6 Month Forecast for the Economy

The outlook for the next six months for the stock market and the economy will require some patience as the FED attempts to dissipate the spending excess of the US government.

Inflation may not go away any time soon as demand from consumers persists and the job market stays strong against a backdrop of supply constraints and anti-development regulations dictated by the US government.

The next 6 to 12 months may be subdued as the full lagging effects of the rate hikes hits markets. Although the 6-month forecast may vary due to specific factors discussed below, the general consensus is for an economic slowdown. However, this doesn’t preclude a rally in the stock market which a few forecasters suggest should happen.

Tom Lee’s Market Forecast in the Face of a Downturn

![]() Tom Lee of Fundstrat says to expect a violent rally for year-end but doesn’t call it a bear market rally. Should investors take a much more cautious approach to their investments right now and avoid buying stocks? Or are the best bargains of the century are what will drive a bear market rally?

Tom Lee of Fundstrat says to expect a violent rally for year-end but doesn’t call it a bear market rally. Should investors take a much more cautious approach to their investments right now and avoid buying stocks? Or are the best bargains of the century are what will drive a bear market rally?

Lee seems certain the government shutdown won’t happen and that energy prices will fade. Is he right? Let’s see what the CB says about the next two quarters and Factset’s prediction of FY2024 economy.

Conference Board Forecast for US Economy

The Conference Board has produced their economic forecast for the next 6 months and they believe we’re in for a short shallow recession.

The factors they say will drive this downturn include:

- elevated inflation

- high interest rates

- dissipating consumer pandemic savings

- mounting consumer mortgage, credit card and other debt

- lower government spending

- resumption of mandatory student loan repayments

They didn’t cite international trade and supply issues, labor strikes, cost of energy, and quantitative tightening by the FED.

It’s not a positive outlook other than its short duration and that rates will ease to get the economy moving again in Q4 2024.

If rates ease in the summer of 2024, the stock market should lead the optimism and re-investment in America and end the soft landing recession. The return or onshoring of manufacturing and withdrawal of trade with communist China will bolster US stocks further making them the best investment going forward.

The current volatility in the markets should continue until at least spring 2024 and that provides opportunities to try swing trading strategies as stock rise up and down in a certain cadence.

The Conference Board expects the business investment in AI and transportation in the first quarter of 2023, will fade as the FED rate stays elevated. They believe the FED will raise the central bank by 25 basis points in November. With the most recent strong jobs report, there is a possibility of one more rate hike to end the current rate hike cycle.

Residential investment (construction starts) should bottom out in Q4. Government spending is expected to drop due to recent Federal bills passed and likely strong opposition from the GOP.

Conference Board Economic Forecast

The Conference Board expects progress over the coming 2 quarters, but the path will probably be bumpy. As we know commodity and stock markets are becoming slightly more volatile.

Housing prices, mortgages, and rent prices are signficant factors in the US inflation rate which stands at 3.7% is far above the FED’s 2% goal.

The CB believes rents will cool which they have as national rent growth has hit zero according to Zumper’s recent rent price report. Yet many cities still see strong rent growth.

CB sees year-over-year inflation readings to remain at about 3% at year-end 2023, and that the FED won’t achieve its 2% goal until the end.

Summer consumer expenditures were strong which means residential investment drops will be delayed for 3 months more. Their peak unemployment rate projection of 4.2% has shifted from Q2 2024 to Q3 2024.

The stats are highlighted by a rise in GDP, unemployment, and residential and nonresidential investment, which could mean outflows of funds from money markets to the stock market. This will likely spawn a significant jump in stock prices on the S&P 500, Dow Jones, and NASDAQ.

CB expects the Fed will lower rates to near 4% down from 4.75 currently and that labor supply will be constrained which could elevate wages.

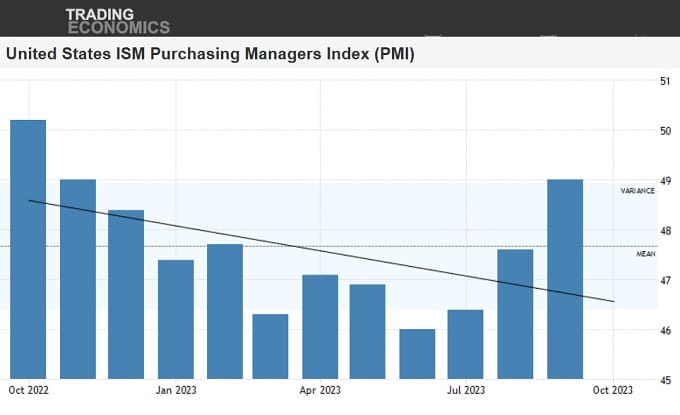

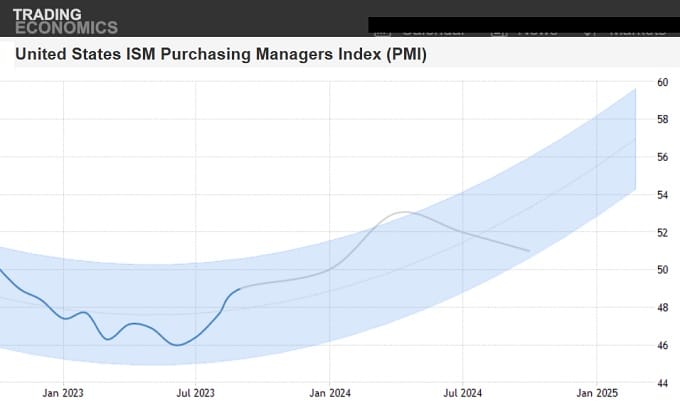

Forecast For US Manufacturing

Most forecasts see manufacturing growth, yet Trading Economics sees the uptrend ending with a fall in activity heading toward 2025. Government spending was cited for half of economic growth, so a reduction in government spending could deflate the economy, however this would cause a reduction in the FED rate later which would restart the economy.

A Focus on Government Spending

What’s notable about economic forecasts is how irrelevant technical data and historic events are as government spending, FED rate action and QT actions battle with an optimistic American consumer.

Oil price volatility too is driven by political decisioning not really supply and demand. Energy prices are a key factor in the economic outlook, however most oil experts believe oil prices will rise in the short term given strong consumer gasoline demand. The recent big drop will likely follow with a rebound back to $90 as winter driving increases consumption.

Strangely, they believe prices will fall thereafter. Current, persistent consumption strength suggests demand can surge when the economy returns in late 2024, thus driving oil prices, gasoline, diesel, and natural gas prices upward.

See more on oil stocks and natural gas stocks.

Labor strikes are an issue as workers demand cost of living increases and more in 2024. These shutdowns including the UAW strike and a government shutdown in November could lower GDP forecasts. This dependent entirely on the November deadline for government spending.

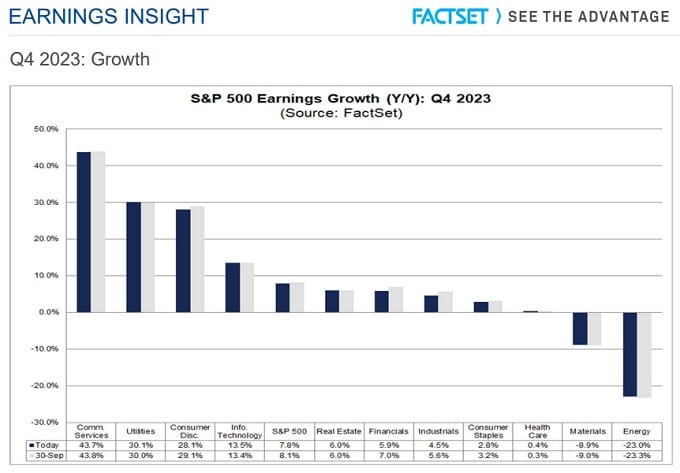

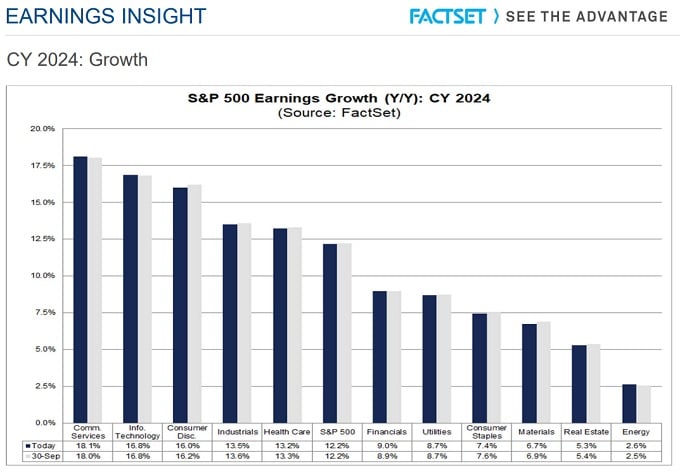

James Investment’s stock market analysts foresee a robust earnings growth of 8.3% in Q4 2023, with projected revenue growth of 3.9%. They see growth estimates for the 2024 calendar year hitting 12.2%.

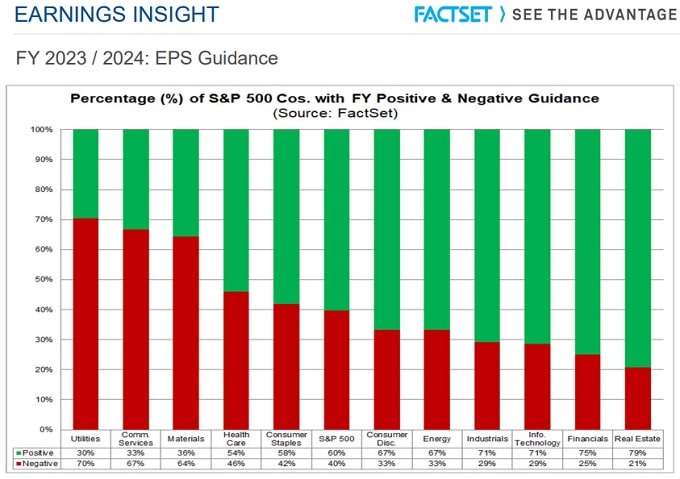

Factset Economic Forecast: Earnings Outlook

Factset sees earnings growth dissipating for the next 6 months.

Here’s how they see earnings for Q4 2023 by sector:

Accuracy of Economic Forecasts

Accurate forecasts for the economy depend a lot on politics, not really markets. The US government will determine whether there will be a shutdown, and what amount of spending will continue in 2024.

Markets left alone will always balance themselves out, but government manipulation leaves the markets like a house of cards. More economists will speak about the fragility and real risk in markets today given the US is spending, with less tax revenue and difficulty paying even the interest on the national debt.

Markets left alone will always balance themselves out, but government manipulation leaves the markets like a house of cards. More economists will speak about the fragility and real risk in markets today given the US is spending, with less tax revenue and difficulty paying even the interest on the national debt.

Expert economists and investment strategists, and even popular fund managers have to be looking at the possibility of something serious breaking and bringing the economy down. Certainly China, Iran and Russia will be watching this period of vulnerability closely to time their actions.

Hopefully, we’ll get through this volatility as everyone hopes and see a prosperous period for the US in 2024.

See more on the predictions for stocks over the next 6 months.

US Economic Forecast | Economic Optimism | 5 Year Stock Market Forecast | Best Stocks Now | China Slowdown | China Forecast | 2024 Recession | Economic Rebound | Google Finance | Yahoo Finance | Stock Quotes | Stock Market Forecast 2024 | Stock Market Rally | Stock Market Reversal | Stock Market News | Gasoline Price Forecast | Author Gord Collins