Tesla Stock

Tesla is the world’s premier AI company and electric powered automobile manufacturer. As you’ll see below, the EV market is growing in 2023, and investors wonder if TSLA is the stock to buy as we head to the recovery in 2024.

It’s built a stellar brand reputation among auto buyers who prefer a new era of environmentally friendly, clean energy powered vehicles. Tesla dominates the EV market and many investors believe that will continue.

From February 2020 to November 2021, TSLA stock price grew 1100% making many investors rich in short period of time. This year again, the company’s stock has jumped in value. Some investors believe a bull market is ahead, yet if the US sinks into a downturn, would TSLA stock make a good buy?

Tesla is the leader in the EV market and in Q1, 2023 electric vehicle sales rose above 250,000 units to give US EV makers 7.2% of total auto sales. Clearly, a huge market remains for Tesla and it may be most capable of expanding and accessing those buyers from 2024 onward. Q1 results for Tesla wasn’t outstanding as a number of threats emerged including government law suits. Nothing seems to really slow this company down however.

Elon Musk’s successful company also manufactures rechargeable batteries, solar panels, and solar power systems. It has alos built a factory for designing and producing microchips to power its fleet of self-driving vehilces. The company is a leader in robotic technology and refers to itself as the world’s biggest robot company.

Despite an adversial relationship with the Dem socialist government, the company’s fortunes have grown, powered by a climate change initiative that provides rebates for electric vehicles. That rebate was not okayed for Tesla by the Biden admin until recently. The government remains a threat to the profitability of TSLA stock however.

The media attacks on Musk and Tesla have been frequent, yet there is something too compelling about the company that makes it a good bet. Will it 11X value again?

2023 Sales Forecast

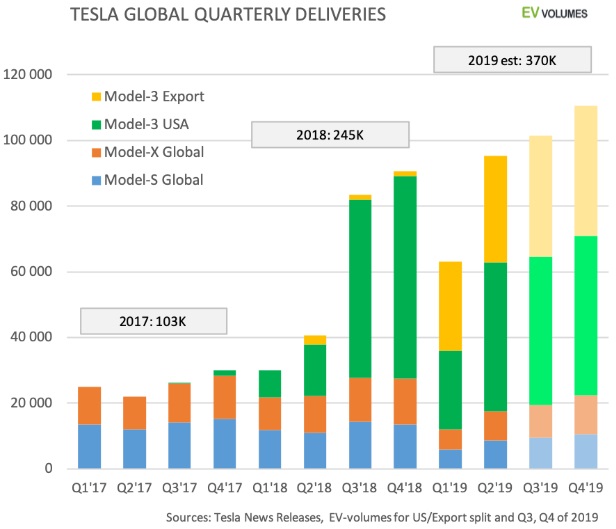

Tesla’s electric vehicle products include: the Tesla Model S, Tesla Model X, Tesla Model 3, and the newly released Tesla Y. The Model 3 in 2021, became Tesla’s best-selling vehicle at over one million units.

According to Motor1.com, the Tesla Model Y was the world’s best-selling car in the first quarter of this year selling 747,500 units of the Model Y, a 91% increase from 2021. The Model Y was just behind the leading Toyota Corolla sedan and RAV4. It’s astonishing the Tesla Y has caught up to the Toyota Corolla which has been a popular vehicle for over 3 decades. It looks like a new perennial leader in vehicle sales is appearing.

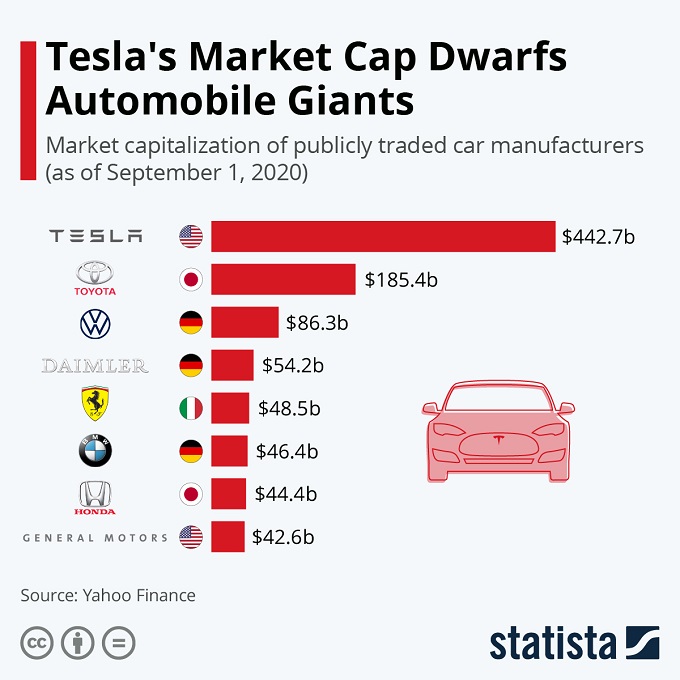

This infographic from Statista shows Tesla has the largest market cap of any car company by far. Market cap tells investors a lot about Tesla’s manufacturing, financing, and sales power. Musk’s company has shown its ability to innovate and build leadership in batteries, recharging stations, and software development. It is the digital services offerings that experts believe has the greatest revenue potential in future.

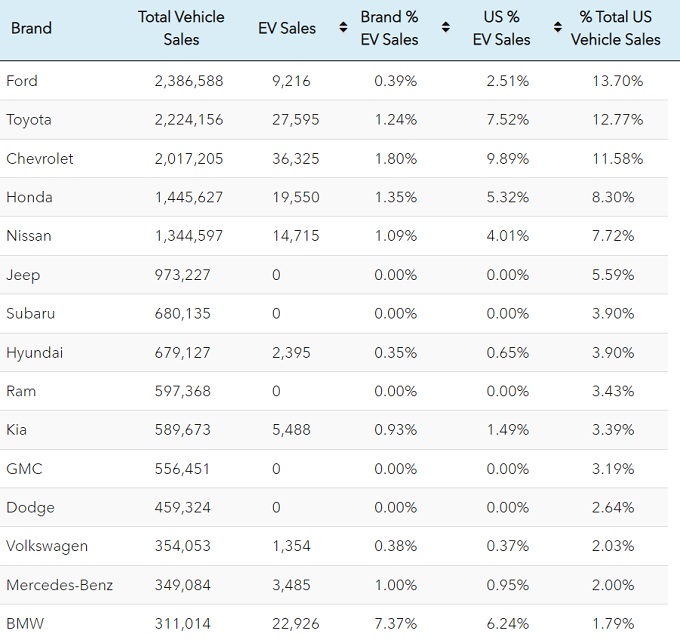

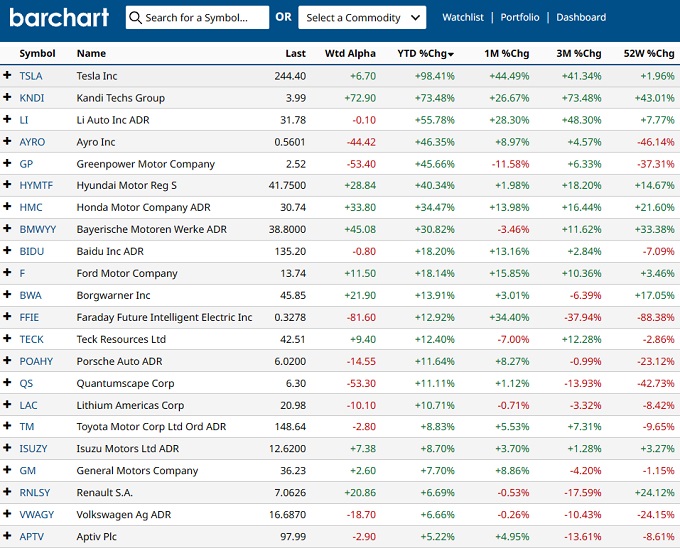

Major EV Brands Sales Stats

Tesla was not included in this list because 100% of its vehicles are electric.

Tesla Vehicle Models

The Model S sells for $104,990, Model S $65,990, Model X $122,00, and the Model Y sells at $46,990. They are categorized as a type of luxury car with the Model X possessing a peak power output of 1000+ HP and a 330 mile maximum range.

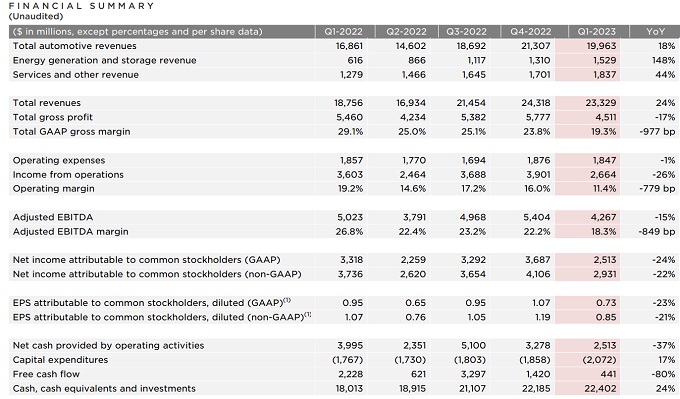

A look at Tesla’s financial and manufacturing growth would make you feel tsla stock is the first on your list. Tesla’s Q3 earnings report is impressive. However, there’s more than meets the eye and the earnings reports.

As the report’s financial summary shows, revenues are up 55% vs one year ago (now $21.5 Billion) and total gross profit is up 47% YoY. Amidst that, expenses are only up 2%.

Tesla’s Financial Reports

Tesla is listed on the S&P and NASDAQ exchanges.

TSLA Recommendations

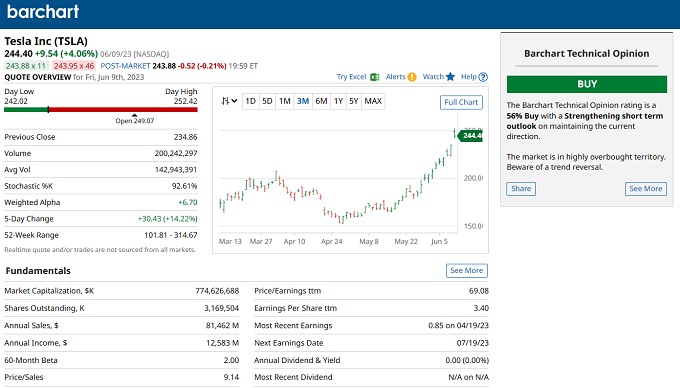

Tesla’s price earnings ratio currently is an ultra-high 68. Toyota’s P/E ratio is 28 and GM’s is 5.86. Barchart had a sell rating for GM and Toyota. Obviously, the rating is not based on earnings, but rather on speculation about the forced obsolescence of gas-powered vehicles.

Barchart’s analysts believe Tesla’s outlook is a moderate buy with a strengthening short term outlook.

How About the EV Competition?

Are there any realistic and recession resilient EV stocks to buy?

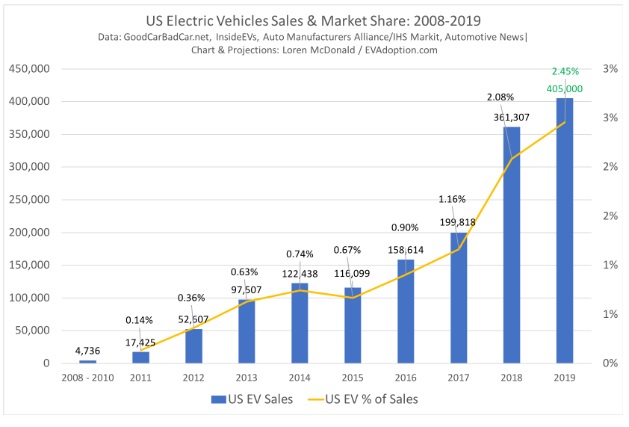

Electric Vehicle Sales and Demand

Sales growth of electric vehicles in the US has been steep. After a hot 2018, growth has slowed, with a forecast of 405,000 units. So when Tesla delivers 175,000 in one quarter this year, that is an astonishing stat for one company. After all, electric cars are a new product. And if gasoline drops in price as it has, it stands to reason the big car makers are going to sell more of their gas guzzlers.

Plug in EVs

Plug in EVs comprise a very small portion of the total market. Regardless of how Tesla performs, they are the premium brand in a market with incredible potential. The upside is something to pay attention to, since the other automakers are more committed to gas powered cars and trucks.

TSLA Price Earnings Ratio

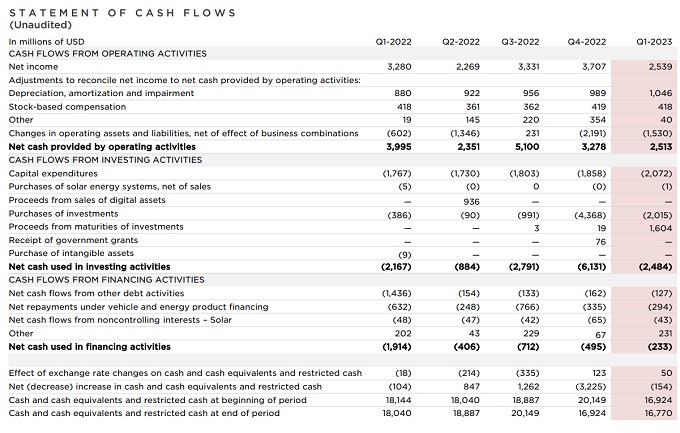

During Q1 2021, Tesla recorded a net income of $438 million on earnings of 93 cents per share on $10.39 billion in revenue. The total investment in Bitcoin by Tesla rose to almost $1.2B. Cash and cash equivalents decreased in value to $17.1B in Q1, driven mainly by a net cash outflow of $1.2B in cryptocurrency (Bitcoin) purchases, net debt and finance lease repayments of $1.2B, partially offset by free cash flow of $293M.

Former Tesla employee Steve Westly discusses the company’s performance last summer with Jim Cramer. His positive outlook has borne out.

Market Threats to Tesla

What are the threats to Tesla success? Very low priced gasoline will keep constant cost pressure on Tesla. And hydrogen cars are not far off either. Hydrogen is a powerful type of fuel. Musk’s original thought that we’re going to run out of oil and fossil fuels is simply not true. In fact, The US has become the world’s largest producer of oil. If the US were to build more fuel refineries, gasoline prices would plummet making gasoline powered cars very cost efficient.

Tesla EV cars are priced above mid-priced autos and might be harder to sell in a recession. However, Tesla is an unmistakable brand of the future. All the cars are built in Tesla’s California factory which will draw the ire of some states who stand to lose auto jobs. Production in China is growing and is expected to make up 40% of sales soon.

Other companies are building EVs such as Nissan, GM and BMW and have production capacity and market reach. It has massive debt which might be hard to finance if interest rates climb.

Tesla positives: It’s a determined, resilient company with a new gigafactory that might produce 500,000 cars per year. The company also produces new age products including solar panels, Solar Roof, the Powerwall home battery, and the Powerpack battery system for commercial and utility-scale sites. Read more about their energy solutions. Read more about the best electric vehicles.

See more on the best stock picks to buy now in anticipation of the 2024 recovery. See more on the S&P outlook, NASDAQ forecast and DJIA.

Stock Trading Platforms | Tsla 2024 | Market Rally | Stock Trading | Lines of Credit | Reverse Mortgages | Mortgage Rates 2024 | Best Finance Bloggers | Finance Blog | Stock Market Predictions for 2024 | 2024 Outlook for US Stocks | Oil Price Predictions for 2024 | Stock Market News Today | Stock Price Quote