Markets Staging a Rally?

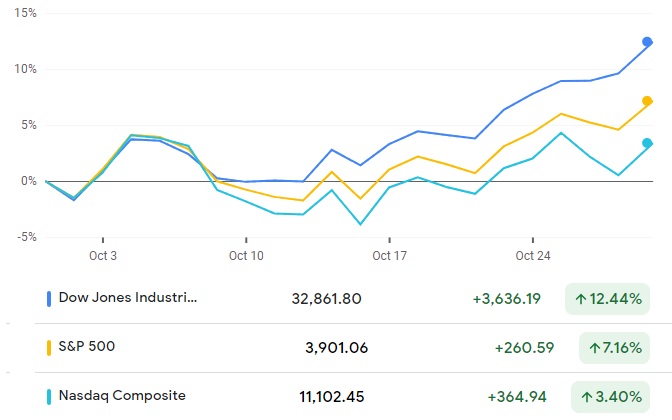

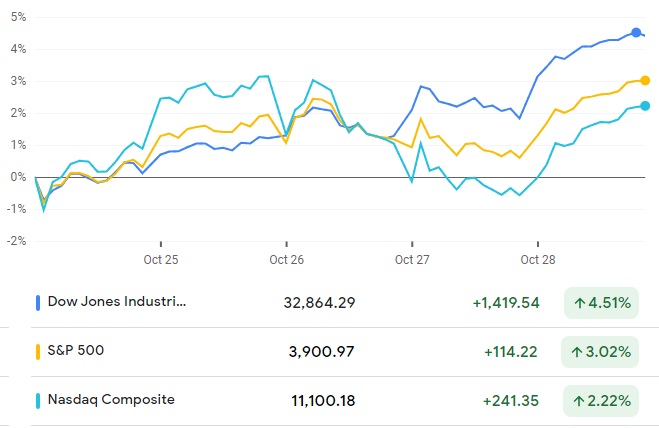

Is last week’s market rally a real trend in investor sentiment? What caused the rise this month and the jump this week?

Was it a technical correction, short covering, rising GDP report, or news regarding inflation rate in October so far (privileged data, not publicly available)?

This chart shows how strong October was. This coming week beginning October 31st., speculators will be guessing about one big event coming up in November. We had such a rally in the summer which was crushed by Fed rate hikes and stern announcements.

Yet inflation is so persistent, the Fed may believe rates may not be the right tool to knock down a mountain of economic potential. Everyone could be realizing, the only way out of this is to reduce regulations and let the US economy rip.

Do Recent Rallies Tell Investors Anything?

Were latest weekly and monthly rallies, this just normal volatility ahead of a further slide in the markets — a fool’s entry point, and a day trader’s paradise? Should you be buying or selling, or holding on and accept the long term downgrade in your 401k?

The rally could be due to experts saying inflation is easing, thus signalling to the Fed that it can slow down, but how could it? Inflation is still hot and oil prices could rise again and when will home foreclosures begin? It looks like fund managers and economists are desperate for a Fed pivot.

The BIG Event is Soon!

Yet there is one event that could send the economy roaring again, the stock market roaring, and prices on an upward trajectory. The Fed would counter with much bigger Fed rate hikes, and launch a battle in the investing community and with the political parties. It could get nasty in January.

The battle ground is US manufacturing and whether regulations and taxes would be dropped, thus allowing companies to pump out as much as they can — thus leading a big decline in consumer prices. Of course, some market deficiencies will be hard to ease — namely food, rents, and lending rates. Yet, a plunge in the price of oil is pivotal in reducing inflation where it is the key input in goods manufacturing, food production, transportation, travel, and more.

And last news wasn’t great and actually pushes investment value into negative territory. Some corporate earnings were down in the last quarter. CNBC’s Jim Cramer believes reports next week will be poor, allowing the Fed to do the big pivot everyone dreams of.

“This market’s trading like next week, we’ll see some real signs that the Fed’s winning its war on inflation, and they can, therefore, ease up on the rate hikes going forward… I wouldn’t be at all surprised if the market got it exactly right…You can’t get a reduction in wages until you see many people losing their jobs, and that’s what the Fed needs to see,” said Cramer in a report.

Bank of America believes No Rally is Forthcoming

Last week, Candace Browning, Head of Bank of America’ Global Securities Research unit forecasted that no rally is expected. Yet one has appeared last week. Twice it rose

She cited the pessimism of B of A survey respondents, that 83% expect profits to fall and 91% believe global earnings will not rise.

Of her department is focused on global stock markets and economic outlooks. The global outlook is much less optimistic than in the US.

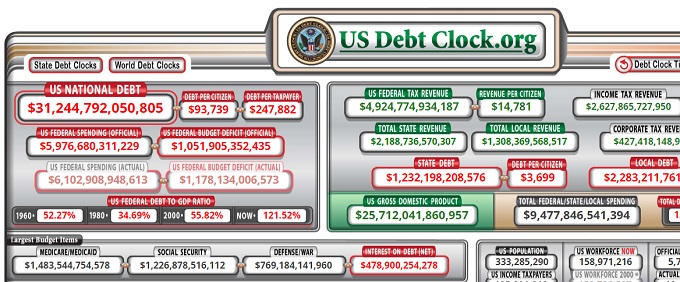

Money Supply is Enormous

We could say what whatever the US does economically creates the engine of change for the world. If the US continues to suppress its own financial system, GDP and economic health, it will send the world into a depression. And the US is deep in debt, and in a depression, may not be able to service that massive debt.

The fact is, the US debt interest payments are affected by current rates, and must be serviced via tax revenue which is about to take a dive. This debt interest payment is just one more factor that makes a deep recession very unwise.

As you know, the Biden admin printed trillions and pushed it into the economy creating a cash bubble that drove markets into a frenzy. That’s an indescribable amount of money that they plan to shrink in 2023. A B of A survey shows investors moved into cash and hold 6.3% in cash, the most since 2001. That’s a lot of buying power in the wings waiting for its moment.

Add high interest rates and it means we likely won’t see this bear market bottom until spring and it could be painful for the rest of 2023.

Last month’s GDP growth of 2.6% is astonishing to most. “I thought we were crashing into a recession?”

This week’s rally is also surprising.

The Forecast Heading into 2024

Still, the 3 month short term, 6 month mid term forecasts are a little gloomy with the effects of the fast rate hikes. Yet the 2024 and 5 year long term outlooks aren’t clear.

However, it seems these firms don’t collect human signals — such as the sentiment against a stock market crash and recession. Certainly, democrat media and research units don’t forward views contrary to their policies. Therefore, that data would remain unpublished for the AI units to collect and analyze. Their algorithms would be processing only politically tainted and skewed data.

I’ve learned that when some trend or force becomes too strong, it may flip flop to its exact opposite. That’s the human reaction formation response – from psychology. The threat in investor’s minds and the public, is the image of another painful recession of loss, waste, sadness and malaise. That might be too much to bear psychologically. Who wants to visualize the loss of their home which they’ve poured hard earned dollars into for the past 5 years. As homeower’s refinance at the new rate levels in 2023, they’re suffering great pain, with many not being able to pay the mortgage payments.

Isn’t that a greater threat than just a 30% loss in value within a stock portfolio?

Forecast 2024 | Dow Jones Forecast 2024 | Stocks with Best P/E Ratios | Best S&P Sectors | Dow Futures | S&P Outlook 2024 | NASDAQ Outlook 2024 | Stock Investing | Buy at Market Bottom | Best Stocks to Buy | Stock Market Today | Stock Market Forecast for 2024 | AI Stock Trading | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO