Are We Sliding into a Bear Market?

Stages of a Bear Stock Market

The exuberance of investors in the summer of 2023 might be waning.

The recent big drop in the Dow Jones, S&P and NASDAQ may not be just volatility. Investors are looking ahead to this winter with less confidence. Google searches for stock market crash and housing market crash are picking up.

For those who are blind to massive government spending, lagging effects of FED rate hikes, shrinking money supply, the nature of a bear market and bear market rallies might not be understood well. While fund managers are positive about the economy, others look at the US debt of $33 trillion and a looming government shutdown. It’s not hard to predict a bear market slide that plummet over the edge.

But with the big showdown over spending in November and persistent inflation, investors seem to know we’re into a change period here. Investors need to review the stages of a bear market to discover if it really is happening. Are you investing in stocks that are only going to trend lower?

$5 Trillion in money markets will be moving to equities markets, but not for a while.

Small Cap Stocks Not Respected

This year, the RUT has been on a wild ride, with steep prolonged ups and downs. This is a troubling volatility as the market is deeply concerned about small-cap valuations and earnings. The RUT actually describes the real economy better than the S&P mega caps. When the RUT moves, it means the 99% are moving.

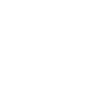

100 Day Moving Average for RUT

This chart from Barchart shows a steep downdraft similar to the Covid crisis, which was fixed with massive stimulus spending. This time, the spending may not be there to save the day.

Of late, the Russell2000 is on a continuous downward path from 2000 reached on July 31st to 1700 points today (-15%). Now that the FED rate hike is kicking in harder, its downpath for the next 3 months will be steeper.

Bear Market Turns into a Crash?

Of course, I’m not suggesting we’re in a recession, although some economists are saying we’re already in one. But this fall, for October, November, and December, the markets will drop further. That creates an amazing buying opportunity which will keep the stock market from dropping too far.

Still, investors like yourself are waiting for the true bottom.

A few stock market analysts are saying corporate earnings are good that GDP is rising, to over 3%. Others point to stocks being overvalued, and that all the growth was only in the megacaps where investors are parking their money for safety.

Some analysts say the bottom should be in the next two months, while others are forecasting a massive market rally by year end. For speculators and day traders, that sounds exciting.

Bellwether Stocks to Watch

5 Stocks are considered Bellwethers for the U.S. Economy:

- FedEx (bolstered by consumer spending)

- Alcoa (volatile in 2023 and now dropping)

- LVMH Moet Hennessey Louis Vuitton (down 25% in last 3 months)

- Caterpillar (strong via infrastructure spending)

- Wal-Mart (very strong via consumer spending)

So the matter comes down to consumers and infrastructure spending, which of course are causing inflation. Given the peril of the US economy, consumer confidence is unrealistic. It’s dropping now. The Conference Board’s Consumer Confidence Index fell again in September to 103 from a revised 108.7 in July.

APPL Stock Price

APPL is a key stock to watch and Apple is experiencing big troubles that may foretell what will happen in the entire marketplace and economy. The economic split with China should produce downward pressure until the US gets its manufacturing and supply chains established. Bringing back everything from communist China is a massive project. Of course, the outcome for the US from 2025 and beyond will nothing short of profound. The economy will boom.

Right now however, we may be in a bear market.

Experts believed the latest release of the impressive new iPhone would save the day, but it didn’t. The downtrend of APPL stock price is noteworthy as it falls from the summer’s peak price. Image courtesy of Google Finance.

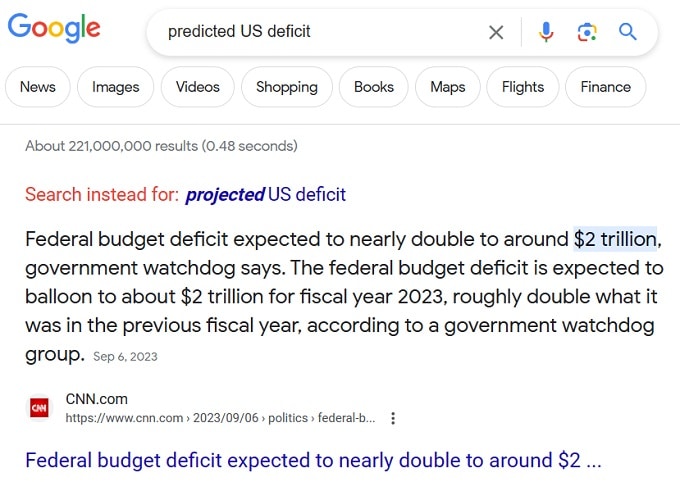

Government Spending Cuts Coming

In 6 weeks, the US government will have to agree on spending cuts. So we may not only see a government shutdown, but also a big fight over the massive spending bills the Democrats keep pushing. The Dems have not met the previous agreements on spending limits, so they have zero credibility about honoring their commitments and to reduce debt spending.

Everyone knows the battle of the spending bills is looming, and that the debt is $33 Trillion and growing ($2 Trillion this year) and Biden and the Dems might not be able to pay the interest on the debt. Their plan is simple: borrow more to fund the previous spend plus debt payments.

At some point, the house of cards is going to collapse. There has to be a natural market response to the $5 to $6 trillion dollar spend in 2020/2021/2022. Since Biden took office, the US national debt has risen $10 Trillion.

What is the Current Bear Market Catalyst?

In my stock market forecast, I predicted geopolitical forces (trade, conflict) could cause a recession and stock market crash. In a way, that has been progressing, but the real catalyst for this bear market coming is US domestic political factors. The volatility isn’t technical factors. It’s because this situation between the Repubs and Dems is weird and making everyone uncertaing and nervous.

The US economy and stock markets are ready to run with the bulls, but only if out-of-control spending ceases. That would result in lower interest rates and easier credit availability. Simple catalysts for a stock market boom.

Yet, we are in short-term bull market, that could potentially last 6 months if the debt spending continues. If the Republicans put their foot down on the Dems, then the bear market would be short-lived. Given the spending already underway, there won’t be a steep collapse but just enough to support a market revival and the coming movement of money from money markets into equities. That transfer is what will make you a millionaire if you pick the right basket of stocks.

The Dems approve of the FED rate hikes in order to draw money into the treasury to help pay for all the spending. So, they must keep rates high until the treasury gets its fill and is able to pay its massive debt, even as tax revenues fall. But can it ever get the situation under control and pay even the interest on the debt?

Tax revenues (how government gets its money) used to be the major balance sheet item, whereas today, it’s a minor note. The Dems print money, and that will have to stop soon. The debt crisis is very real even though the Dem media won’t say a word about it. The spending drop may be the bear market catalyst, although it’s all up to what the Republicans decide to do.

8 Stages of the Bear Market

Let’s look at the stages of a bear market. Note that the last surge of the Russell2000 could be seen as a bear market rally.

- Stage 1 – Pre-Crisis Optimism: This stage occurs before the bear market officially begins. Investors are generally optimistic, with stock prices at or near all-time highs. Economic indicators may start to show signs of weakness, but many investors remain confident in the market’s long-term prospects.

- Stage 2 – Early Decline: In this stage, stock prices begin to drop, often triggered by negative news, economic concerns, or corporate earnings disappointments. Initially, many investors may view the decline as a buying opportunity, and there may be brief rallies.

- Stage 3 – Denial and Hope: As the decline continues, some investors remain in denial, hoping that the downturn is temporary. They may dismiss negative news and expect a quick recovery. This stage can see short-lived rallies that give investors false hope.

- Stage 4 – Panic and Capitulation: In this stage, fear and panic take over. Stock prices experience sharp declines, and investors who were once hopeful now rush to sell their holdings to limit losses. This selling pressure can lead to a steep and rapid drop in market indices.

- Stage 5 – Despair and Depression: During this stage, investor sentiment reaches its lowest point. Pessimism prevails, and there is little faith in the market’s ability to rebound. Stock prices may continue to fall, but at a slower pace. Bargain hunters may begin to cautiously re-enter the market.

- Stage 6 – Gradual Recovery: In the early stages of a bear market recovery, stock prices may remain volatile, but they start to stabilize. Investor confidence slowly returns as economic conditions improve, and the worst of the downturn seems to be over.

- Stage 7 – Return to Optimism: As the recovery continues, optimism begins to replace pessimism. Investors become more confident, and stock prices steadily rise. Positive news and economic indicators contribute to this positive sentiment.

- Stage 8 – Bull Market: The bear market officially ends, and a new bull market begins. Stock prices experience sustained and substantial increases. Investor confidence is fully restored, and the cycle restarts.

Yes, the road in later 2024 could be paved with gold, but until then volatility and investor fears abound. There won’t be a stock market crash, but instead a downturn called the bear market will reign until the FED rate drops and business can return to normal.

Buying individual stocks is a risky play unless you’re looking at the 1 year to 5 year pay off. In the meantime, you’ll likely be looking at energy stocks, but they’re affected by gloomy news too.

Catch up on the current stock market forecast and the 3 month and 6 month forecasts for better insight.

Stock Market Predictions 2024 2025 2026 | Will the Stock Market Crash? | Will the Housing Market Crash? | Government Shutdown November | Stocks with Best P/E Ratios | Best S&P Sectors | Oil Stocks | Natural Gas Stocks | Travel Marketing | SaaS Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel | Travel Stock Market Today | Best Stocks to Buy | 6 Month Forecast | Housing Market 2024 | Google Finance | Author Gord Collins