Forecast of Tesla Stock Price

Tesla stock has created a good number of millionaires who enjoyed the opportunity of buying TSLA when it was undervalued. Its tech advantage, marketshare, and consumer brand value is immense and could easily rocket again.

And a lot of that growth came via Elon Musk’s brilliance and audacity as an entrepreneur. Elon isn’t glorified by the media any longer, yet TESLA is one of the Magnificent 7 enterprise tech mega caps still poised for more growth. Tesla reminds us of Google with all the many ways it can innovate and make money.

Yesterday’s earnings report may have disappointed investors. Yet TESLA’s incredible assets include its unparalleled data collection, next-generation battery technology, supercharging stations set as the US industry standard, a new production facility in India, AI technology along with the new SuperTruck to begin production soon, for perhaps a December release.

The Austin, Texas based manufacturer of electric vehicles, solar panels and batteries reported net income of $2.7 billion in Q2, a 20% increase year over year. TSLA earnings per share rose 20% to 78 cents. Total revenue rose 47% to $24.93 billion. Tesla’s net income rose 91 cents a share to $3.15 billion, blowing past average analyst estimates of 80 cents per share.

This is excellent performance despite increased costs and lower profit margins. The fact is, TESLA has a dominant marketshare with a lead that other manufacturers can’t catch up to. That’s why some experts are calling for a $500+ stock price and higher. If energy prices rise as they’re expected to, it only makes TESLA vehicles that much more attractive.

As you’ll read below, some experts have big predictions for Tesla’s stock price in the coming years. This supposed recession, if it happens would only provide an even better buying opportunity. Buy, hold and wait for the peak for 2023. In 2024, many stock market forecasters feel the sky will fall. Don’t be sure, because 2024 is an election year, typically positive and Biden must boost jobs and the markets to get elected.

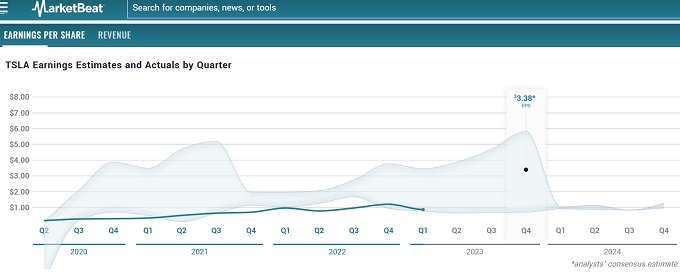

MarketBeat offers a rosy projection for the rest of 2023. That’s plenty of time to ride this stock to the top and then divest!

What is about TSLA that’s So Compelling?

- EV’s are in vogue with this heat dome climate warming news

- oil prices and gasoline prices are rising making cheap electricity more attractive

- Europe is never out of worry about oil supply

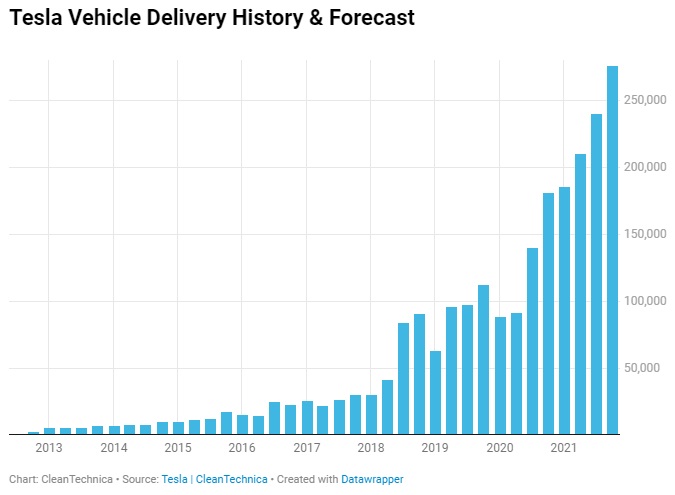

- Tesla delivered astonishing, record deliveries

- Model 3 and Y are now eligible for a $7,500 tax credit in the U.S

- TSLA is one of the safest mega-caps, with market dominance and tech superiority

- more money will stay with the mega caps (Jim Cramer’s magnificent 7)

- the company is expanding production to India

- the company collects massive data on driver habits, and preferences and can offer additional services

- the company’s impressive earnings and 5-year outlook will draw a lot of money out of the money markets

- investor sentiment on TSLA is bullish

Zach’s forecast of TSLA Q2 earnings and revenues are 83 cents per share and $24.88 billion, respectively. TSLA has beaten Zach’s projections the last 4 times. Its last rise was a cup and handle which did not touch the resistance line.

Q2 Earnings Report July 19

As we await the company’s Q2 earning report, we know Tesla now qualifies for the EV tax credit, that gasoline prices are headed upward, production numbers were well up, and that Musk expects to expand into the India market with a new production facility. Genius, confidence, optimism, and risk-taking breed innovation that leads to market leader success.

So with a looming exit from communist China, Elon is adapting to world economic trends. India is the coming economic giant and growth in sales there could be immense. And cheap production there offers cost savings.

Democrat fund managers and investors refused to invest in the stock despite Tesla’s massive success and growth it was having. The numbers weren’t really there yet the stock price exploded, leaving many with red faces. They lost their opportunity to board one of the few stock booms that make people rich.

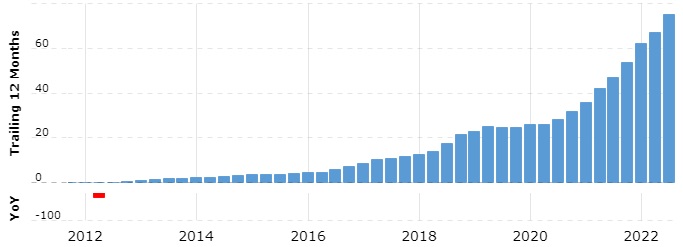

From $2 to $400 in 8 years! That was 20x growth. Fortune favors the bold.

Jim Cramer and others are calling for a Tesla stock breakout however, some such as Craig Irwin, Roth Capital senior analyst believe the stock will plunge to $85. He says the US government may block Tesla batteries from entering the US. The latest boost is about Tesla vehicles qualifying for the government EV credits so there’s a lot contributing to this updraft that began in the beginning of May.

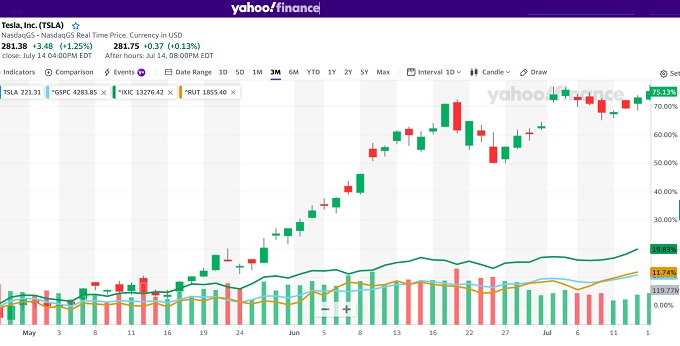

As this chart shows, Tesla stock may be poised for significant growth. But as Mike Wilson of Morgan Stanley projects, the markets may recede this fall. Yet Tesla Inc could come up with great price reductions to help it maintain its dominant market share and keep intense pressure on EV competitors.

Consider that Elon and his Tesla team, are flexing and adapting in a great way again. The recent news bears that out:

- Tesla’s supercharger is yet another revenue stream which wasn’t even priced into their revenue outlook

- Tesla is giving Ford and GM access to its Supercharger network beginning in 2024.

- CEO Elon Musk said he may be open to licensing Tesla software and supplying powertrains and batteries.

- Tesla sell access to its technology and infrastructure.

Dan Ives says the golden goose is Tesla’s battery technology. However the key to future sales could be software licensing and in delivering services via the Tesla data network. These software-related services are said to be the bonanza, and given the AI possibilities, drivers might be more attracted to that than the vehicles themselves.

Will the stock rocket again to stellar heights. Some forecasters believe it will in the next 5 years, however, investors should be cautious in the 6 month to 1 year term ahead.

Tesla has plenty of competitors, yet this company is the Apple, Google, Facebook and Amazon of the electric vehicle sector. Its brand sets the standard. Investors are wise to pay attention to brands and the near monopolies they enjoy. A monopoly is the dominant factor for sales, followed by a great brand, and then the ability to innovate and produce in a growing market.

It seems Tesla has all this, and you’ll find most investment advisors recommending buying Tesla stock. Like Apple and Google, the car maker was looking for a catalyst all these years to get rolling and create serious market share growth at the expense of GM, Toyota, Ford, Honda, and the other major car makers.

The ensuing surge in capital investment and sales helped Tesla rocket its manufacturing output, sales, and its stock price. Yet building new factories in Berlin and Austin have strained the company’s resources and will weigh on earnings.

Tesla released its Q1 2023 earnings report and earnings are down. They’ll likely be down again as the economy slows. That’s a boarding opportunity for investors.

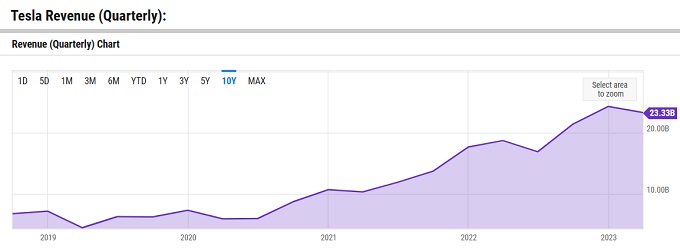

Tesla Sales Revenue Since 2012

One of the steepest company sales growth curves ever and it’s on an unimaginable scale. Many investors believe Tesla is headed to become the top vehicle manufacturer in the world. However, Toyota, GM, Honda, and a host of niche EV manufacturers are producing electric vehicles too. This will erode their sales potential.

With gas powered vehicle sales declining however, companies such as Mercedes Benz, BMW, Ford, GM and Honda are losing the basis of their fortunes and sliding into head to head competition with a car company that is a tech company.

And as observers point out, Tesla can make more money via digital services than it can by selling its cars. Most investors don’t realize that.

Infrastructure for electric vehicle charging is improving but is a long way from matching the hundreds of thousands of gasoline stations that dot the US and the world landscape. Remember that the world is far behind the EV adoption curve. Building it in most countries would cost trillions but Tesla’s supercharger network is leading diffusion into the US.

Further, Tesla and Elon Musk were hoping they would enjoy big sales volumes in the huge China market. With trade relations souring fast and China EV manufacturers picking up the pace, Tesla could find itself shut out of that market and would invest more in the US market.

Tesla Car Sales Market Share

In 2020, in the US, Tesla vehicles accounted for 79% of new electric vehicles sold, and in 2021, that number fell 10% to 70%. During the first two quarters of 2022, Tesla’s car sales are down only 2%. The size of the EV market however is growing.

So far in 2022, the Tesla Model Y (103, 215 units produced) and the Tesla Model 3 (97,075 units produced are by far the two most popular electric vehicles sold in the US.

Fortune Business Insights reports that the global electric vehicle market size reached USD $246.70 billion in 2020. They forecast the market would reach USD $287.36 billion in 2021 and predict it would hit USD 1.318 trillion by 2028 at a CAGR of 24.3%.

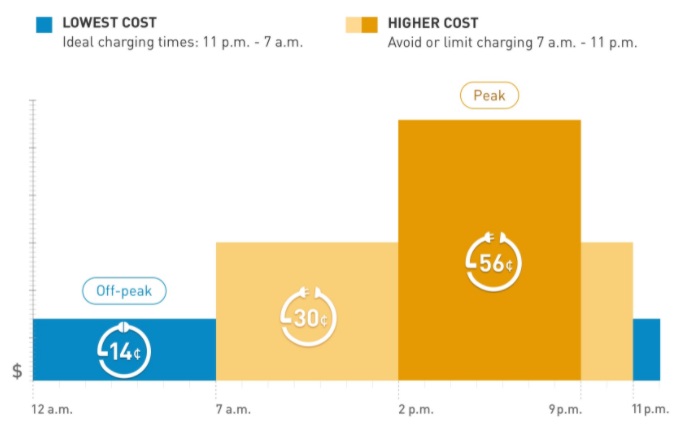

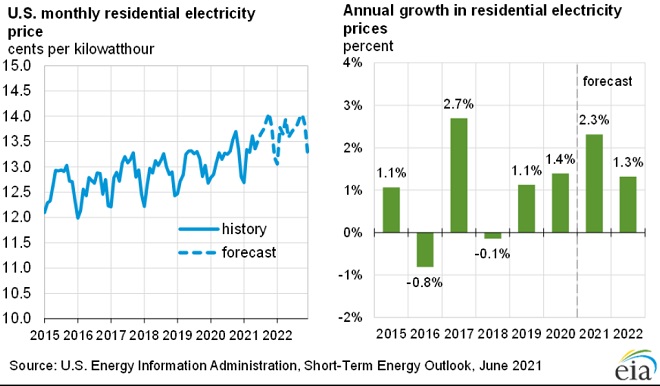

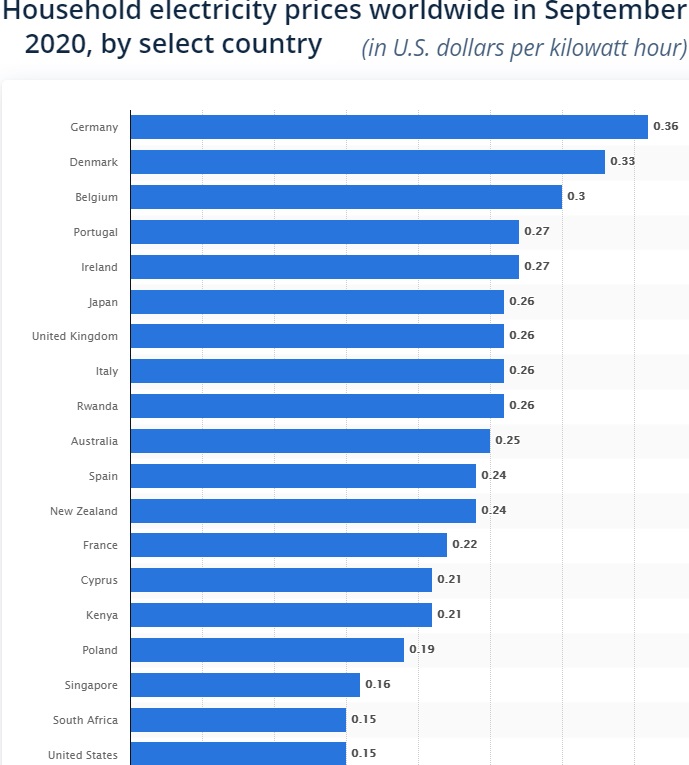

Global EV consumers aren’t wealthy and they will still be buying with an eye on price and utility. The price of electricity in some US states such as California is prohibitive as this chart below depicts. The cost of it isn’t discussed, but in California’s summer heat wave the state was pushed into an energy crisis. The fact is, electricity will become more expensive.

Factors that Could Depress Tesla’s Stock Price Forecast

There are bumps in the EV road, including rising sticker shock and beyond EV range worries. In the US, Tesla’s market share and sales are beginning to slip. And suspiciously, EV sales reports for 2021 are going missing in action. It’s a signal investors should be paying attention to.

Electricity won’t be getting cheaper as demand increases, and as the economy slows in the next 5 years, consumers may balk at the high costs of Tesla vehicles.

Consumers understand these vehicles and can drive them long distances. As demand in the post pandemic period heats up, consumers will buy gas powered vehicles. Cost is just one factor, but it’s getting more attention.

Tesla’s stock price performance has been prolific and while being constantly criticized, the company has been able to leave California’s high tax environment (a democrat state) and ramp up production in the 1st quarter 2021. Yet as the pandemic recession comes to a close, some of the impractical ideology that drove sales may wane through 2022.

Tesla has dominated the EV market for some time, but new entrants are putting pressure on the company. We can’t forge Elon Musk’s comments about getting flattened like a pancake by big competitors and that the company could get bought out by a major manufacturer. Smart people read between the lines.

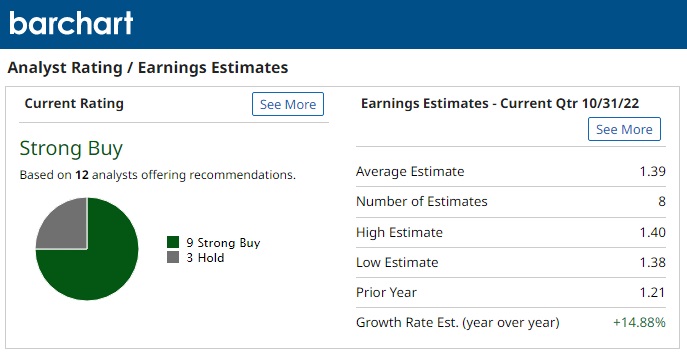

Barchart’s analysts give Tesla a moderate Buy rating.

CNN Business

CNN stock analysts give a strong buy rating for the stock as well, with a median price forecast of $316 a share within 12 months.

Right to the Heart of the Matter

Are Tesla vehicles the most cool electric vehicles on the market? Are they affordable? Well, take a look at the Cooper mini EV and Chevy Bolt and whether consumers might find them attractive. Compare prices to the Tesla models, and ask yourself who is buying EVs. Tesla prices are falling, but for the most part, these are luxury priced vehicles.

See more of competing low price and mid priced alternative EVs on the MotorTrends Website.

If Toyota, GM, or Ford’s push into the EV market is real, the Musk’s comments are definitely forward looking. Ford just announced it’s new electric Ford 150, the EV version of its wildly popular truck. Cyber Truck has not come to the rescue but Dan Ives expects sales of 250,000 units. The price of Tesla stock dropped on the reveal of the new Ford truck but that is a flash in the pan, as the group buying Cybertrucks are younger and like the novelty of them.

Find out more about EVs on insideevs.com You’ll see excellent competition including Fisker, Lucid, Volkswagen, Ford, Lexus, and Mercedes Benz. These are companies with strong brands and loyal customers and now they have products developed and ready to be bought.

Tesla’s forecast for 2021 appears promising, but what the industry isn’t reporting is the sales growth forecast for the rest of the EV manufacturers. Tesla as well appears to be totally reliant on one vehicle, the Model Y.

The EV market continues to be dominated by Tesla, which sold an estimated 69,300 vehicles in Q1 and remains the only significant automaker in the U.S. with an EV-only lineup. Tesla accounted for 71% of total EV sales in the quarter, down from 83% share in Q1 2020. — from Reuters report.

The new Tesla Model Y is the best-selling EV in the U.S., followed by the Tesla Model 3. The Model 3 was the No. 1 best-selling EV in 2020, but sales in the U.S. market declined by more than 50% year over year in the first quarter of 2021. The Chevrolet Bolt was No. 3 on the EV list, with nearly 10,000 sales in the quarter. The all-new Ford Mustang Mach-E, which went on sale in December, was No. 4, outselling both the Tesla Model S and Model X. — from Reuters report.

First, China gave Tesla the gears by blocking its future in China, and now China’s communists regime also saying that won’t allow Bitcoin as a transactional currency. That’s the first step in booting Bitcoin and non China cryptocurrencies right out of the country.

If Tesla sales revenue picture was built in China sales, then the company’s outlook might be dimmer than anyone believes. And with commodity prices rising, who will be able to afford the high priced Tesla models? The recent Battery day turned out to be all hype and propaganda, a big hype fraud playing up the media who seem to be willing to let it go. It was all about a experimental battery that won’t be available for a long time. If you’re cautious investor, you might see these promotional events as a compensation for real weakness. The truth is often opposite to what is said by corporations.

Unrelated but important is the law suits against Tesla for its solar roofing product. Solar roofs were a trendy product, but what is the liability when they have problems? Tesla about to find out as California decides to handle the lawsuits as on e big class action suit. California lawyers love stuff like this.

Tesla Ratcheting Up for Big Sales before 2025

Yesterday’s announcement from Tesla regarding the sale of $5 billion of Tesla stock had investors reacting negatively. However, tonight in after-hours trading, the stock jumped to $659 a share.

Given how well the price of Tesla stock has performed, Tesla’s selling of stock to fund growth is a wise choice. It’s another sign to investors that Tesla will grow and become the company many expect. Read more on Tesla, it’s history and business units.

Tesla is a fascinating company to study and invest in. Do you plan to buy Tesla stock this year? Please leave a comment regarding your investment attitude toward Tesla stock. How high do you believe Tesla’s stock price could go, or do you see other EV manufacturers blowing away Tesla?

Tesla 5 Year Stock Price Forecast

Not many stock analysts are offering up 5 year outlooks for Tesla Stock. Of course, when you do, it can make the expert’s look bad when the price misses by a lot. Better not to do 3 year or 5 year forecasts if image is the priority.

However, it’s uncertain how many cars they can produce up to 2025 via their two new manufacturing plants in Germany and in Texas. So many variables, so we have to rely on reliable estimates from the major stock advisors such as Motley Fool and others. The established brokerages have missed out on recreational investors love of this stock and the company.

A tripling of the stock isn’t out of the question as the pandemic ends mid-June and the economy stimulates a lot of car buying. Gasoline prices will climb, and car loan rates will still be very low making EV car purchases a likelihood.

This chart shows Tesla’s price was up over 300% last February before Covid 19 was imported from China. What other stocks were rocketing before the pandemic? They might be worth watching now as the vaccinations begin.

Back then, the Fool cited 5 factors that drove the price:

- surging Model 3 sales

- Tesla’s China-based manufacturing began

- positive free cash flow

- becoming self funding

- ambitious plans for 2020

Gov Capital predicts Tesla’s stock price will reach $1748 per share by December 23rd, 2025.

Rocketing Tesla Stock Price

There’s plenty who still believe the price is looking a lot like a SpaceX rocket during launch. This is an exciting company with an attractive brand and growing revenue base. Experts believe the company will become a true digital company via software subscriptions, not just auto sales.

Tesla’s stock price has doubled in the last 3 months and has jumped 700% since March. Every time skeptics predict a crash, TSLA just keeps on climbing. There is speculation about who is so negative toward EV technology and Tesla, but we shouldn’t dwell on it.

Change always brings resistance, and Elon Musk really pushes the envelope on market-changing innovation. There’s a lot of pension funds that are fully invested in the Big 3 and Japan automakers and feel threatened by Tesla’s strong brand.

Young investors, likely via Robinhood have overwhelming faith in the upward forecast for Tesla Stock.

Tesla Ramping Up Global Production

Yet the company is building factories to ramp up production numbers to Toyota/GM volume. Tesla will face opposition. For instance, today, the German manufacturing facility was held back by “snake protectionists” who say snakes will be endangered by the new facility.

EV Sales in China

Becoming the biggest company in the world isn’t easy. Yet investing in Tesla didn’t seem like a gamble anymore, but what about the questions about total global sales potential? Is the world enough to create a lofty price.

The China Passenger Car Association reported Tesla’s EV sales soared 128% in November. Sales of the Tesla Model 3 jumped 78% from October. The CPCA announced that Tesla sold 21,604 made-in-China Model 3 cars last month in China.

Sales of EVs in China could jump in the next 2 years to close to 3 million which means Tesla may sell a lot of cars. I have always believed that China would not allow any foreign company to own a market in China. But if Biden jumps up imports of China goods, Tesla might be allowed to sell more EVs there.

Google, Amazon and Facebook however shouldn’t hold their breath as the communists stick to their China-company only world domination supply chain.

With growth in Germany, Europe and China, Tesla is positioned for incredible growth. And those SpaceX rockets and Youtube videos will only make the brand very attractive to future EV buyers around the globe.

Factors Supporting Tesla Stock

There are a lot of factors pushing Tesla stock ever higher. Here are a few:

- global economy will return as vaccinations take effect and car buying will begin

- millennials like a new auto manufacturing company

- G7 countries support the demise of the gasoline engine

- battery technology is improving faster

- Elon Musk is a bold leader with vision and creates new technology

- Elon Musk has moved to low tax Texas and is taking his company with him

- Tesla is producing more cars and are gearing up financially to ramp production up considerably

analysts are giving the buy signal

Please bookmark this post for continuous updates on Tesla and the TSLA stock price. Learn more about the Tesla Stock Price Forecast , Stock Market Predictions for 2024 and about a potential Stock Market Crash in 2024.

AI Stock Prediction Software | Stock Quotes | Stock Market Predictions 2024 | Stock Market Crash | Market Predictions Next 3 Months | 5 Year Stock Forecast | Dow Jones Forecast | NASDAQ Forecast | Oil Price | S&P Predictions | Stocks Next Week | 6 Month Outlook | Stock Trading Platforms | Stock Trading | Reverse Mortgages | Home Equity Loans | Market Rally | Google Finance | Author Gord Collins