Recovery in 2024, 2025 Looks Promising — Mike Wilson

Morgan Stanley’s Chief Investment Officer is bullish on 2024 and 2025, but is bearish on 2023 earnings.

He’s warning investors that this mini bull market may not be trusted, and that a last half 2023 correction, at least in sentiment is due. He lays out his reasoning in the YouTube videos below.

In a Morgan Stanley report, he suggests earnings estimates are inflated, and investors may be overly optimistic on interest rates and other key risks. His warning, for investors to beware of a “head fake” as markets see this early-summer rally.

Wilson says stock market fundamentals are less attractive today than they were last January and that risks are elevated and perhaps increasing in several instances.

“We continue to forecast an earnings recession this year that we don’t think is priced in, followed by a sharp EPS rebound in 2024/2025” — Morgan Stanley.

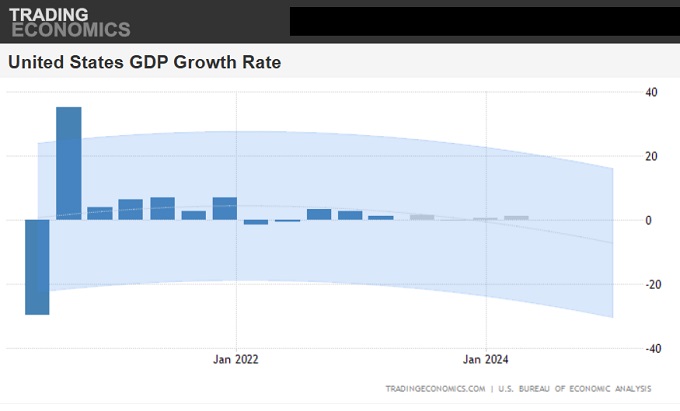

The weak GDP forecast for the next 12 months really backs Wilson’s prediction of a head fake and perhaps a small correction which will stop money market flows into equities.

He backs this head fake market warning with 4 notices about:

Low stock valuations (p/e) ratios. He points out that S&P 500 median stock forward P/E is 18.3x, near record levels back to the mid-1990s and the equity risk premium— (how much a stock is expected to outperform a risk-free investment over time) —is only 2%.

Earnings estimates are too optimistic. Consensus earnings estimates assume a strong re-acceleration for the second half of the year—with markets forecasting mid-to-high single-digit growth for the index overall, even with technology removed. Morgan Stanley’s model sees corporate earnings down 20% for this year.

Investors seem unrealistic about rate cuts. Wilson believes the equity markets already pricing FED interest rate cuts, but their economists believe the Fed will only cut rates if a recession begins, or if stresses in the banking system increase or credit markets deteriorate significantly. He said, investors belief in Fed cuts implicitly assume that inflation will fall to at least 3% which is unlikely given the current strength of the US economy.

Markets may be overlooking other key risks. Wilson says there’s also a presumption that US banks will not be in trouble, consumer spending will stay strong and risks related to the debt ceiling have all been resolved. Wilson says Morgan Stanley economists think banking stresses will accelerate the credit crunch (based on loan officer surveys from January). He says there are significant signs that consumer spending may finally be fading.

Last Month, Wilson met with Bloomberg to discuss his short term bear market thinking.

And for serious investors, here’s Wilson with his thoughts on the market. He says different sectors are leading and hope was pinned on China, which is not booming as expected. He keeps talking of a deep earnings drop despite market sentiment right now.

The Global Economy Won’t be Helping this Year

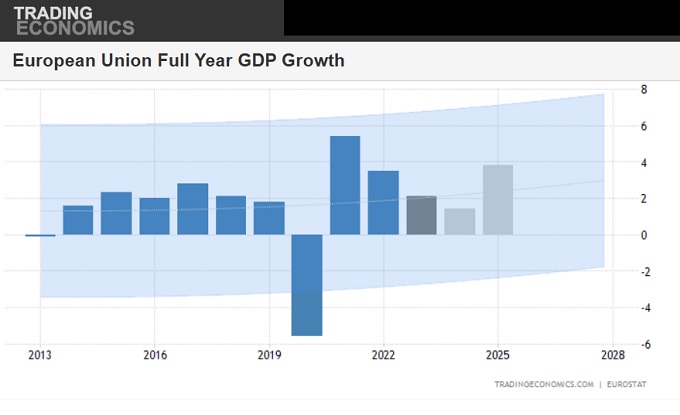

That may not all be all the threats to the 2024 recovery. China and Europe are struggling economically and don’t seem to be shaking of the doldrums. The EuroZone has already slipped into what’s called a technical recession. And as this forecast chart shows, GDP forecasts are poor for the next two years.

According to the IMF, Europe’s outlook is one of slow growth and sticky inflation. Their outlook partly relies on lower energy prices yet Russia’s continuous headline news attacks on the Ukraine, should generate economic penalties as the Euro/US coalition pour money into the Ukraine resistance.

It may be an unsaid belief in OPEC production status quo and Biden releasing huge amounts of oil into the market from the US SPR. Global exploration, drilling and production is falling and that points to shortages. If consumer demand is easing, it would feed into an overreaction to a deeper recession threat.

IMF is predicting annual growth of only .7% this year in Europe, to 1.4% in 2024.

The Impact of High Interest Rates Isn’t Complete

The point of Mike Wilson’s head fake warning might be solely about a lack of appreciation of the lagging effects of rate hikes which may not be complete. They normally take 12 to 18 months, and this hike was sudden and more fallout has to happen. Is tragedy awaiting in the banking sector?

After the summer 2023 spending rush, consumer demand may drop amidst a restricted growth economy in the final quarter and first quarter of 2024, thus sending the economy and the stock market down.

And there are market bears who feel the S&P could still take a plunge this year as 2023 earnings disappoint. The DowJones and the Russell small caps have not enjoyed a field day, showing that perhaps only the big megacaps are seeing the benefits of 2023’s consumer spending.

Not Quite Ready for the Bull Market of 2024

It might be said, we’re not quite ready for a bull market and the current 1st half, 2023 trajectory is unrealistic. There is still time to buy the dip and find stocks that will soar in the new economy in 2024 and the next 5 years.

Almost a mini bubble could be visualized as the heavily depressing effects of tightened money supply and high rates hits all markets. The boom in AI, reminiscent of the .dotcom boom is a signal of overzealous investors too eager to jump on short term profit.

In the housing markets too, there is no crash prediction, but homeowners with variable rate mortgages coming due will be hit with a massive increase in payments.

It’s just one more signal of the need for belt tightening across the economy needed, if 2024/2025/2026 are going to be great years.

Stock Market Today | Stock Price Quote | AI Stock Forecast | Money Market Forecast | Best S&P Sectors | Stocks with Best P/E Ratios | 5 Year Stock Forecast | 10 Year Forecast | Dow Jones Forecast | Tesla Stock Forecast | NASDAQ Forecast | Oil Price Predictions | S&P Predictions 2024 | Housing Market Downturn | Stock Market Crash | XOM Stock Forecast | BP Stock Forecast | Stock Forecast Blog