Market Outlook for Next Week

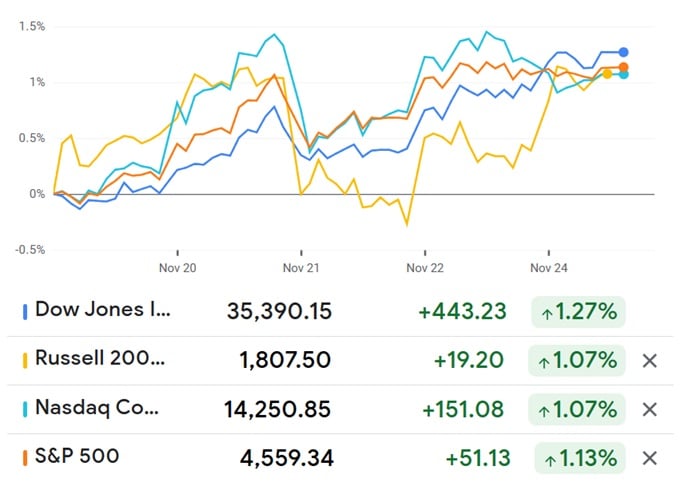

The major stock market indexes all rose about 1% last week, finishing off another week in a 4-week winning stretch.

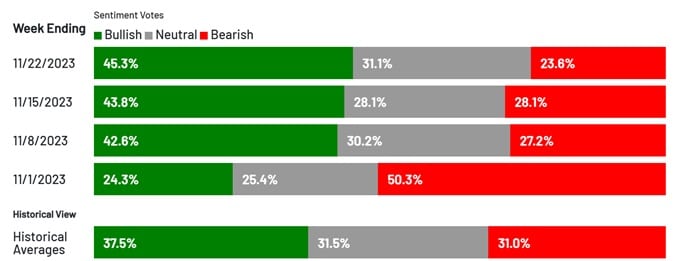

It’s safe to say the bull market rally that Tom Lee of Fundstradt bravely predicted is happening and we’ve got 5 more weeks of trading remaining in 2023. If the FED stays quiet on rate hike cuts and minor inflation spots in the markets, then next week should continue to see stocks rise again.

The S&P hit an astonishing 4559 to end the week. We have to go back earlier in the year with calls from some economists for up to 5000 for the S&P. And only one month ago the S&P plunged to 4100. So 5000 isn’t all that outlandish. With ailing consumer demand the NASDAQ is still doing okay and even the Russell2000 is performing as well as the NASDAQ. In fact, with rate worries easing, the picture for small business stocks should see the Russell2000 rise another 1% this week.

The S&P gained 151 points last week, and with oil prices falling and more investors aware of the warm El Nino weather forecast, there doesn’t seem to be any negative catalysts in sight. I’m sure the media will try to create some, but investors are pushing a lot of money into the stock market. Investors are optimistic and it’s risk on!

The housing market report was not positive and home builders report showed construction is declining fast. Of course that just adds fuel to the frenzy of building we know will happen once the interest rates drop a couple of points.

And with the visible slowing of the economy along with cheap energy (oil glut), we can say that inflation will fall faster. So the FED will be pushed to give a timeline on lowering rates, which since they have all the economic data in front of them, exclusively, they should be able to deliver.

Holiday spending is forecast to be up 4% this year and Black Friday sales results will be out next week. The feeling though is this last binge is it, and credit card balances will be an issue going forward. Each month that passes has consumers facing tougher financial circumstances. That will deflate spending.

Is this the big transfer of funds from the money markets we spoke of? Is the economy out of danger? Many stock analysts and economists are sounding pretty positive, that no big inflationary threat is in view. They seem to concur that the FED is done its crazy inflation of interest rates.

A flat FED rates won’t do anything for the housing market and builders don’t sound too enthusiastic. Consumers are running out of money and holiday spending is expected to be subdued this year. 25% of shoppers still haven’t paid off what they bought last Xmas season.

See more on the 3 month, 6 month, and 5 year stock market outlooks, and the current stock market forecast.

Major Economic Announcements Next Week

On Monday, US new home sales will be announced.

On Tuesday, the Case Shiller home index will be reported and consumer confidence index will be reported. Both of those should be lower. The US job openings report will be released indicating whether business is growing.

There are some scheduled FED governors blowing their horn too and likely to try to contain enthusiasm of investors and consumers.

On Wednesday, Q3 GDP report is due and believed will be steady at 4.9%. And the ADP employment report will be released. The US trade deficit will be released and this is one piece of bad news that lingers and creates its own news storm. The US productivity report will be out and analysts aren’t even venturing a guess on that one.

On Thursday, several core PCE indexes will be reported and they’re expected to be down considerably. The jobless claim report will be released and they’re expected to be up 4%, but that is good news to stock investors as costs are being curtailed.

On Friday, the ISM manufacturing and construction spending reports are published and are expected to be up and flat. Auto sales report is out late day Friday.

Earnings Reports Next Week

Hewlett Packard, Zoom, Splunk, Crowdstrike, FootLocker, Dollar Tree, Petco, Hormel Foods, Snowflake, Kroger, Cracker Barrel, Kirkland’s, Royal Bank of Canada, Dell Technology, Ulta Beauty, all report earnings this week ahead.

The FED put a hold on rate hikes and inflation and jobs data supports that decision. Quite a few equities analysts believe we’re in for an end of year, santa claus rally, but they’re certainly wavering on where the S&P will end up.

Best Stocks to Watch Next: Same as Last Week

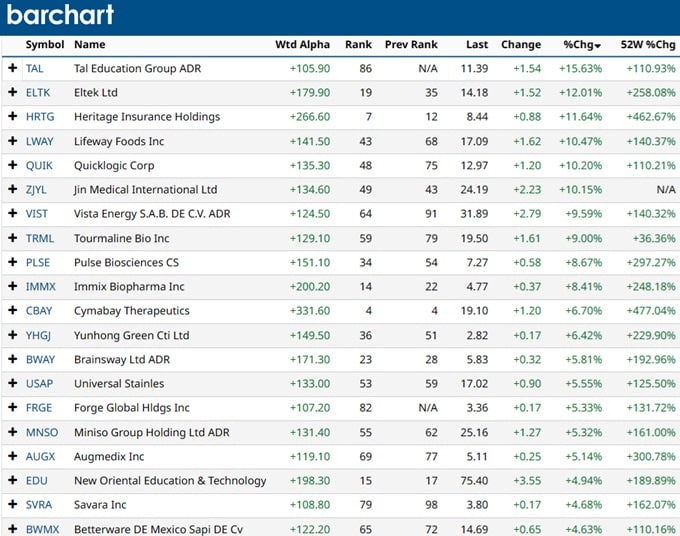

These were the best performers on Friday:

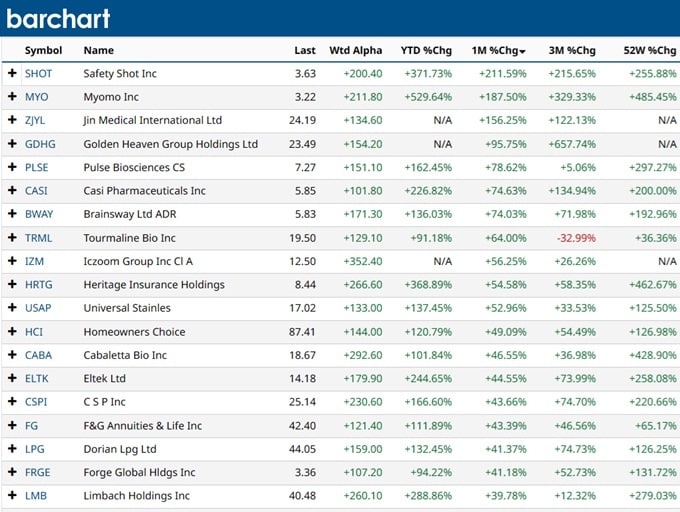

Here’s the best performing stocks the last 4 weeks:

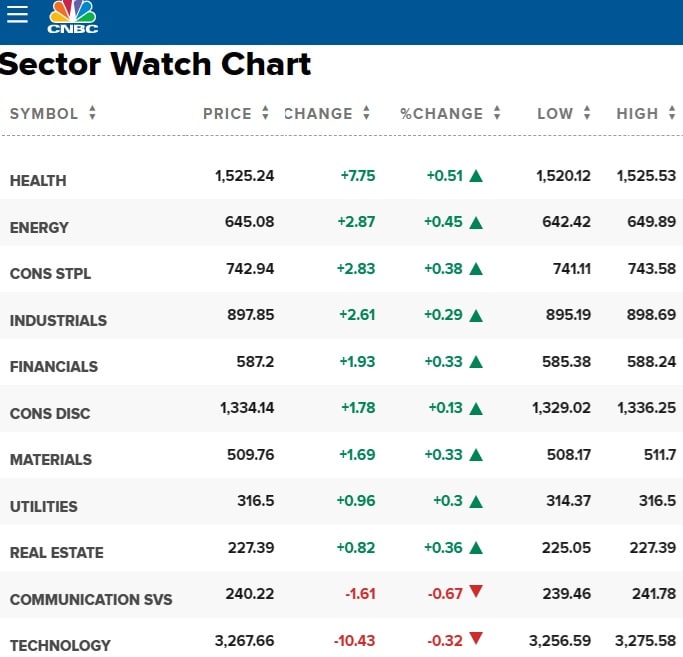

Speaking of S&P, the hottest sectors are health and consumer staples. Energy faded although some energy stocks held their own. Energy might take a while to recover.

Corporate Earnings: Enough to Keep Markets Rolling?

Corporate earnings have been driving the markets this year and the growth of the NASDAQ shows that US stocks could really get rolling as the Fed rate recedes. Looks like we’re already into the late-year rally. Small caps are taking a beating, and that might make the Russell 2000 the right index to be perusing if you’re looking at big gains over the next 3 years.

Small tech companies with good balance sheets should get through this period, and anti-trust, anti-monopoly charges against the tech FAANG monopolies should open up opportunities for those stocks ahead. And, we’re waiting for money to move from the bond market and bank accounts over to equities when the rate hike madness ends.

Before you find and buy stocks this week, make sure you brush up on the 3 month, 6 month, 5 year stock market outlook. and the 6 month economic outlook top. The post on the best stock market sectors and stocks with the best P/E ratios should be on your reading list too. That all fuses into the 2024 stock market forecast, and other stock market predictions.

Robert Haworth, senior investment strategy director at U.S. Bank Wealth Management, told Barron’s that “While stocks rose for the week, they’ll face bigger challenges in the week ahead. It’s been a really light data week. “Next week is much more important when it comes to inflation data and retail sales data.” — report on Barron’s.

Next week’s events from TradingView

Weekly forecast hunters are pursuing clues about the direction of the Dow Jones, S&P, and NASDAQ for specific stocks or ETF’s worth buying or those they should dump. I’d like to hear from you about which stocks you think are the most likely stocks that will jump next week and over the next 6 months.

Is a Weekly Stock Forecast Even Possible?

Day traders especially zero in on these temporal changes in stock values. They love that volatility if they can figure it out. For the last few weeks, there’s been a lot of uncertainty regarding the Fed stimulus package. With it’s passing into action, that volatility might ease and we could be back to the bull market run.

The NASDAQ, S&P, Russell, and Dow Jones are all looking positive right now, and the stock market forecast is looking much brighter as the FED pulls back on its injury of the US economy.

Stock Market 2024 | Best S&P Sectors | Tesla Stock Forecast 2024 | Stock Trading Platforms | AI Stock Forecast | Stock Trading | Reverse Mortgages | Low Mortgage Rates Today | Best Stocks to Buy | Stock Market Today | Stock Market Prediction | Stock Market Forecast | Stock Market News | US Housing Market Forecast 2024 | S&P 500 Forecast 2024 | Dow Jones Forecast 2024 | Best Oil Stocks | Stock Market Today | Travel Management Software

Please do Share this Post on Facebook and your blog!

* Note: This post on next week’s stock prices is for informational and entertainment purposes and should not be regarded as investment advice for any market transactions. Please consult with your stocks and financial advisor for investment decisions.