How to Profit from Today’s Housing Market

With home prices so high, and mortgage rates up above 6% and homeowners staying put, you might wonder if there is a way to profit from real estate in 2023.

Historically, most wealth is generated via real estate, and there’s always a way to get in at a well-timed low point and ride the price wave upward. Given supply and demand principles, real estate values will rise again.

Review the housing market forecast to determine when you should buy and the likely time you can get out with a profit. Should buy and hold forever? No, get out when you’ve captured a good profit. Don’t tempt fate. Fatalistic people leave themselves open to a system that is manipulated by billionaires where the odds are stacked against small investors.

You have to get yourself into a positive and clear state of mind, sure of the opportunity potential, and your willingness to earn profit for yourself.

If you’re doing it for other reasons, that’s a risk.

Preparing first with a plan and using tools such as BiggerPockets and forums on Linkedin, for example, you can learn more about risks from actual, real investors and landlords and get a wider opinion.

Investor Mindset Check

To profit well, it takes good analytics tools and access to great properties for sale. You might want be like a short seller in the stock market. Those investors face disaster if they make a bad decision, with unlimited loss potential. That drives their intense use of analytics to find the right stock to buy short.

I’ll introduce you to 3 powerful and popular real estate analytics software solutions for landlord and other real estate investors.

The nice thing about residential real estate is that real property has a baseline value, and today that value is high. There’s rarely disaster unless it’s those who are overleveraging to buy investment property. In this recession, (which could last another 12 to 18 months), prices in some cities have already dropped a little thus creating opportunities as sellers think about cashing in.

When sellers get desperate, all the sharks move in. You’ll be one of them.

Those “cashing in and getting out” sellers are always there and they’re waiting for the sell signals. But are you able to find them and reach them? Your investment property could come from anywhere in the US (you can use virtual management tools to manage them).

Typically, when investors think about making money in real estate, they think simplistically in terms of executing transactions soon. You’ll need to do a lot of homework before investing in that fixer upper, prefab condo, or multifamily block.

How to Analyze Property Values and Future Performance

The topic of how to assess property values is very complex, and it’s better to use professional analytics tools.

Here’s 3 to to consider:

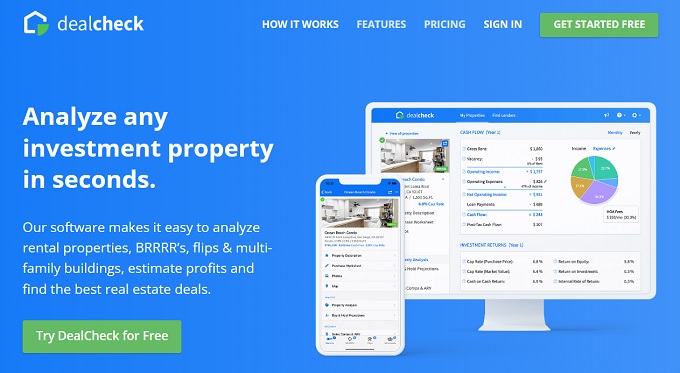

Deal Check

A popular real estate software which makes it easy to analyze rental properties, BRRRR’s, flips & multi-family buildings, estimate profits and find the best real estate deals. Search for properties, fill in your purchase price, financing, closing costs, rehab budget, rent roll and estimated expenses. And you can view each property’s cash flow, cap rate, ROI, profit from sale, acquisition costs and more. Then explore long-term cash flow projections for rentals and profit projections for flips. And lastly, you can browse recent sales comps, comparable rental listings and market statistics. Get after repair value (ARV) and rent estimates based on the unique characteristics of the property you’re analyzing.

You may not need any other real estate software to fulfill your quest to buy quality real estate and maximize profit.

Bigger Pockets

Bigger Pockets brings together education, tools, and a community of more than 2+ million members — all in one place. With a subscription, you’ll be able to assess rental properties with property analysis calculators made for evaluating rentals, BRRRR, house flipping, and more. They’ve rental property calculators, document templates, and real estate listings to peruse. The key value in Bigger Pockets is the community of investors whom you can ask questions and get advice from.

Roofstock

Roofstock is an online marketplace for investing in leased single-family rental homes. The company helps its clients by providing them with research, analytics, and insights to evaluate and purchase certified properties.

The company pre-inspects rental properties with information about tenant, current rent, and property manager and makes this information accessible online. Roofstock’s neighborhood rating algorithm analyzes more than 72,000 Census tracts and applies a risk rating. The rating system evaluates from 1 to 5 on riskiness using data on home values, average rent, income levels, employment rates, education levels, crime data, percentage of owner-occupied homes and school district ratings. It then ranks each neighborhood on a scale of 1 to 5, 1 being the most risky.

The Housing Market in 2023/2024

You’ll need to find the right investible property in a tight real estate market using sophisticated analytics tools. That means something more heavy duty than Zillow’s rental property calculator, although that’s handy after you’ve decided on properties to buy.

According to Fortune Builders, there are 4 ways to make money in real estate:

- Fixer Upper: Increase a property’s value

- Rental Income Property: Generate regular income through a property

- Capital Appreciation: Buy and hold residential real estate

- Real Estate Investment Trusts (REITs)

All of the above are popular. You’ll still need your analytics tools which help you decide on a tough property purchase question: What to buy and where?

First priority is to establish:

- how much property you can afford

- how you want to make money

- which are the best cities to buy property

- which types of housing to buy

- where to get the best lending rates if you’re financing

- how much you’ll spend on your own property

- how much rental income can you make?

- how you can cut cost and taxes

- when will you sell it?

- how do I find a competent Realtor who isn’t just looking for fast commission?

Of course there are plenty more questions and it’s best to draw them out now before you lay out all your hard earned money.

For more intense discussions of how to make money via real estate, try these resources:

- Ways to invest in Real Estate without Buying Property — from Vital Dollar.

- How to buy an Investment Property – from Investor Junkie

- How to Analyze Rental Property Investments – from Bay Management Group

- Rental Property Income Calculator –from Calculator.net

- How to Make Money from Rental Properties from RealWealth.com

Begin your quest for real estate income by reading the US property market forecast now.

Five Year Real Estate Forecast | Boom Year for Realtors 2024 | Home Equity Lines of Credit | Home Equity Conversion Mortgages | Mortgage Rate Forecasst 2024 | Florida Housing Market 2023 | California Real Estate | Denver Property Market | San Diego Property Market | Atlanta Property Market | New York Property Market | Boston Property Market | Best Cities to Buy Property 2024 | Los Angeles Housing Market Outlook | Real Estate Marketing for Los Angeles Agents | Real Estate Marketing Packages | Travel Management Software | Business Travel Marketing