5 Year Forecast for the Housing Market

What does the market crystal ball indicate about the 5 year outlook on the residential real estate markets across the US?

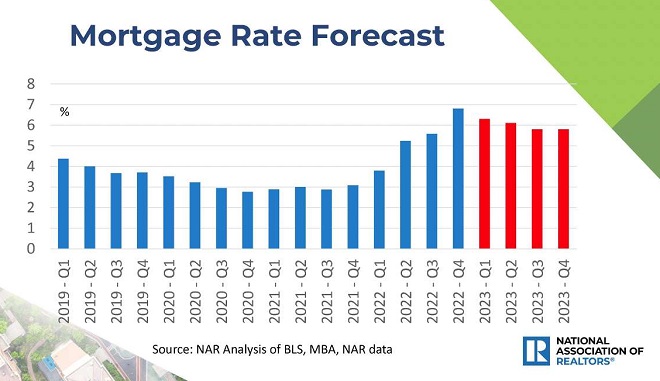

Experts seem pretty certain home prices will fall this year, but almost none of them want to project beyond 2023. But homebuyers aren’t interested in 2023 anymore, and sellers are staying put, likely waiting this period out before home prices rise. And as you’ll discover below, there are a lot of reasons to believe home prices will be on the rise again in mid 2024/2025 as mortgage rates fall.

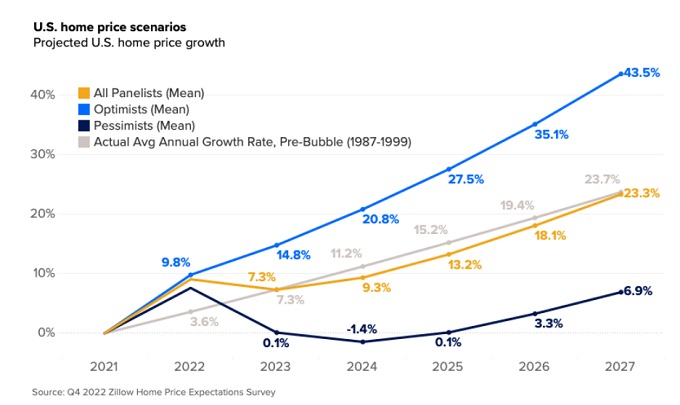

Economists and housing experts polled in the March 2023 Zillow Home Price Expectation (ZHPE) survey predict home prices will fall 1.6% through Dec. 2023.

The picture is fractured for sure, however if we refer first to the economy and what has caused the housing market to implode we might see what will happen in 2024 and the next 5 years.

What Crushed the US housing Market?

- fast rising mortgage rates discourages transactions of any kind

- intense demand has pushed home prices up too high

- housing development resistance (NIMBYs and anti-development local governments)

- homeowners won’t sell because of low supply and high refinancing rates

- high costs of developable land

- high cost of labor and materials

- high taxes on real estate transactions

- fear of recession has stopped buyers in their tracks

- expectations of coming lower prices makes buyers wait patiently

- fears of a recession

What would change in 2024 to 2028?

The FED will lower rates starting in 2024 making it easier for those refinancing and for those wanting to buy, particularly 20 to 50 year old buyers. Sellers won’t fear selling as prices will be strong, refinancing their next home painless, and they’ll have somewhere to relocate to. For the next 6 months the economy will suffer with rising unemployment, low investment, and consumer pessimism.

Here’s the points that support a good forecast in 12 months:

- Debt ceiling deal is reached with a huge spending budget for the Democrats

- oil and commodity prices have fallen dramatically

- FED eases interest rates allowing mortgage rates to fall

- November 2024 election looks bad for Biden so he’ll need to encourage spending and easing restriction on the US economy in order to get enough votes to win

- corporations, mid caps and even small caps will have cut operating expenses and liabilities creating a much cleaner balance sheet

- with more business activity, business borrowing, and more jobs, more Americans will rejoin the workforce with better pay

- bankruptcies will have cleared out much of the uncompetitive businesses or they’re bought out

- US grows its leadership in AI and microchips

- China’s economy fails creating much lower prices for imports

- Corporations have lots of cash and will be cautious for the next 12 months, and then begin to open up in 2024

- AI and automation are cutting costs and will make a big contribution to GDP in the next 5 years

- homeowners will sell because they can refinance to buy

- building permits and home starts will grow as mortgage rates and interest rates drop

- millions of new immigrants landing new jobs will want homes and multifamily dwellings

- tens of millions of Gen Z’s and Millennials still intend to start families, grow families and buy a home

- Last November, NAR Chief Economist Lawrence Yun predicted a strong rebound for housing in 2024, with a 10% jump in home sales and a 5% increase in the national median home price.

- buyers withdraw in 2023, wait for the dust to settle so they can buy in 2024/2025.

So we know there are some strong catalysts for the economy and for the housing market.

Current Trends Signal the Road Ahead for Recovery

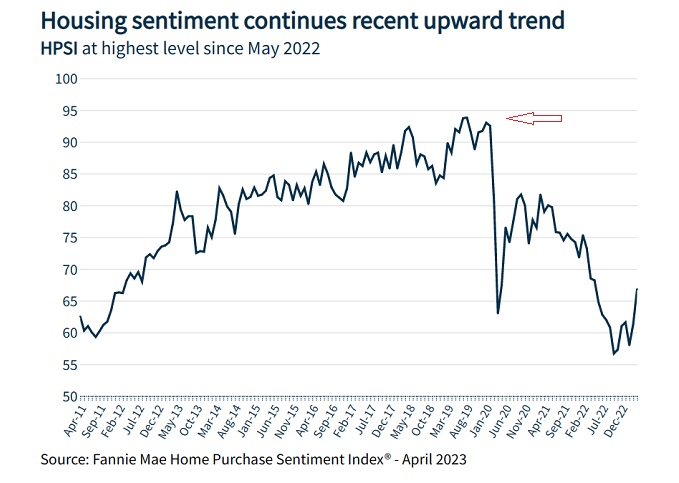

The optimism may have already started:

“This month’s increase in the HPSI was the largest in over two years, primarily driven by consumers’ more optimistic mortgage rate expectations,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “An increased number of respondents indicated they think mortgage rates will go down over the next year, a belief that could be due to a combination of factors, including an awareness of decelerating inflation, market suggestions that monetary conditions will ease in the not-too-distant future, and, of course, actual mortgage rate declines during the month.”

Consider where consumer optimism has been in the last 12 years, including just before the pandemic. Experts and media suggest a continuation of pandemic pessimism when in fact, we will get past those awful years. As optimism returns it carries its own momentum upward. It’s understood that there is a severe shortage housing and home prices are too high.

Someone will take the reigns and create a solution — politicians who want to get elected. Joe Biden has already proven he’s not interested in housing or homelessness and this ensures we’ll have a new President in 17 months. That change alone will spur expectations of better housing and home affordability. Political smoke screen issues pushed by the media won’t work.

The idea that Americans have been beaten into submission and won’t raise hell about housing is about to fade. This rebound will be part psychological driven by extended misery of too many Americans.

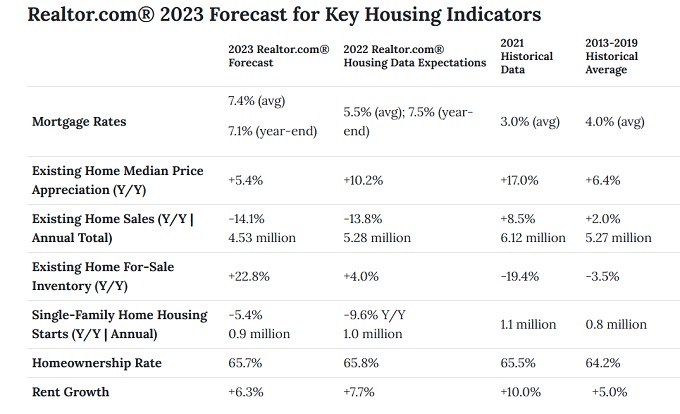

Housing Indicators from Realtor.com

As Realtor.com’s forecast shows, home prices have moderated, home sales have plunged, new construction is down but inventory and listings are not growing as expected. The trend of “staying put” might not have been foreseen.

Zillow predicts home sales will decline to 2016 levels, while prices will slide 1.6% in 2023. Price growth over the following four years is expected to average 3.5%, equivalent to the long-term average.

Zillow Home Price Forecast Next 5 Years

How long will the depressing effect of high rates and FED balance sheet reduction last? It’s all political so we don’t know how that will play out. Just that many politicians might be less hardline as the November 2024 election nears. The Democrats will have everything on the line, and an elderly, frail President whom people won’t vote for. His popularity falls each day and the recession will push that rating down further.

A Republican President would turn the economy around fast, with lower taxes, support for business and cheap energy, and ease up on the domestic economic restrictions that make the US uncompetitive on world markets. They will likely apply import duties to support American companies and force more production onshore from China.

All of this collectively means prosperity for Americans and more money to spend on homes. With such low supply, home prices will climb as will rent prices. Yet more homes will be put up for sale by homeowners who have new options and low refinancing rates. Supply will grow to help avoid rocketing home prices and bidding wars from New Jersey to Los Angeles.

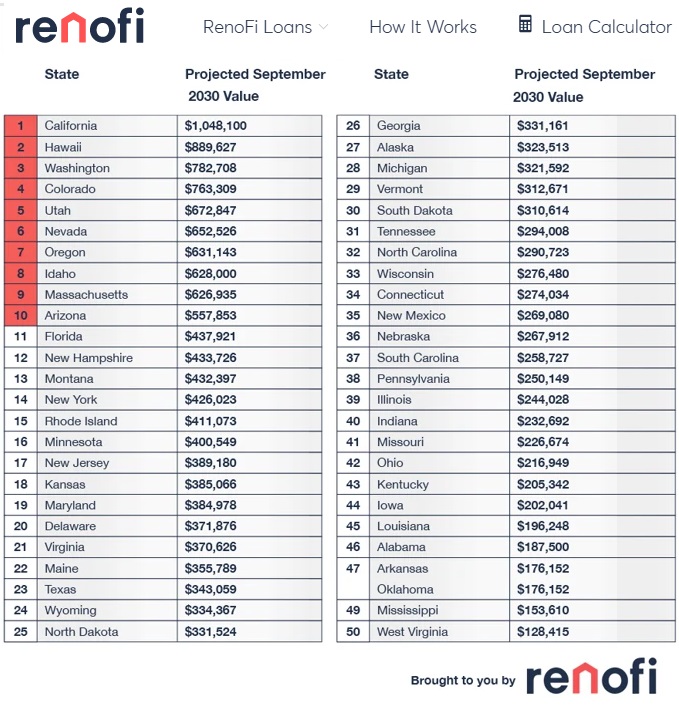

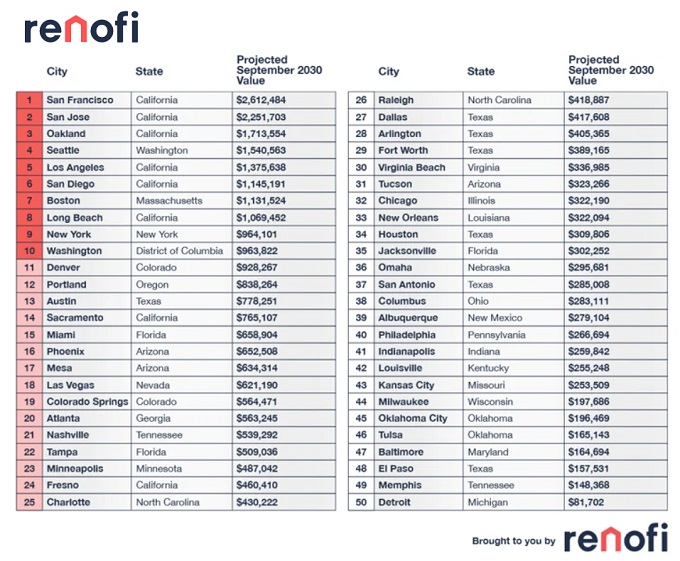

You can see the home prices forecast from Renofi for 2030 for selected major metros below. The housing market forecast and stock market forecast for 2024 both are tempered by the lagging effects of high interest rates.

If new housing isn’t built, then selling a home doesn’t seem intelligent, and sellers have nowhere to go. Most won’t tolerate the uncertainty in the next 5 years. And since housing construction won’t catch up for at least 5 years, prices are going to stay elevanted. NIMBY and local government anti-development regulations will ensure supply will lag.

Does Buying a Home Within 5 Years Make Sense?

The fact you can’t afford the lofty prices in your city might be your saving grace. And home prices likely won’t fall, unless some government action brings the house of cards tumbling down. That could happen given economies are far too complicated for them to comprehend. And remember when Janet Yellon and J. Powell said inflation was transitory. Incompetence at the level is a threat to the economy and the housing market.

As home prices surpass their peak levels, you might be wondering if buying is a good investment. Will the housing market crash and will the stock market crash? Either event might ruin your personal wealth this year. 2007 wasn’t fun. The stock market is heading toward a bottom. The S&P forecasts are not positive.

A look at the 6 month housing forecast is wise, and looking forward with an open mind to the next 5 years is wiser. So where would you start investigating the long term outlook for the US housing market, when such information may not be available? Fortunately, I’ve done some of the research work for you.

There are many housing market experts and each has their own view on market directions. Some are a little too dour (they forecasted a 2018 housing crash which didn’t happen, and some are forecasting one soon) .

We need a continuous prediction of the market in years 2023, 2024, 2025 to 2028 that includes demand estimates and supply estimates. It really is a demand vs supply issue, funded by estimates of economic growth, employment, wages, savings, and more.

If you’re thinking a housing market correction couldn’t happen, consider that when the economy sours, many Realtors will advise their clients to sell, sell, sell. They’ll over do it, in order to look smart and prescient. The markets really are emotionally loaded. It won’t take much to start a cascade of selling to unload stock or housing, after they’ve reached the peak.

Once values stop appreciating, investors lose interest and buyers will then wait until they bottom out. This colors the 5 year housing market forecast — as fearful people bail out of investments with no future.

5 Year Housing Market Outlook

The President’s multi-trillion dollar stimulus packages have injected hundreds of billions into the economy.

That’s a huge injection of funds into housing and into American savings accounts. It’s money in stock markets and 401k’s too. A large pool of money available when the recession eases and buyers won’t hesitate to big because demand is high and builders aren’t all that busy.

Real estate is a solid bet for at least 10 years.

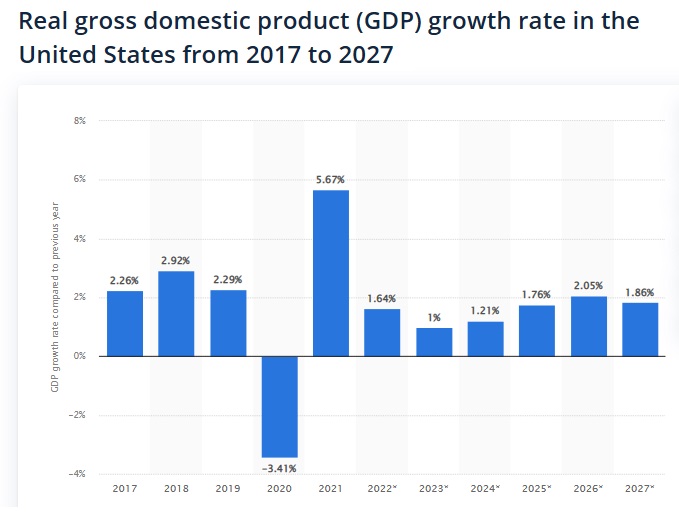

Immigration and Gen Y and Gen Z housing demand will push home prices ever higher. And of course, funds will flow into the DOW, NASDAQ, S&P and Russell 2000 as businesses benefit from this economic recovery. GDP is growing fast right now and could reach 10% by the end of 2021.

The outlook for the housing market to 2026 is rosy, especially for sellers. Financing looks good and plentiful, housing construction will pick up, and there are endless buyers, especially for single detached homes.

Housing Market Trends to Watch

- unemployment moves up a little

- GDP slows this year but rises again in 2024/2025 as interest rates fall

- lending criteria for banks will stay tight but loosen in 2025

- rates may rise in June slightly given April’s inflation rate was higher and FED wants to stick it to the US economy

- work from home will remain a major trend but most will head back to head offices where they may be laid off

- government spending will stay steady through 2024 but drop in the next 5 years

- M2 money supply is shrinking fast constraining funds for real estate purchases

- supplies of steel, copper, lumber, plastics will slowly rise as manufacturing and home building return in 2024

- the number of home renters will grow strongly (home ownership too expensive)

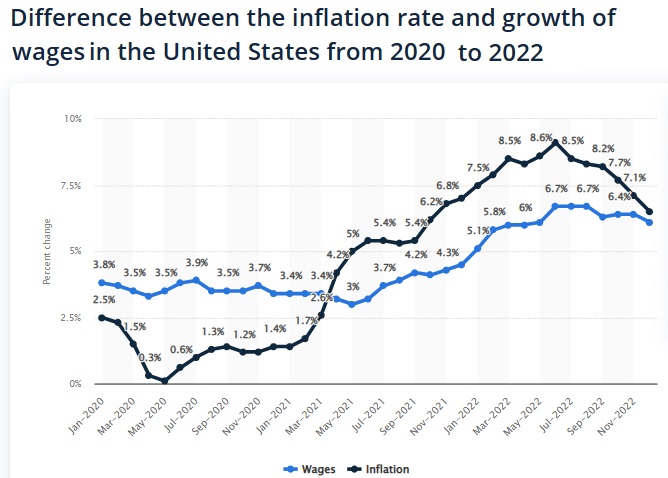

- inflation will remain around 5% for 2023 then drop slowly in 2024

- new President will open up competition in markets thus causing prices to fall

- mortgage defaults will grow this but not be out of control (higher interest rates)

- home prices will continue rising through 2023 due to a lack of supply

- listings and inventory will grow slightly from this point forward

- friction with China will grow and tariffs will increase against China imports

- personal income and wealth will stay level and support the economy

- money will move away from low performance money markets and back into the improving equity markets

- builders will enjoy reduced labor and materials costs in 2024

- new President will open up land for development and reduce red tape which will push money to the builders

- new President will lower energy costs which will aid manufacturing and transportation thus lower consumer prices

- consumers will spend again in 2025 with more confidence in the next 5 years

What about 2025 to 2030?

The pessimists believe American demand is in the past and GDP and home buying will sink. Yet with AI bringing in so much innovation technology into every sector, it’s likely we’re on the verge of an economic and cultural revolution. Business is being redesigned, and even home building will change. Factory, prefab homes is just one innovation that will take off because traditional building is just too slow.

New AI features built into computers, vehicles and production systems will create new demand for new products. Just like the smartphone introduction revolutionized business and communications, AI will take things further using new microchips and cloud-based computing to recreate almost everything we do.

Biomedicine too will revolutionize healthcare and US companies will see leadership that hasn’t happened in 40 years. This new wealth, optimism and productive capacity will allow the massive 20 year old to 50 year demographic to buy homes, condos and apartments.

Rental homes will continue in brisk demand as supply tries to catch up to demand. Investors will continue to buy real estate including build to rent developments for sizable profits. New high density buildings will be built to solve the housing crisis.

The failings of the current government are easy to see, and a new incoming government will capitalize on Americans disappointment and hope for a turnaround. The American Dream will be rekindled and home buying will be in vogue once more. There’s never been a better time to be a Realtor, at least one with advanced digital selling skills.

Which US States Will Surge?

As this chart below shows, Texas is in for dramatic growth for many years. Its zero income tax, energy wealth, growing IT industry, and agricultural production will make it the top US state. Tennessee, North Carolina, Utah, Iowa will grow with Florida more moderate, while California, Washington, New York and other high cost states will flat line.

High costs, high crime, and high taxes in states such as California, New Jersey, New York, Oregon, and Illinois will bring immense pain to residents of those states. They will move out of those states for lower costs and greater supply of housing elsewhere, perhaps Florida, Texas and North Carolina. A migration continues, which means more construction of homes.

Change, high costs, human dreams and technology: creating new demand that should last all the way to 2030 when supply might finally catch up.

Key Statistics in Charts:

Economic growth outlooks for the next 5 years, primarily because of strong latent demand, demographics, and continuous infrastructure stimulus spending. This forecast sees an extension of current trends, so you can expect growth triple to what is predicted in this graph below.

Home Price 5 Year Outlook

In a controversial report, CoreLogic predicts home prices will only grow 3.3% to 2022. NAR has recently predicted 5.7% by year end. Yet prices have risen strongly this winter and spring. The pandemic is ending (buyers will return to the market) housing construction has been slowed, buyer employment and wages will rise, many will feel a home is still the best investment, and euphoria is a very likely mood in both the stock market and housing market.

A more likely scenario is the 10% growth this year, followed by slower levels through to 2026. As mortgage rates rise, the housing market will be highly impacted.

Millennial aged buyers are a big part of the story. 38% of home sales went to millennials in 2020. There’s so many of them getting married or just buying a house now, that this is going to power up the market for many years. As home construction picks up in the next 5 years, they will finally be able to buy one, albeit at a higher mortgage rate. If you can’t buy a home, you may want to invest in builder stocks as the builders will thrive in the next 5 years.

Average Home Prices in Ten Years

By 2030, home prices will have risen substantially, and no one expects the price of real estate will decline. Land is a precious commodity. We will see digital technology make remote work more common. Living in the cities won’t be necessary, but most home buyers don’t buy far from where they and their families live. And that is what pushes prices higher in the cities.

Mortgage Rate Outlook

Interest rates are expected to fall in 2023 and should be back at low numbers by end of 2024. As the economy is suffocated, it will need some relief. No one is forecasting mortgage rates however the CBO is projecting persistent interest rates in the neighborhood of 3% to 2030.

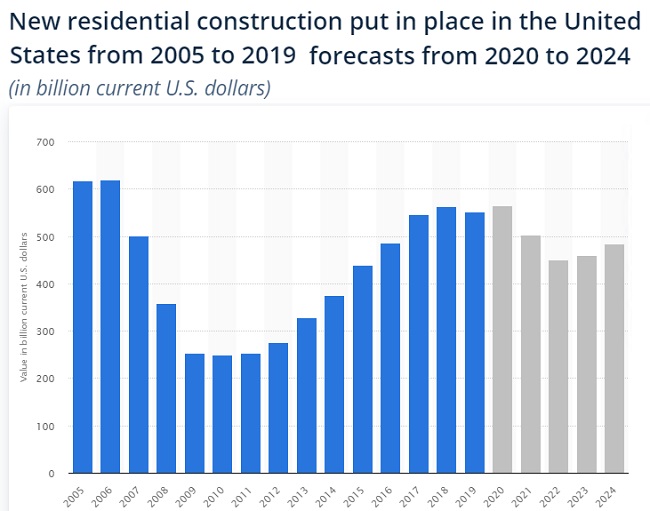

Housing Construction 5 Year Forecast

Statista isn’t quite as optimistic about housing construction. As the Census.gov report shows, it’s all downhill right now, yet falling rates in 2024 should ease the construction losses. Yet demand will persist and there is some political pressure to ease the housing shortage. When rates are eased, we’d expect construction numbers to rise.

Review the current real estate housing market for more details on sales trends and home prices.

Stock Market Forecast for 2024 | 2024 Outlook for US Stocks | Oil Price Forecast for 2024 | Stock Market News Today | Home Equity Lines of Credit | Home Equity Conversion Mortgages | Mortgage Rate Forecast | Florida Housing Market | California Housing Market | Denver Housing Market | San Diego Housing Market | Atlanta Housing Market | New York Housing Market | Best Cities to Buy Property 2024 | Los Angeles Housing Market | Real Estate Marketing for Los Angeles Agents | Real Estate Marketing Packages