

Many of you are likely interesting in Cryptocurrencies given the incredible rise of BitCoin. You can see a selection of cryptocurrencies in your account interface.

FinBrain is a mystery because the company doesn’t publish enough marketing material, test results, and other collateral that convey its full value. Its API is likely of big interest to other companies which may be venturing into the AI stock prediction space with their own value-added service packages.

IKnowFirst Stock Prediction

I Know First is a fintech company that provides state of the art self-learning, AI-based algorithmic forecasting solutions. Its customers are in the capital markets hoping to find the best investment opportunities.

I Know First offers daily investment forecasts based on an advanced, self-learning algorithm. developed by Dr. Lipa Roitman, a scientist with over 20 years of research and experience in artificial intelligence (AI) and machine learning.

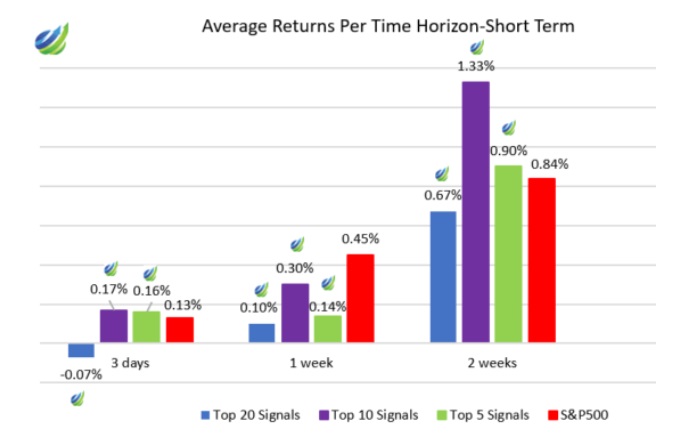

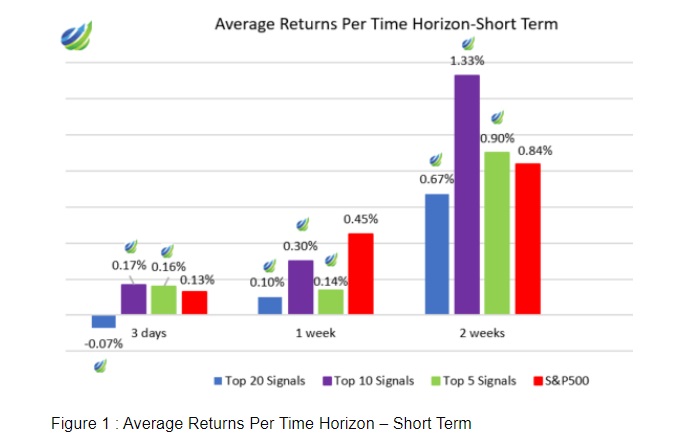

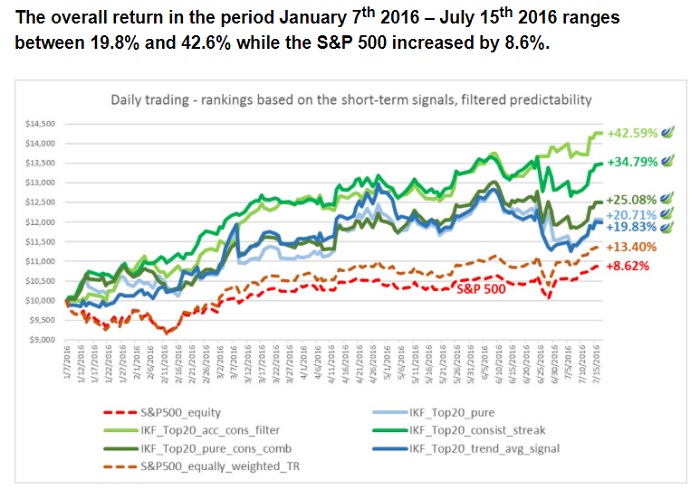

As this graph depicts, iknowfirst’s predictions outperformed the top 10 signals outperformed the S&P average over a 2 week test period.

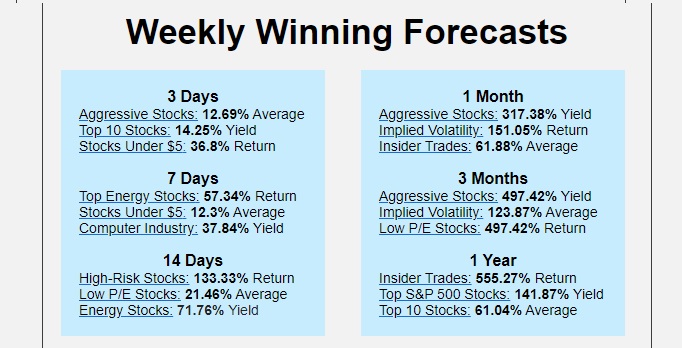

And returns over a long term projection were outstanding when using iknowfirst’s top 5 and top ten signals. They indicated that their algorithm performed with the incredible hit ratio of 99% for the Top 5 Signals, with an average return of 69.88%.

I Know First Day Trading?

One key question you might have is whether Iknowfirst is useful for day traders on intraday or high-velocity trading? Most day traders lost their money, which is a big threat to the retail investor segment driving the stock market today.

There is a blog post on the I Know First website that discusses how you can improve your day trading strategy:

iknowfirst.com/how-ai-can-improve-your-day-trading. In it they explain that I Know First’s short-term modeling is from 1 day to 6 days, so it would not seem useful enough.

This graphic below appears to show the algorithm might have some short term strengths but doesn’t seem to show any intraday sensitivity. What the difference is between high-frequency trading and day trading is something only an expert can tell you. Both might be considered gambling activities that disturb the markets and can be used to inflate stock prices.

Screenshot courtesy of iknowfirst.comThis was a very difficult period for any AI based stock prediction algorithm. The pandemic had very adverse effects on some stocks and positive effects on other equities.

Should FinBrain Tech and I Know First have been able to factor in the recessionary effects on all stocks? Do they have a recessionary effect algorithm and a post pandemic recession algorithm?

Or are the recessionary effects just a weight on the whole graph dragging them all down, but not really changing the performance of single companies? Tough technical questions which only the experts can reveal.

I Know First needs more updated and explicit content that discusses these issues because investors have questions. Without being very confident, investors would not dive into their services with zeal.

Conclusion

I think we all feel good about these AI stock prediction algorithms, yet more about them needs to be carefully reviewed. And by doing that, these companies can perfect their products and offer investors much more value.

You have to appreciate that such services are available to the general public, but there’s little stopping major brokerages or corporations from buying them up.

Stock Market Predictions 6 Months | NVIDIA Stock Price | Google Stock Price | Tesla Stock | Stock Market Today | Stock Market Crash | 3 Month Stock Market Predictions | Best Semiconductor Stocks | 5 Year Stock Forecast | Dow Jones Forecast | NASDAQ Forecast | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Trading Platforms | Stock Trading | Lines of Credit | Reverse Mortgages | Low Mortgage Rates