Exxon: The World Leader in Oil Production

Exxon, (formerly ExxonMobil), is a renowned multinational energy corporation which has established itself as the icon of the oil industry.

As one of the most widely purchased and powerful energy stocks, perhaps trading up 20% forecasted value, it’s a staple in most large fund manager’s portfolio’s. If you believe interest rates will fall and the global and US economies will recover, it stands to reason this one oil company is best positioned to profit.

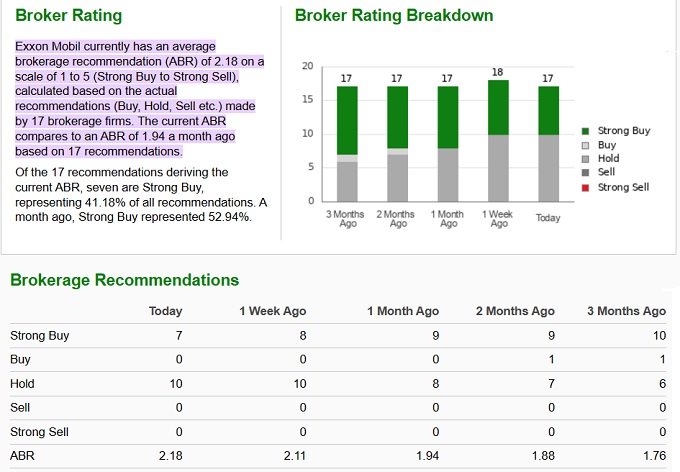

See more on Zack’s ratings of Exxon Mobile below.

After slumping during the 2020 pandemic economic downturn the stock has reemerged as a dominant stock to invest along with the top megacaps. Yesterday, Exxon announced plans to invest in shale oil and gas which will double its output. Accordingly, XOM share prices rose almost 1%.

Exxon Mobil’s earnings per share grew from US$6.03 to US$15.26, over the past 12 months for an impressive year over year growth of 153%. EBIT margins improved by 8.5 percentage points to 19% and dividends paid out at 4.43%.

The 5 Year Picture for XOM

Exxon plans to develop promising new shale production technologies to significantly improve oil volumes. They hope to double oil extraction volumes. Currently, it’s estimated that with 9-11% production growth expected this year, In 2023, they expect to recover 10% of its shale resources.

The Journal of Petroleum Technology reports that the North Dakota’s Bakken Shale has 400 openhole wells capable of generating an excess of $2 billion if refractured (at $60 a barrel). At the $95 a barrel forecasted price in 2024, this opportunity could be a pivotal one for Exxon.

However, according to Simply Insider Wall Street, Exxon Insiders didn’t buy back any stock and instead sold stock at less than market value, which is not a good sign. However, they add that those insiders hold a massive stake in the company worth US$488m.

Aided by rising oil prices, Exxon’s share price has risen and with OPEC cutbacks and falling rig counts globally, the underlying supply fundamentals are favoring higher Exxon share price values. Countering improved prices are continued discounted Russian oil supply to India and China along with deteriorating global economic reports due to high interest rates.

XOM stock is one of the most prized oil stocks to buy on the stock market. It’s a major cap stock in the same category as Apple, Google, Amazon, Microsoft and Tesla. Exxon competes with other large caps in the energy sector including Valero, BP, Shell, along with thousands of smaller oil and gas producers.

See more on the oil price trends which dictate profits. Also view Canadian oil stocks for possible investment opportunities.

Now more than 100 years old, Exxon has established itself as a leader in the oil and gas industry, delivering energy solutions to customers worldwide including gasoline to retailers. This year, ExxonMobil announced the successful startup of its Beaumont refinery expansion project, which adds 250,000 barrels per day of capacity to one of the largest refining and petrochemical complexes in the U.S. Gulf Coast.

See XOM’s stock price below along with key news regarding the company and related events.

Like any large corporation, Exxon has faced its fair share of challenges. The energy industry is highly cyclical, susceptible to fluctuations in oil prices and geopolitical tensions. In recent years, Exxon grappled with the impact of a changing global energy landscape, increasing environmental concerns, and the transition to cleaner energy sources.

To adapt to these challenges, Exxon implemented a number of projects of diversification and innovation. The company invested in research and development to explore alternative energy technologies and to reduce its carbon footprint. Exxon recognizes the importance of addressing climate change and has made commitments to reduce greenhouse gas emissions in its operations.

Investment Potential of XOM Stock:

Investing in Exxon’s stock, XOM, provides oil market investors the safety of a mega cap stock while still enjoying price growth similar to other oil stocks. XOM offers this value proposition:

- Resilience in Tough, Competitive Markets: Exxon has a long-standing history and a robust global presence, making it well-positioned to weather industry challenges. Its integrated business model, spanning upstream exploration and downstream refining, helps offset volatility in oil prices.

- Excellent, Regular Dividend Payouts: Exxon has a history of paying consistent dividends to shareholders, making it an attractive choice for income-focused investors. The company’s commitment to maintaining and growing its dividend reflects its confidence in its ability to generate cash flow.

- Boost to Operations Efficiency: Exxon has been actively implementing cost-saving measures and improving operational efficiencies. By streamlining its operations and capital allocation, the company aims to enhance profitability and shareholder returns.

- Sustainable Energy Efforts: Exxon recognizes the need for a sustainable energy future. The company’s investments in renewable and low-carbon technologies demonstrate its commitment to adapting to evolving energy trends.

Should You Invest in Exxon (XOM: NYSE)?

Exxon’s legacy as a global energy leader and its ability to adapt to changing demand, supply channels, and economic cycles, and adopt new technologies, makes it one of the best oil companies to invest in. Hedge fund and other large fund managers look to Exxon first before considering other energy stocks.

In 2024, with the oil market recovering amidst lower interest rates and business expansion, Exxon stands to gain better than most other oil companies.

This mega cap’s commitment to innovation and sustainability bodes well for its investors. For retail investors seeking exposure to the energy sector, Exxon’s stock, XOM, offers strong upside heading into 2024 and the next 5 year grow period with rising stock price, consistent dividends, and the opportunity to participate in the company’s ongoing transformation toward a cleaner energy future.

Read the Latest news on Exxon Corporation:

See the latest news this week from Yahoo Finance, MSN, BizJournals, TipRanks, and other real times sources.

See more on investing in oil and energy, and keep up to date on the latest economic forecast.

Stock Market Today | Best S&P Sectors | Stock Market 2024 | Gulf of Mexico Oilfield Auctions | Google Finance | GOOG Stock Price | 3 Month Stock Market Predictions | 5 Year Stock Forecast | 6 Month Outlook | Dow Jones Forecast | NASDAQ Forecast | Oil Price Predictions | Gasoline Price Forecast | S&P Predictions | Stock Price Quote | Stock Market Crash | Stocks Next Week | Housing Market Forecast | Stock Market Investing Tips | Stock Trading Platforms