Best Cities to Buy Real Estate in 2024

Looking for the right cities to buy real estate in 2024?

You’ve probably got your favorites in mind, but why not start again from scratch and find cities and towns that you might not have known are real gems? In this phase of your research why not open your imagination wide, so you actually find cities that are investible, that other investors may have missed?

You’re competing with millions of homebuyers and investors in 2024. With more properties expected to be put up for sale all across the country next year, you might need to be extra curious and thorough in your research. In this post we create a collection of cities where the odds are best for affordable prices, best price appreciation prospects and rental income if you’re buying as a rental property wealth generator.

Given mortgage rates are headed back to 6% and real estate is in severely short supply, your next property is as good as any investment you could make. Let’s get right to the task of finding the right cities, perhaps with the lowest prices and those with fixer-upper potential too in this new post-inflation era economy.

Major Cities with Excellent Potential

These major cities are looking strong for the years ahead, especially those with low tax burdens which are pro-business.

Businesses are willing to relocate to these cities and states and with growing workforces, profitable business, and commitments to infrastructure, they might be your best bets as an investment. Currently, some of these cities have seen an exodus and dropping sales prices, as the econony cools and corporations are forcing employees back to the major cities.

And as the economy picks up, home prices in the major metros will soar higher than ever, leading to another exodus to remote work from home cities. Employers will be stressed by rising wages driven by high real estate and rent prices.

- Austin, Texas: Known for its tech industry growth, vibrant culture, and increasing population.

- Raleigh-Durham, North Carolina: Boasts a strong job market, especially in the technology and research sectors, coupled with a high quality of life.

- Nashville, Tennessee: Offers a combination of a growing job market, cultural appeal, and relatively affordable housing.

- Boise, Idaho: Has seen significant population growth and offers a good balance of affordability and quality of life.

- Phoenix, Arizona: Attracts a steady influx of residents due to its climate, job opportunities, and relatively lower cost of living.

- Tampa, Florida: Known for its favorable tax laws, growing job market, and appeal to retirees and job seekers alike.

- Atlanta, Georgia: A hub for business and culture with a diverse and growing population.

- Salt Lake City, Utah: Offers a strong job market, especially in tech, and is surrounded by natural beauty.

- Charlotte, North Carolina: Has a robust financial sector and is experiencing rapid growth and urban development.

- Denver, Colorado: Known for its lifestyle appeal, strong economy, and population growth.

Hard to beat some of the best large cities for buying real estate, but smaller markets offer lifestyle advantages, safety, children children-friendly environments where the whole family is safer from big city violence, crime and strife. It’s not always about jobs and income.

Real Estate Markets under 100,000 Population

Smaller have a unique capacity for good living, while still offering most of the amenities of large cities (Population Under 100,000)

- Bend, Oregon: Known for its outdoor recreation opportunities and a growing tech sector. It’s a popular spot for both retirees and young professionals.

- Carmel, Indiana: Offers a high quality of life with excellent schools and a strong local economy. It’s close to Indianapolis, providing access to larger city amenities.

- Ann Arbor, Michigan: Home to the University of Michigan, which drives the local economy and creates a steady rental market.

- Asheville, North Carolina: Attracts tourists and new residents alike with its vibrant arts scene and beautiful mountain setting.

- Sarasota, Florida: Known for its cultural amenities, beaches, and appeal to retirees, it has a strong real estate market.

Santa Fe, New Mexico: Offers a unique cultural experience with a thriving arts scene, appealing to a diverse group of buyers. - Rochester, Minnesota: Home to the Mayo Clinic, which provides a stable job market and attracts residents from all over the world.

- Charlottesville, Virginia: A historic city with a strong educational foundation due to the University of Virginia and a growing tech sector.

- Boulder, Colorado: Known for its outdoor lifestyle, tech industry, and educational institutions, it’s a sought-after location for various demographics.

- Fargo, North Dakota: Has a growing economy, especially in the healthcare and tech sectors, and offers a high quality of life with a small-town feel.

- Hilton Head Island, South Carolina: Popular for its beaches and golf courses, it’s a prime location for vacation homes and retirement living.

- College Station, Texas: Driven by Texas A&M University, it has a strong rental market and is seeing steady growth.

Ithaca, New York: Home to Cornell University and Ithaca College, creating a strong rental market and a vibrant community. - Plymouth, Minnesota: Offers a high quality of life with good schools and a strong job market, being close to Minneapolis.

- Prescott, Arizona: Known for its historic charm and appeal to retirees, offering a mild climate and a variety of outdoor activities.

Buying Property in Small Towns of Less Than 30,000 Population

Small towns and villages are very popular but with limited housing available. Today, small towns sitll offer shopping, amenities, schools and social opportunities that give them an edge in the real estate market. Homes in these communities are highly cherished by young families looking for a great environment to raise their kids and for more rewarding social connections for healthy, happy living.

Try this array of charming towns with a history for compelling living and more affordability.

- Leavenworth, Washington: Known for its Bavarian-style architecture and vibrant festivals. It’s a great place for those who love outdoor activities and a strong sense of community.

- Taos, New Mexico: Famous for its artistic community, Pueblo architecture, and beautiful desert landscape. Ideal for those seeking cultural richness and inspiration.

- Stowe, Vermont: A picturesque ski town offering year-round outdoor activities and a quaint, New England charm.

- Carmel-by-the-Sea, California: Known for its stunning coastline, artistic community, and fairy-tale cottages. It’s a peaceful retreat for those looking for a blend of art and nature.

- Beaufort, South Carolina: Offers a historic downtown, beautiful antebellum architecture, and a coastal lifestyle.

- Eureka Springs, Arkansas: A Victorian town in the Ozark Mountains, known for its arts, culture, and natural springs.

- Lititz, Pennsylvania: Has a rich history, unique shops, and a small-town feel, making it ideal for families and history enthusiasts.

- Hood River, Oregon: A haven for outdoor enthusiasts, with strong windsurfing and kiteboarding scenes, set amidst beautiful scenery.

- Telluride, Colorado: Renowned for its ski slopes and film festivals, it’s perfect for those seeking an active lifestyle and mountain beauty.

- Franklin, Tennessee: Offers a blend of Southern charm and history, with a vibrant music scene and a strong sense of community.

- Mackinac Island, Michigan: Known for its car-free streets and historic charm, it’s like stepping back in time.

- Breckenridge, Colorado: A historic mining town with world-class skiing and a lively downtown area.

- Decorah, Iowa: Offers a strong Norwegian heritage, beautiful parks, and a famous Nordic Fest.

- Port Townsend, Washington: A maritime town with Victorian architecture and a vibrant arts scene.

- Bisbee, Arizona: A former mining town turned artist haven, known for its colorful houses and unique history.

- Woodstock, Vermont: Epitomizes New England charm with its historic homes and covered bridges.

- Dahlonega, Georgia: Rich in gold mining history and nestled in the North Georgia mountains, offering a quaint downtown and scenic beauty.

- Galena, Illinois: Known for its well-preserved 19th-century buildings and main street, ideal for history buffs.

- Jim Thorpe, Pennsylvania: Often called the “Switzerland of America” for its picturesque setting and rich history.

- Crested Butte, Colorado: A mountain town with stunning landscapes, known for wildflower displays, skiing, and mountain biking.

And if the economy does recover in 2024, Texas and Florida will likely see return of brisk buying and inmigration.

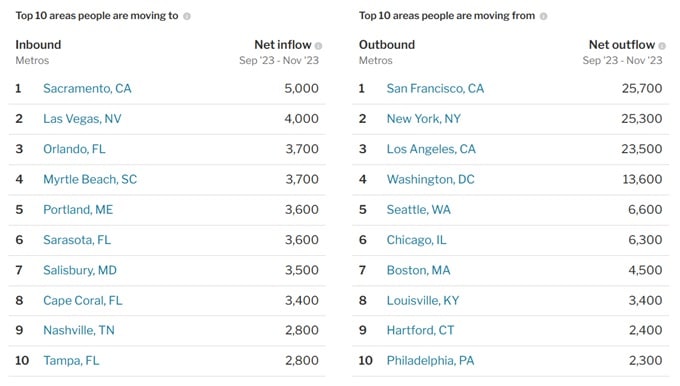

American Migration Trends: Top Cities

Which Cities/Towns Have the Qualities You Seek?

The matter of price vs rental yields, employment growth, taxes, vacancy rates are key signals that will color estimates of value in cities and states both. For homebuyers who want to reside in a particular city, of course prices, taxes, crime rates, school quality, good neighborhoods, and strong employment levels as most important.

17 Things Features To Evaluate in the Best City to Buy Income Real Estate:

- lowest vacancy rate

- rising working-age population

- rising developments

- lowest price-to-rent ratios

- rising number of millennials or baby boomer retirees

- growing economy

- good metro GDP

- lots of US-based companies

- local restrictions on new construction

- located in the heartland or south region

- lower purchase prices

- lower property taxes

- lowest state income taxes

- better ratings for schools

- lifestyle rating

- lower crime rating

- lower pollution and quick commutes

Which cities and states offer the best employment outlook, lowest taxes, fewest regulations, large millennial population, and a pro-business climate? Texas might be first in line, especially as the price of oil has climbed back up to $35 a barrel.

Which State is Most Attractive?

The climate, cost of doing business, state business incentives, presence of labor, and tax costs in each state comes into the calculation. Georgia, Texas, and Michigan would definitely rise to the front of the line. However, cities in North Carolina, Idaho, Texas, Florida, Illinois, Pennsylvania, Colorado, Miami Florida, Boston, Massachusetts, and Ohio also offer potential savings for New York and California companies who are looking to relocate.

Milken Institute’s look at the Best Cities

Milken Institute conducts an investigation of the best big and small towns to consider. This year’s ranking takes these factors into consideration:

- Job growth

- Wage growth

- Short-term job growth

- High-tech GDP growth

- High-tech GDP concentration

- Number of high-tech industries

Yet Milken didn’t appear to take into account the non-employment factors in relocation — namely remote work. Even as subways, airlines, trains, buses gear up for the long daily commutes, we may turning more to a more commute free trend where pollution and time waste must be reduced.

At the same time, many corporations are pushing employees hard to return to headquarters to work in person. This has affected migration in the country. The best cities are situated in states with lower population density offering lower taxes and either lifestyle or employment/career advantages.

Here’s Milken Institute’s 2023 selection of best cities:

- Provo-Orem, Utah

- Austin-Round Rock, Texas

- Raleigh, NC

- Nashville-Davidson-Murphreesburg-Franklin, TN

- Boise City, ID

- Dallas-Plano-Irving, TX

- Wilmington, NC

- Phoenix-Mesa-Scottsdale, AZ

- Fayetteville-Springdale-Rogers, AR

- Palm Bay-Melbourne-Titusville, Florida

And Milken chooses their top 10 Small Cities:

- Idaho Falls, Idaho

- Logan, Utah-Idaho

- St. George, Utah

- The Villages, Florida

- Bend-Redmond, Washington

- Punta Gorda, Florida

- Coeur d’Alene, Idaho

- Missoula, Montana

- Sioux Falls, South Dakota

- Gainesville, Georgia

- Prescott, AZ

- Bloomington, Indiana

- Wenatchee, Washington

- Burlington, North Carolina

- Twin Falls, Idaho

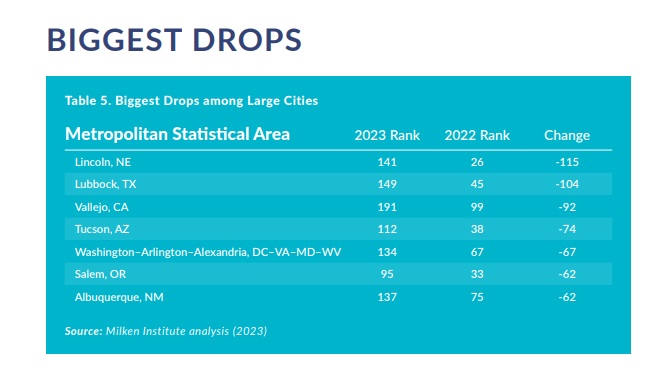

Cities that Are Rated as Declining:

Source: Milken Institute (2023 report)

Wallethub: Best Places to Buy a House

Wallethub the mortgage rate website offers an extensive look at America’s best cities in 2023 from many perspectives. Their calculations focus mainly on quality of life which is after, very important.

However, there is little pertaining to buying homes and rental property nor which will be the best cities in 2024. A few more columns for taxes, income, economic growth, and price-to-rent ratios would be nice.

Best Small Cities to Live in America

| City | Total Score | Affordability | Economic Health | Education & Health | Quality of Life | Safety | |

|---|---|---|---|---|---|---|---|

| Lancaster, PA | 71.04 | 800 | 215 | 659 | 10 | 59 | |

| Carmel, IN | 70.91 | 30 | 36 | 197 | 273 | 27 | |

| Fair Lawn, NJ | 70.59 | 136 | 130 | 29 | 888 | 29 | |

| Lexington, MA | 70.58 | 405 | 68 | 4 | 208 | 7 | |

| Brentwood, TN | 70.57 | 34 | 74 | 169 | 340 | 97 | |

| Melrose, MA | 70.42 | 413 | 78 | 10 | 715 | 22 | |

| Zionsville, IN | 69.9 | 3 | 145 | 177 | 836 | 103 | |

| Needham, MA | 69.88 | 161 | 165 | 20 | 537 | 26 | |

| Portland, ME | 69.82 | 1056 | 454 | 58 | 13 | 380 | |

| Westfield, IN | 69.8 | 41 | 128 | 236 | 822 | 37 | |

| Milton, MA | 69.72 | 140 | 427 | 27 | 674 | 12 | |

| Sammamish, WA | 69.7 | 183 | 89 | 75 | 1164 | 30 | |

| Dublin, OH | 69.31 | 10 | 92 | 719 | 189 | 131 | |

| Brookfield, WI | 69.23 | 91 | 224 | 70 | 294 | 270 | |

| Leawood, KS | 69.06 | 6 | 81 | 105 | 851 | 194 | |

| Apex, NC | 68.93 | 38 | 20 | 206 | 586 | 164 | |

| Arlington, MA | 68.92 | 750 | 352 | 8 | 222 | 8 | |

| Burlington, MA | 68.85 | 367 | 27 | 11 | 488 | 85 | |

| Newton, MA | 68.83 | 680 | 150 | 7 | 338 | 14 | |

| Princeton, NJ | 68.71 | 596 | 114 | 255 | 84 | 60 | |

| Redmond, WA | 68.71 | 604 | 9 | 81 | 113 | 374 | |

| Randolph, MA | 68.58 | 696 | 456 | 53 | 1156 | 275 | |

| Ridgewood, NJ | 68.56 | 262 | 66 | 24 | 947 | 15 | |

| Leesburg, VA | 68.53 | 211 | 334 | 39 | 185 | 181 | |

| Saratoga Springs, NY | 68.46 | 751 | 119 | 101 | 51 | 376 | |

| Fishers, IN | 68.42 | 25 | 305 | 198 | 618 | 35 | |

| Castle Rock, CO | 68.38 | 103 | 167 | 48 | 451 | 185 | |

| Wake Forest, NC | 68.36 | 68 | 13 | 260 | 501 | 286 | |

| Medford, MA | 68.35 | 888 | 23 | 16 | 437 | 80 | |

| Reading, MA | 68.33 | 171 | 654 | 6 | 1088 | 9 |

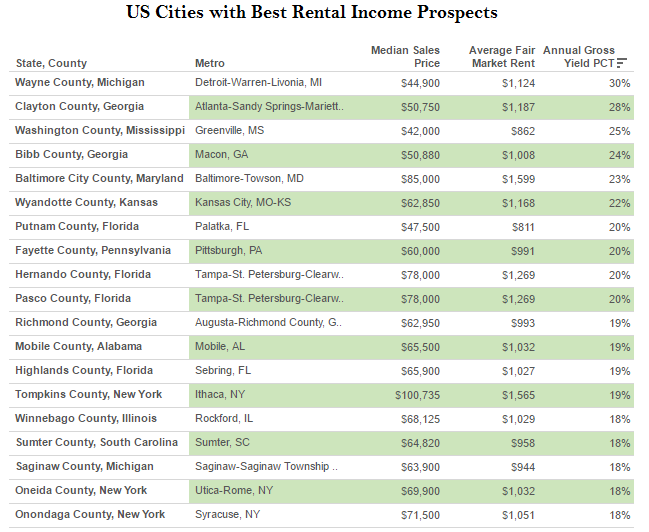

Best Cities for Rental Income Property

For rental property investment buyers, the rules that govern the best places to buy are similar as with young home buyers — employment stability, jobs outlook, migration trends, state GDP, city economic outlook, and house prices. For landlords, cap rates, price-to-rent ratios, rent price trends, and projected maintenance costs come into the picture.

Cities where it’s Better to Buy than Rent

This buy/rent difference stat is important for those want to wait to rent, and for investors who might want to avoid cities where it’s cheaper to buy.

Top 80 Cities and their Potential for Passive Rental Income ROI

These converted stats in this chart from Smart Assets are very insightful. They used U.S. Census data, to calculate the price-to-rent ratio in every U.S. city with a population over 250,000.

This is their list of 80 US cities below with the worst potential for rental property income investment appearing at the top (The ones at bottom such as Detroit have better potential, unless employment fails to recover in Michigan).

| US Cities with Population above 250k | Price-to-Rent Ratio |

Home Price (for a $1,000 Rental) |

|

| 1 | San Francisco, California | 45.9 | 551000 |

| 2 | Honolulu, Hawaii | 40.1 | 481000 |

| 3 | Oakland, California | 38.5 | 462000 |

| 4 | Los Angeles, California | 38.0 | 456000 |

| 5 | New York, New York | 35.7 | 428000 |

| 6 | Seattle, Washington | 35.1 | 421000 |

| 7 | San Jose, California | 34.7 | 417000 |

| 8 | Long Beach, California | 34.6 | 415000 |

| 9 | Washington, District of Columbia | 32.0 | 384000 |

| 10 | Anaheim, California | 31.3 | 375000 |

| 11 | San Diego, California | 30.3 | 363000 |

| 12 | Portland, Oregon | 29.3 | 351000 |

| 13 | Boston, Massachusetts | 28.7 | 344000 |

| 14 | Jersey City, New Jersey | 26.3 | 316000 |

| 15 | Denver, Colorado | 26.0 | 312000 |

| 16 | Chula Vista, California | 25.8 | 310000 |

| 17 | Santa Ana, California | 25.3 | 303000 |

| 18 | Sacramento, California | 24.3 | 291000 |

| 19 | Miami, Florida | 23.4 | 280000 |

| 20 | Austin, Texas | 23.4 | 280000 |

| 21 | Atlanta, Georgia | 23.0 | 276000 |

| 22 | Colorado Springs, Colorado | 22.8 | 274000 |

| 23 | Bakersfield, California | 22.5 | 270000 |

| 24 | Raleigh, North Carolina | 22.4 | 269000 |

| 25 | Riverside, California | 22.4 | 268000 |

| 26 | Lexington, Kentucky | 22.0 | 264000 |

| 27 | Albuquerque, New Mexico | 21.9 | 263000 |

| 28 | Chicago, Illinois | 21.6 | 259000 |

| 29 | Henderson, Nevada | 21.6 | 259000 |

| 30 | Chandler, Arizona | 21.5 | 257000 |

| 31 | New Orleans, Louisiana | 21.4 | 256000 |

| 32 | Virginia Beach, Virginia | 21.1 | 253000 |

| 33 | Fresno, California | 21.0 | 252000 |

| 34 | Newark, New Jersey | 21.0 | 251000 |

| 35 | Minneapolis, Minnesota | 21.0 | 252000 |

| 36 | Anchorage, Alaska | 20.9 | 251000 |

| 37 | Phoenix, Arizona | 20.3 | 244000 |

| 38 | Louisville, Kentucky | 20.1 | 241000 |

| 39 | St. Paul, Minnesota | 20.0 | 239000 |

| 40 | Plano, Texas | 19.9 | 239000 |

| 41 | Stockton, California | 19.5 | 234000 |

| 42 | Durham, North Carolina | 19.5 | 233000 |

| 43 | Las Vegas, Nevada | 19.3 | 232000 |

| 44 | Nashville, Tennessee | 19.1 | 230000 |

| 45 | Greensboro, North Carolina | 19.1 | 229000 |

| 46 | Mesa, Arizona | 19.1 | 229000 |

| 47 | Lincoln, Nebraska | 19.1 | 229000 |

| 48 | Oklahoma City, Oklahoma | 19.1 | 229000 |

| 49 | Wichita, Kansas | 18.4 | 221000 |

| 50 | Charlotte, North Carolina | 18.1 | 217000 |

| 51 | Cincinnati, Ohio | 18.0 | 216000 |

| 52 | Aurora, Colorado | 18.0 | 216000 |

| 53 | Kansas City, Missouri | 17.4 | 209000 |

| 54 | Tulsa, Oklahoma | 17.2 | 206000 |

| 55 | Omaha, Nebraska | 16.7 | 200000 |

| 56 | St. Louis, Missouri | 16.7 | 200000 |

| 57 | Orlando, Florida | 16.6 | 199000 |

| 58 | Tampa, Florida | 16.6 | 199000 |

| 59 | Tucson, Arizona | 16.3 | 196000 |

| 60 | Philadelphia, Pennsylvania | 16.3 | 196000 |

| 61 | Dallas, Texas | 16.2 | 194000 |

| 62 | Laredo, Texas | 15.9 | 191000 |

| 63 | Columbus, Ohio | 15.9 | 190000 |

| 64 | St. Petersburg, Florida | 15.8 | 189000 |

| 65 | Fort Wayne, Indiana | 15.5 | 186000 |

| 66 | Baltimore, Maryland | 15.5 | 186000 |

| 67 | Arlington, Texas | 15.5 | 186000 |

| 68 | El Paso, Texas | 15.4 | 185000 |

| 69 | Indianapolis, Indiana | 15.4 | 184000 |

| 70 | Houston, Texas | 15.3 | 183000 |

| 71 | Fort Worth, Texas | 14.8 | 177000 |

| 72 | Jacksonville, Florida | 14.3 | 172000 |

| 73 | Milwaukee, Wisconsin | 14.2 | 170000 |

| 74 | San Antonio, Texas | 13.7 | 164000 |

| 75 | Toledo, Ohio | 13.3 | 159000 |

| 76 | Corpus Christi, Texas | 13.1 | 158000 |

| 77 | Memphis, Tennessee | 12.3 | 147000 |

| 78 | Pittsburgh, Pennsylvania | 12.0 | 144000 |

| 79 | Buffalo, New York | 10.7 | 128000 |

| 80 | Cleveland, Ohio | 10.5 | 126000 |

| 81 | Detroit, Michigan | 6.3 | 75000 |

There are so many real estate investment opportunities in the US and in Canada too. Hopefully, my amateur US housing forecasts, predictions and unguaranteed advice will help you find those opportunities for the best upside in cash flow, safety and equity appreciation. Be careful with any investment. Do your due diligence.

Cities with the Lowest Prices | Lowest Mortgage Rates | Real Estate Market 2025 | 5 Year Stock Forecast | Florida Real Estate | Boston Real Estate | Los Angeles Real Estate | California Housing Market | Forecast for Housing Market | Housing Market News | Los Angeles Housing Market | Real Estate Marketing for Los Angeles Agents | Real Estate Marketing Packages