Google Finance: A Great Investment Tool

Google Finance is a great place to see real time stock prices, conduct thorough research, and gain insight into stock portfolio performance to help you build better investment strategies.

In this post, we take a closer look at why Google Finance should be an active and quick reference tool to keep you up to the minute on stock price activity. You can set Google alerts too to keep you up on news alerts about stocks you’re interested in.

A large number of finance sites compete for investor’s eyes online and Google Finance is one of them. Commonly compared to Yahoo Finance, investors ask whether these are accurate sources. Google Finance lacks some of the depth of Yahoo Finance, hower still provides some basic investment and portfolio reporting tools you might like (or for young investors) and it’s Free!

The site owned by Google (Alphabet) competes with sites such as Yahoo Finance, Barchart, Fool, TheStreet, Investors, TradingView, Barrons, Investing.com, and many more investing information portals.

What You Can Do on Google Finance

Users can check stock prices and news, read basic company financials, and keep tabs on their own portfolio, however it offers no live stock trading platform. And they’re able to download financial data about stocks, bonds, mutual funds, indexes, currency, and cryptocurrency exchange rates onto Google Sheets. Is Google Finance a credible financial information source? It draws its financial data from exchanges in the U.S. and international sources along with content providers such as S&P Capital IQ (street.com).

Still, it is a handy website for retail self-directed investors with its real-time quotes and price charts. Google Finace doesn’t try to sell you anything or skew things to sell something, so it respects your time and interests. It is a simple and easy-to-read finance and investing portal without the clutter and distraction experienced on Yahoo Finance and other more sophisticated portals. See more on the Yahoo Finance vs Google Finance comparison post.

What Is Google Finance?

Google Finance is a web-based finance/investing information and reporting platform developed by Google. It offers a selection of financial information and tools to help users track and analyze market data, stocks, currencies, bonds, commodities and more. Users enjoy real-time stock quotes, interactive charts, business news, financial statements, and other significant information investors need to make decisions to buy stocks. You can manage your investment portfolio and view your stock’s performance. It’s a convenient tool for the casual investor and for teaching kids about stocks and investing.

8 Key Features of Google Finance:

- Stock Quotes and Charts: Google Finance provides real-time stock quotes, charts, and financial news for individual stocks. Investors can track the performance of specific companies over different time frames, analyze historical data, and identify trends.

- Market News: The platform aggregates financial news from various sources, helping investors stay informed about market trends, company announcements, and other relevant events that could impact financial markets.

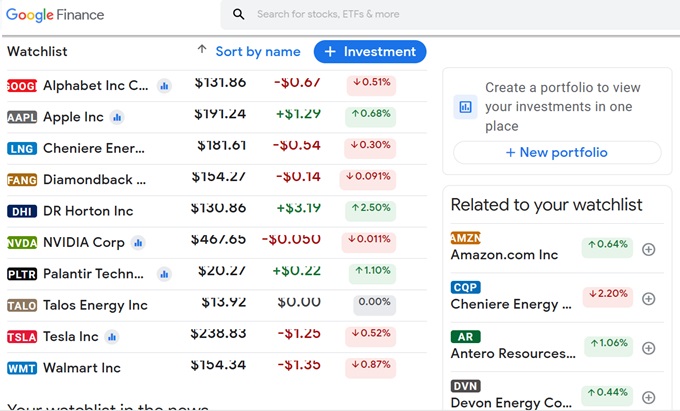

- Portfolio Tracking: Users can create and track their investment portfolios by adding stocks, mutual funds, and other financial instruments. Google Finance provides tools to monitor the overall performance of the portfolio and individual holdings.

- Financial Statements: Detailed financial information, including income statements, balance sheets, and cash flow statements, is available for many publicly traded companies. This data can be valuable for fundamental analysis and assessing the financial health of a company.

- Economic Indicators: Google Finance offers information on economic indicators, such as unemployment rates, GDP growth, and inflation. These indicators can provide context for broader economic trends that may impact investment decisions.

- Sector Performance: Users can explore how different sectors are performing in the market. This can be useful for investors looking to diversify their portfolios or focus on specific industries.

- Google Trends Integration: Google Finance integrates with Google Trends, allowing users to explore search interests over time for specific stocks or financial topics. This can provide additional insights into market sentiment.

- Google Finance App: The platform is accessible through a web interface and also has a dedicated mobile app, making it convenient for investors to stay connected to financial markets on the go.

Quick Info for Reference/Monitoring

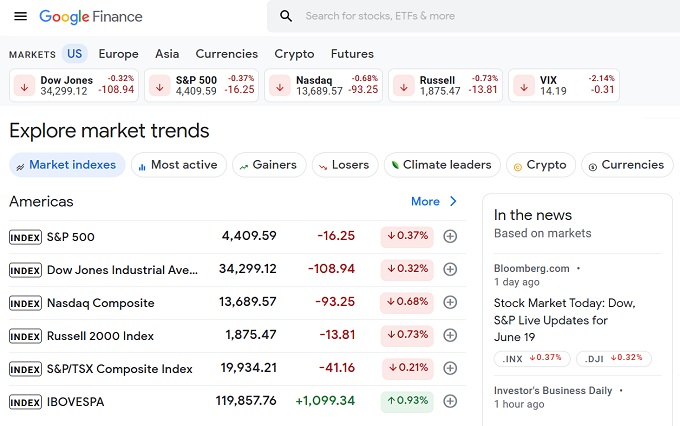

You can look up stocks, find prices, P/E ratios, S&P sectors as well as see how the Dow Jones, S&P 500, NASDAQ and Russell are performing. You’ll also find currency exchange rates, gold futures, oil prices and oil futures.

The stock information portal also provides aggregated finance and stock market news stories, market trends and earnings calendars.

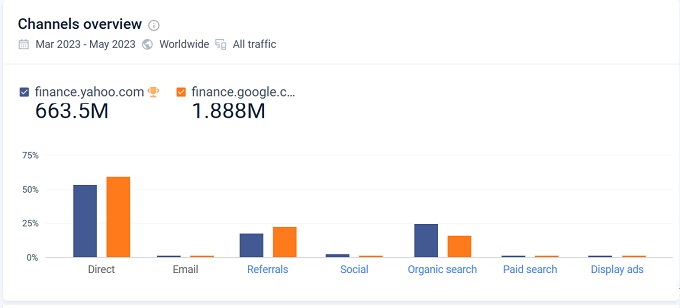

It may surprise web users about how weak Google Finance is compared to Yahoo Finance. Yahoo Finance’s traffic is estimated at 220+ million per month and visitors stay for almost 5 minutes on average. Google Finance’s traffic according to Similarweb is only about 1 million per month. The company spends about $2 million per month on PPC ads to attract traffic.

Google Finance aggregates data from various sources, including stock exchanges, financial news outlets, and other providers, to offer comprehensive market coverage. It provides detailed information on individual stocks, allowing users to track their performance over time, view historical price and trade volume data, and compare them with industry benchmarks.

Additionally, users can create and manage customized portfolios to monitor the performance of their investments.

Here, Think Stocks gives a walkthrough of Google Finance.

Missing Depth and Services Hurts the User Experience

One of the issues for Google Finance is perhaps the lack of depth and breadth of coverage and expert analysis. And Google has no history or competence in the finance space to offer credible investment advice or buy recommendations to retail investors.

It offers one-page details of specific stocks such as Tesla, Microsoft, Nvidia, Apple, Amazon, Facebook, etc.

Here are a few nice features you might enjoy:

- a portfolio charting tool

- a list of news about the companies in which you have invested.

- manually add transactions to your portfolio

- import spreadsheet and text files detailing your transactions in CSV format from applications like Microsoft Excel or Google sheets

- create news and stock alerts

- turn a current custom watchlist into a portfolio

- create a playground portfolio

- add shares of a stock, mutual fund, or cryptocurrency to your portfolio

- compare portfolio to other assets

- view portfolio highlights

- view portfolio returns

Set up your portfolio by adding investments:

Compared to Investing.com, TradingView, Barchart, and Yahoo Finance however, it lacks the details that provide a broader context.

Certainly Google is capable of beefing this service up if they wished, but like the housing market, it’s one they feel might be too tough and expensive to compete in. Given the Google Finance site already has a brand reputation to the investing marketplace, it would be difficult to elevate it to premium status anytime soon for serious investors, especially institutional investors.

However, the site is frequented by many self-directed stock market aficionados as a quick reference to keep an eye on stocks they might be interested in. It’s simplicity and stock quote facility is very useful and fast.

See more on Yahoo Finance , stock price prediction, stock forecast software, and other stock trading platforms.

See more on the: Stock Market Forecast | 3 Month Market Forecast | Best Stocks to Buy | Is Yahoo Finance Helpful? | Stock Market News | Stock Market Forecast 2024 | Stocks with Best P/E Ratios | Best S&P Sectors | Dow Jones Predictions 2024 | S&P Forecast 2024 | Real Estate Market Crash | 6 Month Outlook | 5 Year Outlook | 10 Year Outlook | Best Stock Picks | Google Stock Predictions