When will we see another Bull Run for the Stock Markets?

Now getting past the elections, we didn’t get the results we hoped for, but the win for GOP in taking the house should help to prevent the Dems from damaging the economy too heavily.

There is some hope they won’t be able to raise interest rates too much higher and that when it’s certaint the rate hikes will stop, investors will jump back into the equity markets.

They don’t need to see big earnings or sales reports, just the knowledge that the has hit bottom and that there will be upward momentum for the next 5 years.

As I mentioned in a previous post, we don’t need a recession. What remains of the $7 trillion in pandemic spending can be dissipated via increased supply of energy, goods and services. This would lower consumer prices and support strong job growth.

Is this what the stock market will look like in the 8 months ahead? Likely not, since January, February and March will be bleak. Yet, Q3 of 2023 might bring a glimmer of hope.

Yes the Fed is pushing for more unemployment and higher financing costs, yet when unemployment rises, the post pandemic voter is likely to turn on the government viciously. A lot of people got hurt during 2022/21 and to suffer again will be too much.

Democrat Media Very Quiet

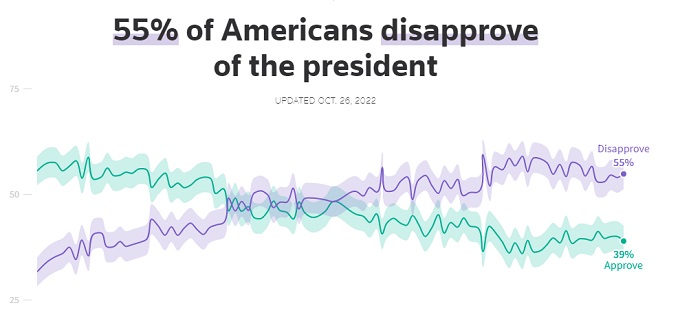

The Democrat media isn’t mentioning the mid-terms and Joe Biden has been instructed to keep quiet right up to and including election night on the 8th. Biden has one of the worst ratings of any American President.

CNN just announced big layoffs and their profits are plummeting. Their support for the Dems may weaken slight as it will for all the other Dem channels.

Undoing the Damage?

Larry Kudlow, former US national economic council director is of the belief that the Republicans can lower taxes, open up energy supplies and pipelines, prevent bad spending and much more if elected. We might get to test his theory soon.

What would that do for the Dow Jones, S&P and NASDAQ? The Dow took a big leap up today while the S&P lagged on the news of higher GDP. Of course they expect interest rates will rise which will hurt the tech tech sector. And a Republican win could foretell dire consequences for the tech sector, particularly, Google, Facebook, and Amazon who were reportedly funding the Democrats and suppressing conservative voices on the Internet.

However, what Republicans could do depends on how much actual power they’ll have. Can they undo the damage the Democrats have done with this artificial recession and record breaking interest rate rises? Is there enough stimulus cash in the economy to keep it rolling into 2024? How can Republicans power up growth?

Biden can and likely will Veto any legislation the Republicans attempt to pass in 2023. This struggle of power would negate each other’s political efforts so that not much can get done. That would have to create a drag on the economy and flatten the stock market.

However, just the fact the Republicans can block destructive legislation brought in by Biden and the Democrats could sit very well with investors, corporations and small business alike. Just not raising taxes is a big incentive.

Markets Heading Upward, along with Interest Rates

After the recent GDP report, up 2.6%, its obvious the Fed will not pivot on rate hikes for 3 more months and will push rates up to a more painful level.

Instead, Americans can see that rising rates won’t fix the economic problems. Increasing supply and competition is the route to go. The oil taps must be opened wide and all distribution channels need to be opened up full tilt. The added supply of oil and natural gas would cause prices to fall, thus ridding the economy of a cause of inflation (and reason for rising interest rates).

The fact is, after a tough Covid pandemic, people aren’t emotionally strong enough for a recession. It’s bad timing for the Democrats who grasping at minor election issues as if they can save them. Of course, they will throw a hail mary pass in the final days before the election, without success.

The fact is, jobs, crime, the economy, inflation, rent prices, home prices, gasoline prices are key issues for voters. Climate, abortion, immigration, national debt, gun control, education costs, and health care are not as important currently.

Independent voters make a small portion of the electorate; however it looks like they will swing Republican. Polls show Americans are hurting and unable to pay rent, food, heating costs and transportation. Republicans are focusing on that increasing pain which is smart strategy.

Inflation is the key issue and voters don’t like that they’ll have to pay with their jobs and likely lose their homes at some point. It takes a lot of hard-earned dollars to buy a home, and to lose it for the sake of a party ideology, likely doesn’t sit well with some new homeowners.

If Elected, the Republicans likely will:

- open up domestic sources of energy to become energy independent

- stop further climate fear-based legislation that makes manufacturing in the US unfair against China competition

- resume and finish the southern Border wall to secure the border

- restart the remain in Mexico border policy

- put spending caps on further public spending by Biden

- end Woke policies to control kids and reduce parental rights

- hire more police to reduce crime

- impeach Joe Biden

- investigate monopolies and big media bias

- work to reduce taxes not raise them

For Investors, What is the Upside?

With Republican influence, we could see:

- energy supply increases to reduce gasoline prices, heating bills, and transportation costs

- a pro-business agenda that puts the US back into productivity phase

- more support for American companies and made in America production policies

- will lower Federal income taxes

- US dollar will fall making American exports cheap and imports more expensive

- lead to more people going back to work

- increase jobs and wages thus increasing GDP and consumer spending

- inflation will rise for a while, then fall

- decrease dependence on China and OPEC+

These actions would support corporate earnings thus the S&P forecast, Dow Jones forecast and NASDAQ forecast would all be much more positive, setting up another 5 year bull market run.

If the markets have fallen 20% to 30% in the past 10 months, then it seems they might reverse and climb 25% into 2023. That forecast is based on the fact that investors look ahead to the future value of stocks.

I’m all for turning the economy around and opening up opportunities for American companies. We don’t know how this will play out now, but by January when the Republican’s take over, we’ll have a good idea of what power they’ll possess.

Stock Market Forecast for 2024 | 2024 Outlook for US Equities | Stock Market Next Week | Stock Market News Today | Market Rally | Dow Jones Forecast | Dow Futures | S&P Outlook | NASDAQ Outlook | Stock Investing | Buy at Market Bottom | Best Stocks to Buy | Stock Market Today | Software as a Service Marketing | Bleisure Travel Marketing | Travel Management Software | SaaS Marketing | Travel Marketing | Business Travel Marketing | Travel SEO